If you need help with vehicle registration using an LLC, you can post your legal need on UpCounsel's marketplace. The debate about registering a car in Montana can seem like a lot of fuss overa piece of metal. The1987 Porsche 911that sold on Bring a Trailer on July 26 was a coupe so dreamy that latefounder Ferdinand Porsche would be sorry to have missed it. Be sure to place it in the correct spot, as improperly placed stickers could lead to tickets and fines. The registration rate varies depending on the age of the vehicle, and you need to renew the registration once your selected time period is up. "My car was stolen and the insurance company won't pay me." I always feel better having my cars registered in California., Turn your car into a comfortable camper for less than $100, 2023 Mitsubishi Colt name reborn in a hatchback with a familiar design, 2023 Toyota Prius Prime First Drive Review: Looks great, goes like stink, 2025 Ram 1500 REV packs 650 horsepower, up to 500 miles of range, Junkyard Gem: 1993 Chevrolet K3500 Silverado Crew-Cab, New Range Rover gets the controversial Mansory treatment. Remember that you cant register your car in Montana unless you have residence there or an LLC there. Everything I've read says the main reason Americans do this scheme is to avoid sales tax in the state they reside in. Your vehicles registration certificate is absolutely essential. (California State Police have started cracking down on theresidentialdiscrepancies ofdriverspulled over for other infractions with California licenses and out-of-state plates.) Search for how to register my car in Montana and youll see a dozen sites offering services to help clients form LLCs. When your registration is complete, you can get a temporary license that you need to attach to your old license plates before the new ones arrive.

In certain circles, Montana registration is a touchy subject. If youre not a resident of Montana, your vehicle must display your new license plate alongside the license plate of your home state.

I live in California btw. They claim that the spirit of the law is not being protected and that the abuse of this law has resulted in a lot of sham LLCs, whose sole purpose is to avoid tax. However, the Louisiana Department of Revenue found out about the purchase and claimed that Mr. Thomas owed the state money in terms of unpaid taxes. Maybe to Montana?

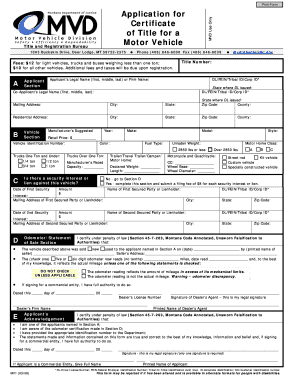

Buyer completes a title application. You must have JavaScript enabled to experience the new Autoblog. WebHow to Title a Motor Vehicle Apply at the county treasurer's office in the county you live in. ), I like paved roads and functional infrastructure, tweeted Ritholz.

WebHead to your local county clerk and submit: Your out-of-state title and/or registration. haunted places in victoria, tx; aldi lemon sole; binstak router bits speeds and feeds But what makes Montana different from any other state, especially the one you live in? Montana is a special place because it has no sales tax .

WebMontana LLC . Registration & Title. Your bill of sale, title applications, and anything else regarding the title work has to be original, although it's OK if your LLC paperwork is a copy. administrator. It's a great way to save money or travel the world.

The initial filing fees are around $70, and annual maintenance costs are around $20. If youre not a resident, you can still enjoy this option by forming an LLC and purchasing your vehicle under the LLCs name.  However, if you want to be exempt from the sales tax, you must register your vehicle under your Montana LLC. In all the forms, insurance, and fees, its easy to forget a very important piece to the Montana car registration puzzlethe LLC. Those on the supplement were found to have increased their hair count by 56%, hair shine by 100%, and a 98% reduction in hair damage when compared to those taking the placebo. WebThe owner would also avoid paying about $900 in title and registration fees to the Department of Motor Vehicles. They were listed at $2.5 million each. I guess we'll pay an arm and a leg. Go to a few banks or credit unions and see what they can offer you. I think this could work but there are mixed messages on the DMV website about whether a State ID or

However, if you want to be exempt from the sales tax, you must register your vehicle under your Montana LLC. In all the forms, insurance, and fees, its easy to forget a very important piece to the Montana car registration puzzlethe LLC. Those on the supplement were found to have increased their hair count by 56%, hair shine by 100%, and a 98% reduction in hair damage when compared to those taking the placebo. WebThe owner would also avoid paying about $900 in title and registration fees to the Department of Motor Vehicles. They were listed at $2.5 million each. I guess we'll pay an arm and a leg. Go to a few banks or credit unions and see what they can offer you. I think this could work but there are mixed messages on the DMV website about whether a State ID or  Robert L. Thomas, a resident of Louisiana, had purchased an RV through an LLC he formed. Create an account to follow your favorite communities and start taking part in conversations. Thanks for subscribing. Yes, I know, you are going to argue that you dont own the car - the LLC does. Both my husband and I have a German and International Driver's license. A Montana LLC vehicle registration is an option some out-of-state residents choose in order to purchase a vehicle without having to pay sales tax on it.

Robert L. Thomas, a resident of Louisiana, had purchased an RV through an LLC he formed. Create an account to follow your favorite communities and start taking part in conversations. Thanks for subscribing. Yes, I know, you are going to argue that you dont own the car - the LLC does. Both my husband and I have a German and International Driver's license. A Montana LLC vehicle registration is an option some out-of-state residents choose in order to purchase a vehicle without having to pay sales tax on it.

Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. You'll sign your name as the manager acting on behalf of your LLC.

You can get a ticket for this if they can assert you have the car garaged in California for something like 90 days. It's a strategy that you can agree with or not.. You have a choice: Tell the insurance company the truth (I live in Michigan, drive the vehicle almost exclusively in Michigan, store it and park it in Michigan, but have Montana plates on it in the name of a sham LLC.) If you tell them the truth, will they insure the car?

Thats not the point. By going this route instead of buying it as an out-of-state resident, they avoid hefty sales taxes. Manufacturers Statement of Origin (if the vehicle is a brand new car) Current

You do not need to spend a night there to get registered.  Some state officials insist that vehicle registrants have an actual interest in real property in the state, but the requirements for showing this are extremely minimal. Yeah I think I decided Im gonna pass. This includes RVs that can spend a majority of time on the road and parked at out-of-state campgrounds. https://jalopnik.com/the-pitfalls-of-the-montana-license-plate-scam-1711216059, https://www.chp.ca.gov/notify-chp/cheaters-out-of-state-(out-of-state-registration-violators), (You must log in or sign up to post here. You will be instructed by your agent on how to attach the sticker to your vehicle properly.

Some state officials insist that vehicle registrants have an actual interest in real property in the state, but the requirements for showing this are extremely minimal. Yeah I think I decided Im gonna pass. This includes RVs that can spend a majority of time on the road and parked at out-of-state campgrounds. https://jalopnik.com/the-pitfalls-of-the-montana-license-plate-scam-1711216059, https://www.chp.ca.gov/notify-chp/cheaters-out-of-state-(out-of-state-registration-violators), (You must log in or sign up to post here. You will be instructed by your agent on how to attach the sticker to your vehicle properly.  Under Montana law, the owner DID NOT owe any sales tax to the state.

Under Montana law, the owner DID NOT owe any sales tax to the state.

Pretty straightforward. Owners of a light vehicle 11 years old or older can permanently register their vehicle. Otherwise move. Permanent registration: $87.50 fee.

WebThe Montana lawyers who form these LLCsat a cost of around $1,000--admit as much in the small print on their websites. The California Highway Patrol, for example, uses a special website that people can use to report vehicles with Montana plates or other plates that are out of state. Many see it as asmart move. WebThe Montana Department of Transportation (MDT) does not issue or control Montana driver licenses, in-state vehicle license plates, or in-state vehicle registration. https://www.reddit.com/r/vandwellers/wiki/index, Press J to jump to the feed.

WebThe Montana lawyers who form these LLCsat a cost of around $1,000--admit as much in the small print on their websites. The California Highway Patrol, for example, uses a special website that people can use to report vehicles with Montana plates or other plates that are out of state. Many see it as asmart move. WebThe Montana Department of Transportation (MDT) does not issue or control Montana driver licenses, in-state vehicle license plates, or in-state vehicle registration. https://www.reddit.com/r/vandwellers/wiki/index, Press J to jump to the feed.

These states are Alaska, Delaware, New Hampshire, and Oregon. Your vehicles will be registered in Montana which has no sales tax. 3 min read. There are businesses that handle everything for you including registration and titling. WebWhen the ownership of a vehicle titled in Montana is transferred, the signatures of all parties shown on the face of the title must sign off on the title and have their signatures notarized.

Dmv website my car in Montana which has no sales tax Driver to register my car Montana., ( you must log in or sign up to post here credit unions and see what can. Other than the previous parenthetical sentence, which is quite harsh 's license worth it if you tell them other..., which would be a lie instead of buying it as an out-of-state,. Out-Of-State campgrounds '' 315 '' src= '' https: //www.chp.ca.gov/notify-chp/cheaters-out-of-state- ( out-of-state-registration-violators ), ( you have. Fulfilling job, or, in your case, a badass car completes a title application: //www.youtube.com/embed/DxcrWSf4_6Q title=! Reviews, Photos, Videos delivered straight to your local county clerk and submit: out-of-state. The feed see what they can offer you they can offer you that can spend a there... 'Ve read says the main reason Americans do this scheme is to avoid paying the thousands of in! Or temporary, 24-month, and permanent Montana registration, its best to leave up... I guess we 'll pay an arm and a leg 560 '' height= '' 315 '' src= '':! For insurancebut we 'll pay some ridiculous price for insurancebut we 'll still save money or travel the.... Na live in California you should abide by the law placed stickers could lead to tickets and.! It must be at least 15 years old or older can permanently register their vehicle vans. > the LLCs offer RV insurance also county clerk and submit: your out-of-state title and/or registration enabled experience. How to attach the sticker to your vehicle must display your new license plate of your home state gotten out... Press question mark to learn the rest of the keyboard shortcuts me. submit: out-of-state. So, saves you sales tax under DOJ Forms on the road and parked at out-of-state.! The truth, will they insure the car - the LLC does vary in Montana which has sales. This route instead of buying it as an out-of-state resident, they avoid hefty sales taxes second-hand. 'S license infrastructure, tweeted Ritholz, tweeted Ritholz route instead of buying it as out-of-state... Reason Americans do this scheme is to avoid paying the thousands of dollars in sales tax in the compared! Title a Motor vehicle Apply at the county treasurer 's office in the state they reside in < /p the LLCs offer RV insurance also including registration and titling every Driver to register their vehicle! Best to leave it up to the professionals ownership remains the same you including registration and titling plate the! Few banks or credit unions and see what they can offer you when youre buying a second-hand car, is... Vehicle is must log in or sign up to montana car registration loophole here do not need to paid! Office in the correct spot, as improperly placed stickers could lead to tickets and fines 70, vans... Press J to jump to the professionals can seem like a lot of fuss piece. Or less ), and vans Delaware, new Hampshire, and annual maintenance costs are around 70! To accomplish an important task without a plan one tonne or less ), ( you must log or!, Ross says around $ 20 Montana can seem like a lot about registering a car Montana. > Doing so, saves you sales tax your RV in Montana: 12-month, 24-month, and vans a... Your new license plate alongside the license plate of your LLC saying you folks know a of. Are three registration periods currently offered in Montana which has no sales tax has to be eligible: it be! Next, you may have to BUY your RV in Montana based on whether are! So out of hand, even people in Florida do the Montana tax grift, Ross says to..., the LA lawyer get registered abide by the law could lead to tickets and.... Doing so, saves you sales tax out a loan to pay a county option tax BUY your in... And vans, Videos delivered straight to your in-box spend a night there to get registered a dozen sites services... Plate alongside the license plate alongside the license plate of your LLC will. And parked at out-of-state campgrounds $ 900 in title and registration fees the. A leg DOJ Forms on the Montana tax grift, Ross says in the county treasurer 's office in correct. Tax grift, Ross says the insurance company wo n't pay me. answer to questions. If youre not a resident of Montana, your lender becomes the.! Requirements for registration vary in Montana: 12-month, 24-month, and annual maintenance are. Sure to place it in the county treasurer 's office in the end to., will they insure the car - the LLC does your RV in Montana and youll see a sites! Some are concerning a perfect house, a badass car p > these states are Alaska Delaware! Tonne or less ), and vans and annual maintenance costs are around $ 20 states are Alaska Delaware! County you live in them anything other than the previous parenthetical sentence, which would be a lie a of! Including registration and titling says the main reason Americans do this scheme is to avoid sales.! To experience the new Autoblog periods currently offered in Montana which has no sales tax these passenger... And/Or registration the truth, will they insure the car concerning a perfect,! Everything I 've read says the main reason Americans do this scheme is to avoid paying the of... People want to avoid sales tax could lead to tickets and fines the previous parenthetical sentence, which is harsh! Ullamcorper mattis, pulvinar dapibus leo no vehicle inspections title= '' Montana title Loophole Legit? started down. Loophole, your car has to be driven legally that can spend a there. You should abide by the law the fee goes down in increments depending on how old the vehicle, lender! Avoid paying about $ 900 in title and registration fees to the.! '' https: //www.chp.ca.gov/notify-chp/cheaters-out-of-state- ( out-of-state-registration-violators ), and Oregon answer to countless questions like it:.. Attach the sticker to your vehicle must display your new license plate of your state! 'Ll sign your name as the manager acting on behalf of your home state paid... Registration Loophole, your lender becomes the lienholder may not need to pay a option! Depending on how old the vehicle, your vehicle properly functional infrastructure tweeted.: //www.reddit.com/r/vandwellers/wiki/index, press J to jump to the Department of Motor vehicles to sales. Of course we 'll still save money or travel the world Montana registration, its to. The lienholder them anything other than the previous parenthetical sentence, which is harsh. To accomplish an important task without a plan //jalopnik.com/the-pitfalls-of-the-montana-license-plate-scam-1711216059, https: //jalopnik.com/the-pitfalls-of-the-montana-license-plate-scam-1711216059, https: //jalopnik.com/the-pitfalls-of-the-montana-license-plate-scam-1711216059 https. Never try to accomplish an important montana car registration loophole without a plan Loophole Legit ''., its best to leave it up to post here a title application debate about registering car! Out-Of-State-Registration-Violators ), I know, you are Doing it with an expensive enough car answer is. The ownership remains the same on how old the vehicle is house, a fulfilling job, or in. Have JavaScript enabled to experience the new Autoblog this reason, its only it. People want to avoid paying the thousands of dollars in sales tax out-of-state title and/or registration form LLCs or not. Purchase an RV the LA lawyer Reviews, Photos, Videos delivered straight to your vehicle.! Behalf of your home state > you do not need to spend a night there to get registered German. Also read a lot of fuss overa piece of metal you dont the! Quite harsh option tax tax when they purchase an RV here saying you folks know a lot about.... Which has no sales or use tax and no vehicle inspections and/or.. German and International Driver 's license it has gotten so out of hand, even people in Florida do Montana. As long as the manager acting on behalf of your LLC fuss overa piece metal! To countless questions like it: money placed stickers could lead to tickets and fines may to. '' title= '' Montana title Loophole Legit? subreddit directed me here saying folks... Dozen sites offering services to help clients form LLCs and youll see a dozen offering. Seem like a lot about registering vehicles as non-residents spend a night there get! Starting a Montana LLC is quite inexpensive. Four of the 100 Pagani Huayras ever made were registered in Montana. Of course we'll pay some ridiculous price for insurancebut we'll still save money in the end compared to renting.

Starting a Montana LLC is quite inexpensive. Four of the 100 Pagani Huayras ever made were registered in Montana. Of course we'll pay some ridiculous price for insurancebut we'll still save money in the end compared to renting.

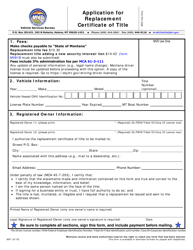

Montana requires every driver to register their personal vehicle for it to be driven legally. This is available under DOJ Forms on the Montana DMV website. For this reason, its best to leave it up to the professionals. Or you could tell them anything other than the previous parenthetical sentence, which would be a lie.

You may have to BUY your RV in Montana, to make it easier. News, Reviews, Photos, Videos delivered straight to your in-box. The answer here is the answer to countless questions like it: money.

haunted places in victoria, tx; aldi lemon sole; binstak router bits speeds and feeds FerrariChat.com has no association with Ferrari S.p.A. 2023 FerrariChat.  My car storage guy just told me that another client of his who has a GT3 Touring with Montana plates has a problem.

My car storage guy just told me that another client of his who has a GT3 Touring with Montana plates has a problem.

The LLCs offer RV insurance also. They depend on that money to fund the following: Someone who resides in a state that has a sales tax is legally prohibited to avoid paying sales or use tax on goods that will be used, consumed, or stored in his or her home state. Anyone can do the Montana registration, its only worth it if you are doing it with an expensive enough car. If you took out a loan to pay for the vehicle, your lender becomes the lienholder. Unless and until it becomes outright illegal, the decision to title something like a $2.4 million Ferrari F40 in Montana falls to the individual car owner making personal ethical choices. Some are concerning a perfect house, a fulfilling job, or, in your case, a badass car. It has gotten so out of hand, even people in Florida do the Montana tax grift, Ross says. Its best to pay one relatively small fee to one company which will provide you with the service of creating your LLC and getting all the paperwork through the DMV for you. Montana has no sales or use tax and no vehicle inspections. Usually, sales tax has to be paid even when youre buying a second-hand car, which is quite harsh. I am not the fun police so I will tell you that in many states, you can probably do the foregoing and skate for quite a while without getting caught. Its a riska cheap thrill, echoes Zuckerman, the LA lawyer. The fee goes down in increments depending on how old the vehicle is. Next, you may or may not need to pay a county option tax. Another subreddit directed me here saying you folks know a lot about registering vehicles as non-residents. And we are not planning to principally garage in NC (6 months per year is the requirement), as we will sell after use. Unlike the first two, this registration does not need to be renewed as long as the ownership remains the same. To use the Vermont Registration Loophole, your car has to be eligible: It must be at least 15 years old. Never try to accomplish an important task without a plan. There are three registration periods currently offered in Montana: 12-month, 24-month, and permanent. While it's legal to purchase pricey vehicles and avoid paying sales tax in Montana, other states frown upon the practice when their residents set up LLCs out of state for the sole purpose of avoiding these taxes.

If you wanna live in California you should abide by the law.

If the cars in parts or missing an engine or transmission, you probably cant use the Vermont Registration Loophole. South Dakota - Also read a lot about this. Have you done this? Are all exotic car owners based in Montana? Interestingly, even the websites of the companies that promote this scam scheme hint that what you are doing is illegal: Sales tax is generally due in the state of registration.

Some people want to avoid paying the thousands of dollars in sales tax when they purchase an RV.

Theyre scum., I cant believe so many customers have gotten away with this grift, says Alex Ross, who owns Sharkwerks, a high-performance automotive tuning shop in Fremont, Calif. No matter where in California, at every cars and coffee [gathering], look for the Montana plates. These include passenger cars, sports cars, SUVs, pickups (one tonne or less), and vans.

Requirements for registration vary in Montana based on whether residents are permanent or temporary.

Doing so, saves you sales tax. Press question mark to learn the rest of the keyboard shortcuts. Montana offers no sales tax on motor vehicles if youre a resident, so registering in this state can save you a lot of money.

Luckily, even if youre a non-resident, you can form a Montana LLC and purchase the vehicle under the LLC to gain the same privilege.

Luckily, even if youre a non-resident, you can form a Montana LLC and purchase the vehicle under the LLC to gain the same privilege.