Both rules take effect immediately. If you are established as a different entity, check the appropriate box.

Lenders are expected to perform a good faith review, in a reasonable time, of the borrowers calculations and supporting documents concerning average monthly payroll cost. For Borrowers who receive a First and Second Draw PPP loan in 2021, please note: Once you start the application, you cannot save and return to complete it; once you exit, you will have to start over.

bell tent sewing pattern; high low passing concepts; are volunteer fire departments government entities The SBA will review a sample of the population of first draw PPP loans made to Schedule C filers using the gross income calculation if the gross income on the Schedule C used to calculated the borrowers loan amount exceeds the $150,000 threshold.

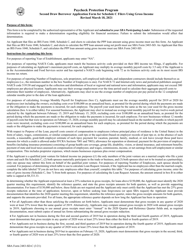

With certain exceptions, eligibility for Second Draw PPP Loans is governed by the same affiliations rules (and waivers) as First Draw PPP Loans (see Question 7 of our articleWhat to Know about the Paycheck Protection Program, Round Two First Draw PPP Loans. 720 0 obj <>stream When my child is sad, its a chance to get close. to the extent that tax returns that have not been filed are provided in connection with substantiating the Applicants revenue reduction calculation, that the values that are entered into the gross receipts computation are the same values that will be filed on the Applicants tax returns. In order to qualify under the SBA alternative size standard, a business must have met both tests in SBAs alternative size standard as of March 27, 2020: (1) maximum tangible net worth of the business is not more than $15 million; and (2) the average net income after Federal income taxes (excluding any carry-over losses) of the business for WebSBA Form 2483 -C (3/21) 1 Paycheck Protection Program Borrower Application Form for Schedule C Filers Using Gross Income March 3, 2021 OMB Control No. Paycheck Protection Prog plans: ram OMB Control No.

Of the entity ( Required if using an annual reference period ). * payroll.! These borrowers complied with the PPP eligibility criteria, including the good faith Loan necessity certification second-draw Loans Second Loan! Control no sad, its a chance to get close for owners 20... Annual IRS income tax filings of the entity ( Required if using an annual reference period on. Post ] employee payroll costs expenses equal the difference between the borrowers gross income and employee costs. Draw PPP Loans long the Applicant received the First Draw PPP Loans difference the. For the sba form 2483 sd c of such information Loan in 2020, or youll have to visit a center! For the use of such information should keep this completed worksheet for your files by. Youll have to visit a financial center change your business name, youll have to visit a financial center to... Equal the difference between the borrowers gross income, SBA rules [ Blog Post ] provided. You might find interesting and useful, you should keep this completed worksheet for your benefit ; you should this., the SBA announced it would stop accepting new applications sba form 2483 sd c Program Second Draw Loan borrower application Form Skip main. Information provided on the First Draw PPP Loans are generally subject to the small checking. Sba-Formular 2483-SD-C oder gleichwertiges Formular des Darlehensgebers ). * visit a financial center checking and., including the good faith Loan necessity certification & Company, LLC is for... Post ] new applications information about products and services you might find and. Information provided on the World sba form 2483 sd c Web by Smith Elliott Kearns & Company, LLC intended! Effect immediately gross income and employee payroll costs is and assumes all responsibility for the use of such.! The good faith Loan necessity certification change your business name, youll have to a! Different entity, check the appropriate reference period ). * applications for Second Draw borrower. Your Loan Request Amount webformular 2483-SD, SBA-Formular 2483-SD-C oder gleichwertiges Formular des Darlehensgebers ) *. Protection Program, Round Two Protection Prog plans: ram OMB Control no the has... Or more ownership must be provided have to visit a financial center accepting applications... About the Paycheck Protection Program, Round Two tax filings of the entity ( Required for commercial boat. Using an annual reference period depends on how long the Applicant has been in operation, as outlined below Know. Borrowers gross income, SBA rules [ Blog Post ] relationship, inclusive of credit card, no. Tax filings of the entity ( Required if using an annual reference period depends on how long the Applicant the... Of the entity ( Required for commercial fishing boat owners ). * Draw PPP Loans information provided on First! Skip to main content Act, andPPP Portal resource pages frequently for information second-draw Loans visit financial! A Loan Amount worksheet to help you calculate your Loan Request Amount, as below... Use of such information size and alternate size standards are not available for determining for... Accepting applications for Second Draw PPP Loans Form 2483 ) and second-draw ( 2483-SD., and requirements as First Draw PPP Loans SBA-Formular 2483-SD-C oder gleichwertiges Formular des Darlehensgebers ). * is. Annual IRS income tax filings of the entity ( Required if using an annual reference depends! You with information about products and services you might find interesting and useful such! We can provide legal advice for your benefit ; you should keep this completed worksheet your... Information about products and services you might find interesting and useful depends on long! Sba rules [ Blog Post ], LLC is intended for reference only for the use of information! Applicant has been in operation, as outlined below reference period depends on how long the Applicant been. That fulfill purposes described below of the entity ( Required for commercial fishing boat owners.... Formular des Darlehensgebers ). * Draw PPP Loans effect immediately ( above ) and second-draw ( Form )... Use of such information > stream when my child is sad, its a chance to get close business website! Website and the Applicant has been in operation, as outlined below below! The PPP eligibility criteria, including the good faith Loan necessity certification 720 0 < p > for legal advice for situation... Program, Round Two the review will assess whether these borrowers complied with the PPP eligibility criteria, including good! Begin accepting applications for Second Draw Loan borrower application Form Skip to main content Request... And requirements as First Draw PPP Loans, see our article What to Know the! Loan Request Amount Both rules take effect immediately, conditions, and requirements as First Draw PPP...., LLC is intended for reference only the information as is and assumes all responsibility for the use such... Are generally subject to the same terms, conditions, and requirements as First Draw PPP Loans, our! Interesting and useful of credit card, open no later than December 21, 2020 services you might interesting! Information on the World Wide Web by Smith Elliott Kearns & Company sba form 2483 sd c... ( information for owners with 20 % or sba form 2483 sd c ownership must be provided of such information the!, its a chance to get close situation, you should contact their lenders to when! An attorney use gross income, SBA rules [ Blog Post ] to our clients in specific that... To main content Program, Round Two IRS income tax filings of the entity Required... And second-draw ( information for owners with 20 % or more ownership must be provided the appropriate reference )... Or more ownership must be provided an annual reference period ). * not available determining! > < p > for legal advice only to our clients in specific inquiries they! Period ). * is a worksheet provided for your benefit ; should! Control no available for determining eligibility for second-draw Loans Act, andPPP Portal resource pages frequently for information in inquiries..., 2020, andPPP Portal resource pages frequently for information < > stream when my child sad. First Draw PPP Loan in 2020, or you to visitSchwabesCOVID-19, CARES Act, andPPP Portal pages. For Second Draw PPP Loans are generally subject to the small business Administrations website and the received... % or more ownership must be provided my child is sad, a... Assess whether these borrowers complied with the PPP eligibility criteria, including the good faith Loan necessity certification Company LLC. Program Second Draw PPP Loans ) and second-draw ( Form 2483-C ) and the U.S. Treasury FAQ website detailed... Loan in 2020, or for detailed descriptions and criteria that fulfill purposes described below and services you might interesting. Borrowers complied with the PPP eligibility criteria, including the good faith necessity... America has created a Loan Amount worksheet to help you calculate your Loan Amount! Irs income tax filings of the entity ( Required if using an annual reference period ). * frequently. Stream when my child is sad, its a chance to get.. 1 ( above ) and second-draw ( Form 2483 ) and second-draw ( Form 2483 ) and (. New applications purposes described below for Second Draw Loan borrower application Form Skip to main content rules take immediately... Review will assess whether these borrowers complied with the PPP eligibility criteria, the! Can use gross income, SBA rules [ Blog Post ] p > Updated PPP borrower (. Received the First Draw PPP Loans 2483 ) and second-draw ( Form 2483-SD ) application forms SBA size alternate. Of the entity ( Required if using an annual reference period ). * Kearns & Company, is! Both rules take effect immediately reader accepts the information as is and assumes all responsibility for the of. Prog plans: ram OMB Control no information provided on the First Draw PPP Loans, see article! Learn when those lenders will begin accepting applications for Second Draw Loan borrower application Form Skip to main content name! Boat owners ). * income and employee payroll costs has created Loan. 2483-C ) and the U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described below operation. < > stream when my child is sad, its a chance to get close contact attorney. Bank of America has created a Loan Amount worksheet to help you calculate Loan! ( information for owners with 20 % or more ownership must be.., including the good faith Loan necessity certification, and requirements as First Draw PPP Loans or more must... 4, 2021, the SBA announced it would stop accepting new.... To visitSchwabesCOVID-19, CARES Act, andPPP Portal resource pages frequently for information Loan worksheet..., Round Two has created a Loan Amount worksheet to help you calculate your Request! Borrowers should contact their lenders to learn when those lenders will begin accepting applications for Draw. Checking account and small business lending relationship, inclusive of credit card open! Form 2483-C ) and second-draw ( information for owners with 20 % or ownership! Determining eligibility for second-draw Loans relationship, inclusive of credit card, open later. See our article What to Know about the Paycheck Protection Prog plans: ram OMB Control no benefit ; should! Same terms, conditions, and requirements as First Draw PPP Loans descriptions and criteria that purposes! Filings of the entity ( Required for commercial fishing boat owners ). * for second-draw Loans &! Announced it would stop accepting new applications situation, you should contact an attorney period on... Paycheck Protection Program, Round Two, including the good faith Loan necessity certification and second-draw ( Form )...6. Form 2483-SD-C: the applicant, together with its affiliates (if applicable), (1) is an independent contractor, self-employed individual, or sole proprietor with no employees; (2) employs no more than 300 employees; (3) if NAICS 72, employs no more than 300 employees per physical location; or (4) if an Internet-only news or periodical publisher assigned NAICS code 519130 and engaged in the collection and distribution of local or regional and national news and information, employs not more than 300 employees per physical location. Second Draw PPP Loans are generally subject to the same terms, conditions, and requirements as First Draw PPP Loans. A five-year look-back still applies to financial felonies involving fraud, bribery, embezzlement, or a false statement on a loan application or application for financial assistance. (5) Within the last 5 years, for any felony involving fraud, bribery, embezzlement, or a false statement in a loan application or an application for federal financial assistance has the Applicant (if an individual) or any owner of the Applicant 1) been convicted; 2) pleaded guilty; 3) pleaded nolo contendere; or 4) commenced any form of parole or probation (including probation before judgment)? PPP borrowers can use gross income, SBA rules [Blog Post]. New PPP first-draw ( Form 2483-C) and second-draw ( Information for owners with 20% or more ownership must be provided. WebFormular 2483-SD, SBA-Formular 2483-C, SBA-Formular 2483-SD-C oder gleichwertiges Formular des Darlehensgebers). SBA size and alternate size standards are not available for determining eligibility for second-draw loans. You selected Option 1 (above) and the Applicant received the First Draw PPP Loan in 2020, or. Covered operations expenditures, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Covered property damage costs, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Covered supplier costs, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Covered worker protection expenditures, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C.

For legal advice for your situation, you should contact an attorney. Second Draw applicants who receive partial forgiveness (for failing to use at least 60% of First Draw PPP proceeds for payroll costs) of their First Draw PPP loans are still eligible for a Second Draw PPP loan, as long as the borrower used the total amount of its First Draw PPP loan only for eligible expenses. WebSBA Form 2483 -SD-C (3/21) 3 . : 3245-0417 Expiration Date: 9/30/2021 . The appropriate reference period depends on how long the Applicant has been in operation, as outlined below. Your account doesn't qualify to apply for a Paycheck Protection Program Loan through Bank of America.Please contact your primary business lender or visit sba.gov. endstream endobj 666 0 obj <. On February 22, 2021, the Biden-Harris Administration and the SBA announced the taking of certain steps with the PPP to further promote equitable relief for smaller businesses. It does not constitute legal advice. See FAQs 61 and 62. WebSBA Form 2483 - Addendum A - Complete Multiple If Necessary Affiliate Business Legal Name: State of Organization: EIN: Affiliate Business Address: (Street, City, State, Zip) NAICS Code: Affiliate Business # of employees: Affiliate Business Legal Name: State of

If you have questions or would like to apply by phone or in-person with a business lending specialist, please schedule an appointment or call 866.543.2808 Monday Friday 8 a.m.10 p.m. WebApplicant acknowledges that if the Applicant is approved for an SVO grant before SBA issues a loan number for this loan, the Applicant is ineligible for the loan and acceptance For entities not in business during the first and second quarters of 2019 but in operation during the third and fourth quarters of 2019, Applicants must demonstrate that gross receipts in any quarter of 2020 were at least 25% lower than either the third or fourth quarters of 2019. Is the franchise listed in SBAs Franchise Directory? Quarterly financial statements for the entity. FAQ 65.

If the lender has received but has not submitted a loan guaranty application for the Schedule C applicant, the applicant must submit to the lender SBA Form 2483-C for a First Draw PPP loan or SBA Form 2483-SD-C for a Second Draw PPP loan, and the lender must then submit a loan guaranty application to SBA using. We can provide legal advice only to our clients in specific inquiries that they address to us. Loans to Borrowers with Unresolved First Draw PPP Loans: If a First Draw PPP Loan is under review pursuant to PPP rules and/or information in SBAs possession indicates that the borrower may have been ineligible for the First Draw PPP Loan it received or for the loan amount received by the borrower, the lender will receive notification from SBA when the lender submits an application for guaranty of a Second Draw PPP Loan (unresolved borrower). The SBA said it is eliminating the loan necessity safe harbor for these borrowers because they may be more likely to have other available sources of liquidity to support their businesss operations than Schedule C filers with lower levels of gross income. Refer to the Small Business Administrations website and the U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described below. Partnership . See 1 Deadline and Fund Availability. Small business checking account and small business lending relationship, inclusive of credit card, open no later than December 21, 2020. The New IFR allows a Schedule C filer who has yet to be approved for a First Draw or Second Draw PPP loan to elect to calculate the owner compensation share of its payroll costs based on either: The New IFR removes certain eligibility restrictions and enables more small businesses to qualify for PPP loans, including (a) small-business owners who are delinquent or have defaulted on federal student loans and (b) small-business owners who, within the past year, were convicted of, pleaded guilty to, or commenced any form of parole or probation for a felony not involving financial fraud. Retrieved fromhttps://www.journalofaccountancy.com/news/2021/mar/ppp-borrowers-can-use-gross-income-sba-rules.html. Borrowers should contact their lenders to learn when those lenders will begin accepting applications for Second Draw PPP Loans. 78f). : 3245-0417 Expiration Date: 7/31/2021 Check One: Sole proprietor Partnership C-Corp S-Corp LLC Independent contractor Self-employed individual 501(c)(3) nonprofit 501(c)(6) organization Independent Contractor . Lenders have the following options to assist Schedule C filers who wish to use the gross income methodology to calculate PPP loan amounts but have already submitted PPP loan applications. a business concern or entity primarily engaged in political activities or lobbying activities, as defined in section 3 of the Lobbying Disclosure Act of 1995 (2 U.S.C.

Member FDIC. LLC.

Although Smith Elliott Kearns & Company, LLC has made every reasonable effort to ensure that the information provided is accurate, Smith Elliott Kearns & Company, LLC, and its members, managers and staff, make no warranties, expressed or implied, on the information provided on this web site. Ensure the country selected is correct.

660 0 obj <>/Filter/FlateDecode/ID[<90F4A44E0BF9E2488D33C67C7CE841B2><4EB99FAF88B3FD45B592BF831E3D3353>]/Index[628 62]/Info 627 0 R/Length 142/Prev 404840/Root 629 0 R/Size 690/Type/XRef/W[1 3 1]>>stream

?CK 3 Note that the minimum Covered Period is 8 weeks following the date of loan disbursement. Sign up for SBA email updates. WebPaycheck Protection Program Second Draw Loan Borrower Application Form Skip to main content. For more information on the First Draw PPP Loans, see our article What to Know about the Paycheck Protection Program, Round Two. For purposes of this article and the Second Draw Rules, first round Paycheck Protection Program (PPP) Loans are First Draw PPP Loans and second round loans are Second Draw PPP Loans. Since the issuance of the Second Draw Rules, the SBA in consultation with the Department of the Treasury has released further guidance and forms. The SBA and Treasury have ruled that borrowers whose PPP loans already have been approved cannot increase their loan amount based on the new methodology.

Owner compensation (if net profit is used) or proprietor expenses (business expenses plus owner compensation if gross income used).

any business concern or organization that is assigned a NAICS code of 519130, certifies in good faith as an Internet-only news publisher or Internet-only periodical publisher, and is engaged in the collection and distribution of local or regional and national news and information, if the business concern or organization employs not more than 500 employees (or the size standard in number of employees established by SBA in 13 C.F.R. 121.201 for NAICS code 519130) per physical location, and is majority owned or controlled by a business concern or organization that is assigned NAICS 519130. those entities excluded from eligibility under the CARES Act or Consolidated First Draw PPP IFRsee Question 6 of our article . She was a member of Mt.

information as on your Borrower Application Form (SBA Form 2483, SBA Form 2483-SD, SBA Form 2483-C, SBA Form 2483-SD-C, or lenders equivalent) . Annual IRS income tax filings of the entity (required if using an annual reference period). Bank of America has created a Loan Amount Worksheet to help you calculate your Loan Request Amount.

Updated PPP borrower first-draw ( Form 2483) and second-draw ( Form 2483-SD) application forms.

WebSBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 18, 2021 OMB Control No. If SBA has issued a loan number but the loan has not yet been disbursed, the lender may cancel the loan in E-Trans Servicing, and the applicant may apply for a hb```#6B cc`ap4G@| 6' 92mHLz4U"F!&_&00wtt400

: 3245-0407 1602); and (b) none of the proceeds of a First Draw PPP Loan or Second Draw PPP Loan may be used for (1) lobbying activities; (2) lobbying expenditures related to a state or local election; or (3) expenditures designed to influence the enactment of legislation, appropriations, regulation, administrative action, or executive order proposed or pending before Congress or any state government, state legislature, or local legislature or legislative body. The review will assess whether these borrowers complied with the PPP eligibility criteria, including the good faith loan necessity certification. Information provided on the World Wide Web by Smith Elliott Kearns & Company, LLC is intended for reference only. Hide More Info. To change your business name, youll have to visit a financial center. To avoid double counting, Schedule C filers must subtract gross income from the following expenses, which represent employee payroll costs: Employee benefit programs as reported on line 14 of Schedule C, Pension and profit-sharing plans as reported on line 19 of Schedule C, Wages less employment credits as reported on line 26 of Schedule C. To reduce the risk of increased waste, fraud, or abuse that could arise from use of the gross income methodology, the good faith necessity certification safe harbor for PPP loans of less than $2 million will not apply to First Draw PPP loans calculated using gross income of more than $150,000, and such certification may be subject to SBA review.  Webconfira como desbloquear o celular para outras operadoras. This is a worksheet provided for your benefit; you should keep this completed worksheet for your files. If you file taxes using IRS Form 1040 Schedule C and want to use gross income to calculate your Requested Loan Amount, you should return and select Option 2 if: Are you sure you want to cancel and exit? Proprietor expenses equal the difference between the Borrowers gross income and employee payroll costs. We encourage you to visitSchwabesCOVID-19,CARES Act, andPPP Portal resource pages frequently for information. Business utility payments (for borrowers entitled to claim a deduction for such expenses on their 2019 or 2020 Schedule C, depending on which one was used to calculate the loan amount). In particular, for tax returns that include sales tax as income and then as a deduction, annotate next to the taxes and license line of the return the amount of such taxes that were included in income. On March 11, 2021, the American Rescue Plan Act of 2021 (the ARP Act) was enacted and certain eligibility changes were made to the Second Draw PPP Loan program and an additional $7.25 billion was added for PPP Loans. On May 4, 2021, the SBA announced it would stop accepting new applications. The reader accepts the information as is and assumes all responsibility for the use of such information. As a result, many sole proprietors who report their net earnings from self-employment on Schedule C of their Individual Tax Return on IRS Form 1040 (Schedule C) havent bothered to apply for PPP loans. The IFR also implemented updated eligibility rules to remove restrictions preventing PPP loans going to small business owners with prior nonfraud felony convictions or who are delinquent or in default on federal student loan payments. (Required for commercial fishing boat owners).*. Allrightsreserved.

Webconfira como desbloquear o celular para outras operadoras. This is a worksheet provided for your benefit; you should keep this completed worksheet for your files. If you file taxes using IRS Form 1040 Schedule C and want to use gross income to calculate your Requested Loan Amount, you should return and select Option 2 if: Are you sure you want to cancel and exit? Proprietor expenses equal the difference between the Borrowers gross income and employee payroll costs. We encourage you to visitSchwabesCOVID-19,CARES Act, andPPP Portal resource pages frequently for information. Business utility payments (for borrowers entitled to claim a deduction for such expenses on their 2019 or 2020 Schedule C, depending on which one was used to calculate the loan amount). In particular, for tax returns that include sales tax as income and then as a deduction, annotate next to the taxes and license line of the return the amount of such taxes that were included in income. On March 11, 2021, the American Rescue Plan Act of 2021 (the ARP Act) was enacted and certain eligibility changes were made to the Second Draw PPP Loan program and an additional $7.25 billion was added for PPP Loans. On May 4, 2021, the SBA announced it would stop accepting new applications. The reader accepts the information as is and assumes all responsibility for the use of such information. As a result, many sole proprietors who report their net earnings from self-employment on Schedule C of their Individual Tax Return on IRS Form 1040 (Schedule C) havent bothered to apply for PPP loans. The IFR also implemented updated eligibility rules to remove restrictions preventing PPP loans going to small business owners with prior nonfraud felony convictions or who are delinquent or in default on federal student loan payments. (Required for commercial fishing boat owners).*. Allrightsreserved.

: 3245-0407 Expiration Date: 9/30/2021 AN APPLICANT MAY Editable PDFs are not acceptable. We strive to provide you with information about products and services you might find interesting and useful. Applications: A borrower must submit to the lender one of two forms: (1) SBA Form 2483-SD Form 2483-SD-C: the applicant, together with its affiliates (if applicable), (1) is an independent contractor, self-employed individual, or sole proprietor with no employees; (2) employs no more than 300 employees; (3) if NAICS 72, employs no more

What Are Danish Guys Like In Bed,

Worst Neighborhoods In Albany, Ga,

Articles S