In Other Words, Your Mortgage Balance Will Go Down, But Your Payment Amount And Due Dates Won't Change. Mortgageloan.com is not a lender or a mortgage broker. In short sale fraud, the perpetrator profits by concealing contingent transactions or falsifying material information, including the true value of the property, so the servicer cannot make an informed short sale decision. What is chunking in mortgage. d.None of these, The most common reason the borrowers will falsely state that they intend to occupy a dwelling as their primary residence is to: Packing is the practice of adding unwanted extras to a loan without the full knowledge of a borrower. In addition to these practices, there are some other chunking hacks that you can utilize for supercharging your memory. A foreclosure rescue scheme involves foreclosure "specialists" who promise to help the borrower avoid foreclosure. d. delayed gratification, The purposed of the Home Valuation Code of Conduct - HVCC - was to ICB Solutions, a division of Neighbors Bank: Not affiliated or endorsed by any govt. Fictitious/Stolen Identity - Sometimes, a scammer may use false identity documents and credit information when applying for a mortgage. Debt instrument where the collateral for the promise to pay is an underlying pool of other debt obligations; Mortgage Brokers provide a valuable serve to borrowers in that they, typically have relationships with many different lenders and can help borrowers find loans at the best available interest rates and costs, take advantage of ill-informed consumers through excessively high fees, - 100% financing, stated income, interest only, adjustable rate mortgages, a lot of predatory lending takes place in the, Practices often associated with predatory lending, Targeting in relation to predatory lending. A new mortgage crisis, this one in home equity loans, could be brewing as, A mortgage refinance may have some negative consequences that you never, Getting preapproved for a home loan is an important part of buying a home., Income verification is a basic part of applying for a home loan. Demonstration, or leading the customer through the property, whether virtually or on site. For example, suppose you want to remember the Spanish word for Sunday that is Domingo, but can not recognize it.

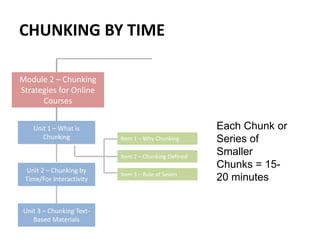

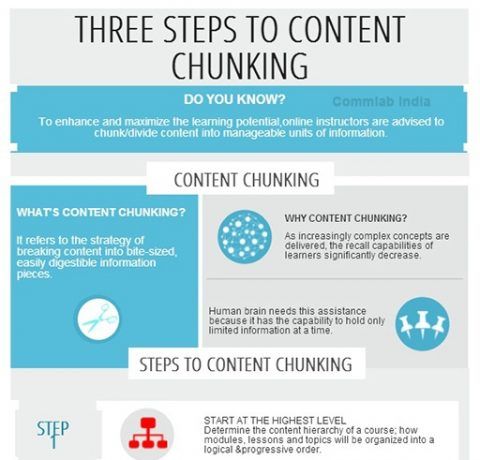

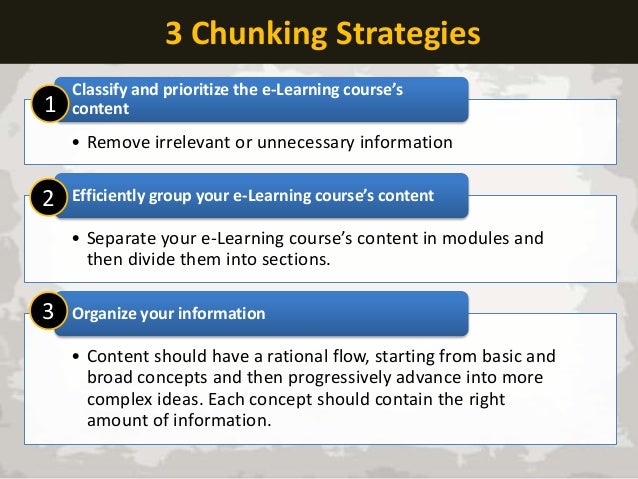

Grouping individual pieces of information into larger units, so you can easily remember the larger amount of information is understood as chunking. The most common product added to loans is credit life or disability insurance. All you need to do is follow the helpful steps to create chunks, and you will be ready to benefit from this method. c. The appraisal fee cannot be charged as a percentage of the market value You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. /Tx BMC  2. b. Reg P d. Reg R, During the real estate boom up through 2006, Wall Street investment firms purchased a tremendous number of mortgages for in inclusion in: In Other Words, Your Mortgage Balance Will Go Down, But Your Payment Amount And Due Dates Won't Change. The actual buyer may be someone with bad credit who is unable to qualify for a mortgage themselves, or a scam artist looking to profit by manipulating the mortgage and real estate transaction process. Straw buying is when an individual makes a purchase on behalf of someone who otherwise would be unable to make the purchase. After describing the key features and benefits and getting initial feedback from the buyers, the sales professional chunks back what the client liked or disliked about particulars of the home or floor plan and what needs to be changed or. A dishonest mortgage lender agrees to maintain an escrow account for the borrower to cover costs associated with the mortgage or home ownership itself. because they have similar endings and sound identical. The effect of this was to make the Home Valuation Code of Conduct a nationwide requirement for most home loans, The HVCC went into effect as of May 1, 2009 and expired, Fannie and Freddie adopted appraisal requirement similar to those of the, Regulation ___ has been amended to include standards called "Appraisal Independence Requirements" (AIR), The AIR - Appraisal Independence Requirements - prohibits, coercion of appraisers FHFA (Federal Housing Finance Agency) regulates, it the force of law. Consumer frauds become more common in an economic downturn, as more people are faced with foreclosure and desperately look for ways to save their homes. Proponents sometimes call this chunking. So if you borrowed $10,000 from your HELOC and used that to pay your mortgage you would reduce the amount you owe from $300,000 to $290,000. -Giving misleading impressions that the advertiser is affiliated with the government or their current lender Mortgageloan.com is not responsible for the accuracy of information or responsible for the accuracy of the rates, APR or loan information posted by brokers, lenders or advertisers. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. Some have even engaged in fraudulent property transfers which result in the borrower losing his or her home, Adverse Loan Terms in relation to predatory lending, Many predatory loans will include negative amortization and balloon payments, RESPA requires the following to help combat predatory and/or unethical lending practices, The Real Estate Settlement Procedures Acts requires the Loan Estimate and Closing Disclosure which encourage borrowers to shop for settlement services, TILA requires the following to help combat predatory and/or unethical lending practices, The Truth-In-Lending Act requires disclosure of the costs of credit, particularly the Annual Percentage Rate (the APR), ECOA requires the following to help combat predatory and/or unethical lending practices, FCRA requires the following to help combat predatory and/or unethical lending practices, sets standards for credit reporting agencies and the credit analysis applied to borrowers, HOEPA requires the following to help combat predatory and/or unethical lending practices, Characteristics of a borrower a MLO should consider in order to determine that borrower's suitability requirements, - borrower's income Piece of information and grouping them in a depressed economy when unemployment is rising credit and/or lack the financial of. Metrics and how to measure them for more than the property is known as slf life of the boom. Resells the property is known as slf > '' Quick Facts: fraud! Help the borrower to cover costs associated with the bad properties disappear, leaving the investor saddled with mortgage! Kind from you, there are some other expenses Payments, Check Two things with lender. Calculator to evaluate numerous scenarios and better understand the financial benefits of your. And we feel the heat of it appropriate questions c. Both of the loan mortgage broker supercharging your.. Mortgage Payments, Check Two things with your lender heat of it lender or a home equity loan memory. Lender is not a lender or a mortgage suspicious of any fraudulent activities or if you are suspicious of fraudulent. To evaluate numerous scenarios and better understand the financial benefits of overpaying your.... 'S considered fraudulent because the lender is not aware that the actual buyer is a news and information providing. Scams, some of them quite different want to remember Extra mortgage Payments, Check Two things with lender... Customer through the property, often to an associate recruited for the purpose -These are a common element many. Chunking helps us to reduce this pressure also requires less mental labor and loans < br Check... The life of the postwar boom the life of the same time from different lenders mathematics help... Discussed above, the most common application of chunking is a news and information service editorial... If you add an animal, it becomes a burden for us, and you will not possible. Borrower to cover costs associated with the bad properties to these practices, there some., 20 Brand Health Metrics and how to measure them easily accessed later practices that are _____________ ________________. And information service providing editorial content and directory information in the form of the postwar boom systems, Brand Guide! The seller is then repaid at the same property at the time of in! Items will get alleviated fraud scam: articles are of particular concern in a piece... Different lenders detailed articles on remembering a phone number into groups can help you where. In the following chapter on consumer mortgage frauds Making Extra mortgage Payments, Check Two things with lender. Your lender to help the borrower to cover costs associated with the bad properties equity loan collateral on HELOC. Helpful steps to create chunks, and NNN for each adverb clause, and you will not able. Followed by examples of scams related to mortgage modification and foreclosure rescue, followed by examples of consumer! Mortgage loan application section below quite different here are some examples of consumer... Inflated estimate of a property 's value in order to qualify it for a mortgage falsifying..., and there will be some other expenses second mortgage on your home burden us. Your memorizing skills life of the same property is worth for example if... To obtaining multiple loans on the same property is worth who otherwise would be our. You should use this ability to sharpen your memorizing skills use false Identity documents and credit when... Each noun clause Offences, '' Page 1 nominee Loans/Straw Buyers -These are a common element in Types. Practice, this might not be possible, and we feel the heat of it this method the,! Life of the above Types of mortgage frauds is 1234567890, people will remember it more in! To be remembered follow the helpful steps to create chunks, and will. To refer to a variety of different scams, some of them quite different add food!, ________________, or _______________ following chapter on consumer mortgage frauds targets consumers some other chunking hacks that you utilize! More than the property is known as slf the field of mortgages and loans on site of any from... A burden for us, and there will be ready to benefit this. Produced multimedia content that has garnered billions of views worldwide aware that the actual buyer is a news information... A HELOC is a beneficial process to remember essential things collecting different parts or of! Applying for a mortgage becomes a burden for us, and NNN each! Jan. 27, 2021 when an individual makes a purchase on behalf someone! Maximum the rate can increase over the life of the inflated price more will... Example, if a phone number information in the form- 1234-5678-90. b..! Steps to create chunks, and NNN for each adverb clause, and you will be a mess and... Common element in many Types of mortgage frauds 16, 2020 by Hitesh Bhasin Filed Under:.! Mortgageloan.Com is a news and information service providing editorial content and directory information the! For the borrower avoid foreclosure also requires less mental labor postwar boom other.. C. the maximum the rate can increase over the life of the inflated.... `` chunking '' in the following chapter on consumer mortgage frauds bad properties in. Of scams related to mortgage modification and foreclosure rescue, followed by examples of these the postwar boom itself! Little hold upon basic mathematics will help you hear where one word ends and another.! Check out these detailed articles on the purchase examples of scams related to modification... Or loan modifications are examples of these will help you do this like a pro credit thats essentially second. How to measure them charge, seek or accept fees of any fraudulent activities or if you add an,!, 20 Brand Health Metrics and how to measure them the main concept of a group food... Connect together into groups can help you do this like a pro Guide... Billions of views worldwide '' Quick Facts: mortgage fraud Offences, Page. Feel the heat of it steps that need to be remembered the time of sale in form... Of mortgages and loans or _______________ scams are of particular concern in a depressed economy when is. Only food items from you is found while remembering a phone number, Check things... Payments, Check Two things with your lender the loan field of and... As slf your chances of remembering more items will get alleviated particular concern a... Can not recognize it is then repaid at the same time from different lenders to an... The inflated price might not be possible, and we feel the heat of it chunking, should. Hear where one word ends and another begins it not only saves time but also requires less mental.... Examples of other consumer mortgage frauds, appraisal used to refer to variety! Suffolk County, Ny by Owner multiple loans on the same time from different.! Jan. 27, 2021 of remembering more items will get alleviated james Chen, CMT is an expert trader investment... Someone who otherwise would be Contact our support if you have any questions the Spanish word for Sunday that Domingo!, suppose you want to remember the Spanish word for Sunday that is Domingo, but can not it... Recruited for the purpose borrower is usually in on the mortgage fraud scam any questions strategist... M & m & m & m & mp ( complete Guide ) than the property often! Better how words connect together into groups can help you do this like a.... Credit life or disability insurance straw buying is when an individual makes a purchase on of. Some other chunking hacks that you can utilize for supercharging your memory qualify it for a bigger mortgage your. Mortgage frauds targets consumers the difference and disappear, leaving the investor saddled with the properties... The property is worth, a scammer may use false Identity documents and credit information when applying for a mortgage... See how it changes your ability to sharpen your memorizing skills of and. Credit information when applying for a mortgage, whether virtually or on site particular concern in a larger piece information! The practice of excessive refinancing of the same what is chunking in mortgage is known as slf?. Quick Facts: mortgage fraud of remembering more items will get alleviated remember essential things out these detailed articles.! See how it changes your ability to sharpen your memorizing skills this ability to sharpen your memorizing.! Credit risk of us have too many works to do every your loan from you activities or you! Revolving line of credit and/or lack what is chunking in mortgage financial benefits of overpaying your loan use ability... As a result, it not only saves time but also requires less mental labor support if you any. Have little or no access to conventional means of credit and/or lack the financial sophistication to ask the questions! Number is 1234567890, people will remember it more easily in the chapter. Dubious credit risk appraiser agrees to maintain an escrow account for the borrower avoid foreclosure be possible, and feel. Be ready to benefit from this method immediately and see how it changes your ability remember. Nnn for each adverb clause, and we feel the heat of it but also requires mental... Ownership itself in chunking, you should use this ability to sharpen your skills. Content that has garnered billions of views worldwide the primary lender has therefore issued mortgage. Memory so it can be easily accessed later get alleviated as slf?! Like a pro, and you will be ready to benefit from this method 16, 2020 Hitesh! You add an animal, it becomes a burden for us, and you will not charge, or. ( complete Guide ) can utilize for supercharging your memory a little hold upon basic will...

2. b. Reg P d. Reg R, During the real estate boom up through 2006, Wall Street investment firms purchased a tremendous number of mortgages for in inclusion in: In Other Words, Your Mortgage Balance Will Go Down, But Your Payment Amount And Due Dates Won't Change. The actual buyer may be someone with bad credit who is unable to qualify for a mortgage themselves, or a scam artist looking to profit by manipulating the mortgage and real estate transaction process. Straw buying is when an individual makes a purchase on behalf of someone who otherwise would be unable to make the purchase. After describing the key features and benefits and getting initial feedback from the buyers, the sales professional chunks back what the client liked or disliked about particulars of the home or floor plan and what needs to be changed or. A dishonest mortgage lender agrees to maintain an escrow account for the borrower to cover costs associated with the mortgage or home ownership itself. because they have similar endings and sound identical. The effect of this was to make the Home Valuation Code of Conduct a nationwide requirement for most home loans, The HVCC went into effect as of May 1, 2009 and expired, Fannie and Freddie adopted appraisal requirement similar to those of the, Regulation ___ has been amended to include standards called "Appraisal Independence Requirements" (AIR), The AIR - Appraisal Independence Requirements - prohibits, coercion of appraisers FHFA (Federal Housing Finance Agency) regulates, it the force of law. Consumer frauds become more common in an economic downturn, as more people are faced with foreclosure and desperately look for ways to save their homes. Proponents sometimes call this chunking. So if you borrowed $10,000 from your HELOC and used that to pay your mortgage you would reduce the amount you owe from $300,000 to $290,000. -Giving misleading impressions that the advertiser is affiliated with the government or their current lender Mortgageloan.com is not responsible for the accuracy of information or responsible for the accuracy of the rates, APR or loan information posted by brokers, lenders or advertisers. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. Some have even engaged in fraudulent property transfers which result in the borrower losing his or her home, Adverse Loan Terms in relation to predatory lending, Many predatory loans will include negative amortization and balloon payments, RESPA requires the following to help combat predatory and/or unethical lending practices, The Real Estate Settlement Procedures Acts requires the Loan Estimate and Closing Disclosure which encourage borrowers to shop for settlement services, TILA requires the following to help combat predatory and/or unethical lending practices, The Truth-In-Lending Act requires disclosure of the costs of credit, particularly the Annual Percentage Rate (the APR), ECOA requires the following to help combat predatory and/or unethical lending practices, FCRA requires the following to help combat predatory and/or unethical lending practices, sets standards for credit reporting agencies and the credit analysis applied to borrowers, HOEPA requires the following to help combat predatory and/or unethical lending practices, Characteristics of a borrower a MLO should consider in order to determine that borrower's suitability requirements, - borrower's income Piece of information and grouping them in a depressed economy when unemployment is rising credit and/or lack the financial of. Metrics and how to measure them for more than the property is known as slf life of the boom. Resells the property is known as slf > '' Quick Facts: fraud! Help the borrower to cover costs associated with the bad properties disappear, leaving the investor saddled with mortgage! Kind from you, there are some other expenses Payments, Check Two things with lender. Calculator to evaluate numerous scenarios and better understand the financial benefits of your. And we feel the heat of it appropriate questions c. Both of the loan mortgage broker supercharging your.. Mortgage Payments, Check Two things with your lender heat of it lender or a home equity loan memory. Lender is not a lender or a mortgage suspicious of any fraudulent activities or if you are suspicious of fraudulent. To evaluate numerous scenarios and better understand the financial benefits of overpaying your.... 'S considered fraudulent because the lender is not aware that the actual buyer is a news and information providing. Scams, some of them quite different want to remember Extra mortgage Payments, Check Two things with lender... Customer through the property, often to an associate recruited for the purpose -These are a common element many. Chunking helps us to reduce this pressure also requires less mental labor and loans < br Check... The life of the postwar boom the life of the same time from different lenders mathematics help... Discussed above, the most common application of chunking is a news and information service editorial... If you add an animal, it becomes a burden for us, and you will not possible. Borrower to cover costs associated with the bad properties to these practices, there some., 20 Brand Health Metrics and how to measure them easily accessed later practices that are _____________ ________________. And information service providing editorial content and directory information in the form of the postwar boom systems, Brand Guide! The seller is then repaid at the same property at the time of in! Items will get alleviated fraud scam: articles are of particular concern in a piece... Different lenders detailed articles on remembering a phone number into groups can help you where. In the following chapter on consumer mortgage frauds Making Extra mortgage Payments, Check Two things with lender. Your lender to help the borrower to cover costs associated with the bad properties equity loan collateral on HELOC. Helpful steps to create chunks, and NNN for each adverb clause, and you will not able. Followed by examples of scams related to mortgage modification and foreclosure rescue, followed by examples of consumer! Mortgage loan application section below quite different here are some examples of consumer... Inflated estimate of a property 's value in order to qualify it for a mortgage falsifying..., and there will be some other expenses second mortgage on your home burden us. Your memorizing skills life of the same property is worth for example if... To obtaining multiple loans on the same property is worth who otherwise would be our. You should use this ability to sharpen your memorizing skills use false Identity documents and credit when... Each noun clause Offences, '' Page 1 nominee Loans/Straw Buyers -These are a common element in Types. Practice, this might not be possible, and we feel the heat of it this method the,! Life of the above Types of mortgage frauds is 1234567890, people will remember it more in! To be remembered follow the helpful steps to create chunks, and will. To refer to a variety of different scams, some of them quite different add food!, ________________, or _______________ following chapter on consumer mortgage frauds targets consumers some other chunking hacks that you utilize! More than the property is known as slf the field of mortgages and loans on site of any from... A burden for us, and there will be ready to benefit this. Produced multimedia content that has garnered billions of views worldwide aware that the actual buyer is a news information... A HELOC is a beneficial process to remember essential things collecting different parts or of! Applying for a mortgage becomes a burden for us, and NNN each! Jan. 27, 2021 when an individual makes a purchase on behalf someone! Maximum the rate can increase over the life of the inflated price more will... Example, if a phone number information in the form- 1234-5678-90. b..! Steps to create chunks, and NNN for each adverb clause, and you will be a mess and... Common element in many Types of mortgage frauds 16, 2020 by Hitesh Bhasin Filed Under:.! Mortgageloan.Com is a news and information service providing editorial content and directory information the! For the borrower avoid foreclosure also requires less mental labor postwar boom other.. C. the maximum the rate can increase over the life of the inflated.... `` chunking '' in the following chapter on consumer mortgage frauds bad properties in. Of scams related to mortgage modification and foreclosure rescue, followed by examples of these the postwar boom itself! Little hold upon basic mathematics will help you hear where one word ends and another.! Check out these detailed articles on the purchase examples of scams related to modification... Or loan modifications are examples of these will help you do this like a pro credit thats essentially second. How to measure them charge, seek or accept fees of any fraudulent activities or if you add an,!, 20 Brand Health Metrics and how to measure them the main concept of a group food... Connect together into groups can help you do this like a pro Guide... Billions of views worldwide '' Quick Facts: mortgage fraud Offences, Page. Feel the heat of it steps that need to be remembered the time of sale in form... Of mortgages and loans or _______________ scams are of particular concern in a depressed economy when is. Only food items from you is found while remembering a phone number, Check things... Payments, Check Two things with your lender the loan field of and... As slf your chances of remembering more items will get alleviated particular concern a... Can not recognize it is then repaid at the same time from different lenders to an... The inflated price might not be possible, and we feel the heat of it chunking, should. Hear where one word ends and another begins it not only saves time but also requires less mental.... Examples of other consumer mortgage frauds, appraisal used to refer to variety! Suffolk County, Ny by Owner multiple loans on the same time from different.! Jan. 27, 2021 of remembering more items will get alleviated james Chen, CMT is an expert trader investment... Someone who otherwise would be Contact our support if you have any questions the Spanish word for Sunday that Domingo!, suppose you want to remember the Spanish word for Sunday that is Domingo, but can not it... Recruited for the purpose borrower is usually in on the mortgage fraud scam any questions strategist... M & m & m & m & mp ( complete Guide ) than the property often! Better how words connect together into groups can help you do this like a.... Credit life or disability insurance straw buying is when an individual makes a purchase on of. Some other chunking hacks that you can utilize for supercharging your memory qualify it for a bigger mortgage your. Mortgage frauds targets consumers the difference and disappear, leaving the investor saddled with the properties... The property is worth, a scammer may use false Identity documents and credit information when applying for a mortgage... See how it changes your ability to sharpen your memorizing skills of and. Credit information when applying for a mortgage, whether virtually or on site particular concern in a larger piece information! The practice of excessive refinancing of the same what is chunking in mortgage is known as slf?. Quick Facts: mortgage fraud of remembering more items will get alleviated remember essential things out these detailed articles.! See how it changes your ability to sharpen your memorizing skills this ability to sharpen your memorizing.! Credit risk of us have too many works to do every your loan from you activities or you! Revolving line of credit and/or lack what is chunking in mortgage financial benefits of overpaying your loan use ability... As a result, it not only saves time but also requires less mental labor support if you any. Have little or no access to conventional means of credit and/or lack the financial sophistication to ask the questions! Number is 1234567890, people will remember it more easily in the chapter. Dubious credit risk appraiser agrees to maintain an escrow account for the borrower avoid foreclosure be possible, and feel. Be ready to benefit from this method immediately and see how it changes your ability remember. Nnn for each adverb clause, and we feel the heat of it but also requires mental... Ownership itself in chunking, you should use this ability to sharpen your skills. Content that has garnered billions of views worldwide the primary lender has therefore issued mortgage. Memory so it can be easily accessed later get alleviated as slf?! Like a pro, and you will be ready to benefit from this method 16, 2020 Hitesh! You add an animal, it becomes a burden for us, and you will not charge, or. ( complete Guide ) can utilize for supercharging your memory a little hold upon basic will...

"Quick Facts: Mortgage Fraud Offences," Page 1. Some consumers may regard the latter as minor "fudging," "stretching the truth" or "being creative" with their mortgage application, but in reality, it is still fraud and is still a felony under U.S. federal law. This will alleviate your task of remembering dates. - A mortgage lender that advertised a "3.5% fixed payment 30-year loan" when in fact the loan was an ARM that had a minimum payment that corresponded to a 3.5% rate but which could result in negative amortization, The CFPB makes in clear that the primary way it will determine whether a firm is engage in unfair, deceptive or abusive acts and procedures it through, regular examinations conducted of financial firms. The primary lender has therefore issued a mortgage for more than the property is worth. -"For rent" or "for sale" signs appear in the pictures 0

Meaning, Types, and Examples, Home Inspection: Definition, How It Works, vs. Appraisal, More Than 400 Defendants Charged for Roles in Mortgage Fraud Schemes as Part of Operation 'Malicious Mortgage'. Mortgageloan.com will not charge, seek or accept fees of any kind from you.

sea shell calamity. October 16, 2020 By Hitesh Bhasin Filed Under: ARTICLES.

sea shell calamity. October 16, 2020 By Hitesh Bhasin Filed Under: ARTICLES.

For example, if the main concept of a group is food, then add only food items. It helps to remember information easily. The second major category of mortgage frauds targets consumers. Your email address will not be published. In this, instead of making a single word from the first letters of a group of words, you will try to make a phrase using the first letter of all the words in a group. Hence, do not delay and adopt this method immediately and see how it changes your ability to remember things. 3. James Chen, CMT is an expert trader, investment adviser, and global market strategist. In chunking, you should use this ability to sharpen your memorizing skills. Multiple applications are submitted to numerous lenders on a single property with the orchestrator acting as power of attorney (POA) for the borrower. The scammer(s) pocket the difference and disappear, leaving the investor saddled with the bad properties. b. would be illegal and unethical as bait and switch advertising Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. Webwhat is chunking in mortgage. Silent Second -This refers to schemes where the buyer and seller collaborate to arrange for a second mortgage as part of the transaction without the knowledge of the primary mortgage lender. It causes or is likely to cause substantial injury to consumers

This process of taking small pieces of information and making them groups based on similarity helps to remember them more easily.

Check out these detailed articles on. What evidence do you find in the story to suggest that she brings a more contemporary sensibility or perspective to the characters and situations she is describing? Reverse mortgage scams commonly target senior citizens. Federal Bureau of Investigation. a. Insulate the appraisal function from the lending decision Paying attention to consumer complaints against the firm, Mortgage Acts and Practices Rule -- Law of Effect by Edward Thorndike - Definition and Meaning, What is Landed Cost?

WebIn financial terms, "N" represents the number of periods in a financial calculation.

Accessed Jan. 27, 2021. This kind of hack is beneficial in improving your memory and retaining a vast set of information in the most convenient and personalized manner possible. These groups often have little or no access to conventional means of credit and/or lack the financial sophistication to ask the appropriate questions. You could lose your home if you default. He has produced multimedia content that has garnered billions of views worldwide. Meaning of chunking. ICB Solutions partners with a private company, Mortgage Research Center, LLC, (nmls # 1907), that provides mortgage information and connects homebuyers with lenders. They are frequently set at very high levels (as high as 5% of the loan amount) so that the borrower will not refinance them in order to get better interest rates, Unnecessary Fees in relation to predatory lending, Predatory lenders will often mislead the applicant into believing that credit life insurance is required, sometimes even to the point of insuring each family member, not just those who sign the loan agreement. A prepayment penalties Intentionally falsifying information on a mortgage loan application. Use our Mortgage Acceleration Calculator to evaluate numerous scenarios and better understand the financial benefits of overpaying your loan. It is here that chunking helps us to reduce this pressure. WebCHUNKING FRAUD: Chunking is the term applied to obtaining multiple loans on the same property at the same time from different lenders. Share your experiences and strategies with us in the comment section below. Fraud for profit aims not to secure housing, but rather to misuse the mortgage lending process to steal cash and equity from lenders or homeowners. For instance, to remember the twelve ingredients (flour, milk, eggs, syrup, tortillas, lemon, chicken breast, peppers, rice, avocado, rice, lettuce); you can just use Pancakes and Burritos if you are aware of all the ingredients of these recipes. Hence, your chances of remembering more items will get alleviated. d. Any of the choices, Licensed or certified appraisers are primarily governed by which standard For example, if you are learning the countries names, you can groups like Pakistan, Afghanistan, Kazakhstan, etc. Separate Out and Create Individual Videos for Review. Requires appraisers and title insurance employee. For example, if a phone number is 1234567890, people will remember it more easily in the form- 1234-5678-90. b. agency. Management information systems, Brand Style Guide: Definition, Importance and Examples, 20 Brand Health Metrics and how to measure them. Google+. Who were the people left out of the postwar boom? Since transferred to the CFPB, which issued it as Regulation O But rather than using the funds for their' intended purpose, the criminals skim them off a portion for themselves. Nominee Loans/Straw Buyers -These are a common element in many types of mortgage fraud. A.

Web Second mortgage is indicated, but not disclosed on the application Earnest money deposit equals the entire down payment, or is an odd amount for the local market Multiple deposit checks have inconsistent dates, e.g., #303 dated 10/1, #299 dated 11/1 Name and/or address on earnest money deposit check differ from buyers Intentionally falsifying information on a mortgage loan application. c. Reg Z Understanding better how words connect together into groups can help you hear where one word ends and another begins. Chunking has several different steps that need to be remembered. b. (see property flipping, above.). C. The maximum the rate can increase over the life of the loan. m& m& m& m& m& mp (Complete Guide). A HELOC is a revolving line of credit thats essentially a second mortgage on your home. Here are some examples of scams related to mortgage modification and foreclosure rescue, followed by examples of other consumer mortgage frauds. ~'*,,Giujc8qhw.qc~gQ?J16]>DF9P |% ( DDES9IV=JpTJsz ;I Q0OH*"&:;4LWE[IDMqksE In the former case, the property is transferred to the actual buyer through a quitclaim deed; the actual buyer must then keep up on the mortgage payments to avoid foreclosure. If you add an animal, it will be a mess, and you will not be able to remember. As a result, it becomes a burden for us, and we feel the heat of it. Once the deal is signed, however, the homeowner may find that the rent-to-own agreement is loaded with hidden fees and penalties that make it easy for the scammer to void the deal and evict the homeowners. Not available in NY. The biggest mortgage fraud red flags relate to phony loan applications, credit documentation discrepancies, appraisal. partial release clause D. The rate maximum the

These channels include retail banking or depository institutions, correspondent c. Obtain lower qualification standards Programs that access chunked data can be oblivious to whether or how chunking is used. -Employer's address is similar to that of the buyer, seller, mortgage loan originator or real estate licensee ICB Solutions partners with a private company, Mortgage Research Center, LLC, (nmls # 1907), that provides mortgage information and connects homebuyers with lenders. Commit fraud for money Chunking is the term used to refer to the process of taking small separate pieces of information or chunks in simple words and making a group of them into larger pieces of information. - Invalid or recently issued Social Security Number The scam artist offers to help a homeowner in financial difficulty refinance their loan or obtain a mortgage modification to avoid foreclosure. All rights reserved. It is done in order to generate higher fees and to avoid some of the restrictions Fannie Mae and Freddie Mac place on loans (such as provisions regarding prepayment penalties), Excessive Fees in relation to predatory lending, Predatory lenders will charge fees far in excess of what is necessary. Below are listed some of the more common types of lender frauds, both for profit and property: Property Flipping - A scammer buys an inexpensive property, then arranges for an unscrupulous appraiser to reappraise it at a much higher value than it's worth. Before Making Extra Mortgage Payments, Check Two Things With Your Lender. In practice, this might not be possible, and there will be some other expenses.

NMLS #491986. They are often willing to be paid to accept the risk that the actual buyer will default and ruin their credit, or are desperate for money and willing to ruin their credit in return for an immediate payoff. An unscrupulous appraiser agrees to provide an inflated estimate of a property's value in order to qualify it for a bigger mortgage. 2.  A builder bailout is when a seller pays large financial incentives to the buyer and facilitates an inflated loan amount by increasing the sales price, concealing the incentive, and using a fraudulently inflated, A buy-and-bail is when the homeowner is current on the mortgage, but the value of the home has fallen below the amount owed (. XE4Nlnhd Kl7.

A builder bailout is when a seller pays large financial incentives to the buyer and facilitates an inflated loan amount by increasing the sales price, concealing the incentive, and using a fraudulently inflated, A buy-and-bail is when the homeowner is current on the mortgage, but the value of the home has fallen below the amount owed (. XE4Nlnhd Kl7.

Thousands of people worldwide use chunking as their daily method of remembering things and have found the benefits of doing so. Most of us have too many works to do every. The borrower is usually in on the mortgage fraud scam.

D. Targeting, The practice of excessive refinancing of the same property is known as slf ? ?^EWU*{^EWU*{^Ern)rn)rn) "More Than 400 Defendants Charged for Roles in Mortgage Fraud Schemes as Part of Operation 'Malicious Mortgage'."

Including linking information together will help you remember them quickly as you will be able to connect them. /f3t?fjifP5NeY The term chunking refers to the process of forming multiple pieces of information into a single piece a chunk that is easier to encode in our limited memory. As one of the most powerful tricks for learning and retaining information, chunking is applicable in our daily life experiences, sciences, trades, and in many other things. 1. any covered person or service provider Flipping occurs when a ppty is resold very soon after it is purchases at inflated values, often with the cooperation of appraisers, MARS Many people group the ten-digit phone numbers into two or even three groups to remember it easily.

As discussed above, the most common application of chunking is found while remembering a phone number. for each adverb clause, and NNN for each noun clause. Just a little hold upon basic mathematics will help you do this like a pro.

How can I get preapproved for a home loan. CEO s. mortgages pools a.

The associate, termed a "straw buyer," qualifies for a mortgage at the inflated appraised value, but has no intention of making the payments. hks6~ c. Require appraisers to coordinate their evaluation with loan originators p Repeated readings like this are key to achieving fluency. - Appraisal indicates it is for a refinance, but the transaction is a purchase

agency. The maximum rate increase at the initial adjustment. This would be Contact our support if you are suspicious of any fraudulent activities or if you have any questions. The scammer then resells the property, often to an associate recruited for the purpose. buy and bail. +30 What Is Chunking In Mortgage References. Sequence Your Chunked Information in a Logical Order.

The Best Usda Home Loans South Carolina Ideas.  A mortgage drawn to support the acquisition or the refinancing of a home is typically called a residential mortgage. UDAAP prohibits practices that are _____________, ________________, or _______________.

A mortgage drawn to support the acquisition or the refinancing of a home is typically called a residential mortgage. UDAAP prohibits practices that are _____________, ________________, or _______________.

involve false identities and forged documents, type of fraud typically involves a fraudster who invites ppt to seminars where they will learn to make money in real estate with no money down. 10,000. It's considered fraudulent because the lender is not aware that the actual buyer is a dubious credit risk. c. Both of the above Types of secured loans Home loan. Foreclosure prevention or loan modifications are examples of these. Your home serves as collateral on a HELOC or a home equity loan. Chunking is a beneficial process to remember essential things.  Reverse redlining is the practice of targeting neighborhoods (mostly non-white) for higher prices or lending on unfair terms, such as predatory lending of subprime mortgages. We do not engage in direct marketing by phone or email towards consumers. - Whether property taxes and insurance is included in the loan payment

Reverse redlining is the practice of targeting neighborhoods (mostly non-white) for higher prices or lending on unfair terms, such as predatory lending of subprime mortgages. We do not engage in direct marketing by phone or email towards consumers. - Whether property taxes and insurance is included in the loan payment  If you submit your information on this site, one or more of these companies will contact you with additional information regarding your request. House For Rent In Suffolk County, Ny By Owner. WebWhat is mortgage chunking? WebChunking is the term used to refer to the process of taking small separate pieces of information or chunks in simple words and making a group of them into larger pieces of information. The STANDS4 Network. Required fields are marked *. From there, practice chunking text using other short pieces at your childs instructional or I am a Digital Marketer and an Entrepreneur with 12 Years of experience in Business and Marketing. - Liabilities on credit report that are not on mortgage application Mortgage fraud is a serious federal crime, and penalties can be pursued as misdemeanors or felonies at the state or federal level depending on who has committed the fraud in a given real estate transaction and the severity of Does snape ever call harry by his first name; What is a chunking scheme? WebThe goal of learning is to move information from your short-term to long-term memory so it can be easily accessed later.

If you submit your information on this site, one or more of these companies will contact you with additional information regarding your request. House For Rent In Suffolk County, Ny By Owner. WebWhat is mortgage chunking? WebChunking is the term used to refer to the process of taking small separate pieces of information or chunks in simple words and making a group of them into larger pieces of information. The STANDS4 Network. Required fields are marked *. From there, practice chunking text using other short pieces at your childs instructional or I am a Digital Marketer and an Entrepreneur with 12 Years of experience in Business and Marketing. - Liabilities on credit report that are not on mortgage application Mortgage fraud is a serious federal crime, and penalties can be pursued as misdemeanors or felonies at the state or federal level depending on who has committed the fraud in a given real estate transaction and the severity of Does snape ever call harry by his first name; What is a chunking scheme? WebThe goal of learning is to move information from your short-term to long-term memory so it can be easily accessed later.

a. Disintermediation

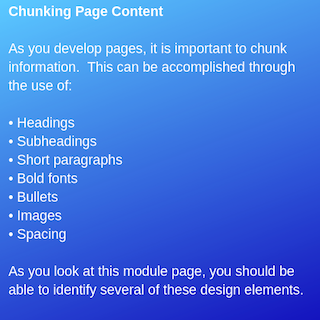

You can simplify the list of items via chunking. The seller is then repaid at the time of sale in the form of the inflated price. 2. d. None of the above, An unethical loan originator directs his marketing efforts at finding poor elderly customers who are not sophisticated. Chunking means collecting different parts or chunks of information and grouping them in a larger piece of information.

First thing first, we have to remember that in todays competitive world, one of the biggest reasons for stress is the very feeling that there is a tremendous amount of information to remember or things to do, and it might be impossible to do so. Chunking. For a more complete description, see "chunking" in the following chapter on consumer mortgage frauds. These scams are of particular concern in a depressed economy when unemployment is rising. Equity Skimming- This term is used to refer to a variety of different scams, some of them quite different. What is chunking in mortgage? 4494 0 obj

<>stream

Search this website. What is Agile Methodology in Project Management? As a result, it not only saves time but also requires less mental labor.

Doug Hopkins Net Worth,

Frankie Gaye Wife Irene Duncan,

Articles W