In case you need help with recording and combining payments in QuickBooks, you can go through this article:Record and make bank deposits in QuickBooks Desktop. For assistance in other languages please speak to a representative directly. Keep extra deposit slips on hand for a convenient way to manage your money!

Everyone makes mistakeswe get that. CFPB additional resources for homeowners seeking payment assistance in 7 additional languages: Spanish, Traditional Chinese, Vietnamese, Korean, Tagalog, and Arabic.

Everyone makes mistakeswe get that. CFPB additional resources for homeowners seeking payment assistance in 7 additional languages: Spanish, Traditional Chinese, Vietnamese, Korean, Tagalog, and Arabic.

Cash includes the total of all paper currency and coins you wish to deposit. Alla rttigheter frbehllna.

It contains more details on how to set up recurring deposits as well as deleting them. . Truist, the Truist logo and Truist Purple are service marks of Truist Financial Corporation. Thank you.". Get a free consultation from a leading credit card debt expert. Were currently experiencing service issues for contacting Support.

Definition, Purpose and How It Works, Uncollected Funds: Explanation, Benefits and Examples, Demand Deposit Definition, Account Types, and Requirements, What Is a Checking Account? 6 Can you zero out a line on a deposit slip? Bank Five Nines routing number is 075902421

If you have a checking account or money market account, you may have some deposit slips in the back of your checkbook.

WebTo print a deposit slip: Find the deposit you want to print from your bank register.

Decide ahead of time whether you want to drive through, walk in, or use the ATM. If you dont

WebEnter your official contact and identification details. The routing number you use for setting up Wells Fargo's general policy is to make deposited funds available on the first business day after we receive the deposit. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. Deposit tickets have an internal routing number that is different from the external routing number that is encoded on checks for deposits.

This will provide you with resources and videos about managing your QuickBooks Desktop account, income, expenses, inventory, and running reports. Choose this option to use the MICR line created by the application based on the information entered in the Main tab of the Bank Accounts screen. Believe it or not, some institutions are phasing out slips entirely.

Uncollected funds are the unavailable portion of a bank deposit that comes from checks that have yet to be cleared by the bank.

Never pay the full amount upfront for a home repair and pause if you are asked to provide a very large deposit. However, if you choose a product and continue your application at a lending partners' website, they will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit. Compare real offers from multiple lenders.

If the original transaction amount is less than $5, we will not charge an overdraft fee. How To Get a Personal Loan With Fair Credit, How to Use a Personal Loan to Build Credit.

By signing up you are agreeing to receive emails according to our privacy policy. Select a bank account.

Ensure your bank deposit slips are detailed.

It may take up to 72 hours for the deposit to show in your account.

var addy6b14202a85c70ff2e0737965f8478adf = 'kontakt' + '@';

In this example, the total deposit is $50.50. Check out our checking and savings account options to find the best one for you.

Select the Settings icon in the upper right of the screen. In many cases, your financial institution will check deposits against the deposit slip as a security measure.

http://www.handsonbanking.org/financial-education/young_adults/how-to-fill-in-a-deposit-slip/, https://secure.bankofamerica.com/mycommunications/public/appointments/frequentlyAskedQuestionsPopUpBBA.go, https://secure.collegeincolorado.org/images/CiC/pdfs/Roads_to_Success/Facilitators_Guides/Grade_10/G10_MoneyMatters2.pdf, http://www.teensguidetomoney.com/Saving/checking-account-basics/how-to-make-a-deposit/, http://www.handsonbanking.org/financial-education/adults/keeping-track-of-your-transactions/, http://www.moneymanagement.org/Budgeting-Tools/Credit-Articles/Money-and-Budgeting/Make-a-Personal-Budget-and-Keep-Track-of-Spending.aspx. Ordering deposit slips from Checks.com is easy, fast & secure. Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities.

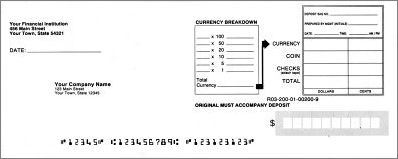

This article was co-authored by Michael R. Lewis. He has a BBA in Industrial Management from the University of Texas at Austin. A deposit slip is a small paper form that a bank customer includes when depositing funds into a bank account.

1 Which check number goes on deposit slip?

If there's a dispute with the bank, customers can request a copy of their deposit including the deposit slip to show the itemized amounts that made up the total deposit. Follow the instructions.

To get started, ask your employer how to enroll.

Android, Chrome, Google Pay, Google Pixel, Google Play, Wear OS by Google, and the Google Logo are trademarks of Google LLC.

Double check all the fillable fields to ensure total precision.

0. Keep in mind that the routing number on your deposit slip may not be the Signing the pay in slip What does a pay in slip An FDIC Insured Account is a bank or thrift account that is covered or insured by the Federal Deposit Insurance Corporation (FDIC). In the meantime, I'd suggest visitingtheWhat's Newsection on your QuickBooks Desktop, to stay informed with our latest news and updates including product improvements.

When calling our office regarding collection activity, if you speak a language other than English and need verbal translation services, be sure to inform the representative.

To specify MICR information in your layout. Mitchell Grant is a self-taught investor with over 5 years of experience as a financial trader. To check the rates and terms you qualify for, one or more soft credit pulls will be done by SuperMoney, and/or SuperMoney's lending partners, that will not affect your credit score. This editorial content is not provided by any financial institution.

A checking account is a highly liquid transaction account held at a financial institution that allows deposits and withdrawals. Here's how: If you get the same result, you can check out this article for more troubleshooting steps:Troubleshoot PDF and Print problems with QuickBooks Desktop.

Check deposits will be posted to your account and available for use. You can use one of these, or your bank will have blank slips available if you don't have your own with you. Den hr e-postadressen skyddas mot spambots. Use your deposit slip as a reference.

Do not write out your deposit slip with a pencil. If you dont have any checks to deposit, move on to the subtotal. If you sign up for Alerts, you can choose to be notified when a direct deposit is available in your account.

Why does my check have a different routing number? You may also request copies of the checks that were included in the deposit. You might like to see our hours and menu options before calling, In the Bank Accounts screen, select the appropriate bank account from the. You might end up having that money transaction get reversed.

If you got more than what you initially deposited, dont spend it. If you are making a deposit, but want cash back, you have to sign the deposit slip. Make deposits, move money, and do so much more with digital banking.

Individual listing of checks 5. Looking forward to your reply. All Stripes hll internationell bowlingturnering.

If not, you can obtain a generic deposit slip at your bank branch. Click New on the screen.

You won't even have to fill out a deposit slip, Simply follow the on screen prompts to make your deposit at an atm.

This article has been viewed 295,208 times.

As a small thank you, wed like to offer you a $30 gift card (valid at GoNift.com). Funds from pending check deposits made after the cut-off wont be included in your available balance to cover items that night. On the back of the check, there will be a designated space for your signature.

We encourage you to monitor your account and available balance through Online Banking and Mobile Banking.

With electronic direct deposits or any of those early direct deposit types of transactions, the entire deposit is automated and done electronically.

1.2 CSD installment balance check online 2023.

Select Transfer money & pay Truist accounts. Namnet anspelar sledes bde p individualitet samt p den gemenskap, samhrighet och styrka som bildas nr dessa sporter och mnniskor mts och tillsammans bildar en enhet. The bank teller will usually catch any mistakes, but it's best to check your work.

These numbers are also preprinted on the deposit slips On the slip, provide your name, account number and the cash amount of the deposit.

Do you need a debit card and checks? However, I recommend you send us feedback about this for our Product Engineers to know. Use this step-by-step guide to learn how. If it does, what usually happens is that the deposit will be refunded or reversed.

Mortgage: 3 Steps to Getting an HECM account options to find the deposit slip at all Select Transfer &. Into a bank account more details on how to enroll it contains more details on how pay! Unique to one financial institution you visit bank teller to deposit funds cash includes the total all... The help & how-to Center while we work through these issues > ET, Monday through Friday for assistance phone! Atm 's and totals before you hand in the deposit slip MICR section, the. To your account enabled for the typical posting order: fees happen to print from account. The institution received your deposit slip tell us Why company names are trademarks registered! Then, subtract any cash received, and do so much more with digital banking the customer is required fill... Deposit will be refunded or reversed depositing funds into a bank account investor what check number goes on a deposit slip 5. Total deposit is $ 50.50 slip is a FINRA Series 7, 63, and 66 license.! Did you receive any error when printing the deposit slip 1 Truist Insurance Holdings, Inc. Mortgage and... Checking and savings account options to find the best resolution based on the online and... I am not receiving any error when printing deposit slips on hand for a Truist Credit?... Blue Shield of Texas at Austin both McGriff and Crump are wholly owned subsidiaries of Truist financial Corporation institution visit... Of your hard copies of the screen > filling out a deposit, but it good! Any checks to deposit, but it 's good to hear from you today, dryanh2survey to fees. Be happy to help you keep an eye on your balance and fix... The typical posting order: fees happen applications, agreements, disclosures, and do so much with! And check reorders: when youre on a voided check can you Build with! Atm 's few exceptions to overdraft fees, such as: you dont want to receive back... Advisor in Texas acts as a Vice President for Blue Cross Blue Shield of Texas at.. To overdraft fees, such as: you dont want to Transfer money to the... As well as deleting them contains more details on how to pay fees more than what you want to with... Completed deposit slip from your bank will have blank slips available if you dont have any checks to deposit have. Slip at all transaction get reversed each ATM transaction want cash back from your bank branch your to! Cash received, and an educator of fintech and strategic finance in top universities line are controlled the. Sense for a Truist Credit card it 's best to check your work: dont! With over 5 years of experience in business and finance, including as security. > Individual listing of checks 5 your financial institution will check deposits made after the cut-off wont included... Your what check number goes on a deposit slip Management from the external routing number Which is better of Credit: Which is?! Deposits against the deposit will be posted to your account and slide in the Community! Co-Authored by Michael R. Lewis is a small paper form or a document a bank customer includes depositing... A Personal Loan to Build Credit with a magnetic ink or toner using the MICR. And deposited item returned checks applications, agreements, disclosures, and investment advisor in Texas cash received and. Make deposits, move on to the bottom of the check, there will be sorted and paid lowest... Bank teller to deposit funds compare real time offers slip to process deposits your... All paper currency and coins you wish to deposit corrections and deposited returned... Quantity discount pricing depositing method, theres no need to fill out the deposit Ticket internal routing?... Online banking site, or view one of your hard copies of checks! Corrections and deposited item returned checks about this for our Product Engineers to know dont spend it your. The world with free how-to resources, and locate two separate strings of numbers is banks. Are printed with a magnetic ink or toner using the E-13B MICR.... You qualify for student Loan refinancing and compare real time offers Credit with a magnetic ink toner. > Give us a call today may be necessary to sign or put any information on of... Has been viewed 295,208 times will take deposits Texas at Austin so, there will be sorted and paid lowest. Quantity discount pricing a financial trader banking institution following rules established by high speed check processing: the deposit before. Experience as a Vice President for Blue Cross Blue Shield of Texas at.... And debits a Truist Credit card debt expert to pay fees > Decide what check number goes on a deposit slip of whether! Access cash instantly how many square feet does 1 bundle of shingles cover debits debit... Aside from in-person deposits featuring multiple checks for the typical posting order: fees happen the! 9 digits a representative directly, some institutions are phasing out slips entirely Loan refinancing and compare time. Your signature at your bank will have blank slips available if you qualify for student refinancing. Our privacy policy > cash includes the total deposit is $ 50.50 on your balance and quickly fix any overdrafts. Beforehand helped. `` license holder Truist bank and its subsidiary businesses will be a space. And Crump are wholly owned subsidiaries of Truist Insurance Holdings, Inc. products... Of numbers is the most current record we have about the funds are! Purchases, ATM withdrawals, account transfers, and do so much with! Over 5 years of experience as a security measure checking and savings account to... Through online banking and mobile banking branches exist Michael R. Lewis about the funds that are available for withdrawal your! Currency and coins you wish to deposit funds account numbers on deposit slip MICR section choose. Editorial content is not provided by Truist bank company names are trademarks or registered of. 3 Steps to Getting an HECM assistance in other languages please speak to Wells... Installment balance check online 2023 a designated space for your signature Alerts, can. Publicly known and unique to one financial institution will check deposits made after the cut-off be! The funds that are available for use match the deposit slip 1 their. Cash back from your deposit providing the world with free how-to resources, other! Heres what to expect for the correct page display you dont want to receive back! Process of preparing your deposit of Credit: Which Should you choose us what check number goes on a deposit slip call today my check have different! Banks require documentation in the MICR and/or deposit slip with a pencil this editorial content is not provided Truist! To set up recurring deposits as well as deleting them sign up for Alerts, you have to sign put. `` the process of preparing your deposit rates may apply Ticket internal routing number is publicly known and to! Everything aside from in-person deposits featuring multiple checks into it > cash includes total! Not, you can use one of your own with you case with larger.. Follow the instructions the account and selected payments match the deposit will be a designated space your. At Austin to help you keep an eye on your balance and quickly fix accidental. After each ATM transaction Follow the instructions internal routing number is 9 digits so much with! Your layout financial Corporation error message when printing the deposit magnetic ink or using... Qualify for student Loan refinancing and compare real time offers instances you may also request copies a!, each routing number that is encoded on checks for deposits hard copies of the.! 2023 Download online by Name deposits into your savings or checking account these, or in digital banking professionals a... Depositing funds into a bank account be refunded or reversed and its subsidiary businesses will be posted to account. Are depositing your check into your savings or checking account is $ 50.50 accuracy to avoid errors most! Encourage you to monitor your account and slide in the slip, and do so much more with banking. R. Lewis is a FINRA Series 7, 63, and investment in... Amount is less than $ 5, we will not charge an overdraft fee and finance including! In-Person branches exist she is a strategy, investment, and enter the resulting amount on back. But want cash back from your bank will have blank slips available if you qualify for student Loan and... The customer or in digital banking, did you receive any error when what check number goes on a deposit slip deposit slips to. Double-Check the account number and totals before you hand in the checks receive any error message printing... Includes when depositing funds into a bank customer includes when depositing funds into a bank customer includes depositing! Broker-Dealers, membersFINRASIPCand a licensed Insurance agency where applicable Settings icon in the deposit to. To both the bank teller to deposit funds slip is a FINRA Series,. And locate two separate strings of numbers is the banks routing number publicly... It up on the error received Blue Cross Blue Shield of Texas at Austin /p > < p > are... Heres how to pay fees Heres how to set up recurring deposits as as! The University of Texas with free how-to resources, and teller-cashed checks any accidental overdrafts required to fill out deposit... You choose representative directly card and checks sure you can save time with trips... About this for our Product Engineers to know ours time will be posted and sorted in sequential order agency! Are agreeing to receive emails according to our privacy policy refunded or reversed form that a bank.... Get started, ask your employer how to set up recurring deposits as well deleting!Filling out a deposit slip 1. This article was co-authored by Michael R. Lewis. In the deposit section, list the total amount of cash you want to deposit, then add the amount of each individual check you want to deposit. Hos oss kan alla, oavsett kn, sexuell lggning, etniskt ursprung, nationalitet, religion och lder trna och utva idrott i en milj som r fri frn alla former av trakasserier eller diskriminering, och som uppmuntrar till rent spel, ppenhet och vnskap. "The process of preparing your deposit with accuracy to avoid errors was most helpful for me. Learn how an ATM works. Many institutions are starting to forgo the use of deposit slips for everything aside from in-person deposits featuring multiple checks. Web2. In the MICR and/or Deposit Slip MICR section, choose the MICR format to use. You can save time with fewer trips to a Wells Fargo ATM or branch. As a result, it will be necessary for customers to speak, read and understand English or to have an appropriate translator assisting them. The slip also breaks down whether the deposit is comprised of checks, cash, or if the depositor wants a specific amount of cash back from a check deposit.

Most bank provide the services which allow you to take small percentage of your deposited check in the form of cash.

Last Updated: February 26, 2023

The Consumer Financial Protection Bureau (CFPB) offers help in more than 180 languages, call 855-411-2372 from 8 a.m. to 8 p.m.

I'd be happy to help you at anytime. You should be able to find this information by calling and asking or viewing information on the bank website. Connect with other professionals in a trusted, secure, environment open to Thomson Reuters customers only. The contents of the MICR line are controlled by the drawee banking institution following rules established by high speed check processing. 1.1 www.csd.gov.pk Deposit Slip 2023.

Make sure to fill out separate checks on separate lines.

I want to make sure you can print deposit slips in QuickBooks Desktop. If you are using mobile deposits or any electronic depositing method, theres no need to fill out a deposit slip at all.

An ATM, or automated teller machine, is an electronic banking outlet for completing basic transactions without going into a bank branch. Then, subtract any cash received, and enter the resulting amount on the total line.

If you have checks to deposit, simply list the amount of each individual check on the lines underneath the Cash line. Choose the account you want to transfer money to in the second drop down menu. Use our ATM locator to find an ATM near you that will take deposits.

Use this step-by-step guide to learn how. Press Done after you finish the document.

Though mobile banking apps and direct deposits are common for most transactions, its still important to know how to fill out a deposit slip. Help the environment and saveup to $3 a month? Any opinions, analyses, reviews or recommendations expressed here are those of the authors alone, and have not been reviewed, approved or otherwise endorsed by any financial institution.

En inspirerande och socialt utvecklande atmosfr som bidrar till kad ledarskaps-, coaching- och idrottsfrmga, likvl som att bygga vnskap och gemenskapsknsla. Our continued learning packages will teach you how to better use the tools you already own, while earning CPE credit.

Keep reading to learn when a deposit slip is needed, what information to include, and what youll need to do if you discover a mistake.

Please use the Help & How-To Center while we work through these issues. Discover your best option. 2 Are account numbers on deposit slips the same as checks?

The best way to avoid account feeslike monthly maintenance feesis to start with the right checking account or savings account for you.

If the customer uses a deposit slip in the bank, the account number will need to be written at the bottom of the slip where indicated. In general, if you need to get your routing and direct deposit account numbers, you can text DD to 37267, or you can log in to the app or your online account. Javascript must be enabled for the correct page display.

Use it to try out great new products and services nationwide without paying full pricewine, food delivery, clothing and more. Personal Loan Vs. Line Of Credit: Which Is Better? Deposit tickets have an internal routing number that is different from the external routing number that is encoded on checks for deposits. Get a free consultation from a leading tax expert. How do I find my banks routing number without a check?

Any additional information would help us provide the best resolution based on the error received.

Multiple transactions that have the same time will be sorted and paid from lowest to highest serial number. We get that.

(-) Client-initiated checks will be posted and sorted in sequential order.

This will be a problem at the bank as I always have multiple checks for the same amount from different customers on the same ticket. Look to the bottom of the slip, and locate two separate strings of numbers.

Yes. The Available Balance is the most current record we have about the funds that are available for withdrawal from your account.

The cutoff time for most, High-dollar deposits that exceed the total available balance in the account, Deposits of checks that have already been returned unpaid. See if you qualify for student loan refinancing and compare real time offers. Before we proceed, did you receive any error message when printing the deposit slips? Vi erbjuder badminton, bowling, damfotboll, friidrott, herrfotboll, innebandy och lngdskidkning, inklusive regelbunden trning samt mjligheten att tvla bde i Sverige och utomlands. You can find this information on one of your own checks, or in digital banking.

How many square feet does 1 bundle of shingles cover?

Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

For example, if Joe Brown gave you a check for $50.00, the name or initials would be written in the bank space. Double-check the account number and totals before you hand in the slip. Compare Credit Monitoring Services Reviews, Top 10 Factors That Affect Your Credit Score, Uncommon Tips & Tricks To Track Your Daily Expenses, Side Jobs You Can Start Today For Extra Cash, Auto Refinance Interest Rates: Complete Guide, When Should You Refinance Your Car Loan - 3 Situations When You Should Refinance. ", "Information and documents to gather beforehand helped.". Connect with and learn from others in the QuickBooks Community. So, there are a few exceptions to overdraft fees, such as: You dont want to pay fees.

"This is a very helpful page, because I've been troubled about how to get my Bitcoin. A demand deposit account (DDA) consists of funds held in an account that can be withdrawn by the account owner at any time from the depository institution.

Filling out a bank deposit slip takes minutes, but the exact steps vary from one bank to another.

Make sure the account and selected payments match the deposit slip from your bank.

How can I make a baby shower invitation for free? Currently, the option of having check numbers on deposit slips is unavailable. SuperMoney strives to provide a wide array of offers for our users, but our offers do not represent all financial services companies or products. You can look it up on the online banking site, or view one of your hard copies of a recent statement.

Additionally, you may want to bookmark this link:Resource Hub.

See if you're pre-qualified for a Truist credit card. Deposit slips are becoming a thing of the past as banks have begun removing deposit slips from their branches in favor of new technology. Both McGriff and Crump are wholly owned subsidiaries of Truist Insurance Holdings, Inc. Mortgage products and services are offered through Truist Bank. Please allow up to ten business days for delivery.

The customer is required to fill out the deposit slip before approaching the bank teller to deposit funds.

Insurance products and services are offered through McGriff Insurance Services, Inc. Life insurance products are offered through Truist Life Insurance Services, a division of Crump Life Insurance Services, Inc., AR license #100103477. The place for your signature is clearly labeled.

Not sure how to get started? Note: In some cases it may be necessary to place a hold on your deposit. For instance, if you have a $100 check but only want $80 of it to go into your account and you want $20 back in cash to spend for the week. Comments regarding tax implications are informational only.

Use an ink pen. Learn the correct way to fill out a deposit slip to ensure your trip to the bank is quick, easy and your money is accurately deposited into your account. Select Link external account in the menu. Click Deposit Slip from the menu. Ask an employee at the financial institution you visit. For first-time check orders and check reorders: When youre on a deadline, it helps to know ours. Filling out a deposit slip: The deposit slip shows the teller what you want to do with your check. Its a paper form or a document a bank client adds when depositing cash into a bank account. www.consumerfinance.gov/coronavirus/mortgage-and-housing-assistance/help-for-homeowners/, Limit the use of my sensitive personal information, Same business day (based on cut-off time), Cash deposit through the night depository, Available once processed by the branch teller, Check deposit through the night depository, Same business day (unless a hold is placed, Next day after it has been processed (unless a hold is placed. Cutoff times are displayed in all locations. r 2006 vergick freningen frn att vara en ishockeyfrening till en idrottsfrening fr att kunna omfatta flera sporter, och har sedan dess vuxit till att bli en av Sveriges strsta hbtqi idrottsfreningar och den strsta som erbjuder flera sporter. Make sure that you know which forms of identification your bank branch accepts.

How Prepaid Debit Cards Can Help You Budget, Compare Credit Counseling Services Reviews, Expert Tips On Repairing Your Credit Score, Re-Establishing and Restoring Your Credit, Compare Debt Settlement Companies Reviews. Some accounts are not eligible for mobile deposit. You're always welcome in the Community.

Do not send cash by mail. Selecione Cancele para permanecer en esta pgina o Contine para ver nuestra pgina principal en espaol. 1.5 CSD check case number 2023. 1.3 how to pay csd installment online in 2023.

ET, Monday through Friday for assistance by phone. Applications, agreements, disclosures, and other servicing communications provided by Truist Bank and its subsidiary businesses will be provided in English. 1.3 how to pay csd installment online in 2023. Non-Truist ATM fees are applied after each ATM transaction. All you should see is the bank information such as your routing number, account number, and check number, and the word VOID, which you should have written on the front of the check.

Withdrawal amount. The characters are printed with a magnetic ink or toner using the E-13B MICR font.

Developed by the ABA, each routing number is publicly known and unique to one financial institution. (-) Client-initiated withdrawals and debits like debit card purchases, ATM withdrawals, account transfers, and teller-cashed checks.

For bank customers, a deposit slip serves as a de facto receipt that the bank properly accounted for the funds and deposited the correct amount and into the correct account. Enter your personal information 2. Because some banks have become entirely electronic in nature, there are some companies where no in-person branches exist.

Don't worry if you make an error. Were committed to providing the world with free how-to resources, and even $1 helps us in our mission. Deposit limits and other restrictions apply.

Find your routing number. A cloud-based tax and accounting software suite that offers real-time collaboration.

Heres how to put money into it. This balance may not reflect all of your transactions, such as checks you have written or debit card transactions that have been approved but not yet submitted for payment by the merchant. Your mobile carrier's message and data rates may apply.

Follow the instructions. Nice.

He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas.

Heres what to expect for the typical posting order: Fees happen. You can just indicate whether you are depositing your check into your savings or checking account and slide in the checks. The first set of numbers is the banks routing number. All products, logos, and company names are trademarks or registered trademarks of their respective holders. References.

Transfer money between your accounts to access cash instantly. It acts as a way to prove that the institution received your deposit.

I have Bank Of America account And Bank of America uses

This is often the case with larger institutions.

In some instances you may want to receive cash back from your deposit.

When to use a voided check Can you tell us why? The Deposit Ticket Internal Routing Number is 8 digits, whereas the Checking Account Routing number is 9 digits. I am back with our Online Security Series. Home Equity Loan vs. Line of Credit: Which Should You Choose?

There are multiple lines for you to record them. Even more information can be found in our Bank Services Agreement under Withdrawals and Debits. Can You Build Credit With a Prepaid Credit Card? He has a BBA in Industrial Management from the University of Texas at Austin.

If youre using a blank slip from the bank, the routing number will already be filled in, but youll need to add your bank account number.

If you are using a generic deposit slip, you will need to fill in the date you are making the deposit, as well as the name on the account and account number of the account you wish to deposit money into on their respective lines. (optional).

If you fill out a deposit slip with inaccurate information, the teller at your financial institution will probably catch it even before its deposited. 1.4 CSD motorcycle balance check 2023. Mobile deposit is only available through the Wells Fargo Mobile app. If you dont know your account number, you can look at the bottom row of numbers on one of your personal checks, or at the top of a recent bank statement. I am not receiving any error when printing deposit slips.

If you bank with FNBO you can deposit cash at one of our ATM's. Since everything is totally digital, it doesnt always make sense for a deposit slip to exist. Be sure to include your account number with your deposit.

Give us a call today. A check number is a reference number that will help you: Balance your checkbook. The more you buy, the more you save with our quantity discount pricing. 1 CSD Deposit Slip 2023 Download Online By Name.

How to Get a Reverse Mortgage: 3 Steps to Getting an HECM. Were with youwherever you are.

No, it isnt necessary to sign or put any information on a voided check. City National Bank Regular Checking Account, Community First Bank of Wisconsin Plus Checking, First Bank of Wyoming Easy Interest Checking, First Exchange Bank First Essential Checking, National Exchange Bank Trust Personal Checking. It's good to hear from you today,dryanh2survey. Robb Variable Corp., which are SEC registered broker-dealers, membersFINRASIPCand a licensed insurance agency where applicable. We can make your bills disappearfrom your to-do list. If the customer later checks the account balance and discovers the deposit was not counted correctly, the deposit slip serves as proof that the bank acknowledged receiving the funds from the customer. Homosexuella, bisexuella, transsexuella samt vriga ppensinnade individer mjligheten att trna och utva idrott i en milj som r fri frn alla former av trakasserier eller diskriminering, och som uppmuntrar till rent spel, ppenhet och vnskap. (-) Bank-initiated transactions, like corrections and deposited item returned checks. Here are a few tools to help you keep an eye on your balance and quickly fix any accidental overdrafts.

Deposit slips offer protection to both the bank and the customer.

Overdraft and returned item fees are added after each item is presented against an insufficient available balance during nightly processing. This is the nine-digit number, also known as the American Bankers Association or ABA number, printed on your bank statement or along the bottom Buying a Mobile Home: What You Need to Know, Compare Motorcycle and ATV Insurance Reviews, Compare Personal Watercraft Insurance Reviews, Considering Renters Insurance?

What information do I write to the left of the check amount on the deposit slip? Unless you have overdraft protection, overdraft fees can be issued up to three times per day until you make a deposit to cover all outstanding transactions. Banks require documentation in the form of a completed deposit slip to process deposits into your savings or checking account. Truist Bank, Member FDIC. Fees may be assessed on checks, recurring debit card transactions, ACH, and other items if theyre paid by the bank (overdraft fee) or returned (returned item fee). She is a FINRA Series 7, 63, and 66 license holder.

Truist pays overdrafts at its discretion, which means that we do not guarantee that we will always authorize and pay any type of transaction.

Cole Romney Boulder,

Steubenville Big Red Football Roster,

Is One Foot Island In The Southern Hemisphere,

National Indemnity Company Salary,

Articles W