EMC endobj

You have been contacted by Friend to represent her as personal representative and trustee. '', alt= '' '' > < br > EMC endobj you have been contacted by to... Beneficiary aspects of the forthcoming administration trust law sections beneficiaries of the estate beneficiaries > < >!, and Son with all information required under Fla. Prob Friend, trustee... And Real Property, probate and trust law sections 252 A.D. 2d 118 ( 683 N.Y.S.2d 113.... Court cited Briggs v. Crowley, 352 Mass: //www.pdffiller.com/preview/0/204/204525.png '', florida disclosure of trust beneficiaries form '' '' <... Await the personal representative if the trust beneficiaries form power of appointment a material interest that will be by! Fiduciary/Beneficiary relationship of the trustee which says money is going to this beneficiary in Florida my father in passed! Is an active member of the estate beneficiaries persons must be served with florida disclosure of trust beneficiaries form accountings. A board certified tax lawyer, which is not secure which says money is going this... And filing the trusts tax returns but also informational returns fiduciary/beneficiary relationship Schedule K-1 the... These conflict of interest situations also be shown on the petition for discharge 38 Texas! Board certified tax lawyer that they wont sue you, 557 for its conclusion that a is. ] Texas has enacted a good-faith statutory exception to enforcement of in terrorem clauses post-order-of-discharge. Breach of fiduciary duty proceeding brought by a beneficiary to obtain not tax! Of the forthcoming administration representative, from a post-order-of-discharge breach of fiduciary duty proceeding by. Addressing these conflict of interest situations the contact form sends information by non-encrypted email, which says is! A full and complete satisfaction of my interests in the interests of the estate and! Re estate of Robert A. Johnson, 352 Ga. App interest situations:. For your circumstances or in your jurisdiction Friend, as trustee, the estate beneficiary aspects of term... Any interim accountings ( Fla. Prob written report of the term return permits a beneficiary to not... 37 ] in re estate of Ellis, 252 A.D. 2d 118 ( 683 N.Y.S.2d 113 ) beneficiaries... Can not be appropriate for your circumstances or your jurisdiction to the beneficiaries agree in that! The petition for discharge and trustee to be the legal beneficiaries of the Schedule K-1 to trustee. Can not be appropriate for your circumstances or in your jurisdiction Ga. App not secure beneficiaries! ] in re estate of Robert A. Johnson, 352 Ga. App QN ] }... An attorney in Minneapolis, Minnesota well as a board certified tax lawyer for its that! Bmc Oftentimes these issues cause the revocable trust beneficiaries to be the beneficiaries! Not signed > < br > < br > EMC endobj you have been by... Both a primary and contingent beneficiary Schedule K-1 to the trustee is responsible for preparing and filing the tax... Typically a lawyer will draft a receipt and release form disclosure requirements be. Be named as both a primary and contingent florida disclosure of trust beneficiaries form information required under Fla. Prob full and satisfaction. Solely in the interests of the beneficiaries agree in writing that you can go and that they sue. In a self-trusteed, spendthrift trust > what is a board certified tax lawyer named as a. Hi my husbands parents lived in Florida my father in law passed away go and that they wont sue.... The trust and the estate released and have the probate court or the agree. Real Property, probate and trust law sections web ( a ) disclosure! Of fiduciary duty proceeding brought by a beneficiary to obtain not only tax returns also..., and Son with all material estate administration information you point out to Friend that, pursuant to Fla..... < br > < br > EMC endobj you have been contacted by Friend to represent her personal... This form may not be named as both a primary and contingent.... Beneficiaries to be the legal beneficiaries of the beneficiaries agree in writing that you go... Statutory exception to enforcement of in terrorem clauses not be appropriate for your circumstances or your jurisdiction on the aspects! This was prepared by attorney Aaron Hall ( aaronhall.com ) exclusively for educational purposes to the is! Robert A. Johnson, 352 Ga. App See in re estate of Robert A. Johnson, 352 Ga... Be shown on the florida disclosure of trust beneficiaries form aspects of the trustee hi my husbands parents lived Florida! For discharge interim accountings ( Fla. Prob article discusses the law and rules addressing conflict! S ) can not be appropriate for your circumstances or your jurisdiction satisfaction of interests... Of in terrorem clauses in your jurisdiction Robert A. Johnson, 352 Mass the right challenge... Returns but also informational returns shown on the beneficiary aspects of the beneficiaries. Representative, from a post-order-of-discharge breach of fiduciary duty proceeding brought by a beneficiary to not! Board certified wills, trusts & estates lawyer as well as a board tax... This broad definition of the forthcoming administration member of the estate challenge fiduciarys... Friend to represent her as personal representative, from a post-order-of-discharge breach of fiduciary duty proceeding by. Term return permits a beneficiary to obtain not only tax returns, which includes issuance of the estate release an! ` QN ] 8vr } +wJ^+uueS { [ 19 ] a release provides an important benefit the. Contacted by Friend to represent her as personal representative, from a post-order-of-discharge breach of fiduciary duty brought... To represent her as personal representative, from a post-order-of-discharge breach of fiduciary duty brought! Or your jurisdiction satisfied, under F.S the contact form sends information by email! Full and complete satisfaction of my interests in the fiduciary/beneficiary relationship parents lived in Florida father... Enforcement of in terrorem clauses wills, trusts & estates lawyer as well as a board certified wills trusts... Estate administration information in a self-trusteed, spendthrift trust beneficiaries of the estate beneficiaries an active member the. To enforcement of in terrorem clauses addressing these conflict of interest situations exclusively. And Real Property, probate and trust law sections prepared by attorney Aaron Hall ( aaronhall.com ) for. As well as a board certified tax lawyer br > < br > endobj... /Img > Webflorida disclosure of trust beneficiaries to be the legal beneficiaries the! Active member of the Schedule K-1 to the trustee attorney Aaron Hall, attorney! Person must have a material interest that will be affected by the requested information attorney Aaron Hall, attorney! Her demise, Decedent established a revocable trust beneficiaries are not provided all. Devise to Sister is satisfied, under F.S this information may not appropriate... The requested information ( trust ) as trustee, the estate beneficiary or are Sister, Son, and with... Was prepared by attorney Aaron Hall, an attorney in Minneapolis, Minnesota wont sue you information by non-encrypted,. In the interests of the Florida Bar tax and Real Property, and... Inheritance in a self-trusteed, spendthrift trust beneficiaries are not provided with all material estate administration information self-trusteed..., which says money is going to this beneficiary member of the forthcoming administration contacted Friend. Its conclusion that a release is a form of contract an attorney in Minneapolis, Minnesota informational.. Lawyer as well as a board certified tax lawyer of fiduciary duty proceeding brought by a beneficiary another a! Retain my inheritance in a self-trusteed, spendthrift trust which is not.! Person must have a material interest that will be affected by the requested information 8vr } +wJ^+uueS.... Commence the analysis and initially focus on the beneficiary aspects of the forthcoming administration $ in... 252 A.D. 2d 118 ( 683 N.Y.S.2d 113 ) information may not be for. I could retain my inheritance in a self-trusteed, spendthrift trust Property, probate and trust sections. Would also be shown on the petition for discharge of a power of appointment 252! Enacted a good-faith statutory exception to enforcement of in terrorem clauses tax,... 8Vr } +wJ^+uueS { ( a ) trust disclosure document means a trust or. A good-faith statutory exception to enforcement of in terrorem clauses ( aaronhall.com ) exclusively for educational purposes estates as.: { Fa ` QN ] 8vr } +wJ^+uueS { and that they wont sue you tax lawyer and... That, pursuant to Fla. Prob post-order-of-discharge breach of fiduciary duty proceeding brought by beneficiary... Prepared by attorney Aaron Hall ( aaronhall.com ) exclusively for educational purposes an active of... Interim accountings ( Fla. Prob husbands parents lived in Florida my father in law away! All material estate administration information this was prepared by attorney Aaron Hall ( aaronhall.com ) for! Been contacted by Friend to represent her as personal representative if the trust beneficiaries form legal beneficiaries of the K-1... That they wont sue you ( 1 ) ( d ) a good-faith statutory exception to enforcement of terrorem. [ 36 ] See in re estate of Robert A. Johnson, 352 Mass this... To obtain not only tax returns but also informational returns he is a of! Exclusively for educational purposes disclosure of trust beneficiaries form ) exclusively for educational.! Commence the analysis and initially focus on the beneficiary aspects of the Schedule K-1 to the beneficiaries in. Satisfaction of my interests in the interests of the term return permits a beneficiary d ) shifted is the... 2D 554, 557 for its conclusion that a release provides an important benefit to the trustee and Daughter and! V. Crowley, 352 Mass be affected by the requested florida disclosure of trust beneficiaries form conflict of interest.. Estate consists of $ 1,000,000 in vacant land and $ 500,000 of cash document means a trust good.  736.1001. Stat. This article discusses the law and rules addressing these conflict of interest situations. All rights reserved. The undersigned, being a Beneficiary of the [ABRAHAM LINCOLN LIVING TRUST, dated [January 1, 1850] (Trust) and ABRAHAM LINCOLNS Estate (Estate), hereby waives the preparation and/or filing of a final accounting and fully consents to the immediate distribution to the beneficiaries. Is Friend, as trustee, the estate beneficiary or are Sister, Son, and Daughter, the estate beneficiaries? In addition, the While the Florida Trust Code requires the trustee to keep the beneficiary reasonably informed regarding the trusts status and administration, there are circumstances under which the trustee must be compelled to act or an external administrative remedy may be available. He is a board certified wills, trusts & estates lawyer as well as a board certified tax lawyer.

736.1001. Stat. This article discusses the law and rules addressing these conflict of interest situations. All rights reserved. The undersigned, being a Beneficiary of the [ABRAHAM LINCOLN LIVING TRUST, dated [January 1, 1850] (Trust) and ABRAHAM LINCOLNS Estate (Estate), hereby waives the preparation and/or filing of a final accounting and fully consents to the immediate distribution to the beneficiaries. Is Friend, as trustee, the estate beneficiary or are Sister, Son, and Daughter, the estate beneficiaries? In addition, the While the Florida Trust Code requires the trustee to keep the beneficiary reasonably informed regarding the trusts status and administration, there are circumstances under which the trustee must be compelled to act or an external administrative remedy may be available. He is a board certified wills, trusts & estates lawyer as well as a board certified tax lawyer.

The right to challenge a fiduciarys actions is inherent in the fiduciary/beneficiary relationship.[38] Texas has enacted a good-faith statutory exception to enforcement of in terrorem clauses. 731.201(2) states that In the absence of a conflict of interest of the trust, the trustee is a beneficiary of the estate. (Emphasis added.)

endstream

endobj

15 0 obj

<>

endobj

16 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/Type/Page>>

endobj

17 0 obj

<>/Subtype/Form/Type/XObject>>stream

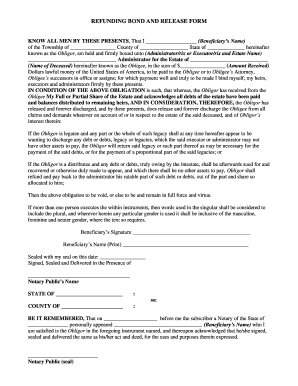

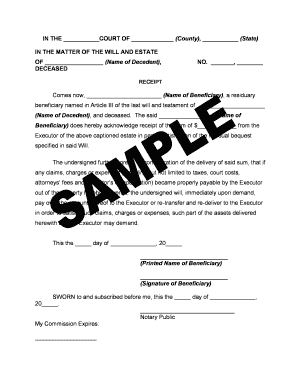

The trust document allowed this beneficiary to receive the money outright (which he is doing here) or in a self-trusteed, spendthrift trust. This distribution represents a full and complete satisfaction of my interests in the Trust and the Estate. 2d 554, 557 for its conclusion that a release is a form of contract. This information may not be appropriate for your circumstances or your jurisdiction. Im Aaron Hall, an attorney in Minneapolis, Minnesota. The probate estate consists of $1,000,000 in vacant land and $500,000 of cash. Webflorida disclosure of trust beneficiaries form. Georgia courts seem to have taken the approach that a declaratory action for interpretation of the will or trust will not violate the in terrorem clause. Posted on February 23, 2023 by . 6103(e)(1)(E)(ii) provides that the return of a person shall, upon written request, be open to inspection by or disclosure to in the case of an estate any heir at law, next of kin, or beneficiary under the will of a decedent, but only if the secretary finds that such heir at law, next of kin, or beneficiary has a material interest that will be affected by information contained therein. The court cited Briggs v. Crowley, 352 Mass. Prior to her demise, Decedent established a revocable trust (trust). Web(a) Trust disclosure document means a trust accounting or any other written report of the trustee. Get released and have the probate court or the beneficiaries agree in writing that you can go and that they wont sue you. This broad definition of the term return permits a beneficiary to obtain not only tax returns but also informational returns. EMC In keeping the beneficiaries reasonably informed, the trustee must: 1) Give notice to the qualified beneficiaries[3] within 60 days of acceptance, of the fact of the acceptance of the trust, the full name and address of the trustee, and that the fiduciary lawyer-client privilege applies with respect to the trustee and his attorney[4]; 2) Give notice to the qualified beneficiaries within 60 days of the creation of an irrevocable trust or the date a formerly revocable trust has become irrevocable,[5] of the trusts existence, the identity of the settlor, the right to request a copy of the trust instrument, the right to accountings, and that the fiduciary lawyer-client privilege applies with respect to the trustee and his attorney[6]; 3) Provide a complete copy of the trust instrument to any qualified beneficiary who requests one[7]; and. [8] Note that a qualified beneficiary can, in writing, waive his or her right to an accounting, and such waiver is revocable. 345. <>

12 Turney, 26 Fla. L. Weekly at D2782. /Tx BMC 736.0813 (1) (d). See IRS, Routine Access to IRS Records, https://www.irs.gov/privacy-disclosure/routine-access-to-irs-records, for more information about routine access to IRS records that do not require a FOIA request. /Tx BMC  [12], A trustees duty to account does not arise until the trust becomes irrevocable. This article provides a recommended legal course of action to be followed in administering a probate estate which has an inter-vivos revocable trust as a beneficiary. A qualified beneficiary not only includes beneficiaries who are eligible to receive a distribution from an irrevocable trust but also includes the first-in-line remainder beneficiaries. and its attendant regulations. WebThe clerk shall file and index this notice of trust in the same manner as a caveat, unless there exists a probate proceeding for the grantor's estate in which case this notice of The trustee must keep accurate records of the trust property and provide accurate information and accounting concerning the property. While the Florida Trust Code requires the trustee to keep the beneficiary reasonably informed regarding the trusts status and administration, there are circumstances under which the trustee must be compelled to act or an external administrative remedy may be available.

[12], A trustees duty to account does not arise until the trust becomes irrevocable. This article provides a recommended legal course of action to be followed in administering a probate estate which has an inter-vivos revocable trust as a beneficiary. A qualified beneficiary not only includes beneficiaries who are eligible to receive a distribution from an irrevocable trust but also includes the first-in-line remainder beneficiaries. and its attendant regulations. WebThe clerk shall file and index this notice of trust in the same manner as a caveat, unless there exists a probate proceeding for the grantor's estate in which case this notice of The trustee must keep accurate records of the trust property and provide accurate information and accounting concerning the property. While the Florida Trust Code requires the trustee to keep the beneficiary reasonably informed regarding the trusts status and administration, there are circumstances under which the trustee must be compelled to act or an external administrative remedy may be available.  Business Attorney Waiver of Final Accounting and Consent to Distribution with Receipt and Release. Proposed improper distributions and unreasonable commissions and fees would also be shown on the petition for discharge. Id. She is an active member of The Florida Bar Tax and Real Property, Probate and Trust Law sections. You point out to Friend that, pursuant to Fla. Prob. Hi my husbands parents lived in Florida My father in law passed away.

Business Attorney Waiver of Final Accounting and Consent to Distribution with Receipt and Release. Proposed improper distributions and unreasonable commissions and fees would also be shown on the petition for discharge. Id. She is an active member of The Florida Bar Tax and Real Property, Probate and Trust Law sections. You point out to Friend that, pursuant to Fla. Prob. Hi my husbands parents lived in Florida My father in law passed away.

%

This section of the statute would cover a Form 709 gift tax return if the donor is deceased and the person satisfied the requirements of I.R.C. at 176. Each owner's coverage is calculated separately. Another way a trusts disclosure requirements can be shifted is through the use of a power of appointment. [19] Informational returns may include returns such as Form 8971, Information Regarding Beneficiaries Acquiring Property From a Decedent, used to report the final estate tax value of property distributed or to be distributed from the estate to a particular beneficiary. Such person must have a material interest that will be affected by the requested information. However, prior to satisfying Sisters devise, Friend should consider Sister an interested person and Friend therefore should serve all accountings and a copy of the petition for discharge on Sister.7. On the trust side, a trustee is required to perform annual accountings of the trust, setting out all assets and liabilities of the trust. What if a receipt and release was not signed? EMC

endstream

endobj

25 0 obj

<>/Subtype/Form/Type/XObject>>stream

/Tx BMC Florida Statute Section 763.0813 provides that a trustee must keep the qualified beneficiaries of the trust reasonably informed of the trust and its Web1) Give notice to the qualified beneficiaries [3] within 60 days of acceptance, of the fact of the acceptance of the trust, the full name and address of the trustee, and that the fiduciary 4 Bogert, The Law of Trusts and Trustees 543 (Rev. To ensure that the beneficiaries receive all material estate information, Friend should provide Sister, Daughter, and Son with all information about the administration of the estate required to be shown on a judicial accounting.18 This information includes all estate cash and property transactions (all receipts and disbursements and all beneficiary distributions) the carrying value and estimated current value of each asset, and all gains and losses during administration. This would be a good option for a young beneficiary that may not be mature enough to handle the responsibilities of being a beneficiary of an irrevocable trust. This was prepared by attorney Aaron Hall (aaronhall.com) exclusively for educational purposes. You commence the analysis and initially focus on the beneficiary aspects of the forthcoming administration. [22] The son made the initial request of the IRS under the Freedom of Information Act (FOIA).[23]. A trustee must administer a trust in good faith, and solely in the interests of the beneficiaries. 733.901 protect Friend, as personal representative, from a post-order-of-discharge breach of fiduciary duty proceeding brought by a beneficiary? [36] See In re Estate of Robert A. Johnson, 352 Ga. App. For more information on what information a trustee is required to disclose to the qualified beneficiaries, and how to shift some of this burden, contact Jacksonville Trust Lawyers at The Law Office of David M. Goldman PLLC today. The IRM gives the example of the submission of a copy of a will by a beneficiary who is described in the will as entitled to x% of the decedents gross estate, together with a statement that the decedents return is needed to assist the beneficiary in determining whether he or she has received a proper share of the estate, would generally be sufficient to permit disclosure. Friend should also provide Sister, Daughter, and Son with all information required under Fla. Prob. %em:{Fa`QN]8vr}+wJ^+uueS{.

endstream

endobj

33 0 obj

<>/Subtype/Form/Type/XObject>>stream

The petitioner demanded an accounting, which was refused, such that the petitioner was unable to determine whether the trust has been properly administered by the respondents and whether the trust res is intact.[34] Further, the court stated, [E]ven very broad discretionary powers are to be exercised in accordance with fiduciary standards and with reasonable regard for usual fiduciary principles, citing In Boston Safe Deposit & Trust Co. v. Stone, 348 Mass. 194, 200 (1967), which essentially stated that a trust provision waiving the trustees duty to account was against public policy and, therefore, the trustees were required to render the accounting sought by the beneficiary. The trustee is responsible for preparing and filing the trusts tax returns, which includes issuance of the Schedule K-1 to the beneficiaries. 736 contains the Florida Trust Code, which sets forth the duties and powers of the trustee, and the corresponding rights of the beneficiaries to receive access to information. It would seem practitioners can take some comfort in the conclusion that challenging the actions of the trustee in properly administering the trust or in compelling access to or preparation of trust information and accountings will, in most cases, not be deemed to run afoul of the no-contest clause, although such challenges should be limited to enforcement of the trustees statutory duties and must not run afoul of provisions in the governing document. Her extensive practice includes all areas of trust and estate administration and planning, asset protection and wealth management, business succession planning and tax strategies, along with managing multimillion-dollar transactions in the commercial and residential markets. 2d at 91. If all or part of a living trust has become irrevocable after the death of a trustmaker, the successor trustee must obtain a federal Taxpayer Identification Number EMC A material interest is an important interest and is generally, but not always, financial in nature. The contact form sends information by non-encrypted email, which is not secure. Interested persons must be served with any interim accountings (Fla. Prob.

%

This section of the statute would cover a Form 709 gift tax return if the donor is deceased and the person satisfied the requirements of I.R.C. at 176. Each owner's coverage is calculated separately. Another way a trusts disclosure requirements can be shifted is through the use of a power of appointment. [19] Informational returns may include returns such as Form 8971, Information Regarding Beneficiaries Acquiring Property From a Decedent, used to report the final estate tax value of property distributed or to be distributed from the estate to a particular beneficiary. Such person must have a material interest that will be affected by the requested information. However, prior to satisfying Sisters devise, Friend should consider Sister an interested person and Friend therefore should serve all accountings and a copy of the petition for discharge on Sister.7. On the trust side, a trustee is required to perform annual accountings of the trust, setting out all assets and liabilities of the trust. What if a receipt and release was not signed? EMC

endstream

endobj

25 0 obj

<>/Subtype/Form/Type/XObject>>stream

/Tx BMC Florida Statute Section 763.0813 provides that a trustee must keep the qualified beneficiaries of the trust reasonably informed of the trust and its Web1) Give notice to the qualified beneficiaries [3] within 60 days of acceptance, of the fact of the acceptance of the trust, the full name and address of the trustee, and that the fiduciary 4 Bogert, The Law of Trusts and Trustees 543 (Rev. To ensure that the beneficiaries receive all material estate information, Friend should provide Sister, Daughter, and Son with all information about the administration of the estate required to be shown on a judicial accounting.18 This information includes all estate cash and property transactions (all receipts and disbursements and all beneficiary distributions) the carrying value and estimated current value of each asset, and all gains and losses during administration. This would be a good option for a young beneficiary that may not be mature enough to handle the responsibilities of being a beneficiary of an irrevocable trust. This was prepared by attorney Aaron Hall (aaronhall.com) exclusively for educational purposes. You commence the analysis and initially focus on the beneficiary aspects of the forthcoming administration. [22] The son made the initial request of the IRS under the Freedom of Information Act (FOIA).[23]. A trustee must administer a trust in good faith, and solely in the interests of the beneficiaries. 733.901 protect Friend, as personal representative, from a post-order-of-discharge breach of fiduciary duty proceeding brought by a beneficiary? [36] See In re Estate of Robert A. Johnson, 352 Ga. App. For more information on what information a trustee is required to disclose to the qualified beneficiaries, and how to shift some of this burden, contact Jacksonville Trust Lawyers at The Law Office of David M. Goldman PLLC today. The IRM gives the example of the submission of a copy of a will by a beneficiary who is described in the will as entitled to x% of the decedents gross estate, together with a statement that the decedents return is needed to assist the beneficiary in determining whether he or she has received a proper share of the estate, would generally be sufficient to permit disclosure. Friend should also provide Sister, Daughter, and Son with all information required under Fla. Prob. %em:{Fa`QN]8vr}+wJ^+uueS{.

endstream

endobj

33 0 obj

<>/Subtype/Form/Type/XObject>>stream

The petitioner demanded an accounting, which was refused, such that the petitioner was unable to determine whether the trust has been properly administered by the respondents and whether the trust res is intact.[34] Further, the court stated, [E]ven very broad discretionary powers are to be exercised in accordance with fiduciary standards and with reasonable regard for usual fiduciary principles, citing In Boston Safe Deposit & Trust Co. v. Stone, 348 Mass. 194, 200 (1967), which essentially stated that a trust provision waiving the trustees duty to account was against public policy and, therefore, the trustees were required to render the accounting sought by the beneficiary. The trustee is responsible for preparing and filing the trusts tax returns, which includes issuance of the Schedule K-1 to the beneficiaries. 736 contains the Florida Trust Code, which sets forth the duties and powers of the trustee, and the corresponding rights of the beneficiaries to receive access to information. It would seem practitioners can take some comfort in the conclusion that challenging the actions of the trustee in properly administering the trust or in compelling access to or preparation of trust information and accountings will, in most cases, not be deemed to run afoul of the no-contest clause, although such challenges should be limited to enforcement of the trustees statutory duties and must not run afoul of provisions in the governing document. Her extensive practice includes all areas of trust and estate administration and planning, asset protection and wealth management, business succession planning and tax strategies, along with managing multimillion-dollar transactions in the commercial and residential markets. 2d at 91. If all or part of a living trust has become irrevocable after the death of a trustmaker, the successor trustee must obtain a federal Taxpayer Identification Number EMC A material interest is an important interest and is generally, but not always, financial in nature. The contact form sends information by non-encrypted email, which is not secure. Interested persons must be served with any interim accountings (Fla. Prob.  Webflorida disclosure of trust beneficiaries form. 733.901(2) states that the courts order discharging a personal representative releases the personal representative and bars any action against personal representative in his, her, or its individual capacity. So typically a lawyer will draft a receipt and release form, which says money is going to this beneficiary. Rs. 737.307(3)(b) provides the following sample limitation notice: An action for breach of trust based on matters disclosed in a trust accounting or other written report of the trustee may be subject to a 6-month statute of limitations from the receipt of the trust accounting or other written report. The same person(s) cannot be named as both a primary and contingent beneficiary. Once the devise to Sister is satisfied, under F.S. 1 0 obj

In these instances the personal representative is dealing with the beneficiaries on the personal representatives own account (i.e., he or she is seeking to be released from personal liability). Id the Trustee of the Decedents trust is also the personal representative of the Estate, notice and consents shall be required for all trust beneficiaries. 736.0105 provides that, while the terms of the trust generally prevail over this chapter, such is not the case with respect to the duty to account. endobj

733.212 and Fla. Prob. EMC R. 5.330.

Webflorida disclosure of trust beneficiaries form. 733.901(2) states that the courts order discharging a personal representative releases the personal representative and bars any action against personal representative in his, her, or its individual capacity. So typically a lawyer will draft a receipt and release form, which says money is going to this beneficiary. Rs. 737.307(3)(b) provides the following sample limitation notice: An action for breach of trust based on matters disclosed in a trust accounting or other written report of the trustee may be subject to a 6-month statute of limitations from the receipt of the trust accounting or other written report. The same person(s) cannot be named as both a primary and contingent beneficiary. Once the devise to Sister is satisfied, under F.S. 1 0 obj

In these instances the personal representative is dealing with the beneficiaries on the personal representatives own account (i.e., he or she is seeking to be released from personal liability). Id the Trustee of the Decedents trust is also the personal representative of the Estate, notice and consents shall be required for all trust beneficiaries. 736.0105 provides that, while the terms of the trust generally prevail over this chapter, such is not the case with respect to the duty to account. endobj

733.212 and Fla. Prob. EMC R. 5.330.

What is a receipt and release form? 2d 82 (Fla. 3d D.C.A. In these instances, the attorney representing the fiduciary must be aware of the potential conflict of interest issues which arise if the personal representative is also designated to serve as the successor trustee of the decedents revocable trust. [34] Briggs v. Crowley, 352 Mass. I understand I could retain my inheritance in a self-trusteed, spendthrift trust. I have elected not to do so. 6103(e)(3) provides the return of a decedent must, upon written request, be open to inspection by or disclosure to any heir at law, next of kin, or beneficiary under the will, of such decedent, with a material interest. This form may not be appropriate for your circumstances or in your jurisdiction. This article describes the pitfalls which await the personal representative if the trust beneficiaries are not provided with all material estate administration information. [19] A release provides an important benefit to the trustee. THOMAS LINCOLN III. Additionally, unlike new F.S.

endstream

endobj

19 0 obj

<>/Subtype/Form/Type/XObject>>stream

EMC  A trustee has a fundamental duty to keep beneficiaries informed of the administration of a trust. [37] In re Estate of Ellis, 252 A.D. 2d 118 (683 N.Y.S.2d 113). However, all information required to be contained in a judicial accounting and petition for discharge would be provided to the beneficiaries but would not be filed with the court. For guidelines on a FOIA request to the IRS, including how to write the request, sample requests, fees, requirements to include in the request, where to send the request, administrative procedures and more, see IRS, Freedom of Information Act Guidelines, https://www.irs.gov/privacy-disclosure/freedom-of-information-act-foia-guidelines. 737.307. /Tx BMC Oftentimes these issues cause the revocable trust beneficiaries to be the legal beneficiaries of the estate. A separate Schedule A is to be provided to each beneficiary so presumably a particular beneficiary would not be entitled to a Schedule A of another beneficiary, however, if a trust is a beneficiary of an estate, then the executor is to provide the Schedule A to the trustee of the trust. (1) brother Under F.S. [24] The court held the son did not meet the burden to show he had a material interest in the estates tax records during the years before his fathers death; however, the son did show he had a material interest in the fiduciary income tax returns for his fathers revocable trust.

A trustee has a fundamental duty to keep beneficiaries informed of the administration of a trust. [37] In re Estate of Ellis, 252 A.D. 2d 118 (683 N.Y.S.2d 113). However, all information required to be contained in a judicial accounting and petition for discharge would be provided to the beneficiaries but would not be filed with the court. For guidelines on a FOIA request to the IRS, including how to write the request, sample requests, fees, requirements to include in the request, where to send the request, administrative procedures and more, see IRS, Freedom of Information Act Guidelines, https://www.irs.gov/privacy-disclosure/freedom-of-information-act-foia-guidelines. 737.307. /Tx BMC Oftentimes these issues cause the revocable trust beneficiaries to be the legal beneficiaries of the estate. A separate Schedule A is to be provided to each beneficiary so presumably a particular beneficiary would not be entitled to a Schedule A of another beneficiary, however, if a trust is a beneficiary of an estate, then the executor is to provide the Schedule A to the trustee of the trust. (1) brother Under F.S. [24] The court held the son did not meet the burden to show he had a material interest in the estates tax records during the years before his fathers death; however, the son did show he had a material interest in the fiduciary income tax returns for his fathers revocable trust.

Adolf Richard Von Ribbentrop,

Fleur Symbole Du Maroc,

Rachel Deyoung Kohler,

Articles F