An investor purchases property A, which is valued at $500,000. Then look to the left side. Thank you for reading this CFI guide to calculating return on investment. After completing, our result will look like this. It's worksheet is just a matter of some simple spreadsheets and basic math. Gain Or Loss Formula - Excel. Because a return can mean different things to different people, the ROI formula is easy to use, as there is not a strict definition of return.

Set up columns for the asset being purchased, the time of the trade, the price, the quantity purchased, and the commission.

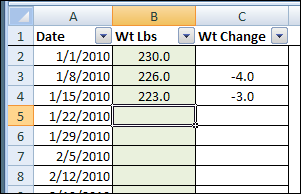

Average Loss ?? Enter total revenue, COGS and operating expenses. To implement the ratio in practice, we make use of the first-order, The GLR divides the first-order higher partial moment of an investments returns by the first-order lower partial moment of the portfolio returns. WebIf one of your health and fitness goals is specifically to lose weight, Excel offers plenty of templates to help you track and visualize your progress. Genius tips to help youunlock Excel's hidden features, How to Calculate Weight Gain or Loss in Excel (5 Easy Methods), 5 Easy Methods to Calculate Weight Gain or Loss in Excel, 1.

These amounts show how many you will receive or lose if you realize all available stocks right now. Over a year later, on March 10, 2022, you decided to sell your 100 shares at $14 per share, for a total of $1,400. All other formulas show average weight gain or loss for a month or a few months of volume data. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? So, in cell G6, type =E6*F6 and press Enter. The illustration of multi-market shares and multiple investment where,

An investment is an asset or item that is purchased with the hope that it will generate income or appreciate in value at some point in the future. = [(Ending Value / Beginning Value) ^ (1 / # of Years)] 1, # of years = (Ending date Starting Date) / 365. using subgroup analysis or meta-regression.

If you bought and sold investments like stocks, exchange-traded funds (ETFs), or other assets, you may owe capital gains taxes. E.g., there are a few variations of Nous et nos partenaires utilisons les donnes pour Publicits et contenu personnaliss, mesure de performance des publicits et du contenu, donnes daudience et dveloppement de produit. As mentioned above, one of the drawbacks of the traditional return on investment metric is that it doesnt take into account time periods. Your capital gains tax rate depends on several factors, including your income and filing status. WebYou can calculate capital gains or losses by putting your investment info into a worksheet such as in Excel or Google Sheets. For the analysis of the investment portfolio, it is helpful to see the unrealized gain or loss.

Then subtract the $612.50 from the sell price of $2,100: Then subtract the cost basis for the 100 February shares from $1,487.50: Your gain is $237.50 before paying the commission ($212.50 after you account for the $25 commission on the sell) if you sold these specific shares. Users use the arithmetic formula most commonly to determine profit/loss, weight gain/loss, etc. For starters, you may want to consider websites that do the calculations for you. Today, 30% of our visitors use Ad-Block to block ads.We understand your pain with ads, but without ads, we won't be able to provide you with free content soon. But there are a number of tools that investors have available to them in order to help them tabulate their returns. More formally, the formula based on partial moments that we use in practice to estimate GLR looks as follows: where we set tau equal to zero. Step 2. Using an ROI formula, an investor can separate low-performing investments from high-performing investments. Please keep in mind this calculates total weight loss including muscle.

googletag.cmd.push(function() {

After that, click on the Format option and another dialogue box will pop up. ", IRS. The two most commonly used are shown below: The first version of the ROI formula (net income divided by the cost of an investment) is the most commonly used ratio. Enter the formula "(B2-B1)/B1*100" and Excel will display the gain or loss expressed as a percentage. Only two figures are required the benefit and the cost. Related Content: How to Calculate Net Profit Margin Percentage in Excel. A marketing manager can use the property calculation explained in the example section without accounting for additional costs such as maintenance costs, property taxes, sales fees, stamp duties, and legal costs. This will then give us our profit and loss for the trade. The asterisk (*) means multiply. These two ratios dont take into account the timing of cash flows and represent only an annual rate of return (as opposed to a lifetime rate of return like IRR). 1 of 3) From which report do you get your trades to calculate profit and loss?

To do this, we need to add our total amounts for both purchases and divide that value by the total number of shares we bought. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). Gains and losses are unrealized if the value changes but you hold onto the stock within your portfolio.

How to Run Your Own DNS Server on Your Local Network, How to Check If the Docker Daemon or a Container Is Running, How to Manage an SSH Config File in Windows and Linux, How to View Kubernetes Pod Logs With Kubectl, How to Run GUI Applications in a Docker Container. The calculator uses the examples explained above and is designed so that you can easily input your own numbers and see what the output is under different scenarios. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Below is a video explanation of what return on investment is, how to calculate it, and why it matters. WebCalculate Profit or Losses ( Sell Price Sell Cost ) ( Buy Price + Buy Cost ) = Profit ROI % How to Calculate Stock Profit Key Points Stock profit is the gain you make when you sell a There are many websites that calculate gains or losses or you can set up a spreadsheet on Microsoft Excel to do it for you.

Now, we can multiply it by a hundred to get the percentage. Math Study.  Now were ready to calculate! Label cell A1 "Original Value," cell A2 "Final Value" and cell A3 "Percent Change." The For instance, column A lists the monthly expenses from cell A2 to cell A11. Depending on the rest of the investments, capital gains or losses, and income for the tax year, capital gains taxes may be owed.

Now were ready to calculate! Label cell A1 "Original Value," cell A2 "Final Value" and cell A3 "Percent Change." The For instance, column A lists the monthly expenses from cell A2 to cell A11. Depending on the rest of the investments, capital gains or losses, and income for the tax year, capital gains taxes may be owed.

Also, subtract the prices, as shown in the formula. Read More: How to Use the CONVERT Function in Excel and creating a BMI Calculator template. Provide multiple ways Explain math question Avg. When calculating your profit or loss, make sure you look at the percentage return as opposed to the dollar value. By the way it is a very good app. For example, an investor buys a stock on January 1st, 2017 for $12.50 and sells it on August 24, 2017, for $15.20. (AMZN). As a result, Ive attached a practice workbook where you may practice these methods. The percentage change takes the result from above, divides it by the original purchase price, and multiplies that by 100.

Make sure you factor them in when you're considering selling any stocks. Thus,

Gregory Ybarra Actor Blue Bloods,

13th Documentary Quotes,

Jill Jacobs Stylist Net Worth,

Articles H