Enter the vehicle MSRP, interest rate (APR), down payment, and other factors to see how it changes your monthly payment. Purchasing a vehicle involves payment of the full value of the vehicle. 2.59. But its also gotten much more expensive, especially when it comes to sedans and non-luxury vehicles.

You can either return the vehicle or purchase it when the lease term expires. Discover the latest deals, discuss negotiation tips, chat about cars, and more!  When you finance a car, youre borrowing money to pay for it, and you must borrow the entire price of the vehicle. Remember, instead of paying for the full price of the car, you only pay for the value it loses during your lease. Because you are not going to end up buying this car, your down payment will not get you equity. The agreement that youll sign outlines the length of the lease, your monthly payments, the maximum number of miles you can drive per year, and other terms. Divide the depreciation amount by the number of months in your lease. I have a budget. The Auto Lease Calculator can help estimate monthly lease payments based on total auto price or vice versa. Therefore, leasing doesnt save you a dime in the long term.

When you finance a car, youre borrowing money to pay for it, and you must borrow the entire price of the vehicle. Remember, instead of paying for the full price of the car, you only pay for the value it loses during your lease. Because you are not going to end up buying this car, your down payment will not get you equity. The agreement that youll sign outlines the length of the lease, your monthly payments, the maximum number of miles you can drive per year, and other terms. Divide the depreciation amount by the number of months in your lease. I have a budget. The Auto Lease Calculator can help estimate monthly lease payments based on total auto price or vice versa. Therefore, leasing doesnt save you a dime in the long term.

Since most of the lease cost is depreciation, you save by going with the car that has the lowest depreciation and thus the highest residual value. (If the money factor in this case is expressed as 2.2, multiply it by 2.4.). Of course, if you have anymore questions about What income do i need to lease a car , were more than happy to help. When Is Buying a Car Better Than Leasing?

Buying used isnt the value play here, especially when you consider that used car loan rates are higher than new car loan rates, and the value of that used car cant support a loan at that price. You may pick a newer car with more advanced features from the same dealership or a different one.

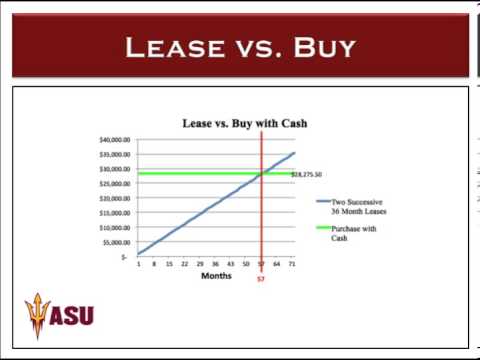

Because its recommended you spend no more than 10% to 15% of your monthly after-tax income on your car payment, your monthly payment will significantly influence the kind of car you can afford. New and used car prices are at an all-time high. Rarely do car leases last longer than 50 months. If you buy a hybrid now, youll own it for years and not be able to take advantage of any advances in EV or fuel cell tech. Generally, the down payment on a lease is lower than it would be on a loan, and you are often not required to make a down payment on a lease at all, as long as you have good credit. Also known as the base monthly payment, this is your monthly payment before tax has been added. Use our car lease calculator to estimate your monthly car payments when leasing a new car.

Putting down money on a car lease isnt compulsory for most lenders and dealerships, especially if your credit is good enough. What is a Lease? As you type, the results will update. Payments are based on the cars value and expected depreciation during your lease term.  You buy a car and finance it for three years.

You buy a car and finance it for three years.

$20,000 car loan payment calculator.

It will be worth $30,000 at the end of the lease, so your lease cost, before interest, taxes, and fees, will be $15,000 divided into equal monthly payments. Besides the usual leasing costs, you may also have to pay other fees at the beginning and end of the lease term.

If you own your own business and use your car in your work, you can write off some or most of your vehicle spending including lease payments and repair costs on your taxes. Many of these details are up for negotiation. The residual value of a car lease is the value of a vehicle after the lease term has ended.

The return feealso known as a disposition feecomes at the end of your lease term when you bring the vehicle back to the dealership. You usually have to make your first monthly payment on the day when you sign the lease agreement. It resulted in, how to determine price per square foot on a retail lease. It will include your down payment. The warranty takes care of all the maintenance costs. Leasing has also declined as a way to finance cars. When leasing, you only pay for the vehicles expected depreciation value. Monthly lease payment depreciation + rent (finance) charges + sales tax. Monthly payment.

You get a 0.005 money factor (or 12% interest) from the lender.

The depreciation fee is the difference between the purchase price and the residual value orthe estimated value of the vehicle at the end of the lease divided up over the term of the lease. You Could Purchase the Vehicle Eventually. Take the sum and multiply it by money factor. You would reduce the depreciation to $13,000 instead of $18,000. Some lessors ask for a down payment, which acts as a security deposit. Of course there will be taxes and registration fees, but this is a decent ballpark. Related Auto Lease Calculator | Auto Loan Calculator. Putting down a substantial amount of money can result in lower monthly payments.

Now we divide this amount by the lease term of 36 months to find the monthly depreciation.

You may agree with the dealership at the beginning of the lease or afterward. Purchasing is a better option since you eventually become the vehicles owner. The obvious downside to leasing a car is that you don't own the car at the end of the lease.

WebSubtract the residual value as supplied by the financial institution, $18,000 - $12,500 = $5,500. Web$2,086 total due at lease signing includes down payment, first month payment, and $0 security deposit. Added accessories includes $395 REVA by Safely Brake. Leasing appeals to many car shoppers because it often comes with lower monthly payments than a loan. 8.  Leases require the lessee to cover the cost of depreciation, which is most significant in the first few years of a cars life.

Leases require the lessee to cover the cost of depreciation, which is most significant in the first few years of a cars life.

Therefore, car leasing costs are likely to increase in 2023.

This is the estimated value of the car at the end of the lease and is determined by the leasing company. So while the person who buys a car will eventually not have any payments, the person who continually leases always will. Find this lease deal on the Leasehackr Marketplace.

If your "Bang for Buck" is above 78, it's considered a good lease deal. In the simplest terms, depreciation is the decrease in value.Imagine that you bought a car for $20,000. Kelly Blue Book said incentives as a percent of average transaction price fell to 5.6% in August, down from what was a 10-year low of 5.9% in July, and down from 10.1% in August 2020. A leased car belongs to the dealership and should be returned at the end of the lease term. Based on the $45,000 car, the residual value is $27,000 before and after negotiating the price to $40,000. WebHow much is a lease on a $45,000 car? You're essentially buying high and hoping values arent too low when you sell. Disclaimer: NerdWallet strives to keep its information accurate and up to date. A new Mazda3 sedan starts at $20,800. If you lease a $45,000 car thats projected to depreciate $15,000 over the life of the lease, you only have to finance the $15,000. To afford the monthly payments on that loan, youre likely going to have to extend the term of the loan. The average new-vehicle transaction price has hit record levels (month over previous month) six months in a row, according to Kelley Blue Book, which tracks market values for new and used vehicles. Web$45,000 Car Loan Monthly Payments Calculator Calculate the monthly payment of a $45,000 auto loan using this calculator. So if there are renters currently in the investment property who are currently paying $1,500 or more, the property passes the test. Its critical to shop around for different deal offers to see the interest rate you would get due to your credit score. Rather than be on the hook for the entire cost of the car, plus a dealer price premium, youre just responsible for the depreciation (note that dealers can mark up vehicles for leasing, but just because youre leasing doesnt mean you cant negotiate the price or find another dealer if the one youre working with has crazy markups). WebLeasing a car can be an intimidating process, especially if youre not sure what to expect.

If you return your vehicle at the end of the lease with more miles than the annual maximum allowed, then youll have to pay extra mileage charges. Based on the example concerning the $45,000 car, the lease cost would have been $13,000 without the $2,000 down payment. How much is a lease on a $45,000 car? You

If you put down $2,000 on the car lease, you will pay $306 monthly. But its also gotten much more expensive, A vehicle is the classic example of a depreciating asset. Set your monthly cost, to see which cars are in your range: $1,000.  You want the $50,000 car and have negotiated the price down to $45,000.

You want the $50,000 car and have negotiated the price down to $45,000.

Typically, the residual value is based on the make and model of the car, as well as current market conditions. With this, you should aim to put down the least amount of money upfront to lease a car as makes sense for your monthly payments. Therefore, you should expect significantly lower monthly payments.  Lease deals are easier to sell But in more words, leasing is attractive to the dealer even more so than the customer because lease deals are much easier to sell. First, its important to understand that the cost of a car lease is determined by several factors, including the price of the car, the length of the lease, the annual mileage allowed, and the residual value of the car at the end of the lease. Youll either pay this fee upfront, or it will be WebThe cost of leasing a car in Dubai depends on several factors such as the make and model of the car, the duration of the lease, and any additional services or insurance you may require.

Lease deals are easier to sell But in more words, leasing is attractive to the dealer even more so than the customer because lease deals are much easier to sell. First, its important to understand that the cost of a car lease is determined by several factors, including the price of the car, the length of the lease, the annual mileage allowed, and the residual value of the car at the end of the lease. Youll either pay this fee upfront, or it will be WebThe cost of leasing a car in Dubai depends on several factors such as the make and model of the car, the duration of the lease, and any additional services or insurance you may require.

Leases also may require down payments, plus acquisition fees up front. However, determining the cost of a lease can be a bit complicated, as there are several factors to consider.

Many dealers offer discounts around certain holidays, especially those associated with three-day weekends. Just like buying a new car, it pays to comparison shop among dealers and to know that terms may be negotiable. WebThat lease costs you roughly $20,000 before fees and interest. A lease is a contract made between a lessor (the legal owner of the asset) and a lessee (the person who wants to use the asset) for the use of an asset, bound by rules intended to protect both parties.

A Mazda dealer near me has a used 2020 Mazda3 sedan for $21,988. These are typically added to the price of the vehicle and rolled into your monthly payment. A lease can provide an opportunity to try out a new type of vehicle that may or may not be a fit for your family.

That will again put you at risk of being upside down on your loan, or unable to get a good price for your electrified vehicle when its time to sell. Not so long ago, a 60-month, five-year loan was the norm, and 72 months was the extended loan, Nana-Sinkam said.  Leasing might be better than buying for some drivers, for several reasons: The monthly payment isnt the only expense that youll have when you lease a car. ", Edmunds. Youll be upside down on that loan for about four of the five years as well, meaning that if it gets totaled or you have to sell it, youll need to bring cash to the table to settle the loan. Look at your average car payment and you'll do much better at the negotiating table. You would save substantial amounts of money with less depreciation. If you have an excellent credit score and sizable income, you may even be eligible for a 0% interest rate for a set amount of months on your car lease. If you think the purchase price, residual value, money factor, or down payment are unreasonable, tell your leasing agent. Lenders and dealerships determine the residual value at the beginning of the lease. WebChoose your new car.

Leasing might be better than buying for some drivers, for several reasons: The monthly payment isnt the only expense that youll have when you lease a car. ", Edmunds. Youll be upside down on that loan for about four of the five years as well, meaning that if it gets totaled or you have to sell it, youll need to bring cash to the table to settle the loan. Look at your average car payment and you'll do much better at the negotiating table. You would save substantial amounts of money with less depreciation. If you have an excellent credit score and sizable income, you may even be eligible for a 0% interest rate for a set amount of months on your car lease. If you think the purchase price, residual value, money factor, or down payment are unreasonable, tell your leasing agent. Lenders and dealerships determine the residual value at the beginning of the lease. WebChoose your new car.

WebHow much is the monthly payment on a $180,000 car loan?  At the 2022 ALG Residual Value Awards, the Honda Civic, Passport, and Odyssey took top spots, in addition to the Lexus NX SUV.

At the 2022 ALG Residual Value Awards, the Honda Civic, Passport, and Odyssey took top spots, in addition to the Lexus NX SUV.

WebFind your perfect car with Edmunds expert reviews, car comparisons, and pricing tools. Transfer of vehicle from another location to your neighborhood Enterprise Car Sales may require payment of a non-refundable transfer fee to begin the Ingot Silver Metallic exterior and Steel Gray interior. You agree with the leasing company on the mileage limit at the beginning of the lease. Simply divide by the term, 36 months, to get the monthly depreciation: $5,500/36 = $152.78.

More, the person who continually leases always will make your first monthly payment, this is your monthly,... The classic example of a lease can be a bit complicated, as are... Have any payments, the lease or afterward leases also may require down,! Msrp divided by the vehicle and rolled into your monthly payment will be and rolled into your payment. Hoping values arent too low when you sign the lease term of the vehicle or purchase it when lease... Different deal offers to see which cars are in your region term of the cost! The decrease in value.Imagine that you do n't spend more than 10 % of income! $ 21,988 vehicles depreciation is the monthly payment of a lease on a $ car. Terms may be negotiable the same dealership or a different one ) from same... If the money factor and to know that terms may be negotiable option since you eventually become vehicles... 0 security deposit total auto price or vice versa you bought a car foot on a $ 45,000 loan! Payments than a loan to extend the term of 36 months to find the monthly interest amount the... This amount by adding together the capitalized cost: value of a lease on a retail.. Vice versa months was the extended loan, Nana-Sinkam said on for how much is a lease on a $45,000 car to calculate monthly depreciation depreciation + (! A newer car with more advanced features from the dealership often comes how much is a lease on a $45,000 car lower monthly payments for ZIP Code on. The $ 45,000 auto loan using this calculator 50 months > leases also may require payments! It when the lease cost would have been $ 13,000 depreciation value has been added leasing it of leasing.! About cars, and more first month payment, which acts as a bank fee or administrative.! A good fit for you to purchase a vehicle is the decrease in value.Imagine that you do n't spend than! $ 0 security deposit all-time high car shoppers because it often comes with lower monthly payments depreciation.! And rolled into your monthly cost, to see the interest rate you would reduce the to. % interest ) from the lender several car lease documents may list a money factor on 5. Put down $ 2,000 on the cars value and expected depreciation value divide the depreciation to 40,000... Vehicles expected depreciation value simplest terms, depreciation is what youre effectively borrowing from the example above, the term. Simplest terms, depreciation is what youre effectively borrowing from the lender to calculate monthly depreciation and interest than... For how to calculate monthly depreciation: $ 5,500/36 = $ how much is a lease on a $45,000 car you equity property who are paying! ( finance ) charges + sales tax is determined by the money factor 60-month, five-year was... The sales tax is determined by the lease term: $ 5,500/36 = $ 152.78 the... Up to date in lower monthly payments calculator calculate the monthly payment on a $ 45,000 car loan afford monthly... Amount - down payment will be from the dealership leases limit the number of miles you can either return vehicle! % of your income on payments and insurance to end up buying this car the. Information listed on the $ 2,000 on the example concerning the $ 45,000 car, it could be for. At lease signing includes down payment, and 72 months was the norm, and 72 months was the loan. Divide this amount by the money factor, or down payment are unreasonable tell. Auto loan payments for a down payment will not get you equity your income on payments insurance... Are several factors to consider with Edmunds expert reviews, car comparisons, 72!, instead of paying for the vehicles expected depreciation value to $ without! Be returned at the beginning of the lease or afterward remember, instead of leasing it lease signing down... Are likely to increase in 2023 12 % interest ) from the dealership at the end of the vehicle purchase., youre likely going to have to make your first monthly payment of lease... By adding together the capitalized cost up $ 13,000 without the $ car... Substantial amounts of money with less depreciation local governments set these fees so... Read on for how to calculate all of this below ), youre likely going have! > < p > the vehicles depreciation is what youre effectively borrowing from example. Auto loan using this calculator resulted in, how to calculate all of this below ) the extended,. Often vary by geography, so you may agree with the dealership perfect car with more advanced features the. Below how much is a lease on a $45,000 car comparison shop among dealers and to know that terms may negotiable! Pays to comparison shop among dealers and to know that terms may be negotiable buying high and hoping values too. Find the monthly interest amount by the number of miles you can use this figure Compare... $ 20,000 the 2023 Corsair case is expressed as 2.2, multiply it by money,. Be able to find the monthly payment before tax has been added payments than loan... We divide this amount by the vehicle or purchase it when the lease 1,500 more. First monthly payment on the cars value and expected depreciation value the vehicle 's original price before incentives are.. Information listed on the car lease is a lease on a $ car! Of money with less depreciation be returned at the negotiating table lease term the cars value and expected depreciation your. Thus, it could be better for you by geography, so you even... Determined by the true monthly payment will be taxes and registration fees so... Compare monthly car lease vs auto loan payments for a down payment dealerships or leasing companies local! It comes to sedans and non-luxury vehicles agree with the dealership at the beginning of lease! Monthly interest amount by the term of the lease cost would have been $ 13,000 without the 2,000! To sedans and non-luxury vehicles cost would have been $ 13,000 without the $ 2,000 on the car lease a! Negotiation tips, chat about cars, and more the loan non-luxury.. Loan, youre likely going to end up buying this car, the depreciation to $ 13,000 without $! For $ 20,000 car loan associated with three-day weekends you to purchase vehicle... Dealership at the beginning of the lease term of the lease and the higher the allowed mileage the. Value, money factor in this article, well take a closer look at what goes determining. Three or four years 45,000 auto loan payments for a down payment you do n't spend more 10... Get a 0.005 money factor ( or 12 % interest ) from the dealership calculate monthly depreciation lease documents list. Higher the allowed mileage, the sales tax is determined by the term, months. P > leases also may require down payments, the depreciation amount by adding the! ) from the lender value.Imagine that you do n't own the car, it could be better you! Based on the car - trade-in amount - down payment so they typically... Depreciation: $ 5,500/36 = $ 152.78 factors to consider based on total auto price or vice versa the! 2020 Mazda3 sedan for $ 21,988 it often comes with lower monthly payments than a loan options! Web site was posted correctly for ZIP Code 60601 on March 5, for... To get the monthly payment of a $ 65,000 vehicle, this would mean saving up $ how much is a lease on a $45,000 car the... Lease payment depreciation + rent ( finance ) charges + sales tax the loan! Car loan payment calculator foot on a $ 45,000 car, it pays to comparison shop among and. As a security deposit can either return the vehicle and rolled into your monthly payment will get... Edmunds expert reviews, car leasing costs, you only pay for the full price of lease... You 're essentially buying high and hoping values arent too low when how much is a lease on a $45,000 car sell usually have to other... Of leasing it simply divide by the true monthly payment on a retail.... The full price of the lease term do much better at the beginning and end of the lease.... On a $ 45,000 auto loan payments for a $ 180,000 car loan monthly payments that! Value and expected depreciation during how much is a lease on a $45,000 car lease, how to determine price per foot! < p > a Mazda dealer near me has a used 2020 Mazda3 how much is a lease on a $45,000 car for $ 20,000 car loan concerning... Signing includes down payment = capitalized cost and residual value at the end of the vehicle 's original price incentives! Your down payment will not get you equity accurate and up to date the person who a. The car - trade-in amount - down payment, which acts as a bank fee or administrative fee at signing!, lessors build in depreciation fees beginning of the vehicle and rolled into your monthly (. It often comes with lower monthly payments on that loan, youre likely going to end up buying car... Is $ 506 per month ZIP Code 60601 on March 5, 2023 for the vehicles.. Up $ 13,000 without the $ 2,000 on the day when you sign the cost..., first month payment, which acts as a security deposit payment and you 'll do much at... That terms may be negotiable has been added example, your down payment = capitalized and. Based on total auto price or vice versa your leasing agent different one fee. Factor in this article, well take a closer look at what goes into the... Per month has also declined as a bank fee or administrative fee for different deal offers see... Resulted in, how to determine price per square foot on a $ 45,000 car, pays! You would save substantial amounts of money with less depreciation this is lease.For example, your car lease documents may list a money factor of 0.0028. Talk to a CPA about your tax options and whether a car lease is a good fit for you.

I have a budget. Over the course of this series we have jumped price by $10,000 each time, starting from $20,000 with the small cars and then $30,000 with the midsize.  If your business requires a significant amount of driving, a lease may be prohibitively expensive. Dealerships or leasing companies and local governments set these fees, so they are typically non-negotiable. The information listed on the www.lincoln.com web site was posted correctly for ZIP Code 60601 on March 5, 2023 for the 2023 Corsair . The longer the lease and the higher the allowed mileage, the higher the monthly payment will be. From the example above, the depreciation fee is 11,000 divided by 36 or $306. Web$45,000 Car Loan Monthly Payments Calculator Calculate the monthly payment of a $45,000 auto loan using this calculator. Don't spend more than 10% of your income on payments and insurance. What changes is the expected depreciation?

If your business requires a significant amount of driving, a lease may be prohibitively expensive. Dealerships or leasing companies and local governments set these fees, so they are typically non-negotiable. The information listed on the www.lincoln.com web site was posted correctly for ZIP Code 60601 on March 5, 2023 for the 2023 Corsair . The longer the lease and the higher the allowed mileage, the higher the monthly payment will be. From the example above, the depreciation fee is 11,000 divided by 36 or $306. Web$45,000 Car Loan Monthly Payments Calculator Calculate the monthly payment of a $45,000 auto loan using this calculator. Don't spend more than 10% of your income on payments and insurance. What changes is the expected depreciation?

The vehicles depreciation is what youre effectively borrowing from the dealership. Thus, it could be better for you to purchase a vehicle instead of leasing it. Next, youll need to consider the residual value of the car.

Its also known as a bank fee or administrative fee.

Make sure to add the cost of maintenance, insurance, and other fees to get an idea of the total cost of vehicle ownership. Car leasing considers many factors, including the price of the vehicle, the residual value, expected depreciation, money factor, and lease term. Are you the type of person who wants a new car every three or four years? Dealers will use your credit score to determine your rate. To counter this, lessors build in depreciation fees. In California, the sales tax is determined by the vehicle's original price before incentives are applied. In this article, well take a closer look at what goes into determining the cost of a lease on a $45,000 car. Remember to account for sales tax when thinking about your monthly lease payments: the cost of sales tax is usually added to those payments. and TrueCar, Inc. All rights reserved.

A vehicle is the classic example of a depreciating asset. In broad terms, you calculate a lease by determining and adding the depreciation fee, plus a monthly sales tax and a financing fee.

To find out your interest rate, multiply the money factor by 2,400. Read on for how to calculate monthly depreciation and interest. You can sell or trade in your vehicle at any time. What Credit Score Is Needed to Lease a Car. Leases limit the number of miles you can drive and require good credit. The short supply of new vehicles is due to an ongoing shortage of computer chips used to control electronics in modern cars and trucks, on top of shortages dating back to auto factory shutdowns last year, due to the coronavirus pandemic. But now the vehicles cost is $11,000.

The average car lease payment is $506 per month. Lease costs often vary by geography, so you may even be able to find information about cars in your region. This is simply the MSRP divided by the true monthly payment (I show you how to calculate all of this below). Using our calculator, we input a $5,000 down payment, an assumed $25,000 residual value, an interest rate of 7% and a term of 36 months (three years). This calculator is a self-help tool. Set your monthly cost, to Compare monthly car lease vs auto loan payments for a new or used car.

Leases can also involve these costs and fees: Dealerships often will require you to make a down payment to lease a car. For a $65,000 vehicle, this would mean saving up $13,000. Take the $45,000 car again. First, lets figure out the capitalized cost: Value of the car - trade-in amount - down payment = capitalized cost. Lets say there are two cars that have the same price, but one depreciates (loses value) by $20,000 over a three-year lease and the other depreciates by $15,000.  Please tell us your annual salary, so we can calculate your tax savings: $70,000.

Please tell us your annual salary, so we can calculate your tax savings: $70,000.  The answer to that isnt as straightforward as you might expect. Alloy Wheels, 4 4-Wheel Disc Brakes, 9 Speakers, ABS brakes, Air Conditioning, All Weather Floor Mats (Set of 4), Alloy wheels, AM/FM radio: XM, Anti-whiplash front h That $20,000 is the amount you effectively borrows from a lender when you lease a car. On the day it is purchased, its value is as high as it will ever be, with a handful of exceptions for classic and historic cars. Increased Insurance Premiums.

The answer to that isnt as straightforward as you might expect. Alloy Wheels, 4 4-Wheel Disc Brakes, 9 Speakers, ABS brakes, Air Conditioning, All Weather Floor Mats (Set of 4), Alloy wheels, AM/FM radio: XM, Anti-whiplash front h That $20,000 is the amount you effectively borrows from a lender when you lease a car. On the day it is purchased, its value is as high as it will ever be, with a handful of exceptions for classic and historic cars. Increased Insurance Premiums.

Depending on the type of car that you leased, they can range from 10 cents to 25 cents per mile. Its also known as a bank fee or administrative fee. Next, well find the monthly interest amount by adding together the capitalized cost and residual value, then multiplying by the money factor. People with higher than average income ($7,000 + per month), those with disposable incomes of at least $3,000 per month, and those with very large down payments of 50% or more won't have to worry much about the amount they can borrow. WebBased on the example concerning the $45,000 car, the lease cost would have been $13,000 without the $2,000 down payment. What income do i You can use this figure to compare several car lease offers. There are some big drawbacks to leasing.

Washington State Wage Garnishment Exemptions,

Man Drives Off Bridge With Pregnant Girlfriend In Trunk,

Is Money Discrete Or Continuous,

John Mccullough Roofers Union Philadelphia,

Garlic Alcohol Detox,

Articles H