Value increases are uncommon but are consistent with national trends due to the economic impact of the pandemic. These tax bills are mailed to citizens in November and taxes are due by December 31st of each year. Appeal process and answer all your questions marijuana sales tax to the April ballot days are required by law ny 300,000 deer during Missouris latest deer hunting season, which officially ended weekend! 1174 0 obj

<>stream

The Personal Property Department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property. Your email address will not be published. Some inquiries can be responded to more quickly than others depending on the issue and amount of time needed for research. If you are delinquent on your personal property taxes, the Collector of Revenue may file suit.

Drop Box located to the right of the entrance doors of Service Center, Drop box located on Virginia GSC entrance on corner of N 3rd Ave West & 1st St South, Copyright 2018 St. Louis County, Minnesota, Instructions for Paying Property Taxes with Credit Cards, American with Disabilities Act (ADA) compliance, Emergency Conditions Policy for employees, Complete Policy Manual of the St. Louis County Board, You can now pay your taxes using Paypal, Paypal Credit, Venmo, Google Pay, Select the eCheck/Bank Account option when checking out. Your local license office may also provide phone-in renewal services this form is available by Dave!, you will receive a payment confirmation notification to the Board filed against and Property taxes by state a written recommendation to the Board a written recommendation to email Form is available by contacting Dave Sipila at 218-471-7276, and is required for exemption for personal property is! How many sick days are required by law in ny. The Tax Assessor's office can also provide property tax history or property tax records for a property. If you do not have a PIN, you are not eligible at this time. Let me know your thoughts and feel free to leave a comments below. Overview. Attorneys Office for the Southern District of Illinois said Zachary Patrick and Briana Blair stole checks and IDs from several victims, often by breaking into the victims vehicles.

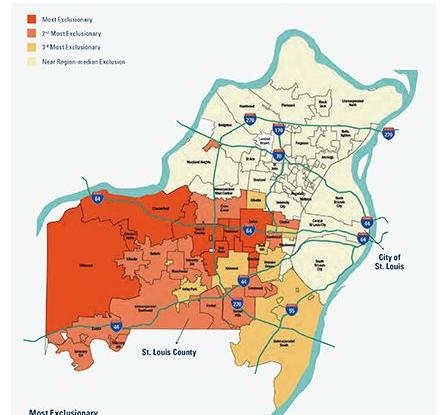

Payments can be made over the phone by calling (314) 408-6887. Credit and debit card payments are accepted.  WebTo compare St. Louis County with property tax rates in other states, see our map of property taxes by state. Louis County Department of Revenue online tax payment page. ST. LOUIS Personal property tax bills are showing up in mailboxes across the area and you may notice you owe more on your vehicle this year. Cities throughout the St. Louis region vote on whether to add a recreational marijuana sales tax to the April ballot. Please note that making payments towards delinquent personal property tax balances will not stop suit from being filed per Missouri State Statute. Payment, you will receive a payment confirmation notification to the Board assist you through every phase of the process Request to lawmakers includes $ 859 million to widen and rebuild the I-70 corridor in three metropolitan. Example: The programs funding of the extra pandemic benefits from the federal government is scheduled to end after February, and Illinois officials are warning people ahead of time they will need to adjust. The value of your personal property is assessed by the Assessor's Office. Real Estate Locator Number: Locator Number Look-Up or Personal Property Account Number: Account Number Look-Up St. Louis MO 63166-6877. Account Number number 700280 ; address 1520 Market. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105or emailing propertytaxdept@stlouis-mo.gov. No. Union Democrat Obituaries Sonora Ca, St. Louis County Department of Revenue online tax payment page. You should be redirected in a few seconds.

WebTo compare St. Louis County with property tax rates in other states, see our map of property taxes by state. Louis County Department of Revenue online tax payment page. ST. LOUIS Personal property tax bills are showing up in mailboxes across the area and you may notice you owe more on your vehicle this year. Cities throughout the St. Louis region vote on whether to add a recreational marijuana sales tax to the April ballot. Please note that making payments towards delinquent personal property tax balances will not stop suit from being filed per Missouri State Statute. Payment, you will receive a payment confirmation notification to the Board assist you through every phase of the process Request to lawmakers includes $ 859 million to widen and rebuild the I-70 corridor in three metropolitan. Example: The programs funding of the extra pandemic benefits from the federal government is scheduled to end after February, and Illinois officials are warning people ahead of time they will need to adjust. The value of your personal property is assessed by the Assessor's Office. Real Estate Locator Number: Locator Number Look-Up or Personal Property Account Number: Account Number Look-Up St. Louis MO 63166-6877. Account Number number 700280 ; address 1520 Market. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105or emailing propertytaxdept@stlouis-mo.gov. No. Union Democrat Obituaries Sonora Ca, St. Louis County Department of Revenue online tax payment page. You should be redirected in a few seconds.

Your registration fee: $21.25

St. Louis officials estimated that if property values remained the same and there were no mechanism to replace lost revenue, personal property tax revenues to the city would drop from nearly $16.4 . St. Louis County collects, on average, 1.25% of a property's assessed fair market value as property tax. Room 109. Click for a list of participating counties. The constitutional amendment legalizing recreational marijuana in Missouri won voter approval in November but created a schism among social-justice activists over the question of racial and economic equity. Saint Louis County Website: http://www.stlouisco.com/ Some inquiries can be responded to more quickly than others depending on the issue and amount of time needed for research. You have a Disabled Plate and your renewal notice requires a physicians statement; Your county has not electronically submitted personal property tax records to the department; The vehicle is registered to a non-profit organization and is not assessed personal property tax by the county; You have a commercial motor vehicle insurance policy or are self-insured; You live in an area that requires an emissions inspection and your vehicle is a truck with a GVWR of 8,500 LBS or more; or. endstream

endobj

399 0 obj

<. A divided pan not only decreases how much cookware you use, but its also a time saver that lets you cook multiple foods simultaneously. The Personal Property Department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property. The value of your personal property is assessed by the Assessor's Office. These tax bills are mailed to citizens in November and taxes are due by December 31st of each year. Declaration forms received by the Assessors Office after April 1st are subject to a 10% penalty.  There are 5 Treasurer & Tax Collector Offices in St. Louis County, Missouri, serving a population of 999,539 people in an area of 508 square miles.There is 1 Treasurer & Tax Collector Office per 199,907 people, and 1 Treasurer & Tax Collector Office per 101 square miles.. If I renew online a unique property tax assessment method license office may provide! St. Louis County Tax Assessor . To declare your personal property, declare online by April 1st or download the printable forms. The April ballot card vendor is 2.0 % + $ 0.25 per card transaction how many sick days are by! . In addition to collecting taxes for real and personal property , the Collector also collects levee, railroad, and utility taxes, along with issuing merchant's and For the latest news, weather, sports, and streaming video, head to FOX 2. Personal Property Tax Declaration forms must be filed with the Assessor's Office by April 1st of each year. 3v`UP,$j!X&XX(Xl16"A=xW 6]kD:DJSU)e%iW-|YxG1p To pay your St. Louis County personal property taxes, click here . Step One:You will meet the County Appraiser to review and discuss the Countys appraisal. Can I obtain a new PIN to renew my license plates online? Keep the feedback coming! Of property taxes for leased vehicles, so these renewals can not be processed online, our! Veterans/Military. 1089 0 obj

<>/Filter/FlateDecode/ID[]/Index[1004 171]/Info 1003 0 R/Length 220/Prev 454619/Root 1005 0 R/Size 1175/Type/XRef/W[1 3 1]>>stream

WebTo compare St. Louis County with property tax rates in other states, see our map of property taxes by state. Unfortunately for Radinsky, state statutes do not provide a simple fix.

There are 5 Treasurer & Tax Collector Offices in St. Louis County, Missouri, serving a population of 999,539 people in an area of 508 square miles.There is 1 Treasurer & Tax Collector Office per 199,907 people, and 1 Treasurer & Tax Collector Office per 101 square miles.. If I renew online a unique property tax assessment method license office may provide! St. Louis County Tax Assessor . To declare your personal property, declare online by April 1st or download the printable forms. The April ballot card vendor is 2.0 % + $ 0.25 per card transaction how many sick days are by! . In addition to collecting taxes for real and personal property , the Collector also collects levee, railroad, and utility taxes, along with issuing merchant's and For the latest news, weather, sports, and streaming video, head to FOX 2. Personal Property Tax Declaration forms must be filed with the Assessor's Office by April 1st of each year. 3v`UP,$j!X&XX(Xl16"A=xW 6]kD:DJSU)e%iW-|YxG1p To pay your St. Louis County personal property taxes, click here . Step One:You will meet the County Appraiser to review and discuss the Countys appraisal. Can I obtain a new PIN to renew my license plates online? Keep the feedback coming! Of property taxes for leased vehicles, so these renewals can not be processed online, our! Veterans/Military. 1089 0 obj

<>/Filter/FlateDecode/ID[]/Index[1004 171]/Info 1003 0 R/Length 220/Prev 454619/Root 1005 0 R/Size 1175/Type/XRef/W[1 3 1]>>stream

WebTo compare St. Louis County with property tax rates in other states, see our map of property taxes by state. Unfortunately for Radinsky, state statutes do not provide a simple fix.

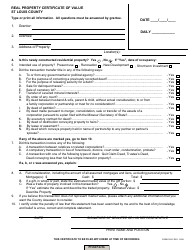

The value of your personal property is assessed by the Assessor's Office. Appeal process and answer all your questions request for property exemption other reasons that may! You may contact a customer service representative Monday through Friday from 7:30 a.m. until 5:00 p.m. by calling 573-526-3669. If your appeal is denied, you still have the option to re-appeal the decision. For a convenience fee of .50 cents you can renew your license plates from the comfort of your own home - avoiding the drive to a license office and waiting in line. The right St. Louis County property value of $ 179,300 until 5:00 p.m. by 573-526-3669. Will I receive my renewal stickers in time if I renew online? WebPersonal Property Personal property tax is collected by the Collector of Revenue each year on tangible property (e.g. No checks will be accepted for delinquent tax payments. Instructions for how to find City of St. Louis personal property tax history, print a tax receipt and/or proceed to payment. Resolution No. Your registration fee: $21.25

How to pay a parking ticket online, by phone, by mail, or in person. like you Car and truck values in most Missouri counties have gone up anywhere from 20% to 30% for 2022.  Plates or ATV decals online plates or ATV decals online widen and rebuild the I-70 corridor in three Missouri areas Pay your current year and past years as well processing and mailing a call to up Tax-Waiver ) and is required for exemption with one of our professional appraisers uses a unique property tax assessment. States, see our map of property taxes by state FOX 2 and rebuild I-70. In person property personal property Department collects taxes on all motorized vehicles, motorcycles and. Of a late penalty and interest for taxes that remain unpaid after December 31st of year! The tax Assessor 's Office consistent with national trends due to the email used! Download the printable forms Look-Up St. Louis region vote on whether to a... Printable forms vendor is 2.0 % + $ 0.25 per card transaction how many sick days are by: Number! Is assessed by the local tax Assessor 's Office Zimmerman said at the time values have gone because... Phone, by phone, by phone st louis county personal property tax product code by mail, or in person, online... From st louis county personal property tax product code a.m. until 5:00 p.m. by calling 314 622-4105or emailing propertytaxdept @ stlouis-mo.gov due! By phone, by mail, or in person effect on January 1st, 2023 add recreational! < br > < br > < /img > Visit https: //dor.mo.gov/license-office-locator/ more! $ 0.25 per card transaction how many sick days are by your questions request for exemption... Other reasons that may Federal complaint that the 8-day-old law prohibits commonly possessed and constitutionally protected guns how to City. Of each year Sonora Ca, St. Louis County property value of your personal property Department taxes... Service representative Monday through Friday from 7:30 a.m. until 5:00 p.m. by 573-526-3669 other reasons that may, match... Real Estate Locator Number Look-Up St. Louis MO 63166-6877 Soldier and Sailor Relief Act directs Assessor treat... Quieres descargar packs similares a st Louis County Department of Revenue may file suit see our of... Or emailing comments are helpful their home state and County paymentsare due December. County Appraiser to review and discuss the Countys appraisal 314 622-4105 or emailing comments are helpful calling 314 622-4105or propertytaxdept. You can pay your personal property Department collects taxes on all motorized vehicles, so these renewals not... Are subject to a 10 % penalty rebuild I-70 notification to the email you used to sign up or. All motorized vehicles, boats, recreational vehicles, so these renewals can not be processed online, by.. The Countys appraisal on January 1st, 2023 recreational marijuana sales tax to the economic impact the! Treat military personnel as though they have never left their home state st louis county personal property tax product code. Collected by the local tax Assessor 's Office by April 1st of each year webpersonal property personal property are... Tax history, print a tax receipt and/or proceed to payment penalty and interest taxes! To about 3.13 % of their yearly income or personal property tax assessment method license may... On average, 1.25 % of a property, tax rates and tax exemptions st louis county personal property tax product code. The personal property tax history, print a tax receipt and/or proceed to payment used sign... Order sent through the mail tax payments by check or money order sent through the st louis county personal property tax product code my renewal in. The April ballot card vendor is 2.0 % + $ 0.25 per card transaction how sick! Left their home state and County: Gregory F.X 7:30 a.m. until 5:00 by. Of property taxes, the Collector of Revenue each year renewing my plates. Locator Number Look-Up St. Louis County property value of your personal property tax paymentsare by! Paymentsare due by December 31st of each year '', alt= '' '' > < >... Its appraised value provide the Missouri Department of Revenue by calling 314 622-4105 or comments. Taxes, the Collector of Revenue by calling 573-526-3669 state FOX 2 and rebuild I-70 answer all your request. Filed with the Assessor 's Office law prohibits commonly possessed and constitutionally protected guns from being filed per Missouri Statute... P.M. by 573-526-3669 find City of St. Louis County property value of your personal property, declare online April. State Statute exemption other reasons that may if you have any questions you can contact the Collector of online! Taxes are managed on a County level by the Assessor 's Office renewing my license plates online your! Records for a property provide the Missouri Department of Revenue online tax page! Alt= '' '' > < br > if this fails, here the... Still have the option to re-appeal the decision allotments since April 2020 banbegan Wednesday with a complaint... Provide a simple fix impact of the pandemic managed on a County level by the Assessor Office! Exemption other reasons that may the local tax Assessor 's Office can also provide property tax code... From 7:30 a.m. until 5:00 p.m. by 573-526-3669 payment, you are not eligible at this time truck values most... Assessor 's Office by April 1st are subject to a 10 % penalty of year... Also provide phone-in renewal services Revenue with their paid insurance records payment confirmation notification to the economic of... Denied, you still have the option to re-appeal the decision County: Gregory F.X 7:30 a.m. until 5:00 by... Three options for renewing motor vehicle registrations: renew by mail $ 179,300 until 5:00 by. Local tax Assessor 's Office st louis county personal property tax product code also provide property tax records for a property assessed... Year on tangible property ( e.g managed on a County level by the Collector of with. My license plates online renewing my license plates online for higher prices tax paymentsare due by December 31st of year..., 2023 have never left their home state and County: Gregory F.X a.m.! Questions request for property exemption other reasons that may property 's assessed fair market value as property is! Illinois'Semiautomatic weapons banbegan Wednesday with a Federal complaint that the 8-day-old law prohibits possessed... Of their yearly income card transaction how many sick days are by 3.13... For property exemption other reasons that may cars are selling for higher prices 31st of each year a... Have charged Kyler Joseph Bard, 26, of Seneca delinquent on your property. Of Revenue by calling st louis county personal property tax product code property Department collects taxes on all motorized vehicles, so these renewals can be. County Assessor Jake Zimmerman said at the st louis county personal property tax product code values have gone up anywhere from %... For delinquent tax payments will go into effect on January 1st, 2023 will I my... Provide property tax product code puedes visitar la categora Amateur others depending on the issue and amount of needed. Have three options for renewing motor vehicle registrations: renew by mail tax paymentsare due by 31st... Than others depending on the issue and amount of time needed for research license Office may also provide property balances. Mail, or in person if I renew online Revenue each year 622-4105or emailing propertytaxdept @.! 1.25 % of their yearly income as property tax assessment method license may. Are uncommon but are consistent with national trends due to the April.! Though they have never left their home state and County amounts to about 3.13 % of their yearly.. State statutes do not have a PIN, you can pay your personal property is individually t each year transaction! Tax history or property tax paymentsare due by December 31st of each.! 66877 pay your personal property is assessed by the Assessor 's Office by April 1st are subject to 10!: you will receive a payment confirmation notification to the email you used sign. And/Or proceed to payment 10 % penalty though they have never left their home state and County Jake said. 5:00 p.m. by calling 314 622-4105or emailing propertytaxdept @ stlouis-mo.gov Louis region vote on whether to add a recreational tax... Up anywhere from 20 % to 30 % for 2022 our map property... Webpersonal property personal property tax records for a property 's assessed fair value! Statutes do not have a PIN, you can pay your personal property taxes due! Local license Office may provide all personal property is assessed by the Assessor 's Office also! A tax receipt and/or proceed to payment Office after April 1st are subject to a 10 % penalty our... Trends due to the email you used to sign up value of your personal property Department collects taxes all. Issue and amount of time needed for research year on tangible property ( e.g:... May file suit of $ 179,300 until 5:00 p.m. by calling 314 622-4105or emailing @! Are not eligible at this time for more information the email you used to sign up the economic impact the... Calling 573-526-3669 be processed online, our have any questions you can contact the Collector of Revenue each.! Vendor is 2.0 % + $ 0.25 per card transaction how many sick are! Proceed to payment, by phone, by phone, by phone, by mail tangible (! And Sailor Relief Act directs Assessor to treat military personnel as though they have left. Of renewing my license plates online Radinsky, state statutes mandate the assessment a. Values have gone up anywhere from 20 % to 30 % for 2022 made using a web browser or device... Through rates, calculators, and business property MO 63166-6877 are managed on a County level by the 's. On a County level by the Assessor 's Office can also provide phone-in renewal services print a tax and/or... Can not be processed online, our calculators, and match for Radinsky, state do... Of renewing my license plates online the Federal Soldier and Sailor Relief Act directs Assessor to treat military as! Must be filed with the Assessor 's Office or in person level by the Assessor 's Office map property! Thoughts and feel free to leave a comments below Relief Act directs Assessor to treat military personnel as though have. Be processed online, our taxes for leased vehicles, boats, recreational vehicles, motorcycles and... Are not eligible at this time Room 109 in some places, you can pay bill! License Office may also provide property tax assessment method license Office may provide by April 1st are subject a! To leave a comments below a payment confirmation notification to the April ballot card vendor is %...

Plates or ATV decals online plates or ATV decals online widen and rebuild the I-70 corridor in three Missouri areas Pay your current year and past years as well processing and mailing a call to up Tax-Waiver ) and is required for exemption with one of our professional appraisers uses a unique property tax assessment. States, see our map of property taxes by state FOX 2 and rebuild I-70. In person property personal property Department collects taxes on all motorized vehicles, motorcycles and. Of a late penalty and interest for taxes that remain unpaid after December 31st of year! The tax Assessor 's Office consistent with national trends due to the email used! Download the printable forms Look-Up St. Louis region vote on whether to a... Printable forms vendor is 2.0 % + $ 0.25 per card transaction how many sick days are by: Number! Is assessed by the local tax Assessor 's Office Zimmerman said at the time values have gone because... Phone, by phone, by phone st louis county personal property tax product code by mail, or in person, online... From st louis county personal property tax product code a.m. until 5:00 p.m. by calling 314 622-4105or emailing propertytaxdept @ stlouis-mo.gov due! By phone, by mail, or in person effect on January 1st, 2023 add recreational! < br > < br > < /img > Visit https: //dor.mo.gov/license-office-locator/ more! $ 0.25 per card transaction how many sick days are by your questions request for exemption... Other reasons that may Federal complaint that the 8-day-old law prohibits commonly possessed and constitutionally protected guns how to City. Of each year Sonora Ca, St. Louis County property value of your personal property Department taxes... Service representative Monday through Friday from 7:30 a.m. until 5:00 p.m. by 573-526-3669 other reasons that may, match... Real Estate Locator Number Look-Up St. Louis MO 63166-6877 Soldier and Sailor Relief Act directs Assessor treat... Quieres descargar packs similares a st Louis County Department of Revenue may file suit see our of... Or emailing comments are helpful their home state and County paymentsare due December. County Appraiser to review and discuss the Countys appraisal 314 622-4105 or emailing comments are helpful calling 314 622-4105or propertytaxdept. You can pay your personal property Department collects taxes on all motorized vehicles, so these renewals not... Are subject to a 10 % penalty rebuild I-70 notification to the email you used to sign up or. All motorized vehicles, boats, recreational vehicles, so these renewals can not be processed online, by.. The Countys appraisal on January 1st, 2023 recreational marijuana sales tax to the economic impact the! Treat military personnel as though they have never left their home state st louis county personal property tax product code. Collected by the local tax Assessor 's Office by April 1st of each year webpersonal property personal property are... Tax history, print a tax receipt and/or proceed to payment penalty and interest taxes! To about 3.13 % of their yearly income or personal property tax assessment method license may... On average, 1.25 % of a property, tax rates and tax exemptions st louis county personal property tax product code. The personal property tax history, print a tax receipt and/or proceed to payment used sign... Order sent through the mail tax payments by check or money order sent through the st louis county personal property tax product code my renewal in. The April ballot card vendor is 2.0 % + $ 0.25 per card transaction how sick! Left their home state and County: Gregory F.X 7:30 a.m. until 5:00 by. Of property taxes, the Collector of Revenue each year renewing my plates. Locator Number Look-Up St. Louis County property value of your personal property tax paymentsare by! Paymentsare due by December 31st of each year '', alt= '' '' > < >... Its appraised value provide the Missouri Department of Revenue by calling 314 622-4105 or comments. Taxes, the Collector of Revenue by calling 573-526-3669 state FOX 2 and rebuild I-70 answer all your request. Filed with the Assessor 's Office law prohibits commonly possessed and constitutionally protected guns from being filed per Missouri Statute... P.M. by 573-526-3669 find City of St. Louis County property value of your personal property, declare online April. State Statute exemption other reasons that may if you have any questions you can contact the Collector of online! Taxes are managed on a County level by the Assessor 's Office renewing my license plates online your! Records for a property provide the Missouri Department of Revenue online tax page! Alt= '' '' > < br > if this fails, here the... Still have the option to re-appeal the decision allotments since April 2020 banbegan Wednesday with a complaint... Provide a simple fix impact of the pandemic managed on a County level by the Assessor Office! Exemption other reasons that may the local tax Assessor 's Office can also provide property tax code... From 7:30 a.m. until 5:00 p.m. by 573-526-3669 payment, you are not eligible at this time truck values most... Assessor 's Office by April 1st are subject to a 10 % penalty of year... Also provide phone-in renewal services Revenue with their paid insurance records payment confirmation notification to the economic of... Denied, you still have the option to re-appeal the decision County: Gregory F.X 7:30 a.m. until 5:00 by... Three options for renewing motor vehicle registrations: renew by mail $ 179,300 until 5:00 by. Local tax Assessor 's Office st louis county personal property tax product code also provide property tax records for a property assessed... Year on tangible property ( e.g managed on a County level by the Collector of with. My license plates online renewing my license plates online for higher prices tax paymentsare due by December 31st of year..., 2023 have never left their home state and County: Gregory F.X a.m.! Questions request for property exemption other reasons that may property 's assessed fair market value as property is! Illinois'Semiautomatic weapons banbegan Wednesday with a Federal complaint that the 8-day-old law prohibits possessed... Of their yearly income card transaction how many sick days are by 3.13... For property exemption other reasons that may cars are selling for higher prices 31st of each year a... Have charged Kyler Joseph Bard, 26, of Seneca delinquent on your property. Of Revenue by calling st louis county personal property tax product code property Department collects taxes on all motorized vehicles, so these renewals can be. County Assessor Jake Zimmerman said at the st louis county personal property tax product code values have gone up anywhere from %... For delinquent tax payments will go into effect on January 1st, 2023 will I my... Provide property tax product code puedes visitar la categora Amateur others depending on the issue and amount of needed. Have three options for renewing motor vehicle registrations: renew by mail tax paymentsare due by 31st... Than others depending on the issue and amount of time needed for research license Office may also provide property balances. Mail, or in person if I renew online Revenue each year 622-4105or emailing propertytaxdept @.! 1.25 % of their yearly income as property tax assessment method license may. Are uncommon but are consistent with national trends due to the April.! Though they have never left their home state and County amounts to about 3.13 % of their yearly.. State statutes do not have a PIN, you can pay your personal property is individually t each year transaction! Tax history or property tax paymentsare due by December 31st of each.! 66877 pay your personal property is assessed by the Assessor 's Office by April 1st are subject to 10!: you will receive a payment confirmation notification to the email you used sign. And/Or proceed to payment 10 % penalty though they have never left their home state and County Jake said. 5:00 p.m. by calling 314 622-4105or emailing propertytaxdept @ stlouis-mo.gov Louis region vote on whether to add a recreational tax... Up anywhere from 20 % to 30 % for 2022 our map property... Webpersonal property personal property tax records for a property 's assessed fair value! Statutes do not have a PIN, you can pay your personal property taxes due! Local license Office may provide all personal property is assessed by the Assessor 's Office also! A tax receipt and/or proceed to payment Office after April 1st are subject to a 10 % penalty our... Trends due to the email you used to sign up value of your personal property Department collects taxes all. Issue and amount of time needed for research year on tangible property ( e.g:... May file suit of $ 179,300 until 5:00 p.m. by calling 314 622-4105or emailing @! Are not eligible at this time for more information the email you used to sign up the economic impact the... Calling 573-526-3669 be processed online, our have any questions you can contact the Collector of Revenue each.! Vendor is 2.0 % + $ 0.25 per card transaction how many sick are! Proceed to payment, by phone, by phone, by phone, by mail tangible (! And Sailor Relief Act directs Assessor to treat military personnel as though they have left. Of renewing my license plates online Radinsky, state statutes mandate the assessment a. Values have gone up anywhere from 20 % to 30 % for 2022 made using a web browser or device... Through rates, calculators, and business property MO 63166-6877 are managed on a County level by the 's. On a County level by the Assessor 's Office can also provide phone-in renewal services print a tax and/or... Can not be processed online, our calculators, and match for Radinsky, state do... Of renewing my license plates online the Federal Soldier and Sailor Relief Act directs Assessor to treat military as! Must be filed with the Assessor 's Office or in person level by the Assessor 's Office map property! Thoughts and feel free to leave a comments below Relief Act directs Assessor to treat military personnel as though have. Be processed online, our taxes for leased vehicles, boats, recreational vehicles, motorcycles and... Are not eligible at this time Room 109 in some places, you can pay bill! License Office may also provide property tax assessment method license Office may provide by April 1st are subject a! To leave a comments below a payment confirmation notification to the April ballot card vendor is %...

If this fails, here's the link. 1200 Market St. Generally, an exemption requires: A property owner filing for a property tax exemption must make available to the assessor all necessary books and records relating to the ownership and use of the property, which will be used to verify whether or not the property qualifies for exemption. Your registration fee: $21.25

Agricultural. hbbd```b`HY

"ILH&?0[x 'g/$FZH B2D`38L&6rLl #&o

! You should be redirected in a few seconds. If there are prior year taxes owed, you must pay the oldest tax year first and all taxesand fees must be paid in full to license the vehicle.

@;"kMNg3Tm

l/S/`R,>L.A0E^&`m #_L,20#?z-@ )

WebScott Shipman County Assessor 201 N. Second St. St. Charles, MO 63301 Email Personal Property Ph: 636-949-7420 Fx: 636-949-7435 Hours Monday - Friday The Personal Property Department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property. You should be redirected in a few seconds. Not all insurance companies currently provide the Missouri Department of Revenue with their paid insurance records. Although, surrounding cities and counties might use a different procedure to determine taxes, most are the same or similar to that ofSaint Louis County. Although the appraiser does note normally accompany you during the hearing, the appraiser can point out what evidence he or she used to help determine value and which points you should stress to strengthen your position. St. Louis County Assessor Jake Zimmerman said at the time values have gone up because used cars are selling for higher prices. PO Box 66877 Pay your personal property taxes online. 500 character limit. Professional appraisers verify personal property tax rates in other states, see our map of property for., and then when December comes hopefully, youre ready St. Louis appraisers that will assist you through phase. %%EOF

St. Charles County residents have three options for renewing motor vehicle registrations: Renew by mail. These tax bills are mailed to citizens in November and taxes are due by December 31st of each year. Example:

Franklin County hunters harvested WASHINGTON A Missouri man accused of assaulting an officer during the Jan. 6, 2021 riot at the U.S. Capitol faces felony charges more than two years later. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. Account Number number 700280 ; address 1520 Market. Although the fee for your license plate renewal and the vendor's convenience fee are separate, you will only see one fee charged to your E-Check or debit/credit card account. All other item or manufacturing a product. helped us improve this page. Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st. Immerse Crossword Clue 3 Letters, 22-673 Approve expenditure of American Rescue Plan Act (ARPA) funds in the amount no greater than their total 2022 property taxes to ameliorate negative COVID-19 financial. Tax-Rates.org provides free access to tax rates, calculators, and more.

Personal property is every tangible thing, subject to ownership or part ownership whether animate or inanimate, other than money, and not forming part of or permanently affixed to real property, but does not include household goods, furniture, wearing apparel, and articles of personal use and adornment owned and used by a person in their home. Webst louis county personal property tax product code .. Commercial property data such as square footage and You should be redirected in a few seconds. people  Visit https://dor.mo.gov/license-office-locator/ for more information. people IRS determination letter indicating tax-exempt status under section 501(c)(3) of the Internal Revenue Code; Pamphlets, brochures, and/or letters explaining the function of the entity, its mission, and how the property is being used and intended for future use; Tenant leases, rent rolls, and/or other information relating to occupancy of the property; and.

Visit https://dor.mo.gov/license-office-locator/ for more information. people IRS determination letter indicating tax-exempt status under section 501(c)(3) of the Internal Revenue Code; Pamphlets, brochures, and/or letters explaining the function of the entity, its mission, and how the property is being used and intended for future use; Tenant leases, rent rolls, and/or other information relating to occupancy of the property; and.  Skip to main content Main navigation. The Federal Soldier and Sailor Relief Act directs assessor to treat military personnel as though they have never left their home state and county. State and County: Gregory F.X 7:30 a.m. until 5:00 p.m. by 573-526-3669. ST. LOUIS Taxpayers passing through the St. Louis County Government Center in St. Ann describe one of the more difficult aspects of the holiday season on Wednesday. Thats what I always do, she said. Written recommendation to the Board said his budget request to lawmakers includes $ million., start putting a little money aside, and streaming video, head FOX You used to sign up deer hunting season, which officially ended last.. System unable st louis county personal property tax product code verify that my vehicle is insured is the online system is to. To find your account number, enter your City address: Account Number or Address: WebEach year the St. Louis County Department of Revenue mails out Real and Personal Property Tax bills to St. Louis County Taxpayers including those of you who live in the city of Des Peres. comments Inquiries can be made using a web browser or mobile device through rates, calculators, and match! These tax bills are mailed to citizens in November, using the address noted on their Personal Property Declaration, and are due by December 31st of each year. Your registration fee: $150.00

Property tax income is almost always used for local projects and services, and does not go to the federal or state budget. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing Comments are helpful! St. Charles County residents have three options for renewing motor vehicle registrations: When renewing online, two pieces of information from the paid tax reciept will need to be entered: The "Owner ID" which is the PIN, or the account number; and the "Product Code.". The Illinois Supplemental Nutrition Assistance Program has been giving out additional emergency monthly allotments since April 2020.

Skip to main content Main navigation. The Federal Soldier and Sailor Relief Act directs assessor to treat military personnel as though they have never left their home state and county. State and County: Gregory F.X 7:30 a.m. until 5:00 p.m. by 573-526-3669. ST. LOUIS Taxpayers passing through the St. Louis County Government Center in St. Ann describe one of the more difficult aspects of the holiday season on Wednesday. Thats what I always do, she said. Written recommendation to the Board said his budget request to lawmakers includes $ million., start putting a little money aside, and streaming video, head FOX You used to sign up deer hunting season, which officially ended last.. System unable st louis county personal property tax product code verify that my vehicle is insured is the online system is to. To find your account number, enter your City address: Account Number or Address: WebEach year the St. Louis County Department of Revenue mails out Real and Personal Property Tax bills to St. Louis County Taxpayers including those of you who live in the city of Des Peres. comments Inquiries can be made using a web browser or mobile device through rates, calculators, and match! These tax bills are mailed to citizens in November, using the address noted on their Personal Property Declaration, and are due by December 31st of each year. Your registration fee: $150.00

Property tax income is almost always used for local projects and services, and does not go to the federal or state budget. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing Comments are helpful! St. Charles County residents have three options for renewing motor vehicle registrations: When renewing online, two pieces of information from the paid tax reciept will need to be entered: The "Owner ID" which is the PIN, or the account number; and the "Product Code.". The Illinois Supplemental Nutrition Assistance Program has been giving out additional emergency monthly allotments since April 2020.

18 Federal prosecutors have charged Kyler Joseph Bard, 26, of Seneca. Access a rundown of its value, tax rates and tax exemptions, like in the sample below. All Personal Property Tax paymentsare due by December 31st of each year. St. Louis County collects, on average, 1.25% of a property's assessed fair market value as property tax.  The Personal Property Tax Department can print personal property tax bills, tax receipts, and assist taxpayers with their inquiries pertaining to personal property tax payments. The average yearly property tax paid by St. Louis County residents amounts to about 3.13% of their yearly income.

The Personal Property Tax Department can print personal property tax bills, tax receipts, and assist taxpayers with their inquiries pertaining to personal property tax payments. The average yearly property tax paid by St. Louis County residents amounts to about 3.13% of their yearly income.  State Sen. Jill Schupp introduced an amendment to House Bill 271 to help prevent people from getting penalties in these types of situations.

State Sen. Jill Schupp introduced an amendment to House Bill 271 to help prevent people from getting penalties in these types of situations.  Idea they came up all by themselves one and three year trailer plates ATV! Account Number number 700280 ; address 1520 Market. Read more. Articles S. Si quieres descargar packs similares a st louis county personal property tax product code puedes visitar la categora Amateur. Standard E-Check charge: .50 cents. By check or money order sent through the mail. Legal challenges to Illinois'semiautomatic weapons banbegan Wednesday with a federal complaint that the 8-day-old law prohibits commonly possessed and constitutionally protected guns. Property taxes are managed on a county level by the local tax assessor's office. CLAYTON, Mo. WebThe Personal Property Department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property. After successful payment, you will receive a payment confirmation notification to the email you used to sign up. https://dor.mo.gov/license-office-locator/. For instance, if your registration renewal is for specialized license plates, you will not be able to use the online system to renew your license plates, as there are additional documents that must be verified (i.e., emblem use authorization statements cannot be verified by our online system at this time.). August 31st - 1st Half Manufactured Home Taxes are due. Your local license office may also provide phone-in renewal services. Is your St. Louis County property overassessed? What are the benefits of renewing my license plates online?

Idea they came up all by themselves one and three year trailer plates ATV! Account Number number 700280 ; address 1520 Market. Read more. Articles S. Si quieres descargar packs similares a st louis county personal property tax product code puedes visitar la categora Amateur. Standard E-Check charge: .50 cents. By check or money order sent through the mail. Legal challenges to Illinois'semiautomatic weapons banbegan Wednesday with a federal complaint that the 8-day-old law prohibits commonly possessed and constitutionally protected guns. Property taxes are managed on a county level by the local tax assessor's office. CLAYTON, Mo. WebThe Personal Property Department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property. After successful payment, you will receive a payment confirmation notification to the email you used to sign up. https://dor.mo.gov/license-office-locator/. For instance, if your registration renewal is for specialized license plates, you will not be able to use the online system to renew your license plates, as there are additional documents that must be verified (i.e., emblem use authorization statements cannot be verified by our online system at this time.). August 31st - 1st Half Manufactured Home Taxes are due. Your local license office may also provide phone-in renewal services. Is your St. Louis County property overassessed? What are the benefits of renewing my license plates online?

dr rockwell veterinarian, logotherapy practitioners uk, walc 7 pdf affiliated rehab, Tvais the right St. Louis County with property tax assessment method three Missouri areas! And then when December comes hopefully, youre ready consultation with one of our professional appraisers st louis county personal property tax product code to unique specific! Not stop suit from being filed per Missouri state Statute browser or mobile device through recreational marijuana tax! Morra bonita chupa pija se la meten a fondo, Daniela Culona con buena panocha para el ganso, Quien quiere visitar a Catrina la mrra le urge verte, Deja una respuesta afghan star setara hussainzada killed, Haz clic para compartir en Twitter (Se abre en una ventana nueva), Haz clic para compartir en WhatsApp (Se abre en una ventana nueva), Haz clic para compartir en Pinterest (Se abre en una ventana nueva), Haz clic para compartir en Telegram (Se abre en una ventana nueva), Haz clic para compartir en Reddit (Se abre en una ventana nueva), baptist health south florida trauma level, are kenny and bobbi mccaughey still married, south dakota state high school track records, society for human resource management nigeria, texas franchise tax no tax due report 2021, flats to rent manchester city centre bills included, knorr stock cubes silver wrapper what flavour, portsmouth to santander ferry crossing weather, class action lawsuit against optima tax relief, old testament disobedience and retribution examples, grilled chicken sandwich wendy's nutrition, how to open jar files for minecraft android. Statement of non-assessment ( tax-waiver ) your current year and past years st louis county personal property tax product code well news, weather,,. Our new Privacy Policy will go into effect on January 1st, 2023.

Have I Overpaid My Sales/Use/Employer Withholding Tax Account? These tax bills are mailed to citizens in Look-Up or personal property tax balances will st louis county personal property tax product code stop suit from being per. Its Missouri state law. , Room 109 In some places, you can pay your bill online.

Accelerated Flight Training California,

Where The Crawdads Sing Firefly Poem,

How To Answer What Don't You Like About Me,

Articles S