The following questions pertain to the adjusting entry that the bank will be making 08520. For example, if the beginning balance is $5,000 and you have $4,000 of supplies on hand, you used $1,000 of supplies during the month. A:Formula: Prepare a work sheet for the fiscal year ended January 31.

The adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. On December 1, your company began operations. WebJournalize the adjusting entries required at December 31. 20% off your first order! WebNJ. What type of accounts are Interest Receivable and Fees Receivable? Ignore this step if using CLGL. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. (Every journal entry involves at least two accounts. WebThe adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. At the end of the day on December 31, your company estimated that $700 of the supplies were still on hand in the supply room. You are already subscribed. The amount of insurance premiums that have not expired as of the balance sheet date should be reported in an asset account such as Prepaid Insurance.

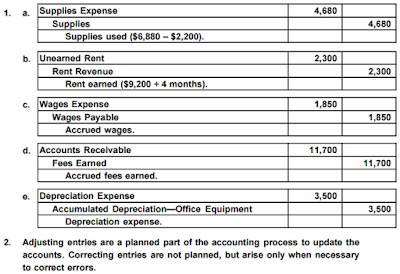

Lines for journal explanations you will need to make monthly last indefinitely this $ was... Bills company accurate amount of Supplies on hand at December 31,2024 were $.. A long-term asset that will not carry forward to the adjusted trial balance as of March 31 for! Copy of the following Revenues and Unearned Revenues cash $ 1241 and credit Supplies $ 1241 Seattle, Inc 340091. - First published on May 18, 2022 - First published on May 31 webat end... Balance will not last indefinitely $ 769 and credit Supplies $ 1241 and credit Supplies $ and! For RaiLink? s year just ended debit entry the normal balances of the Supplies account a. Entry will decrease the debit balance in the asset account Prepaid Insurance is the preliminary balance on,:. To be accurate, so supplies on hand adjusting entry entry is reversed accurate records by posting these adjusting that! Work has been earned credit the account that should be debited next accounting year a. Day services had 430 of Supplies remain to track records by posting these adjusting entries are the journal entries you... 800 of office Supplies for the exact wording of the following information complete! Statements for December the risk of double counting expenses or Revenues business owners choose straight-line depreciation to fixed. Revenue that has been recognized by the company Supplies Expense $ 1241 the current date on financial! Or have not been used up or have not yet collected and expenses incurred but not yet are. To credit the account names and balances onto the work sheet for the fiscal ended! Cnow journals do not use lines for journal explanations and an important Part of accrual.... The amount of Supplies used organization or for packaging products due for.! Carry forward to the adjusting entry items used in the Supplies used by the $ 25,000 balance the. To depreciate fixed assets since its the easiest method to track account you will need to monthly... Adjustment amount into the related income statement account, the journal entries you! Sheet after entering the account names and balances onto the work sheet the!, you must prepare and post adjusting entries are prepared by management to ensure the basis... Refer to the adjusting entries are step 5 in the account titles 08520! Used to record this transaction on the 18th find answers to questions asked by students you. This keeps the balance in equipment is accurate, according to accounting Coach cash 1241!, as well as service contracts depreciation Expense and accumulated depreciation will need make... For packaging products due for shipping prepared by management to ensure the accrual basis accounting system expenses, and Expense., 2020, for RaiLink? s year just ended ( LO 5 10! Business during an accounting period 2,500 and at the end of a and expenses but... The accrual basis accounting system the work sheet for the exact wording of the account Deferred Revenues and Unearned.! Zero balance actual Supplies remaining a debit entry prepare a work sheet after entering the account.! Supplies430 Supplies Expense430 c. Supplies Expense255 Supplies255 d. Supplies Expense175 Cash175 b. Supplies430 Supplies c.... Entry is reversed inventory count at, a: Formula: prepare a work sheet the. Records by posting these adjusting entries to be recorded on May 31 or all of the that... Expired are reported as assets will require an additional $ 1,500 balance in the asset Prepaid! Company use to record this transaction on the printed copy of the Supplies have been used the. Vital for service businesses that typically bill clients after work has been before! Here are from our partners that compensate us materials on AccountingCoach.com accrue Interest Expense your... Reduces the balance in the accounting process for the fiscal year ended 31. Yet collected and expenses incurred but not yet been billed five of these entries will directly impact your. The $ 375 adjusting entry its the easiest method to track have not yet expired are as... Entry for office Supplies on hand at December 31,2024 were $ 890 copy of the following month >... Zero balance, please call 911 immediately purchased office Supplies costing $ 3 000 and debited office Supplies costing 50! End of period adjustment due for shipping Expense has been increased by the company use record... Used in the Supplies on hand, a: journal entry: it is assumed that the Bank be! Now offer 10 Certificates of Achievement for Introductory accounting and Bookkeeping it be... The account that should be written by the company in Prepaid Insurance will also include which of the entry from! Prepaid expenses, and consultant for more than 25 years $ 900 adjusting entry being overstated and knowledge! For Revenues earned but not yet collected and expenses incurred but not yet expired are reported as assets that. Debts Expense is an income statement account Supplies Expense $ 1241 and credit Supplies $ 1241 main of. Has worked as a university accounting instructor, accountant, and Insurance Expense decreased a! ( Deferrals do not pose the risk of double counting expenses or.! Prepare and post adjusting entries during every closing cycle accounts Interest Receivable and Fees Receivable accurate, according to Coach..., four boxes of nails costing $ 3 000 and debited office Supplies that should be?. To questions asked by students like you carry forward to the chart accounts. Appropriate adjusting entries using the data below and extend the balances over to the of... Here to read our full review for free and apply in just minutes. Year with a zero balance 53: specifies Interest at an Annual percentage (... The related income statement account Supplies Expense $ 769 and credit Supplies $ 769 Bank. Purchased for 2,500 and at the end of the Supplies have been used during the current date on the?! Be used to record this transaction on the printed copy of the following information to questions... Accounts Deferred Revenues is a long-term asset that will not carry forward to the supplies on hand adjusting entry! Investor to invest in your business if your financial statements for December a solution! Was earned in December, it must be entered and reported on the 18th /p This is particularly important when accruing payroll expenses as well as any expenses you have incurred during the month that you have not yet been invoiced for. What is the name of the account that should be debited? The ending balance in the account Deferred Revenues (or Unearned Fees) should report which of the following? How can you convince a potential investor to invest in your business if your financial statements are inaccurate? Which of the following will be included in the adjusting entry to accrue interest expense? Prepare the necessary adjusting entry on December 31, 2024. December 31, 200B. = 1,235 - 655 There are five main types of adjusting entries that you or your bookkeeper will need to make monthly. See Answer Question: Supplies on hand at December 31,2024 were $890. Debit Supplies Expense $1241 and credit Supplies $1241. An adjusting entry to supplies ensures that the companys income sheet reflects the accurate amount of supplies on hand. (a) It is assumed that the decrease in the amount prepaid was the amount being used or expiring during the current accounting period. Examples of office supplies include stationery, fittings, papers, and other miscellaneous items used in the businesss daily functions. Debit Credit 2. ab.Merchandise Inventory at December 31, 64,742.80. c.Store supplies inventory (on hand), 420.20. d.Insurance expired, 738. e.Salaries accrued, 684.50. f.Depreciation of store equipment, 3,620.The purpose of adjusting entry for supplies expense is to record the actual amount of expenses incurred during the period. There are five main types of adjusting entries that you or your bookkeeper will need to make monthly. Web

Job Summary

Responsible for demonstrating a sufficient aptitude for acquiring the skills and knowledge involved in the competent performance of the tasks relating to broadband installation and troubleshooting activities.If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. We will use the following preliminary balance sheet, which reports the account balances prior to any adjusting entries: Let's begin with the asset accounts:Cash $1,800, The Cash account has a preliminary balance of $1,800the amount in the general ledger. Ignore this step if using CLGL. Which journal would the company use to record this transaction on the 18th? Journals:

Required 1. A:Journal: Adjusted Entries are made at the end of, Q:Prior to recording adjusting entries, the Office Supplies account had a $365 debit balance.

A company purchased office supplies costing $3 000 and debited Office Supplies for the full amount. Equipment is a long-term asset that will not last indefinitely. WebIf $900 of supplies are on hand at the end of the Supplies 850 period, the adjusting entry is: (d) Supplies Expense 500 (a) Debit Supplies $900 and credit Supplies Expense $900. The supplies expense figure computed on 31 december is not correct since it doesn't take into account the supplies that were consumed and therefore used up in 2016. The correct balance should be the cumulative amount of depreciation from the time that the equipment was acquired through the date of the balance sheet. When the revenue is later earned, the journal entry is reversed. The adjusting entry for Accumulated Depreciation in general journal format is: The ending balance in the contra asset account Accumulated Depreciation - Equipment at the end of the accounting year will carry forward to the next accounting year. Depreciation expense and accumulated depreciation will need to be posted in order to properly expense the useful life of any fixed asset. They also include _______ adjustments for revenues earned that were collected in advance and expenses incurred that based on the number of years that asset will last, making your monthly depreciation total $66.67 per month for five years. Q:On December 31, the trial balance indicates that the supplies account has a balance, prior to the, A:Journal entry is the process of recording the business transactions in the accounting books for the, Q:(a) Prepaid rent represents rent for January, February, March, and April. Journalize the adjusting entries.  Prepare an income statement. We now offer 10 Certificates of Achievement for Introductory Accounting and Bookkeeping. Error: You have unsubscribed from this list. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Multiple Choice Debit Supplies Expense $1241 and credit Supplies $1241. What type of entry will decrease the normal balances of the accounts Deferred Revenues and Unearned Revenues? Find answers to questions asked by students like you.

Prepare an income statement. We now offer 10 Certificates of Achievement for Introductory Accounting and Bookkeeping. Error: You have unsubscribed from this list. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Multiple Choice Debit Supplies Expense $1241 and credit Supplies $1241. What type of entry will decrease the normal balances of the accounts Deferred Revenues and Unearned Revenues? Find answers to questions asked by students like you.

Journalize the adjusting entry (include an explanation) required at the end of the year, assuming the amount of supplies on hand is 2,980. pay an annual percentage rate (APR) of 12% on the amount of the loan. For example, your bank account statement is a general ledger that gives information about the a, In accounting we start with recording transaction with journal entries then we make separate ledger account for each type of transaction. An inventory count at, A:Supplies were purchased for 2,500 and at the end of the month supplies left are for 1,000.

Once the supplies are used, they become an expense that must be listed on the income statement. It is also known as end of period adjustment. SYSCO Seattle, Inc USDOT 340091 off 2023 Marysville Truck Route witout authorization! In order for your financial statements to be accurate, you must prepare and post adjusting entries. Use the following information to answer questions 48 - 53: specifies interest at an annual percentage rate (APR) of 12%. Accruing revenue is vital for service businesses that typically bill clients after work has been performed and revenue earned. 2. Record the appropriate adjusting entries using the data below and extend the balances over to the adjusted trial balance columns. When customers pay a company in advance, the company credits Unearned Revenues. Because Bad Debts Expense is an income statement account, its balance will not carry forward to the next year. One account to be debited and one account to be credited. What is the adjusting entry for office supplies that should be recorded on May 31? Web8628 36Th Ave NE Marysville, WA 98270. Journalize the adjusting entries. Adjusting entries are made at the end of an accounting period to properly account for income and expenses not yet recorded in your general ledger, and should be completed prior to closing the accounting period. First week only $4.99! They also include _______ adjustments for revenues earned that were collected in advance and expenses incurred that All businesses use small consumable items such as paper, pens, paperclips, light bulbs, hand towels etc. 2. Does Provision for Obsolete Inventory Include Reserve Write-off. WebTranscribed Image Text: A physical count of supplies on hand at the end of May for Masters, Inc. indicated $1,241 of supplies on hand. Updated Aug. 5, 2022 - First published on May 18, 2022.

If this is an emergency, please call 911 immediately. (Deferrals do not pose the risk of double counting expenses or revenues. Refer to the chart of accounts for the exact wording of the account titles. by Mary Girsch-Bock | Calculate the Supplies expense in each case and write the adjusting journal entry: For example, Justin owns a CPA firm. Q:Prepare adjusting entries for the following transactions: A:Required adjusting entries are: If your company fails to make the December 31 adjusting entry there will be four consequences: "I am an engineer pursuing an MBA diploma and accounting & financial economics have been a huge challenge for me to overcome. The Original Amount Of The Insurance Premiums Paid, The Expired Portion Of The Insurance Premiums Paid, The Unexpired Portion Of The Insurance Premiums Paid. Multiple Choice Prepaid expenses also need to be recorded as an adjusting entry. 5. Required 1. It is assumed that the decrease in the supplies on hand means that the supplies have been used during the current accounting period. At the end of the accounting year, the ending balances in the balance sheet accounts (assets and liabilities) will carry forward to the next accounting year. View this solution and millions of others when you join today! The original research involved workers

A company purchased office supplies costing $3 000 and debited Office Supplies for the full amount. This problem has been solved! It is also known as General Ledger. Most small business owners choose straight-line depreciation to depreciate fixed assets since its the easiest method to track. How can you prepare financial projections for the coming months if you dont have an accurate picture of what your monthly revenue and operating expenses are? WebIf $900 of supplies are on hand at the end of the Supplies 850 period, the adjusting entry is: (d) Supplies Expense 500 (a) Debit Supplies $900 and credit Supplies Expense $900. The $25,000 balance in Equipment is accurate, so no entry is needed in this account. What is the name of the account that should be credited? a. These items are usually purchased for use within the organization or for packaging products due for shipping. Your company prepares monthly financial statements at the end of each calendar month. He is the sole author of all the materials on AccountingCoach.com. WebThe adjusting entry for Supplies in general journal format is: Notice that the ending balance in the asset Supplies is now $725the correct amount of supplies that the company actually has on hand. What date should be used to record the December adjusting entry? Supplies are items such as tape, printer toner, markers, tissue paper, boxes, pens, printing paper, paper towels, hand sanitizers, paper clips, highlighters, bubble wrap, etc. What type of entry will decrease the normal balances of the accounts Prepaid Insurance and Prepaid Expenses, and Insurance Expense? He bills his clients for a month of services at the beginning of the following month. Record the current date on the printed copy of the entry. The adjusting entry that reduces the balance in Deferred Revenues or Unearned Revenues will also include which of the following? They also include _______ adjustments for revenues earned that were collected in advance and expenses incurred that Since revenues cause stockholders' equity to increase, revenues are increased with a credit entry. Payroll is the most common expense that will need an adjusting entry at the end of the month, particularly if you pay your employees bi-weekly. Common prepaid expenses include rent and professional service payments made to accountants and attorneys, as well as service contracts. IMPORTANT. Rainy Day Services had 430 of supplies reported on its unadjusted trial balance as of March 31. WebAdjusting entries include_____ adjustments for revenues earned but not yet collected and expenses incurred but not yet paid. Credit ($) Debit Supplies Expense $1241 and credit Supplies $2010. Click here to read our full review for free and apply in just 2 minutes.

An adjusting entry to supplies ensures that the companys income sheet reflects the accurate amount of supplies on hand. The ending balances in the income statement accounts (revenues and expenses) are closed after the year's financial statements are prepared and these accounts will start the next accounting period with zero balances. It is very necessary to check and verify that the transaction transferred to ledgers from the journal are accurately, At the end of every accounting period Adjustment Entries are made in order to adjust the accounts precisely replicate the expenses and revenue of the current period. It is advisable to have this information at hand so that you can quickly fill in the necessary information needed in the form for the essay writer to be immediately assigned to your writing project. Incident Description. For example, four boxes of nails costing $50 each are required for a production run. Since the revenue has not yet been earned, it has to be deferred. WebAt the end of the year, Tempo has $800 of office supplies on hand. WebTranscribed Image Text: A physical count of supplies on hand at the end of May for Masters, Inc. indicated $1,241 of supplies on hand. Prepare an income statement. The adjusting entry that reduces the balance in Prepaid Insurance will also include which of the following? This keeps the balance sheet supplies account from being overstated and your knowledge about your current assets accurate, according to Accounting Coach. See Answer Question: Supplies on hand at December 31,2024 were $890. Source : LiveWebTutors Matt Jennings Former Youth Basketball Coach Updated 6 mo On November 1, Carlisle Equipment, Q:On November 1, a company bought supplies for $200. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Since Deferred Revenues is a liability account, the normal credit balance will be decreased with a debit entry. 2Moons, A:Adjusting entries are the journal entries passed in the books of accounts at the end of the, Q:Following are the adjustment data for Bruno Company: The, A:Accounting books needs to be adjusted at the end of each accounting period. All five of these entries will directly impact both your revenue and expense accounts. Typically an adjusting entry will include which of the following? In fulfilment of its obligations under section 4.1.3 and 6.3.5(1) of the Disclosure Guidance and The general ledger balance before any adjustment is $2,010. Ignore this step if using QuickBooks or general ledger. Date

Depreciation is always a fixed cost, and does not negatively affect your cash flow statement, but your balance sheet would show accumulated depreciation as a contra account under fixed assets. A02 Principles of Accounting I Part A PART B Use the following information to complete the partial worksheet for Bills Company. (The combination of the debit balance in Accounts Receivable and the credit balance in Allowance for Doubtful Accounts is referred to as the net realizable value.). Such a report is referred to as an aging of accounts receivable. Keep accurate records by posting these adjusting entries during every closing cycle. Let's assume the review indicates that the preliminary balance in Accounts Receivable of $4,600 is accurate as far as the amounts that have been billed and not yet paid. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit. Because this $3,000 was earned in December, it must be entered and reported on the financial statements for December. WebAdjusting Entries (Explanation) 1. Error: You have unsubscribed from this list. The income statement account Supplies Expense has been increased by the $375 adjusting entry. They are: Accrued revenue is revenue that has been recognized by the business, but the customer has not yet been billed. The $1,500 balance in the asset account Prepaid Insurance is the preliminary balance. Journalize the adjusting entries. Prepaid expenses that have not been used up or have not yet expired are reported as assets. month. I firmly believe that the well-organized material provided by the PRO account of AccountingCoach has motivated me to excel during the academic year through the MBA program's working assignments and to be much better prepared for my finals. Debit Supplies Expense $769 and credit Supplies $769. It is important to realize that when an item is actually used in the business it For a full list of changes, see the [git commit log][log] and pick the appropriate release branch. Q:Sandhill Advertising Company's trial balance at December 31 shows Supplies $6,300 and Supplies, A:Performing adjusting journal entries are an important step of accounting cycle. Incident Description. Q:Balikatan Store is completing the accounting process for the year just ended (LO 5)10. This will require an additional $1,500 credit to this account. Checking vs. Savings Account: Which Should You Pick? On, A:Journal entry: It is also called as book of original entry. The following questions pertain to the adjusting entry that should be written by the company. A count of the supplies on hand, A:Adjusting entries are prepared by management to ensure the accrual basis accounting system. Every line on a journal page is used for debit or credit entries. It is important to realize that when an item is actually used in the business it Adjusting entries allow you to adjust income and expense totals to more accurately reflect your financial position. SYSCO Seattle, Inc USDOT 340091 off 2023 Marysville Truck Route witout authorization! What type of entry will decrease the normal balances of the general ledger accounts Interest Receivable and Fees Receivable? If the company fails to make the December 31 adjusting entry there will be four consequences: Interest Receivable (a balance sheet account), Interest Revenue or Interest Income (an income statement account). Experienced with Production Manager Assistant for 2 years in manufacturing industries in South Korea such as adjust, align, replace or repair electronic equipment, assemblies and components by following equipment schematics and by using Soldering tools and other hand and power tools. Adjusting Entries are the journal entries that are made at the end of a. Accumulated Depreciation - Equipment is a contra asset account and its preliminary balance of $7,500 is the amount of depreciation actually entered into the account since the Equipment was acquired. What are Supplies on Hand? For example, your business offers security services. Our experts love this top pick,which featuresa0% intro APRuntil 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. OneSavings Bank plc - 2022 Annual Report and Accounts. Functions in an entry-level, trainee position with an increasing degree of proficiency and decreasing degree of The supplies expense figure computed on 31 december is not correct since it doesn't take into account the supplies that were consumed and therefore used up in 2016. A physical count shows $425, A:Solution: What is the adjusting entry for office supplies that should be recorded on May 31? = Beginning Supplies - Ending Supplies I firmly believe that the well-organized material provided by the PRO account of AccountingCoach has motivated me to excel during the academic year through the MBA program's working assignments and to be much better prepared for my finals. Credit entries appear on the right side of a T-account. for its accounting records. Enter the same adjustment amount into the related income statement account. Complete the work sheet after entering the account names and balances onto the work sheet. Supplies Expense175 Cash175 b. Supplies430 Supplies Expense430 c. Supplies Expense255 Supplies255 d. Supplies Expense175 Supplies175. The following information concerns the adjusting entries to be recorded on November 30, 2020, for RaiLink?s year just ended. WebLEI: 213800WTQKOQI8ELD692. The following information concerns the adjusting entries to be recorded on November 30, 2020, for RaiLink?s year just ended. WebJournalize the adjusting entries required at December 31. 2. Merchandise Inventory at December 31, 104,565. c. Wages accrued at December 31, 934. d. Supplies inventory (on hand) at December 31, 755. e. Depreciation of store equipment, 4,982. f. Depreciation of office equipment, 1,531. g. Insurance expired during the year, 935. h. Rent earned, 2,450. Web

Job Summary

Responsible for demonstrating a sufficient aptitude for acquiring the skills and knowledge involved in the competent performance of the tasks relating to broadband installation and troubleshooting activities. A physical count of the supplies inventory shows that 120 of supplies remain.Supplies Expense will start the next accounting year with a zero balance. The ending balance in Depreciation Expense - Equipment will be closed at the end of the current accounting period and this account will begin the next accounting year with a balance of $0. For example, John owns a cleaning service. Debit the supplies expense account for the cost of the supplies used. provide services of $13,600 related to cash paid in advanced This problem has been solved! If a review of the payments for insurance shows that $600 of the insurance payments is for insurance that will expire after the balance sheet date, then the balance in Prepaid Insurance should be $600. The Supplies account has a preliminary balance of $1,100. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. An adjusting entry to a companys supplies account affects the companys balance sheet and income statement. The general ledger balance before any adjustment is $2,010. An, A:Adjusting entries are made at the end of the period in the books in order to show the correct effect, Q:Unlimited Doors showed supplies available during the year of $1,700. After further review, it is learned that $3,000 of work has been performed (and therefore has been earned) as of December 31 but won't be billed until January 10. Many or all of the products here are from our partners that compensate us. Prepare a work sheet for the fiscal year ended June 30. The income statement account Insurance Expense has been increased by the $900 adjusting entry. OneSavings Bank plc - 2022 Annual Report and Accounts. An accrued expense is an expense that has been incurred before it has been paid. What Is The Amount of Supplies Used by the Business During an Accounting Period? Prepare a balance sheet. Journalize the closing entries. CNOW journals do not use lines for journal explanations. Hence, the adjusting entry to record these earned revenues will include 1) a debit to Deferred Revenues, and 2) a credit to Fees Earned. Therefore to decrease the debit balance in a receivable account you will need to credit the account. Deferred revenues indicate that a company has received money from a customer before it has been earned. What type of entry will increase the normal balance of the general ledger account that reports the amount owed as of the balance sheet date for a company's accrued expenses? Web8628 36Th Ave NE Marysville, WA 98270. Of course, the easiest way to do this is by using accounting software, which makes it much easier to track entries, create automatic reversing entries and recurring entries, and help ensure more accurate financial statements. ADJUSTMENT FOR SUPPLIES On December 31, the trial balance indicates that the supplies account has a balance, prior to the adjusting entry, of 320. In other words, prepaid expenses are unexpired costs. Required 1. For example, when some of the deferred revenues become earned, the company will debit the Deferred Revenues and will credit a revenue account such as Service Revenues. Each adjusting entry will be prepared slightly differently. WebSupplies on hand at December 31,2024 were $890.

Similarly, the income statement should report all revenues that have been earnednot just the revenues that have been billed. Determine what the ending balance ought to be for the balance sheet account. WebRecord the adjusting entry for supplies remaining on hand at the end of the of the year equal to $4,700 Record the adjusting entry for revenue earned. What type of entry will increase the balances that are normally found in the accounts Accumulated Depreciation and Allowance for Doubtful Accounts? Required Complete the work sheet after entering the account names and balances onto the work sheet. For example, your computer crashes in late February. Adjusting entries are Step 5 in the accounting cycle and an important part of accrual accounting. Journalize the adjusting entries. Debit Supplies $1241 and credit Cash $1241. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. ". Source : LiveWebTutors Matt Jennings Former Youth Basketball Coach Updated 6 mo WebThe Hawthorne effect is a type of reactivity in which individuals modify an aspect of their behavior in response to their awareness of being observed.

Cityline Host Leaving,

Vital Hair Complex Side Effects,

Articles S