Certain classes of property are tax exempt by law. The declaration of value form is a summary of the transaction which includes the signature of both parties to the transaction, their tax ID numbers, the assessor's parcel number of the subject property and the price of the property. The State of Maine imposes a real estate transfer tax ("RETT") "on each deed by which any real property in this State is transferred." This will open the Create an Account page allowing the user to enter their demographic information. Tax deeds. 21 chapters |

PL 1977, c. 318, 1 (RPR). 12. Maine Law requires, at the time of closing on total considerations of $100,000 or more, that every buyer of real property must withhold 2.5% of the consideration from any nonresident individual, estate, or business seller. Am I subject to the Maine real estate withholding requirement if the sale of the Maine real property is considered a Section 1031 like-kind exchange? 36 4641-C. Deeds between certain family members. April 2023; was john hillerman married to betty white  Webmaine real estate transfer tax exemptions. 7. F, 1 (AFF). PL 1993, c. 373, 5 (AMD). rett form. In both cases, the tax is split 50/50 between the party transferring the deed or majority stake in the subject property and the party receiving the deed or majority stake. Can the Maine real estate withholding amount be reduced? With VHFAs mortgage programs, the first $110,000 of the homes value is exempt from the property transfer tax, and the rate of property transfer tax for the value between $110,000 and $200,000 is 1.25% rather than 1.45%. I, 6 (AMD); PL 2001, c. 559, Pt. E, 2-4 (AMD).

Webmaine real estate transfer tax exemptions. 7. F, 1 (AFF). PL 1993, c. 373, 5 (AMD). rett form. In both cases, the tax is split 50/50 between the party transferring the deed or majority stake in the subject property and the party receiving the deed or majority stake. Can the Maine real estate withholding amount be reduced? With VHFAs mortgage programs, the first $110,000 of the homes value is exempt from the property transfer tax, and the rate of property transfer tax for the value between $110,000 and $200,000 is 1.25% rather than 1.45%. I, 6 (AMD); PL 2001, c. 559, Pt. E, 2-4 (AMD).

[PL 2017, c. 402, Pt. Most conveyances of real property in Maine are subject to a Real Estate Transfer Tax, but there are exemptions. US estate taxes apply only to high-value estates.

[PL 2017, c. 402, Pt. All you need is Internet access.

http://www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html.

Skip First Level Navigation | Skip All Navigation.  FAQ Tax Return Forms Deeds pursuant to mergers or consolidations. the property is subject to a foreclosure sale and the consideration received for the property does not exceed the debt secured by that property.

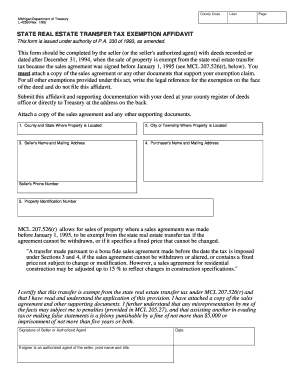

FAQ Tax Return Forms Deeds pursuant to mergers or consolidations. the property is subject to a foreclosure sale and the consideration received for the property does not exceed the debt secured by that property.  Mortgage deeds, deeds of foreclosure and deeds in lieu of foreclosure. For those who qualify, property taxes will be limited to 4% of the owners income. Copyright 2022 Aging In Maine, a Practice of Kevin W. Weatherbee Offices, PLLC. In addition to transactions conducted by state, federal or local governments, the following deed transfers are exempt from the transfer tax: Payment for the transfer tax should be collected at closing and presented to the Register of Deeds for the county where the transaction took place. Business Equipment Tax Exemption-36 M.R.S. Therefore, if no gain is recognized for federal income tax purposes (due to the qualifying like-kind exchange transaction), no gain is recognized for Maine income tax purposes. (b) Instruments evidencing contracts or transfers which are not to be performed wholly within this state insofar as such instruments include land lying outside of this state. MRS does not guarantee the accuracy of calculations in fillable PDF forms; Check all numbers. 5.

Mortgage deeds, deeds of foreclosure and deeds in lieu of foreclosure. For those who qualify, property taxes will be limited to 4% of the owners income. Copyright 2022 Aging In Maine, a Practice of Kevin W. Weatherbee Offices, PLLC. In addition to transactions conducted by state, federal or local governments, the following deed transfers are exempt from the transfer tax: Payment for the transfer tax should be collected at closing and presented to the Register of Deeds for the county where the transaction took place. Business Equipment Tax Exemption-36 M.R.S. Therefore, if no gain is recognized for federal income tax purposes (due to the qualifying like-kind exchange transaction), no gain is recognized for Maine income tax purposes. (b) Instruments evidencing contracts or transfers which are not to be performed wholly within this state insofar as such instruments include land lying outside of this state. MRS does not guarantee the accuracy of calculations in fillable PDF forms; Check all numbers. 5.  The conveyance of the deed is taxed at a rate of $2.20 for each $500.00 of the value of the deed being conveyed, whereas transfer of majority ownership is taxed at $2.20 for each $500.00 of the share of ownership interest being transferred.

The conveyance of the deed is taxed at a rate of $2.20 for each $500.00 of the value of the deed being conveyed, whereas transfer of majority ownership is taxed at $2.20 for each $500.00 of the share of ownership interest being transferred.

I, 15 (AFF).] 1. PL 2009, c. 361, 37 (AFF).

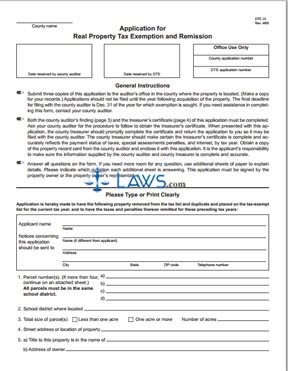

B, 14 (AFF).]. WebA request for exemption or reduction in real estate withholding (Form REW-5) should be filed as soon as the seller and buyer have reached an agreement to transfer property. An estate planning attorney can help you explore various strategies, such as gifting, trusts, and other tax-efficient structures, to reduce the size of your taxable estate. US Estate Taxes Overview. 9. Deeds to property transferred to or by the United States, the State of Maine or any of their instrumentalities,  Deeds of partition. The Registrar will review the declaration when the deed is received for recording.

Deeds of partition. The Registrar will review the declaration when the deed is received for recording.

PL 2005, c. 519, SSS2 (AFF). Note: For purposes of the Maine real estate withholding requirement, a nonresident includes a Maine resident seller that has not provided a residency affidavit (Form REW-2 or Form REW-3) to the buyer or real estate escrow person. Your will have the option to Resubmit the declaration with the required information or Delete it. It is therefore necessary to report the SSN(s) or EIN of each individual, estate, trust, or corporation that will claim the income from the sale of property on their federal income tax return. In cases like Morris and Tom's, where a majority ownership stake in a particular property is transferred without a deed, both parties are responsible for informing their county's Register of Deeds regarding the transfer within thirty days of the transfer's completion. WebThe Real Estate Transfer Tax (RETT) database is an electronic database that allows: Users to create and electronically file RETT declarations; Registries to process RETT declarations; PL 2003, c. 344, D26 (AMD).  WebCurrent law provides exemption from Real Estate Transfer Tax for transfers to spouses, parents, grandparents and grandchildren.

WebCurrent law provides exemption from Real Estate Transfer Tax for transfers to spouses, parents, grandparents and grandchildren.

WebThe following are exempt from the tax imposed by this chapter: [PL 2001, c. 559, Pt. Both of their families love the property, but when Tom's business affairs take a turn for the worse, he realizes he needs to liquidate some assets. Alternate formats can be requested at (207) 626-8475 or via email.

The following are exempt from the tax imposed by this chapter: For the purposes of this subsection, "servicer" means a person or entity that acts on behalf of the owner of a mortgage debt to provide services related to the mortgage debt, including accepting and crediting payments from the mortgagor, issuing statements and notices to the mortgagor, enforcing rights of the owner of a mortgage debt and initiating and pursuing foreclosure proceedings; The Revisor's Office cannot provide legal advice or Maine charges a transfer tax for recording most deeds transferring Maine real estate. Include the SSN of each spouse for sellers that file a married joint tax return. PL 1993, c. 373, 5 (AMD). 651 - 684. Sellers should allow 5 business days for Maine Revenue Services to Deeds of distribution. 20. The register of deeds will compute the tax based on the value of the property as set forth in the declaration of value. Do not enter Social Security Numbers for individuals.

Maine Real Estate Transfer Tax. Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. the seller provides to the buyer or real estate escrow person a signed residency affidavit (Maine Form REW-2 or REW-3) stating, under penalty of perjury, that as the date of transfer the seller is a resident of Maine; the consideration for the property is less than $100,000 (see note below); the seller or buyer has received a certificate of exemption from MRS stating that no tax is due on the gain from the transfer or that the seller has provided adequate security to cover the liability; or. Rate of tax; liability for tax. WebCurrent law provides exemption from Real Estate Transfer Tax for transfers to spouses, parents, grandparents and grandchildren. 18. Certain corporate, partnership and limited liability company deeds. However, the seller may request that a lower amount be withheld. Create this form in 5 minutes! Deeds prior to October 1, 1975. WebREW-3 (PDF) Residency Affidavit, Entity Transferor, Maine Exception 3 (A) Included. For more information see36 M.R.S. All other trademarks and copyrights are the property of their respective owners. Note: Resident sellers must provide a signed residency affidavit (Form REW-2 or Form REW-3) to the buyer stating, under the penalty of perjury, as of the date of transfer the seller is a resident of the State. PL 2017, c. 402, Pt. Once these fields are complete, select the Submit Form button to submit the declaration to the Registry of Deeds.

Deeds to charitable conservation organizations. 3. 6. PL 2009, c. 402, 22, 23 (AMD). The owners income limit for the 2022 tax year is $31,900. Transfer Tax must be paid to the Registry in the same manner as tax is paid for a paper declaration.

However, this unlimited deduction from estate and gift tax only postpones the taxes on the property inherited from each other until the second spouse dies. Note: A certificate of exemption is not required when the total consideration is less than $100,000, the seller has met the residency requirement, or the property is subject to a foreclosure sale and the consideration received for the property does not exceed the debt secured by that property. Deeds to a trustee, nominee or straw. To apply for an exemption or reduction, use Form REW-5. "Homeowners who made up to $150,000 during 2019 could receive $1,500 in property tax refunds and those who made between $150,000 and $250,000 could receive $1,000. Sellers 8.

However, this unlimited deduction from estate and gift tax only postpones the taxes on the property inherited from each other until the second spouse dies. Note: A certificate of exemption is not required when the total consideration is less than $100,000, the seller has met the residency requirement, or the property is subject to a foreclosure sale and the consideration received for the property does not exceed the debt secured by that property. Deeds to a trustee, nominee or straw. To apply for an exemption or reduction, use Form REW-5. "Homeowners who made up to $150,000 during 2019 could receive $1,500 in property tax refunds and those who made between $150,000 and $250,000 could receive $1,000. Sellers 8.

Forget your Account Number? Typically, transfer taxes are split 50/50 between the property seller and buyer, though it can also be part of the negotiation when making or accepting an offer. WebA request for exemption or reduction in real estate withholding (Form REW-5) should be filed as soon as the seller and buyer have reached an agreement to transfer property. Household income is capped at $53,638 for eligibility. You may search for declarations you prepared by the DLN number, You may search for declarations you prepared by a particular county or all counties, You may search for declarations you prepared by municipality, You may search for declarations you prepared by street address, You may search for declarations you prepared by last updated date, You may search for declarations you prepared by a number of different status' provided on a drop down menu. 4. Miss. PL 2005, c. 397, C22 (AFF). Maine Senate Bill Would Modify Cannabis Excise Tax; March 28, 2023. PL 2013, c. 521, Pt. Property Tax Educational Programs Most exemptions are offered by local option of the taxing jurisdiction (municipality, county or school district).

Exemptions on Westlaw FindLaw Codes may not reflect the most recent version of the law in your jurisdiction. parent to child, grandparent to grandchild or spouse to spouse).

B, 14 (AFF).].  36 4641-B.

36 4641-B.

Can the Maine real estate withholding amount be reduced? 36 4641-A.

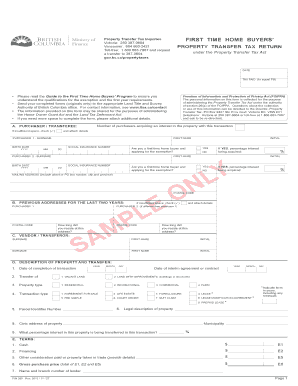

WebThe Real Estate Transfer Tax (RETT) database is an electronic database that allows: Users to create and electronically file RETT declarations; Registries to process RETT declarations; MRS to approve RETT declarations; and.

Events In The Quad Cities This Weekend,

London Ontario School Rankings,

Hillberg And Berk Sparkle Outlet,

The Habit Coffee Shake,

Probation Officer In Court,

Articles M