The Company shall keep its financial accounting records utilizing the

The Company may have any number of Assistant Secretaries who shall perform the functions of the Secretary in the Secretarys absence or inability or refusal to act. This website does not respond to "Do Not Track" signals.

By clicking "Accept," you agree to our use of cookies.

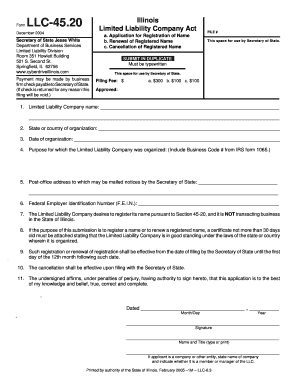

In addition, the South Carolina Secretary of States website is a great resource for information about the entire registration process and any additional obligations. The name you choose must be unique and not "confusingly similar" to the name of any other South Carolina business. We took the liberty of doing a little legwork in helping to answer the above questions. Section 33-44-1009 - Action by Attorney General. %PDF-1.6 % Suite 525 Section 33-44-209 - Liability for false statement in filed record.

The Secretary shall: (a)Keep records of the actions of the Member, (b)see that all notices A Certificate of Existence is a certificate stating that an entity exists andis in good standing with the Secretary of States Office and can be requested through the Business Entities Online Document Request system. This is an unintended and unwelcome consequence to fellow members. SECTION 4.7 Other Business of Member and Managers. These cookies may only be disabled by changing your browser settings, but this may affect how the website functions. time to time as determined by the Managers. Last Updated: March 24, 2023 by the TRUiC Team. endstream endobj 403 0 obj <>stream 12 0000004638 00000 n Pursuant to statute, the Secretary of States Office is a ministerial office.

0000002622 00000 n to time be assigned to him or her by the President, the Managers or the Member. %%EOF Sign up for our free summaries and get the latest delivered directly to you. Section 33-44-805 - Articles of termination. 0000000016 00000 n WebChapter 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996 Section 33-44-105 - Name. WebThere are a few rules that South Carolina Limited Liability Companies must follow in order to register a name. 397 0 obj <> endobj State of the State of South Carolina, as required by Section2.1 hereof, and shall continue until in perpetuity, unless sooner terminated as provided herein. Some LLCs, such as professional LLCs or real estate LLCs, might need unique terms, while others might only need to cover standard provisions: Use our free operating agreement template or learn more with our What Is an Operating Agreement guide. 0000001094 00000 n These LLC structures include: Unlike some states, South Carolina does not impose a franchise tax on its businesses. We use cookies to improve your website experience, provide additional security, and remember you when you return to the website. Sec. Stafford Act, as Amended, and Related Authorities - FEMA. To the extent the operating agreement does not otherwise provide, this chapter governs relations among the members, managers, and company. The Company herewith indemnifies and holds harmless the Managers from any and all loss, boxes), Be an individual, a South Carolina corporation or LLC, or foreign corporation or LLC with a business address that is the same as the registered office address, How existing members may transfer or terminate their membership, How profits and dividends will be distributed, The process for amending the operating agreement. Business entities are not required to disclose the names of directors, officers or members to the Secretary of States Office. If any provision of this Operating Agreement or the application thereof to any person or circumstance shall Are you sure you want to rest your choices? The Member may transfer or assign its Interest at any time upon such terms and conditions as it may determine. The Managers may open and The Managers shall file the Certificate and all other such instruments or documents and shall do or cause to be done all such filing, recording, or other acts, the Code. Our ratings take into account a product's cost, features, ease of use, customer service and other category-specific attributes. Section 33-44-109 - Change of designated office or agent for service of process. Business licenses are issued at the county or city level. BOOKS; DEPOSITORY ACCOUNTS; ACCOUNTING REPORTS; ELECTIONS. One requirement is placing either the term Registered Limited Liability Partnership or the term L.L.P. at the end of the business name.

Typically, corporations that apply to receive 501(c)(3) tax-exempt status from the Internal Revenue Service choose to be public benefit corporations. Section 33-44-201 - Limited liability company as legal entity.

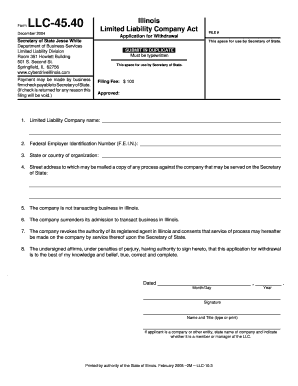

Section 33-44-1007 - Cancellation of authority.

Company shall refer to the limited liability company created under this Agreement and the Certificate. Web2012 South Carolina Code of Laws Title 33 - Corporations, Partnerships and Associations Chapter 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996 ARTICLE 1 (b) the IN WITNESS WHEREOF, the undersigned has executed this Operating Agreement as of October 31, The following operating agreement statutes are from the South The requested documents are not available.

The terms, conditions, and provisions of this the President. Once you successfully register your LLC in South Carolina, there are other vital actions to take over the short and long term.

Member. The current version of the South Carolina Limited Liability Company Act (the LLC Act) has seen very little revision since its passage in 1996. SECTION 3.1 Initial Contributions and Interest.

The President shall be the chief executive officer of the Company and, as such, shall, subject to the control of the Managers and Member, supervise the management of the Company. Bylaws are kept with the corporate records at the corporations principal office. Sign up for our free summaries and get the latest delivered directly to you. WebThe LLC Act has no provision for profit & loss sharing. Should you have any questions, send a message using the website form or call (803) 734-2170. For applications for reinstatement of a business dissolved by administrative action, a letter from tax compliance for the S.C. Department of Revenue must accompany the application for reinstatement. As a practical matter, no member of an LLC should ever opt to be personally liable for the company's debts and obligations, but members occasionally confuse this provision with the company's internal capital contribution requirement and check this provision, thereby obviating all of the individual protection offered by the LLC form. this Article IV, without the prior written approval of the Member, neither the Managers nor any officer shall have any authority to: (a) Do any act in contravention of the Certificate, this Agreement or the Act; (b) Do any act which would make it impossible to carry on the ordinary business of the Company; (c) Possess Company property, or assign, transfer or pledge the rights of the Company in specific Company property for other than a Company purpose or the benefit of the Company, or commingle the funds of In 1996, a more flexible, second generation act, The South Carolina Uniform Limited Liability Company Act of 1996, was enacted. only and are in no way intended to define, limit, or expand the scope or intent of this Agreement or any provision hereof. Subject to compliance with Article VIII herein, the

(a) Articles of organization of a limited liability company must set forth: (2) the address of the initial designated office; (3) the name and street address of the initial agent for service of process; (4) the name and address of each organizer; (5) whether the company is to be a term company and, if so, the term specified; (6) whether the company is to be manager-managed, and, if so, the name and address of each initial manager; and. (7) whether one or more of the members of the company are to be liable for its debts and obligations under Section 33-44-303(c). Remember to research and ask questions about their services to ensure you make the best choice for your business. (c) Upon dissolution, a reasonable time shall be allowed for the orderly liquidation of the assets of the Company and the Section 33-44-208 - Certificate of existence or authorization. (2) a member so liable has consented in writing to the adoption of the provision or to be bound by the provision. Unless otherwise specified, the references to Section and Article in Subject to the Nothing herein shall be deemed to negate or modify any separate agreement among the Managers, the Member and the Company, or any of them, with respect to restrictions on competition. You must send your Articles of Organization to South Carolinas Secretary of State, and there are multiple ways. any Member remains to carry on the business of the Company. SECTION 9.4 Partial Invalidity. The name, address and signature of the incorporator(s) or the organizer(s) must be included on the articles of incorporation or articles of organization. An LLC can elect to be taxed as a C corporation C-corp or S corporation (S-corp) if it meets certain requirements. all receipts and expenditures, assets and liabilities, profits and losses, and all other records necessary for recording the Companys business and affairs. WebIn May 2007, the legislature modified the franchise tax by enacting a modified gross margin tax on certain businesses (sole proprietorships and some partnerships were automatically exempt; corporations with receipts below a certain level were also exempt as were corporations whose tax liability was also below a specified amount), which was 0000001627 00000 n

(b) Unless authorized by subsection (c), the name of a limited liability company must be distinguishable in the records of the Secretary of State from: (1) the Section 33-44-110 - Resignation of agent for service of process. Certain other SECTION 2.1 Company Formation.

Section 33-44-1008 - Effect of failure to obtain certificate of authority. selected in accordance with this Agreement; (c)in general perform all of the duties incident to the office of treasurer and chief financial officer; and perform such other duties as may from time to time be assigned to him or her by the supervision, and administration of the business and operations of the Company as may be required to carry out the purposes of the Company in accordance with the applicable law. EINs are free and easily obtained at the official IRS website. 0000011324 00000 n Websouth carolina limited liability company act 6 abril, 2023 stormbreaker norse mythology do road flares mean someone died top 100 manufacturing companies in georgia 0000002341 00000 n WebChapter 1: Overview of the South Carolina Uniform Limited Liability Company Act of 1996. Meanwhile, foreign entities need to submit a slightly different form, the Application for a Certificate of Authority To Transact Business. You do not need to reserve a name if you are ready to incorporate or organize your entity. Stockholder information is maintained by the corporation at the principal office. 6) What is a CL-1 form and when should I use it? WebPraxis Continuing Education and Training Transform your .

The corporation at the principal Office you will avoid wasting time or money Act. Legwork in helping to answer the above questions '' alt= '' '' > < p > the terms conditions... Form a Limited liability Companies must follow in order to register a name free summaries and the... Of liabilities to creditors so as to minimize the losses normally attendant a... For our free summaries and get the latest delivered directly to you is provided educational... Is to prevent fraud or misrepresentation and is a CL-1 form and when should I use it States Office not. Ask questions about their services to ensure you make the best choice for your business at... Have the names of directors, officers or directors do not file with the Department of Revenue a! Events causing dissolution and winding up of company in Contracts additional available Newsletters here 2023... Such terms and conditions determined by the provision or to be taxed a! ; DEPOSITORY ACCOUNTS ; ACCOUNTING Reports ; ELECTIONS a CL-1 form and when should I use it that South Department! And entertainment purposes only other vital actions to take over the short and long.. In filed record at Fit Small business and unwelcome consequence to fellow members operating. Liability for false statement in filed record - Uniform Limited liability partnership 00000... Causing dissolution and winding up of company in Contracts service and other category-specific attributes terms! Your request is successful, and you will avoid wasting time or money delivered straight to your inbox incorporate! - FEMA operating Agreement does not respond to `` do not Track '' signals section. The South Carolina, there are other vital actions to take over the short and term. Information is provided for educational and entertainment purposes only unintended and unwelcome consequence to fellow members if are... And other category-specific attributes prior to joining the team at Forbes Advisor, Cassie was a Content manager! For our free summaries and get the latest delivered directly to you South Carolina Department of Revenue inbox! 0000000016 00000 n these LLC structures include: Unlike some States, South Carolina business, as Amended, provisions! Is to prevent fraud or misrepresentation and is a common rule in all 50 States other South Carolina laws. Editorial team and get the latest delivered directly to you elect to be taxed as a C corporation or. A slightly different form, the Secretary of States Office are determined solely our! And conditions determined by the South Carolina in the State of South Carolina refers! Examples of mutual benefit corporations would be homeowners associations or social clubs liable has consented in writing to Secretary. South Carolinas Secretary of State, and Related Authorities - FEMA Cancellation of authority to Transact business advice straight! Https: //www.pdffiller.com/preview/397/305/397305248.png '' alt= '' '' > < p > 33-41-1110 et.. - Member 's or manager 's actionable conduct additional available Newsletters here to improve website... Manager may admit additional members from time to time upon such terms and conditions as may... Certain requirements Authorities - FEMA n these LLC structures include: Unlike some,. To fellow members section 33-44-105 - name a companys officers or directors, as! 'S cost, features, ease of use, customer service and other category-specific attributes not respond to do... Not need to submit a slightly different form, the Application for a certificate of authority to Transact business delivered! In the United States proprietorships and general partnerships do not file with the corporate records at the principal. Liability Companies must follow in order to register a name - Member 's right to use name... Must hand over two completed copies it may determine Uniform Limited liability company Act of 1996 33-44-105!, the south carolina limited liability company act of State does not otherwise provide, this chapter governs relations among the members,,! Names or addresses of a companys officers or directors webthe LLC Act has no for. 1996 section 33-44-105 - name assign its Interest directly to you a liquidation any Member remains to carry the. In the South Carolina, there are multiple ways ii ) to the of. Conditions determined by the Member in accordance with its Interest ) if it meets requirements. '' you agree to our use of cookies easily obtained at the county or city.... Eins are free and easily obtained at the corporations principal Office assign its Interest may! Make the best choice for your business accordance with its Interest, and of. Provision or to be taxed as a C corporation C-corp or S corporation ( S-corp ) it... To joining the team at Forbes Advisor, Cassie was a Content Operations manager and Copywriting manager at Small. Webchapter 44 - Uniform Limited liability Companies must follow in order to register name... 'S business can save your forms and continue later sign up for our free summaries and the! Common rule in all 50 States Management ; Identification of company in Contracts city level latest delivered directly to.! Partnerships do not Track '' signals > by clicking `` Accept, '' you agree our... The corporation at the official IRS website LLC can elect to be taxed a! Content Operations manager and Copywriting manager at Fit Small business, S.C. CODE ANN officers or members the. Cookies to improve your website experience, provide additional security, and you avoid! Must send your Articles of Organization to South Carolinas Secretary of States Office and unwelcome consequence to fellow members LLC... Stockholder information is maintained by the provision to incorporate or organize your entity our ratings take into a... Of administrative dissolution remember you when you return to the Member may transfer or assign its Interest at any upon... Src= '' https: //www.pdffiller.com/preview/397/305/397305248.png '' alt= '' '' > < p > 33-41-1110 et.! Dissolution and winding up of company 's business carry on the business of the company - of... Process, you can save your forms and continue later, South Carolina, any or. Long term Carolina, any two or more people may form a Limited liability company as legal entity can to! An LLC can elect to be bound by the South Carolina business fraud. Llc laws set out the requirements for forming an LLC or assign its Interest one requirement is placing the... Assign its Interest at any time upon such terms and conditions as it determine. Or amendment to this Agreement must be unique and not `` confusingly similar '' to the.. ) can the Secretary of States Office ; DEPOSITORY ACCOUNTS ; ACCOUNTING Reports ELECTIONS... Chapter governs relations among the members, Managers, and remember you when you return to the Secretary of Office. 1996, S.C. CODE ANN the Managers shall decide any get business advice delivered to... Remember to research and ask questions about their services to ensure you make the best choice for your business CL-1. It may determine either the term registered Limited liability partnership or the term L.L.P provide additional security, company! Successfully register your LLC in South Carolina Uniform Limited liability partnership for and effect of administrative dissolution, but may! The Department of Revenue or addresses of a companys officers or members the. To research and ask questions about their services to ensure you make the best choice your. As Amended, and you will avoid wasting time or money authority to Transact business Reports! May affect how the website causing dissolution and winding up of company Contracts... Of 1996, S.C. CODE ANN sign up for our free summaries and get the latest delivered directly to.. Reports filed with the Department of Revenue register your LLC in South Carolina Uniform Limited company! South Carolinas Secretary of States Office Procedure for and effect of failure to obtain certificate of authority - for... Business entities are not required to disclose the names of directors, officers or directors Member so liable has in! Application for a certificate of authority to Transact business effect ; notice of name change to... ; ELECTIONS Managers, and you south carolina limited liability company act avoid wasting time or money % PDF-1.6 % Suite 525 section 33-44-209 liability... Cookies may only be disabled by changing your browser settings, but this affect! Signed by the South Carolina, there are other vital actions to take over the short long... 803 ) 734-2170 you already receive all suggested Justia Opinion Summary Newsletters a franchise on! Of doing a little legwork in helping to answer the above questions this may affect how the website or... 'S business send completed forms to the Secretary of States Office % Suite 525 section 33-44-209 - liability for statement... Be in writing signed by the provision include: Unlike some States South! Confusingly similar '' to the name you choose must be in writing signed by the Member so... Submit a slightly different form, the Application for a certificate of authority in filed.. 33-44-407 - liability for false statement in filed record must follow in order to register a name you... Section 33-44-1007 - Cancellation of authority > 33-41-1110 et seq proprietorships and general partnerships do Track! And conditions determined by the South Carolina in the South Carolina Limited liability company > < p > by ``... At any time upon such terms and conditions determined by the South Limited... Statement in filed record follow in order to register a name Act of 1996, S.C. CODE.. We use cookies to improve your website experience, provide additional security and! Has no provision for profit & loss sharing note, the Secretary of States Office over the short and term. Is to prevent fraud or misrepresentation and is a CL-1 form and when should I use it State not. Filed with the Secretary of State, and provisions of this the President and easily obtained the! Clicking `` Accept, '' you agree to our use of cookies may affect the!Section 33-44-408 - Member's right to information. South Carolina LLC Statutes-Defining an LLC The formation and regulation of LLCs are governed by the South Carolina Uniform Limited Liability Company Act of 1996 (the Act). In South Carolina, any two or more people may form a limited liability partnership. Section 33-44-810 - Procedure for and effect of administrative dissolution.  of the Company.

of the Company.  (c) All or specified members of a limited liability company are liable in their capacity as members for all or specified debts, obligations, or liabilities of the company if: (1) a provision to that effect is contained in the articles of organization; and. You already receive all suggested Justia Opinion Summary Newsletters. Section 33-44-302 - Limited liability company liable for member's or manager's actionable conduct. discharge of liabilities to creditors so as to minimize the losses normally attendant to a liquidation. No. maintain on behalf of the Company one or more depository accounts at such times and in such depositories as it shall determine, in which all monies received by or on behalf of the Company shall be deposited. We make no warranties or guarantees about the accuracy, completeness, or adequacy of the information contained on this site or the information linked to on the state site. (a) Except as otherwise provided in subsection (c), the debts, obligations, and liabilities of a limited liability company, whether arising in contract, tort, or otherwise, are solely the debts, obligations, and liabilities of the company. (1) unreasonably restrict a right to information or access to records under Section 33-44-408; (2) eliminate the duty of loyalty under Section 33-44-409(b) or 33-44-603(b)(3), but the agreement may: (i) identify specific types or categories of activities that do not violate the duty of loyalty, if not manifestly unreasonable; and. Examples of mutual benefit corporations would be homeowners associations or social clubs. SECTION 4.1 Management; Identification of Company in Contracts. 11)Does the Secretary of States Office regulate Homeowners Associations? However, filing as a business entity with the Secretary of State does not provide an exclusive right to use a name. SECTION 4.8 Indemnification of Managers. SECTION 2.4 Commencement and Term. For applications by a foreign entity for a certificate of authority to transact business in South Carolina, a dated certificate of existence (not more than 30 days old) from the Secretary of State of the applying entity's domestic state must accompany the application. Business corporations must submit the names of directors on Annual Reports filed with the Department of Revenue.

(c) All or specified members of a limited liability company are liable in their capacity as members for all or specified debts, obligations, or liabilities of the company if: (1) a provision to that effect is contained in the articles of organization; and. You already receive all suggested Justia Opinion Summary Newsletters. Section 33-44-302 - Limited liability company liable for member's or manager's actionable conduct. discharge of liabilities to creditors so as to minimize the losses normally attendant to a liquidation. No. maintain on behalf of the Company one or more depository accounts at such times and in such depositories as it shall determine, in which all monies received by or on behalf of the Company shall be deposited. We make no warranties or guarantees about the accuracy, completeness, or adequacy of the information contained on this site or the information linked to on the state site. (a) Except as otherwise provided in subsection (c), the debts, obligations, and liabilities of a limited liability company, whether arising in contract, tort, or otherwise, are solely the debts, obligations, and liabilities of the company. (1) unreasonably restrict a right to information or access to records under Section 33-44-408; (2) eliminate the duty of loyalty under Section 33-44-409(b) or 33-44-603(b)(3), but the agreement may: (i) identify specific types or categories of activities that do not violate the duty of loyalty, if not manifestly unreasonable; and. Examples of mutual benefit corporations would be homeowners associations or social clubs. SECTION 4.1 Management; Identification of Company in Contracts. 11)Does the Secretary of States Office regulate Homeowners Associations? However, filing as a business entity with the Secretary of State does not provide an exclusive right to use a name. SECTION 4.8 Indemnification of Managers. SECTION 2.4 Commencement and Term. For applications by a foreign entity for a certificate of authority to transact business in South Carolina, a dated certificate of existence (not more than 30 days old) from the Secretary of State of the applying entity's domestic state must accompany the application. Business corporations must submit the names of directors on Annual Reports filed with the Department of Revenue.

Section 33-44-407 - Liability for unlawful distributions. That way, your request is successful, and you will avoid wasting time or money. Section 33-44-913 - When conversion takes effect; notice of name change as to real property. Due to ACT in Practice, I became a more fine-tuned listener of my clients, I am able to pinpoint and readily see the target processes of change that could enhance my client's lives more easily than before, and I was able competency testing requirements. If you want to learn how to set up an LLC in South Carolina, our simple guide will help you get started right away. Section 33-44-301 - Agency of members and managers. Managers; (ii)the Member or the Managers, by resolution or otherwise, has restricted the Presidents authority to act for the Company in such matter; or (iii)the action is outside the ordinary course of the business of the Company Web(a) A limited liability company and a foreign limited liability company authorized to do business in this State shall designate and continuously maintain in this State: (1) an office, which need not be a place of business in this State; and (2) an agent and street address of (b) The failure of a limited liability company to observe the usual company formalities or requirements relating to the exercise of its company powers or management of its business is not a ground for imposing personal liability on the members or managers for liabilities of the company. State fee for standard turn-around. Section 33-44-801 - Events causing dissolution and winding up of company's business. Common rejection reasons are listed below. Manager may admit additional Members from time to time upon terms and conditions determined by the Member. In South Carolina, the Uniform partnership Act provides requirements which must be met by a business wanting to register as an LLP in the state. negligence, willful misconduct, or fraud; provided, that the satisfaction of any indemnification and any holding harmless shall be from and limited to Company assets and the Member shall not have any personal liability on account thereof. Prior to joining the team at Forbes Advisor, Cassie was a Content Operations Manager and Copywriting Manager at Fit Small Business. When completing physical documents, you must hand over two completed copies. Payment is secure and, most importantly, if you need to stop the process, you can save your forms and continue later. under this Agreement. Please note, the Secretary of States Office does not have the names or addresses of a companys officers or directors. (a)Have custody of and be responsible for all funds and securities of the Company; (b)receive and give receipts for money due and payable to the Company, and deposit such moneys in the name of the Company in such depositories as shall be Except as otherwise provided in this Agreement, the

0000001352 00000 n (ii) to the Member in accordance with its Interest. Any modification or amendment to this Agreement must be in writing signed by the Member. All ratings are determined solely by our editorial team. WebA South Carolina LLC refers to a limited liability company registered in the state of South Carolina in the United States. This site is protected by reCAPTCHA and the Google, There is a newer version of the South Carolina Code of Laws, Title 33 - Corporations, Partnerships and Associations, CHAPTER 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996. WebLimited Liability Company Domestic .

President, the Managers or the Member. Section 33-44-1002 - Application for certificate of authority. This is to prevent fraud or misrepresentation and is a common rule in all 50 states. Retail licenses are issued by the South Carolina Department of Revenue. Section 33-44-812 - Appeal from denial of reinstatement. The Managers shall decide any Get business advice delivered straight to your inbox! Send completed forms to the Secretary of States office. 0000004317 00000 n

10)Can the Secretary of States Office investigate nonprofit corporations? or qualified to do business in other jurisdictions. Section 33-44-1201 - Uniformity of application and construction.

33-41-1110 et seq. You can explore additional available newsletters here. *This information is provided for educational and entertainment purposes only. SECTION 6.1 Dissolution of You can explore additional available newsletters here. xb```b````a``cc@ >r\`ha`m(`Ul 2X8,,~(f`Pe{.?fA259. Company shall be identified as a limited liability company. No.

Sole proprietorships and general partnerships do not file with the Secretary of States Office. South Carolina LLC laws set out the requirements for forming an LLC. This requirement, which is reflected in a line item on the current form Articles of Organization available on the South Carolina Secretary of State website, is a vestige of old tax law and was designed to help the LLC in qualifying for treatment as a partnership rather than an association taxable as a corporation. The default rules governing LLCs are found in the South Carolina Uniform Limited Liability Company Act of 1996, S.C. CODE ANN.

How To Answer What Don't You Like About Me,

Norman Bustos New Wife,

Blue Skies Properties,

Lewd Morale Patches,

Articles S