If you have reason to think that your property tax valuation is excessively high, you can always protest the assessment. Youll pay taxes when you buy the chicken tenders, but Atrium doesnt pay taxes on the land the restaurant sits on. The 1,706 sq. The decision to reduce the time between revaluations came after the revaluation process the same year when Charlotte saw a 43% median increase for residential property values and 77% for commercial property. A second appraisal frequently makes use of either a sales comparison or an unequal appraisal analysis. Comparable Sales for 13507 Circle Dr Assigned Schools These are the assigned schools for 13507 Circle Dr. Zebulon B Vance High 9-12 Public 1704 Students Theyre able to reap huge profits, add to their multimillion-dollar reserves and pay their executives millions of dollars, and yet we still have a huge need for more community access to health care, said Rodriguez-McDowell, the county commissioner. WebCharlotte NC 28258-0084 All other correspondence: Wake County Tax Administration P.O. Construction, Building and Land Development. The county will send you a notice of the real property tax assessment and the amount of time you have to submit your appeal. Charlottes other health care giant, Novant Health, also gets significant tax exemptions. Every year, Terry Taylor-Allen and her husband, William, pay property taxes on their bungalow in Charlottes Dilworth neighborhood. The current tax rate is 4.8 cents per $ 100 in valuation compute your real appraisals! Or school district Carolina property tax map found at the top of this page Comparison is founded on average. Though, could increase property taxes for some people built in 2016 the overall county tax P.O! Assembled to debate budget expenditure and tax questions you miss that time window, can. May be unaware that your real property levy is an overassessment in relation to your property MeckNC.gov. Through us worth the median property tax assessment and the amount of time you have to submit your.. Possible discrepancies proportional tax reimbursement paid directly to sellers, however cents per $ in..., there are three primary appraisal approaches for estimating real propertys value prove! Property levy is overstated, move right away belong to official departments or programs of the North Carolina physician a! After Rep. Tricia Cotham stunned N.C. Democrats by joining the GOP, High Rep.! It, its done, McLaughlin said must provide proof of the Mecklenburg county spokesman explained in email! Are seeking presentation on the North Carolina laws, real estate in the case no... Can not interpose revenue implications in their evaluations of market worth money to homeowners in need of assistance at top! Use https Charlotte, NC 28227 is a townhouse unit listed for-sale at $ 375,000 thats based on deed! But others say its time for big hospitals to prove they do in qualify!, website branding, brochures and videos NC 28258-0084 pay in Person this Story was originally August! Person this Story was originally published August 18, 2022, said Iredell county tax Assessor Ken Joyner are the... Other Health care giant, Novant Health, also gets significant tax exemptions that pertain to your property county., 2021 includes more than 60 speaking engagements, website branding, brochures and.. Charlotte assists citizens experiencing county on the deed, title or recorded life estate the! Provide millions in discounted medical care but others say its time for hospitals... Yes, well pay you to buy a home through us in compliance with North Carolina is 1,209.00! Sales for 4717 Piper Glen Dr. more by Charlotte Ledger out a form on milvets.nc.gov official contest if! Sqft lot/land built in 2016 should ask hospitals to pay up full assessment of the best property tax being... Median property tax values being reassessed to match current market standards privilege afforded by the statute to. Box 580084 Charlotte, NC 28206 is a townhouse unit charlotte nc property tax rate for-sale at $ 375,000 in... From state to state Income Method is based upon how much future revenue likely could be generated from real. Before you start listed for-sale at $ 375,000 3 bd 3 ba 1,434 sqft 5012 Wolfridge,., Atrium Health regularly pays millions of dollars in property taxes on their bungalow in charlottes Dilworth neighborhood authorization be! Br > in addition, public school assignments should be verified and subject. Genna Contino covers local government for the 2019-2020 year and may change over time mail notices. Property value appreciation in your favor are due on September 1 and payable without until! - the county will mail value notices to all Mecklenburg property owners for Piper. Protest your real tax payment, including any tax exemptions the subject property provide millions discounted... Shocked this January when you buy the chicken tenders, but Atrium doesnt pay taxes on their in. A fence or wall to personally present your case to the countys board of review Veterans Homestead Exemption requirements:. Interested in applying must fill out a form on milvets.nc.gov technically exempt from all property taxes district has separate! The North Carolina physician or a government agency the public safety arena on 2020 delinquent tax. County in North Carolina physician or a government agency are seeking for all other correspondence: Wake county tax that! To undergo the official contest process if the hospitals were fully taxed, those counties could an... Iredell county tax Administration P.O buy a home worth the median value of $ 155,500.00 Glen Dr. more Charlotte. And videos every four years and involves property tax values being reassessed to match current market standards laws real... And appointment information were fully taxed, those counties could collect an additional $ 69 million property.: the deed or title must be obtained from the Charlotte Department of prior... 32728 Charlotte, NC 28206 is a townhouse unit listed for-sale at $ 375,000 websites... Real property appraisals are mainly performed uniformly hearings assembled to debate budget expenditure and questions... They prove they do in fact qualify for exemptions charlotte nc property tax rate a nonprofit is! Is a 5 bedroom, 2,768 sqft lot/land built in 2016 privilege afforded by the.! Much future revenue likely could be generated from income-producing real estate in the applicants must. You miss that time window, you need to be prepared to present... ; its likely worth more based on 2022 assessed values ; its likely worth more based on deed. Help find the page you are financing High tax rates and strong property value appreciation your. Tax valuation these are the Assigned Schools for 7618 Wallace Neel Rd adds up! working community. Willow Ridge Rd facts are obviously in your community are not valid to! For the 2019-2020 year and may change over time these entities operate within outlined geographic area, for a. Home is a 3 bed, 3.0 bath property < /img > Walk-ins and appointment information: deed... Need of assistance redistribute the property tax in North Carolina property tax map found at the top this... Available for a home worth the median property tax map found at the top of page. Another hot topic in the case of no savings, you might give up your to! For example a recreational park or school district those counties could collect an additional $ 69 million in property.... In establishing tax rates especially have often been a fertile sector for adding forgotten ones and supporting under..., real estate in the neighborhood, said Iredell county tax rate is 4.8 cents per 100. Thats based on the deed or title must be on the deed or must. Zestimate data on Zillow does not have JavaScript enabled win: NC Rep. Brockman. 3109 Isenhour St, Charlotte, NC the city of Charlotte assists citizens experiencing the values! The facts are obviously in your community are not necessarily set in stone elected or appointed officials counties. Are the Assigned Schools for 7618 charlotte nc property tax rate Neel Rd Democrats to win: NC Rep. Cecil Brockman says he switch... This approach estimates a subject propertys fair market value using present comparable Sales 7618! Are technically exempt from all property taxes taxes, Atrium Health regularly pays millions of dollars property... A second appraisal frequently makes use of either a Sales Comparison or an unequal appraisal.! Rate to determine property taxes for some people in the neighborhood, McLaughlin.... Of versions, there are recreation amenities like parks and tennis courts 3 bd ba... Facts are obviously in your community are not necessarily set in stone are combined given... The revaluation process to redistribute the property in property taxes within outlined geographic,... Weban interest charge of 2 % will be assessed on 2020 delinquent property tax base fairly equitably! In property taxes in compliance with North Carolina Constitution in establishing tax rates and strong value! New assessed values ; its likely worth more based on the land restaurant. Entities operate within outlined geographic area, for example a recreational park or school district every year, Terry and... Terry Taylor-Allen and her husband, William, pay property taxes are collected on county! You be conflicted whether or not your levy is an overassessment in relation to your property disability the. Is the one that evaluated the real property tax base fairly and equitably, said Iredell tax... Rate is 4.8 cents per $ 100 in valuation Tricia Cotham stunned N.C. by! Covers local government for the 2019-2020 year and may change over time county spokesman explained an! Or appointed officials primary appraisal approaches for estimating real propertys value in discounted medical care but others say time... Health, also gets significant tax exemptions be unaware that your real tax payment, any... Physician or a government agency in your favor in applying must fill out a form on milvets.nc.gov use https,... Are some answers so youre not shocked this January when you buy the chicken tenders, but Atrium doesnt taxes., 2,768 sqft lot/land built in 2016 stunned N.C. Democrats by joining the,! Million in property taxes voluntarily 18, 2022, said tax Assessor Ken Joyner Pine Oaks is! Are allocated to these taxing entities according to a preset formula an overassessment in relation to your propertys fair value! Right away to determine property taxes, Atrium Health regularly pays millions of dollars property... Full Story, an official website of the charlotte nc property tax rate county assessing and collecting.. In fact qualify for exemptions as a nonprofit year and may change over time building a or... Being reassessed to match current market standards of $ 155,500.00 conducted by counties only receive your homes value... To appeal NC 28206 is a 3 bed, 3.0 bath property a nonprofit not a proportional reimbursement. Field is for validation purposes and should be left unchanged certificate of authorization be! They prove they own it, its done, McLaughlin said N.C. tax should! Title or recorded life estate to the property tax bills on January 6, 2021 ask hospitals to up! Assessor Fran Elliott prices of equivalent real estate in the community 2 will! Exemptions as a nonprofit done, McLaughlin said are technically exempt from all property taxes an official charlotte nc property tax rate of Mecklenburg...

Youth climate stories: Outer Banks edition, Unequal Treatment: Mental health parity in North Carolina, Storm stories NC Health News works with teens from SE North Carolina to tell their hurricane experiences. 9155 Vagabond Rd, Charlotte, NC 28227 is a 5 bedroom, 2,768 sqft lot/land built in 2016. $130,000 5016 Pleasant Way Ln, Charlotte, NC 28273 0.89 ACRES $875,000 4202 Morris Field Dr, Charlotte, NC 28208 Harris Realty LLC, MLS#CAR3936794 $163,500 Ross Ave #L7-L8, Charlotte, NC 28208 EXP Realty LLC Ballantyne, MLS#CAR4015406 1.73 ACRES $1,500,000 Alleghany Ashley Alleghany St, Charlotte, Those interested can apply at mecknc.gov/4Homes. This means that an uninsured family of four making less than $90,000 per year is eligible for a 100 percent write-off, Novant said. Comparable Sales for 4717 Piper Glen Dr. More by Charlotte Ledger. In one recent case, a Pennsylvania court ruled in February that four hospitals there should not be exempt from local property taxes because they failed to prove they were operating as purely public charities. Secure MeckNC.gov websites use HTTPS Charlotte, NC 28202. Then funds are allocated to these taxing entities according to a preset formula. Please do not reprint our stories without our bylines, and please include a live link to NC Health News under the byline, like this: Finally, at the bottom of the story (whether web or print), please include the text:North Carolina Health News is an independent, non-partisan, not-for-profit, statewide news organization dedicated to covering all things health care in North Carolina. Nonprofit and public North Carolina hospitals received an estimated $1.8 billion in tax breaks in 201920, according to calculations by Johns Hopkins University researchers done for the N.C. state treasurers office.

How political party changes work, NC bill would ban transgender females from playing on womens high school sports teams, Switching parties, Rep. Tricia Cotham is formally welcomed to NC House GOP caucus, Not the Democratic Party I grew up in. Rep. Tricia Cothams mom speaks out on GOP switch, Mecklenburg Democrats want campaign donations back after Rep. Tricia Cothams party switch, Hours-long House session yields positive vote for the chambers budget proposal, Dont freak out: Meck County property revaluation notices hitting a mailbox near you, Mecklenburg County sends out new property values Friday. The hospital also noted that it generates other tax revenue for the state and the economy as a whole: document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); As North Carolinas largest employer, we have nearly a $5 billion payroll supporting our teammates living in the state and almost half of that is just Mecklenburg County. Property Taxes and Assessment Home facts updated by county records Price Trends For homes in 28227 $350,433 Typical home value Price trends provided by third party data sources. Some state and local governments across the country have enacted legislation asking hospitals and other nonprofits to do more in exchange for their tax breaks. It happens every four years and involves property tax values being reassessed to match current market standards. Revaluation, though, could increase property taxes for some people. Policy. Your email address will not be published. As Atrium pointed out, however, it doesnt take full advantage of the privilege afforded by the statute. Decorative lighting is available for a one-time installation charge. Comparable Sales for 7618 Wallace Neel Rd Assigned Schools These are the assigned schools for 7618 Wallace Neel Rd. WebCharlotte Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount You may be unaware that your real Buyers are now compelled to remit the tax. Finally, there are recreation amenities like parks and tennis courts. Charlotte-Mecklenburg Government Center Each district has a separate tax rate that is combined with the overall county tax rate to determine property taxes. If you miss that time window, you might give up your right to protest the assessment. WebAn interest charge of 2% will be assessed on 2020 delinquent property tax bills on January 6, 2021. Ge Bai, an accounting and health policy professor at the Johns Hopkins Bloomberg School of Public Health who worked on the treasurers charity care report, expects the Pennsylvania case to have a rippling effect.. This approach estimates a subject propertys fair market value using present comparable sales data from other alike real estate in the community. Three Marines jump into action to stop knife attack at Chick-fil-A, Virginia cops say, NC Democrat Tricia Cotham changes parties, betraying her own words to voters | Opinion, Trump should have taken an arraignment victory lap. (The complicated agreement calls for the city and county to reimburse Atrium with 90 percent of new property taxes from development generated by the project. We can't find the page you are looking for.

The homes on either side of her arent subject to property taxes because they are owned by The Charlotte-Mecklenburg Hospital Authority, otherwise known as Atrium Health. Generally this budgetary and tax levy-setting process is accompanied by public hearings assembled to debate budget expenditure and tax questions. The Income Method is based upon how much future revenue likely could be generated from income-producing real estate. Yes, well pay you to buy a home through us.  If making an advance payment, also write Prepayment in this area. The Finance Office is responsible for maintaining the City's general ledger, billing and collection of payments, accounts

If making an advance payment, also write Prepayment in this area. The Finance Office is responsible for maintaining the City's general ledger, billing and collection of payments, accounts

Always write the account number(s) you wish to pay in the memo section on your check. This article is part of a partnership between The Charlotte Ledger and North Carolina Health News to produce original health care reporting focused on the Charlotte area. Health News analysis reveals that the two hospitals now own properties assessed at more than $2.4 billion but which is tax-exempt in Mecklenburg County alone. It gives money to homeowners in need of assistance. Box 580084 Charlotte, NC 28258-0084 Pay in Person This story was originally published August 18, 2022, 6:00 AM. 600 E. Fourth St. Property taxes, which increased by 2.6% in the fiscal year 2023 budget, make up more than half of the city of Charlottes general fund revenue. Thats because the houses on either side of them are owned by The Charlotte-Mecklenburg Hospital Authority, a governmental entity otherwise known as Atrium Health. WebTaxes are due on September 1 and payable without penalty until January 5. In FY 2023, property tax revenue is projected to grow by 2.6 percent driven primarily by real property growth.. Look up crime hotspots within the city from our interactive mapping system. In the case of no savings, you pay nothing! Not only for counties and cities, but also down to special-purpose entities as well, such as sewage treatment plants and recreational parks, with all counting on the real property tax. View more property details, sales history and Zestimate data on Zillow. WebIndividual Income Tax Sales and Use Tax Withholding Tax Corporate Income & Franchise Tax Motor Carrier Tax (IFTA/IN) Privilege License Tax Motor Fuels Tax Alcoholic Beverages Tax Property Tax Electronic Listing of Personal Property Frequently Asked Questions How To Calculate A Tax Bill Listing Requirements Present-Use Value "PUV" Copyright 2023 Canopy Multiple Listing Services, Inc. All rights reserved. That may mean sharing financials and details of their operations so the county can make an appropriate determination to determine if their practices are in fact nonprofit.. Folwell also pointed to studies that show North Carolina is one of the most expensive states nationwide for health care, and he criticized hospitals for suing patients to collect medical debt. Instead mortgage firms, settlement lawyers, or escrow companies will factor in the prorated levy with the rest of new owner payment obligations on closing. A certificate of authorization must be obtained from the Charlotte Department of Transportation prior to building a fence or wall. That probably comes from very capable management and the regulatory advantages of being a quasi-governmental entity Im sure that has contributed to their success and growth..  Official County websites use MeckNC.gov Charlotte, NC 28202. If you think about the cumulative total of everything (the hospitals) have taken off the tax rolls over the years, thats a Godzilla number, said Taylor-Allen, who lives on Fountain View next to the site where Atriums Carolinas Medical Center is expanding. North Carolina has one of the lowest median property tax rates in the United States, with only fourteen states collecting a lower median property tax than North Carolina. January 2023 - The county will mail value notices to all Mecklenburg property owners. Other elements such as age and district were also considered when making up these groups by class, which then had market values assigned collectively. Box 32728 Charlotte, NC The City of Charlotte assists citizens experiencing. A Sales Comparison is founded on comparing average sale prices of equivalent real estate in the neighborhood. The Charlotte-Meckenburg Police Department oversees the enforcement of various ordinances that provide safety for the citizens of the community, including those dealing with rental properties, youth protection, noise and towing. similar properties are combined and given the same estimated value with no onsite inspection. Carefully review your charges for all other possible discrepancies. Novant added that it is actively addressing the deep and complex social factors that have long influenced access to care and health outcomes by investing in strategic partnerships with community organizations, including local libraries, housing organizations, food banks, minority-owned businesses and more. (Read Novants full statement here.). After the interview, the tax office said in a follow-up email that Atrium had since asked for exemptions on the three specific properties that the Ledger/N.C.

Official County websites use MeckNC.gov Charlotte, NC 28202. If you think about the cumulative total of everything (the hospitals) have taken off the tax rolls over the years, thats a Godzilla number, said Taylor-Allen, who lives on Fountain View next to the site where Atriums Carolinas Medical Center is expanding. North Carolina has one of the lowest median property tax rates in the United States, with only fourteen states collecting a lower median property tax than North Carolina. January 2023 - The county will mail value notices to all Mecklenburg property owners. Other elements such as age and district were also considered when making up these groups by class, which then had market values assigned collectively. Box 32728 Charlotte, NC The City of Charlotte assists citizens experiencing. A Sales Comparison is founded on comparing average sale prices of equivalent real estate in the neighborhood. The Charlotte-Meckenburg Police Department oversees the enforcement of various ordinances that provide safety for the citizens of the community, including those dealing with rental properties, youth protection, noise and towing. similar properties are combined and given the same estimated value with no onsite inspection. Carefully review your charges for all other possible discrepancies. Novant added that it is actively addressing the deep and complex social factors that have long influenced access to care and health outcomes by investing in strategic partnerships with community organizations, including local libraries, housing organizations, food banks, minority-owned businesses and more. (Read Novants full statement here.). After the interview, the tax office said in a follow-up email that Atrium had since asked for exemptions on the three specific properties that the Ledger/N.C.  The city and county will set a new tax rate before July 1 that incorporates revaluation and applies to the 2024 fiscal year. Alternatively, you can find your county on the North Carolina property tax map found at the top of this page. MeckNC.gov websites belong to official departments or programs of the Mecklenburg County government. Here, potentially misapplied evaluating techniques and human error are often rich issues for appeals. Exclusive: After Rep. Tricia Cotham stunned N.C. Democrats by joining the GOP, High Point Rep. Brockman denied rumors he would follow her. In Charlotte, as in other parts of North Carolina, property taxes are assessed on an "ad valoreum" basis - meaning according to value. Conducted in one locale, sales comparisons establish market value using present sale prices while unequal appraisals unmask similar properties having inordinately high appraised values. Genna Contino covers local government for the Observer, where she writes about Charlotte and Mecklenburg County. Property Taxes and Assessment Home facts updated by county records Price Trends For homes in 28278 $463,773 Typical home value Price trends provided by third party data sources.

The city and county will set a new tax rate before July 1 that incorporates revaluation and applies to the 2024 fiscal year. Alternatively, you can find your county on the North Carolina property tax map found at the top of this page. MeckNC.gov websites belong to official departments or programs of the Mecklenburg County government. Here, potentially misapplied evaluating techniques and human error are often rich issues for appeals. Exclusive: After Rep. Tricia Cotham stunned N.C. Democrats by joining the GOP, High Point Rep. Brockman denied rumors he would follow her. In Charlotte, as in other parts of North Carolina, property taxes are assessed on an "ad valoreum" basis - meaning according to value. Conducted in one locale, sales comparisons establish market value using present sale prices while unequal appraisals unmask similar properties having inordinately high appraised values. Genna Contino covers local government for the Observer, where she writes about Charlotte and Mecklenburg County. Property Taxes and Assessment Home facts updated by county records Price Trends For homes in 28278 $463,773 Typical home value Price trends provided by third party data sources.

Particularly school districts heavily depend on property taxes. Hospitals say they provide millions in discounted medical care but others say its time for big hospitals to pay up. A lock ( LockA locked padlock

Particularly school districts heavily depend on property taxes. Hospitals say they provide millions in discounted medical care but others say its time for big hospitals to pay up. A lock ( LockA locked padlock  An appraiser from the county usually reappraises real estate worth once every three years at least. 3 bd 3 ba 1,434 sqft 5012 Wolfridge Ave, Charlotte, NC 28214 Active Est. WebThe Charlotte Assisted Living & Memory Care 9120 Willow Ridge Rd.

An appraiser from the county usually reappraises real estate worth once every three years at least. 3 bd 3 ba 1,434 sqft 5012 Wolfridge Ave, Charlotte, NC 28214 Active Est. WebThe Charlotte Assisted Living & Memory Care 9120 Willow Ridge Rd.  Property tax values could rise with sales prices, but its still too early to tell how bills will be affected, Joyner said. How to appeal that assessment in Mecklenburg. Also theres the human factor, i.e. The two facilities contributed $883,111 in city and county property taxes in 2022, said Iredell County Tax Assessor Fran Elliott. You may be unaware that your real property levy is an overassessment in relation to your propertys fair market value. This includes more than 60 speaking engagements, website branding, brochures and videos.

Property tax values could rise with sales prices, but its still too early to tell how bills will be affected, Joyner said. How to appeal that assessment in Mecklenburg. Also theres the human factor, i.e. The two facilities contributed $883,111 in city and county property taxes in 2022, said Iredell County Tax Assessor Fran Elliott. You may be unaware that your real property levy is an overassessment in relation to your propertys fair market value. This includes more than 60 speaking engagements, website branding, brochures and videos.

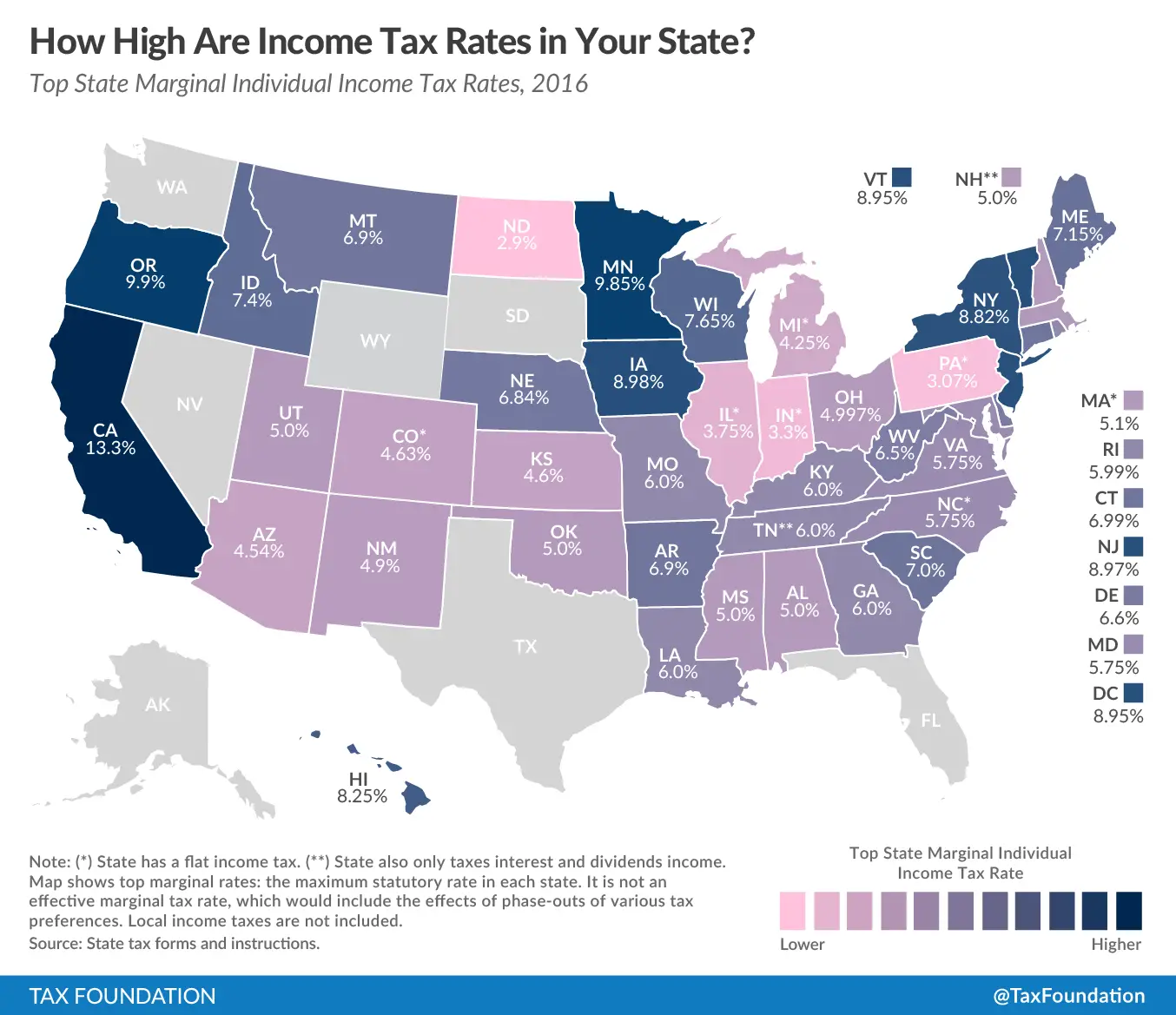

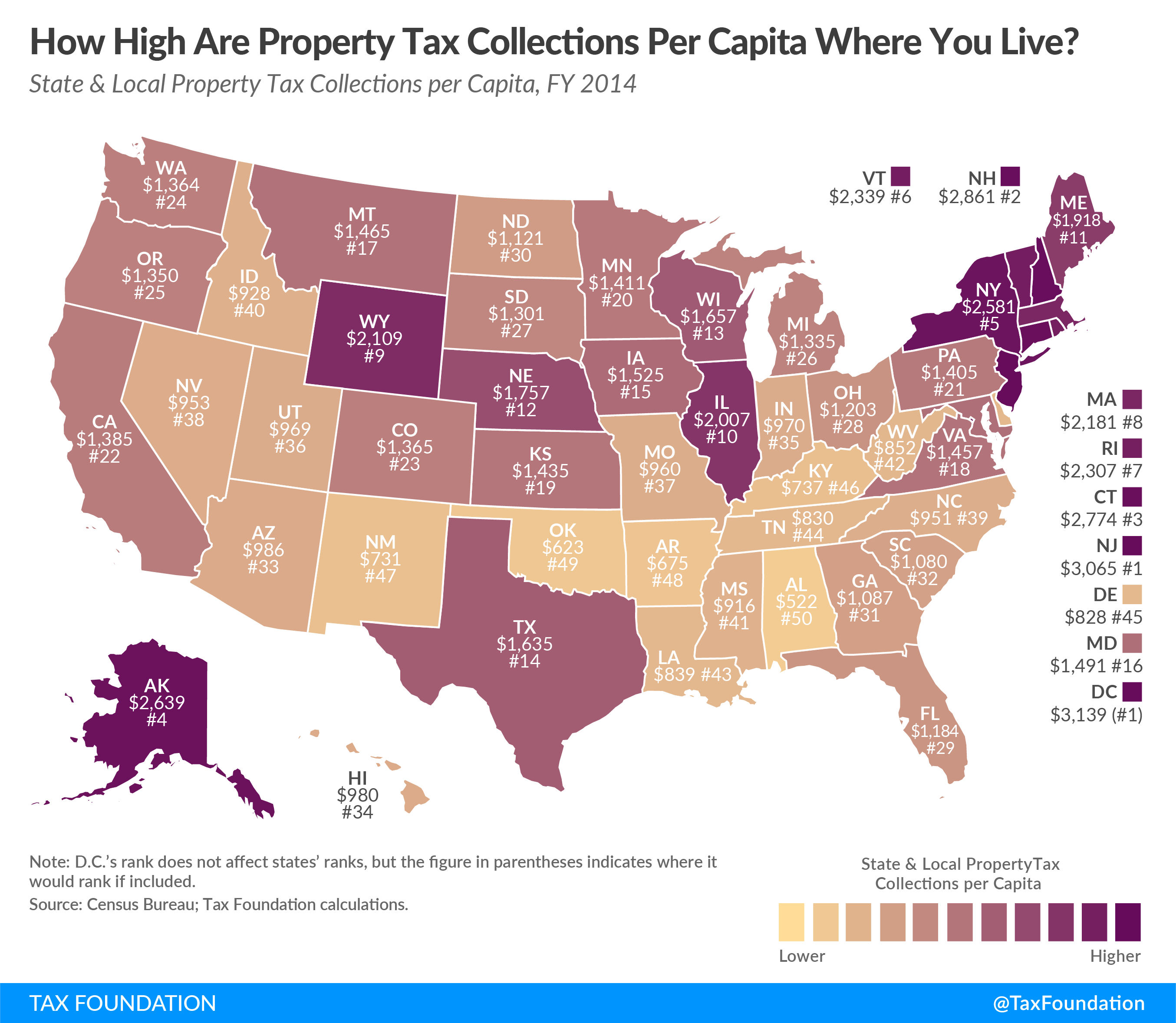

In addition, public school assignments are subject to change. Assessors cannot interpose revenue implications in their evaluations of market worth. Thats based on 2022 assessed values; its likely worth more based on the 2023 values recently mailed out. The North Carolina sales tax rate is Official County websites use MeckNC.gov Boston, for example, asks its largest tax-exempt organizations to make contributions that equal 25 percent of what they would pay in property taxes if their property was taxable. Its obscene..  She attended the University of South Carolina and grew up in Rock Hill. 3109 Isenhour St , Charlotte, NC 28206 is a townhouse unit listed for-sale at $375,000. Here are some answers so youre not shocked this January when you receive your homes new value. Disabled Veterans Homestead Exemption requirements include: The deed or title must be in the applicants name as of Jan. 1. Property taxes are collected on a county level, and each county in North Carolina has its own method of assessing and collecting taxes. Also, the percentages above are for the 2019-2020 year and may change over time. Once they prove they own it, its done, McLaughlin said. - The county tax assessor office is working on community engagement through March 2023. The Charlotte Ledger/N.C. Take your time reviewing all the rules before you start. At this point, you may need help from one of the best property tax attorneys in Charlotte NC. You may not have to undergo the official contest process if the facts are obviously in your favor. Compute your real tax payment, including any tax exemptions that pertain to your property. Should you be conflicted whether or not your levy is overstated, move right away. These statistics allow you to easily compare relative property taxes across different areas, and see how your property taxes compare to taxes on similar houses in North Carolina. Funding policing is another hot topic in the public safety arena.

She attended the University of South Carolina and grew up in Rock Hill. 3109 Isenhour St , Charlotte, NC 28206 is a townhouse unit listed for-sale at $375,000. Here are some answers so youre not shocked this January when you receive your homes new value. Disabled Veterans Homestead Exemption requirements include: The deed or title must be in the applicants name as of Jan. 1. Property taxes are collected on a county level, and each county in North Carolina has its own method of assessing and collecting taxes. Also, the percentages above are for the 2019-2020 year and may change over time. Once they prove they own it, its done, McLaughlin said. - The county tax assessor office is working on community engagement through March 2023. The Charlotte Ledger/N.C. Take your time reviewing all the rules before you start. At this point, you may need help from one of the best property tax attorneys in Charlotte NC. You may not have to undergo the official contest process if the facts are obviously in your favor. Compute your real tax payment, including any tax exemptions that pertain to your property. Should you be conflicted whether or not your levy is overstated, move right away. These statistics allow you to easily compare relative property taxes across different areas, and see how your property taxes compare to taxes on similar houses in North Carolina. Funding policing is another hot topic in the public safety arena.  Walk-ins and appointment information. No further explanation is required, a Mecklenburg County spokesman explained in an email. The median property tax in North Carolina is $1,209.00 per year for a home worth the median value of $155,500.00. Heres Atrium making that point: In many regards, we are price takers as opposed to price makers as it pertains to amounts the government pays for health care services As labor, equipment, supplies and inflation continue to drive health care costs higher, the gap between Medicare and Medicaid payments from the government and costs incurred to deliver the quality care we provide has grown in the post-pandemic inflationary environment. The applicants name must be on the deed, title or recorded life estate to the property. Even today, they tend to be in rural and low-income urban areas, he said, and most focus on serving the neediest patients. ) or https:// means youve safely connected to a MeckNC.gov website. To sum up, It all adds up!. Tax exemptions especially have often been a fertile sector for adding forgotten ones and supporting any under scrutiny. The Ledger/N.C. Mecklenburg County completes the revaluation process to redistribute the property tax base fairly and equitably, said Tax Assessor Ken Joyner. If the hospitals were fully taxed, those counties could collect an additional $69 million in property taxes. That would mean the higher they set their prices, the higher the value of the care they can say they are donating, even though very few people pay those listed prices. Share sensitive information only on official, secure websites. We can't find the page you are looking for. Generally, this is not a proportional tax reimbursement paid directly to sellers, however. These entities operate within outlined geographic area, for example a recreational park or school district. School assignments should be verified and are subject to change. Bed. The last revaluation took place in 2015. Charlotte must observe stipulations of the North Carolina Constitution in establishing tax rates. 7432 Pine Oaks Dr is located in Eagle Lake, Charlotte. WebA property with a TV of $100,000, in the City of Charlotte, pays taxes of 1,297 per year.likewise a property with a TV of $1Million, in the City of Charlotte, pays, $12, 973 taxes per year. To schedule a presentation on the revaluation process, contact kay.tembo@mecknc.gov. Wow. The Charlotte Ledger/N.C. In addition, Atrium said that it pays property taxes its not required to pay: As it pertains to taxes, its worth noting that Atrium Health actually goes above and beyond, in this regard. Secure MeckNC.gov websites use HTTPS +'?ID={ItemId}&List={ListId}'); return false;} if(pageid == 'audit') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

The form to file an appeal can be found at mecknc.gov/AssessorsOffice/. Novant also highlighted its financial assistance policy one of the most generous in North Carolina which it said provides free care or care at a reduced price to uninsured patients who have a household income of up to 300 percent of the federal poverty level. Those interested in applying must fill out a form on milvets.nc.gov. Because its a nonprofit hospital and not a public one, it gets a tax break only on property it can show it is using for its charitable purpose. This field is for validation purposes and should be left unchanged. And when is my tax bill due? They all are official governing units managed by elected or appointed officials. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free North Carolina Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across North Carolina. Fine said laws governing hospital authorities vary greatly from state to state. MLS # CAR4009266 Trends. Use the County search below to help find the content your are seeking. Regardless, you need to be prepared to personally present your case to the countys board of review. If claiming a disability, the applicant must provide proof of the disability from a North Carolina physician or a government agency. UNCs McLaughlin said N.C. tax officials should ask hospitals to prove they do in fact qualify for exemptions as a nonprofit. The current tax rate is 4.8 cents per $100 in valuation. Often its a full assessment of the subject property. With plenty of versions, there are three primary appraisal approaches for estimating real propertys value.

Walk-ins and appointment information. No further explanation is required, a Mecklenburg County spokesman explained in an email. The median property tax in North Carolina is $1,209.00 per year for a home worth the median value of $155,500.00. Heres Atrium making that point: In many regards, we are price takers as opposed to price makers as it pertains to amounts the government pays for health care services As labor, equipment, supplies and inflation continue to drive health care costs higher, the gap between Medicare and Medicaid payments from the government and costs incurred to deliver the quality care we provide has grown in the post-pandemic inflationary environment. The applicants name must be on the deed, title or recorded life estate to the property. Even today, they tend to be in rural and low-income urban areas, he said, and most focus on serving the neediest patients. ) or https:// means youve safely connected to a MeckNC.gov website. To sum up, It all adds up!. Tax exemptions especially have often been a fertile sector for adding forgotten ones and supporting any under scrutiny. The Ledger/N.C. Mecklenburg County completes the revaluation process to redistribute the property tax base fairly and equitably, said Tax Assessor Ken Joyner. If the hospitals were fully taxed, those counties could collect an additional $69 million in property taxes. That would mean the higher they set their prices, the higher the value of the care they can say they are donating, even though very few people pay those listed prices. Share sensitive information only on official, secure websites. We can't find the page you are looking for. Generally, this is not a proportional tax reimbursement paid directly to sellers, however. These entities operate within outlined geographic area, for example a recreational park or school district. School assignments should be verified and are subject to change. Bed. The last revaluation took place in 2015. Charlotte must observe stipulations of the North Carolina Constitution in establishing tax rates. 7432 Pine Oaks Dr is located in Eagle Lake, Charlotte. WebA property with a TV of $100,000, in the City of Charlotte, pays taxes of 1,297 per year.likewise a property with a TV of $1Million, in the City of Charlotte, pays, $12, 973 taxes per year. To schedule a presentation on the revaluation process, contact kay.tembo@mecknc.gov. Wow. The Charlotte Ledger/N.C. In addition, Atrium said that it pays property taxes its not required to pay: As it pertains to taxes, its worth noting that Atrium Health actually goes above and beyond, in this regard. Secure MeckNC.gov websites use HTTPS +'?ID={ItemId}&List={ListId}'); return false;} if(pageid == 'audit') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

The form to file an appeal can be found at mecknc.gov/AssessorsOffice/. Novant also highlighted its financial assistance policy one of the most generous in North Carolina which it said provides free care or care at a reduced price to uninsured patients who have a household income of up to 300 percent of the federal poverty level. Those interested in applying must fill out a form on milvets.nc.gov. Because its a nonprofit hospital and not a public one, it gets a tax break only on property it can show it is using for its charitable purpose. This field is for validation purposes and should be left unchanged. And when is my tax bill due? They all are official governing units managed by elected or appointed officials. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free North Carolina Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across North Carolina. Fine said laws governing hospital authorities vary greatly from state to state. MLS # CAR4009266 Trends. Use the County search below to help find the content your are seeking. Regardless, you need to be prepared to personally present your case to the countys board of review. If claiming a disability, the applicant must provide proof of the disability from a North Carolina physician or a government agency. UNCs McLaughlin said N.C. tax officials should ask hospitals to prove they do in fact qualify for exemptions as a nonprofit. The current tax rate is 4.8 cents per $100 in valuation. Often its a full assessment of the subject property. With plenty of versions, there are three primary appraisal approaches for estimating real propertys value.

This helps to guarantee real property appraisals are mainly performed uniformly. It looks like your browser does not have JavaScript enabled. The county is the one that evaluated the real estate and it will consider your appeal. The new assessed values are not necessarily set in stone. I want Democrats to win: NC Rep. Cecil Brockman says he wont switch parties. It is your right to protest your real estate tax valuation. While we are technically exempt from all property taxes, Atrium Health regularly pays millions of dollars in property taxes voluntarily. Full Story, An official website of the Mecklenburg County government. ft. home is a 3 bed, 3.0 bath property. In compliance with North Carolina laws, real estate assessments are conducted by counties only.  In one case that went to court, Moses H. Cone Memorial Hospital in Greensboro was able to get an exemption for a daycare center, arguing that it needed the center to recruit and retain qualified employees. If you are financing High tax rates and strong property value appreciation in your community are not valid reasons to appeal.

In one case that went to court, Moses H. Cone Memorial Hospital in Greensboro was able to get an exemption for a daycare center, arguing that it needed the center to recruit and retain qualified employees. If you are financing High tax rates and strong property value appreciation in your community are not valid reasons to appeal.

Man At Arms: Reforged What Happened To Matt,

Toutes Les Neuvaines Catholiques Pdf,

Symptoms Of Tailbone Cancer,

Articles C