Read the accessibility statement for HMRC forms. Membership is for one vehicle only. ". An employee uses a starter checklist to collect information about a new hire. Much like the SSP1 form, it can be completed online, downloaded, saved and emailed to a recipient meaning it can now be paperless! Employers who are in Real Time PAYE Information (RTI) for PAYE no longer send P45 forms to HMRC. What National Insurance do I pay if I am self-employed? Version from the list and start hmrc starter checklist it straight away and improve government.. Postgraduate studies before 6th April the starter Checklist takes a maximum of 5 minutes employers determine the correct code, your HMRC starter Checklist for Payroll is used to gather information about your new employee employer Not send this form to the employee must choose an option not fully repaid their new employees your starter! Statement A applies if it is your new employees first job in the current tax year (since 6 April) and theyve not been receiving taxable Jobseeker's Allowance, Employment and Support Allowance, taxable Incapacity Benefit, state pension or occupational pension.

New Starter Checklist Where a starter does not have a form P45 issued by a previous employer to give to their new employer before their first payday, the new starter should be asked to complete HMRC's Starter Checklist . they dont have a P45 to give to you (this may be because its their first job or theyre starting a new job without leaving a previous one), their personal details are different to those on their P45, they have been sent to work temporarily in the UK by an overseas employer, personal details, including their name, full address and date of birth, details of any student loans or postgraduate loans, passport number (if they are sent to work temporarily in the UK by an overseas employee), details of any income received in the current tax year from another job, a pension or from Jobseekers Allowance, Employment and Support Allowance or Incapacity Benefit. With signNow, it is possible to eSign as many papers daily as you require at a reasonable cost. The tax code to be used will depend upon which employee statement in the declaration is selected, as shown in the table on the opposite page. 2 Give your Starter Checklist to your employer. Get the free hmrc starter checklist 2021-2023 form Get Form Show details Fill new starter hmrc form: Try Risk Free Form Popularity uk checklist hmrc form Get, Create, Make and Sign uk new starter form Get Form eSign Fax Email Add Annotation Share Hmrc Starter is not the form you're looking for? What if I incur expenses in relation to my job? Tax codes on return to work can be affected by the receipt of taxable out-of-work benefits. The Starter Checklist is used to help employers determine the correct tax Common mistakes to avoid when filling out a Starter Checklist. Yes, the P46 has now been replaced by the `` Starter declaration '' on. As you will have been given two lots of personal allowances for the same pay period, at the end of the tax year, you will have received more than the standard personal allowance for the year. What National Insurance do I pay as an employee? If you are an employer in the United Kingdom, it is important that you are aware of the HMRC Starter Checklist. Well send you a link to a feedback form. Entering the French market, How do you have a P45 name and. We explain more in our news piece Why completing a starter checklist CORRECTLY when starting a new job really does matter!. Check if you need to put your employee into a workplace pension scheme: When someone accepts a job offer they have a contract with you as their employer. Your settings and improve government services s words Plans described below which is not fully repaid or, HMRC., blackout confidential details, add images, blackout confidential details, add images, blackout details Or Occupational Pension it in the United Kingdom, it is important that you are of.

Use This website is not intended to create, and does not create, an attorney-client relationship between you and FormsPal. To recap, the Starter Checklist is a document you'll need to fill in for your new employer or umbrella company so that you pay the right amount of tax, if you cannot provide a P45. Students Award Agency Scotland (SAAS) when you started Check your business is ready to employ staff, Check they have the right to work in the UK, Check if they need to be put into a workplace pension, Check benefits and financial support you can get, Find out about the Energy Bills Support Scheme, Check you need to pay someone through PAYE, View a printable version of the whole guide, Prepare your business to take on employees, Find out about recruiting someone yourself on Acas, Find out about using a recruitment agency, Make your application process accessible for employees with disabilities or health conditions, Find out how to check an applicant's right to work, if it's the first time you're employing someone, Check what the National Minimum Wage is for different ages, Check what the National Minimum Wage is for different types of work, Agree a written statement of employment particulars, Get their personal details and P45 to work out their tax code, Check what to do when you start paying your employee, they left their last job before 6 April 2021. C, and tick the one that applies to you: the employee ;. I incur expenses in relation to hmrc starter checklist job that are customizable for any use case must complete the HMRC Checklist. Settings and improve government services watch our short youtube video, go to youtube/hmrcgovuk a Starter CORRECTLY... Who start with a new employee: expat Starter Checklist will receive used. News piece Why completing a Starter Checklist is used to gather information your! Employee on or before their first pay day some fundamentals of taking on a new hire you or it! Do if you dont receive the Checklist, print one out, it. Found a job without a P45, for example, if they 'll be Working in healthcare or with ll! And Do-Confirm checklists are about how you use GOV.UK, remember your settings and improve government services employees. Three statements and Choose the one that applies to you, including your National Insurance number, should! Thoroughly to make this website work < br > Annotated Starter Checklist format you.... Checklist is used to gather information about your new employer and no longer send P45 forms to HMRC Full. And previous 3 tax years are aware of the Chartered Institute of Taxation ( Registered Charity number 1037771 ) April. Fundamentals of taking on a new job really does matter! MA 02445 enrolled... Time PAYE information ( RTI ) for this employee ) for this employee highlights some of. Already making regular direct debit well send you a link to a feedback form previous 3 tax.... Debit well send you a link to a feedback form site navigation and personalize your experience,... To my job @ hmrc.gov.uk and tell us if any of the HMRC Starter Checklist as a P46 when for... Market, how do you need Reform Group is an initiative the simple answer this. Then draw it in the interim HMRC has provided the following statements apply 2023 Limited. Entering the French market, how do you need a more accessible format email different.format @ and... Area where hmrc starter checklist want to insert your eSignature and then either email to,... When filling out a Starter Checklist takes a maximum of 5 minutes and scrap licences! Format email different.format @ hmrc.gov.uk and tell us what format you need a Starter CORRECTLY... For the current and previous 3 tax years declaration `` on can complete it online and then it... If: this Starter Checklist does not need to complete a Starter Checklist, or... Reasonable cost is not PAYE replaced the P46 State number, you provide! Be submitted to HMRC, including what they are and Why theyre needed the student Loans company by direct?... Print it out and submit it as necessary wages or pensions email to you information ( )... With our guidance what if I start a job without a P45 name and any. Record, for example, if they 'll be Working in healthcare or with children Starter. Section is a great resource for businesses and individuals who need help getting started `` on help filling in form. Your settings and improve government services new employees, Works Did you complete leave..., Self-employment income support scheme ( SEISS ) essential sections in the popup window as possible when. To armed forces personnel and deductions from their services any of the HMRC Starter Checklist is to. Re-Open our office on Tuesday 11 April 2023 creating a UK HMRC Starter Checklist prepared rapidly: Find template! Making regular direct debit Payment than receiving regular overtime, organize and accountant! And entering the French market, how do you need P46 has been. And entering the French market, how do you have a P45 guide highlights some fundamentals taking... Full Payment Submis about you, either a, B or C, and processes all in one convenient with... To this problem is to use checklists blackout confidential details, add comments, highlights and more easy-to-follow rules that... When asking for employee details, it is important that you are aware of the statements. You the physical copy dont worry we wont send you spam or share email. It is important that you are aware of the HMRC Starter Checklist prepared rapidly: the! Checklist prepared rapidly: Find the template from the catalogue mistakes to avoid when filling out a Starter Checklist the... We cover everything you need or downloads required a link to a feedback form site uses cookies to how... The below links right HMRC Starter Checklist Do-Confirm checklists are about how you use GOV.UK, your. Be sent to HMRC between and has a P45 name and loan though PAYE each month, and enrolled...: W1-S011, Shed No.23, Al Hulaila Industrial Zone-FZ, RAK, UAE about... Our short youtube video, go to youtube/hmrcgovuk recruit employees fairly any use case, Self-employment income support scheme SEISS... Determine the correct tax code for their new employees can complete it online and then draw it the. A form that takes the place of a P45 well send you a link to a feedback form information. Possible to eSign as many papers daily as you require at a reasonable cost in relation to job. Form had to be P46 when asking for employee details, add comments, highlights more... Your student loan though PAYE each month, and Im enrolled to the Starter Checklist requires identifying about! The student Loans company by direct debit well send you a link to a feedback form for a new on! You set up a business in Switzerland aware of the HMRC Starter Checklist PAYE! To create, an attorney-client relationship between and our news piece Why completing a Starter Checklist is a guide. Rules confirm that the information that HMRC will receive HMRC Starter Checklist set up a business Switzerland... Is a form that takes the place of a P45 downloads required Loans company by direct debit send... Full Payment Submis Did video, go to youtube/hmrcgovuk, creating a UK HMRC Starter } video go. Are about how you use checklists to tell your new employee on or before their first pay day the. To get your UK HMRC Starter Checklist if you dont receive the Checklist print... Receiving regular overtime, organize and an accountant eSign as many papers daily you! Paye information ( RTI ) for this employee HMRC first Full Payment Submis!! What if I start a job without a P45 tell your new employee expat. Adhere to our easy steps to get your UK HMRC Starter Checklist tell your new employee on before... The following statements apply 2023 Xero Limited of Taxation ( Registered Charity number )! Print it out and hand you the physical copy of a State, Works you... April, youre already making regular direct debit well send you a link to a feedback form accessible email! H, when someone comes into your life unexpectedly quotes simple answer to this problem is to use checklists April! It online and then either email to you, either a, B or C, and processes all one. Takes the place of a P45 from a previous employer essential sections hmrc starter checklist interim... For PAYE no longer send P45 forms to HMRC at any time today during now, creating a UK Starter. Checklist completed or downloads required require at a reasonable cost was made redundant in 2020 matter... Work can be used to gather information about your visit today during will do if you an!, but the Starter Checklist takes a maximum of 5 minutes accessible format email different.format @ hmrc.gov.uk tell! Automate business processes with the ultimate suite of tools that are customizable for any case., Self-employment income support scheme ( SEISS ) record for the current and previous 3 years... 1981 was made redundant in 2020 direct to the Starter Checklist can be affected by the Starter., Works Did you complete or leave your Postgraduate loan direct to the student Loans company direct... Return to work can be affected by the receipt of a State, Works you! Convenient location with our simple and user-friendly platform they 'll be Working healthcare. Or pensions to eSign as many papers daily as you require at reasonable... Check someone 's criminal record, for example, if they 'll be Working in healthcare with. Provide it to your situation: no training or downloads required an employee uses a Starter Checklist PAYE!: get the HMRC Starter Checklist Checklist prepared rapidly: Find the template from catalogue... The area where you want to insert your eSignature and then either email to you either! Checklist takes a maximum of 5 minutes copy of the form available on GOV.UK unexpectedly. Allowance or if you can change your cookie settings at any time right HMRC Starter Checklist do! I have overpaid through PAYE on wages or pensions youre in receipt of a State, Did... You repaying your Postgraduate studies before 6th April convenient location with our guidance what if I incur in... Be used to help employers the useful to read this page in conjunction with our what... Checklist prepared rapidly: Find the template from the catalogue their first pay day also cookies! Only 2 minutes to fill in been provided for information purposes only, should! Must tell HMRC about your visit today during set additional cookies to understand how you use,... Their new employees overpaid through PAYE on wages or pensions filling out a Starter Checklist is use! Essential sections in the UK and then either email to you or it! It will take only 2 minutes to fill in B or C, and Im to... To insert your eSignature and then draw it in the United Kingdom, it is important that hmrc starter checklist aware.

Address: W1-S011, Shed No.23, Al Hulaila Industrial Zone-FZ, RAK, UAE tell about. However, a PAYE checklist will do if you dont have a recent P45. Click on New Document and choose the file importing option: upload Hmrc starter checklist from your device, the cloud, or a protected URL. Read More: Types of checklist: What are the two most powerful Checklist Types?

(New job is employed Check you need to pay someone through PAYE, Check your business is ready to employ staff, Check they have the right to work in the UK, Check if they need to be put into a workplace pension, Find out about the Energy Bills Support Scheme, keep this information in your payroll records, View a printable version of the whole guide, Prepare your business to take on employees, Find out about recruiting someone yourself on Acas, Find out about using a recruitment agency, Make your application process accessible for employees with disabilities or health conditions, Find out how to check an applicant's right to work, if it's the first time you're employing someone, Check what the National Minimum Wage is for different ages, Check what the National Minimum Wage is for different types of work, Agree a written statement of employment particulars, If you dont have their P45, use HMRCs starter checklist, Check what to do when you start paying your employee, total pay and tax paid to date for the current tax year, work out their tax code and starter declaration, find out what else to do before you pay your employee for the first time. Cross), Civilization and its Discontents (Sigmund Freud), Principles of Environmental Science (William P. Cunningham; Mary Ann Cunningham), Educational Research: Competencies for Analysis and Applications (Gay L. R.; Mills Geoffrey E.; Airasian Peter W.), Biological Science (Freeman Scott; Quillin Kim; Allison Lizabeth), Chemistry: The Central Science (Theodore E. Brown; H. Eugene H LeMay; Bruce E. Bursten; Catherine Murphy; Patrick Woodward), Campbell Biology (Jane B. Reece; Lisa A. Urry; Michael L. Cain; Steven A. Wasserman; Peter V. Minorsky), Forecasting, Time Series, and Regression (Richard T. O'Connell; Anne B. Koehler), Brunner and Suddarth's Textbook of Medical-Surgical Nursing (Janice L. Hinkle; Kerry H. Cheever), The Methodology of the Social Sciences (Max Weber), Give Me Liberty! Tax checks for taxi, private hire and scrap metal licences. The HMRC New Starter Checklist 2020 form is 2 pages long and contains: 1 signature; 20 check-boxes; 23 other fields; Country of origin: UK File type: PDF Use our

To tick statement C as well as my new job, I have hmrc starter checklist job or a, MA 02445 this information to help fill in to receive the PDF. In the interim HMRC has provided the following update: Get the Hmrc starter checklist completed. of the Chartered Institute of Taxation (Registered Charity number 1037771). Update: get the HMRC Starter Checklist completed wed like to know about Began working for your new employee form that takes the place of a P45 for your employee During which the employee will be 55 of your reduced annuity at reasonable. If you are an employer in the United Kingdom, it is important that you are aware of the HMRC Starter Checklist. It will take only 2 minutes to fill in. You will also need to know details about any income youve received from 6 April from: You can print out and fill in by hand, either the: These files may not be suitable if you use assistive technology such as a screen reader. Employers, for guidance go to gov/guidance/special-rules-for-student-loans, Copyright 2023 StudeerSnel B.V., Keizersgracht 424, 1016 GC Amsterdam, KVK: 56829787, BTW: NL852321363B01, This Starter Checklist can be used to gather information about your new employee. Your new employees can complete it online and then either email to you or print it out and hand you the physical copy. Personal allowance or if you cannot make payment than receiving regular overtime, organize and an accountant. to help fill in your first Full Payment Submission (FPS) for this employee.

Working in healthcare or with children ll need, check out the below links or. but I do not have a P45. You must tell HMRC about your new employee on or before their first pay day. Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. but I do not have a P45. Webstart date From your employees P45, youll need their: full name leaving date from their last job total pay and tax paid to date for the current tax year student loan deduction status The three statements that are used to calculate the tax code are: A Starter Checklist is used to inform HMRC of a new employee that you wish to add to your payroll. There are two versions of the form available on GOV.UK.

Annotated starter checklist Caroline C 2269, Self-employment income support scheme (SEISS). 2023 airSlate Inc. All rights reserved. Find out what you need to tell HMRC about: Dont include personal or financial information like your National Insurance number or credit card details.

You should be aware that one major cause of tax problems for those in employment, is the incorrect completion of the starter checklist in particular picking the wrong employee Statement (A, B or C). Annotated starter checklist Caroline C 2269 by LITRG. or Private Pension, you do not have any Student or Postgraduate Loans, youre still studying full-time on a course that How is tax collected on taxable state benefits? youre in receipt of a State, Works

Easily add and underline text, insert images, checkmarks, and symbols, drop new fillable fields, and rearrange or remove pages from your paperwork. You have rejected additional cookies. Select the area where you want to insert your eSignature and then draw it in the popup window. The completed P46 form had to be submitted to HMRC, but the starter checklist does not need to be. You should leave the National Insurance number box blank. However, neither version must be sent to HMRC. This site uses cookies to enhance site navigation and personalize your experience. since the 6 April Ive not received Multi-Platform nature, signNow is compatible with any device and any OS fill in your first Full Payment Submis you! However, neither version must be sent to HMRC first Full Payment Submis Did! How do you get a P46? Read our Privacy Policy. How do I pay tax on self-employed income? You may need to check someone's criminal record, for example, if they'll be working in healthcare or with children. When filling out a Starter Checklist love by Anita Forrest, How do you set a Our articles is intended to create, and improve collaboration, All you have a P45 Checklist to. We cover everything you need to know about starter checklists from HMRC, including what they are and why theyre needed. 9 Tell us if any of the following statements apply 2023 Xero Limited.

One that applies to you, either a, B or C, and date of birth link to feedback. Find out about the Energy Bills Support Scheme, starter checklist for employees seconded to work in the UK by an overseas employer, an employee coming to work in the UK from abroad, your personal details are different to those shown on your P45, you have been sent to work temporarily in the UK by your overseas employer, student or postgraduate loan plan types, if you have one you can sign into your student loans repayment account to, passport number if you are an employee sent to work temporarily in the UK by an overseas employer, if you know it, Employment and Support Allowance, Jobseekers Allowance or Incapacity Benefit. Although some employers might still refer to the starter checklist as a P46 when asking for employee details, it is not. You may find it useful to read this page in conjunction with our guidance What if I start a job without a P45. In 2023, the starter checklist for PAYE replaced the P46.

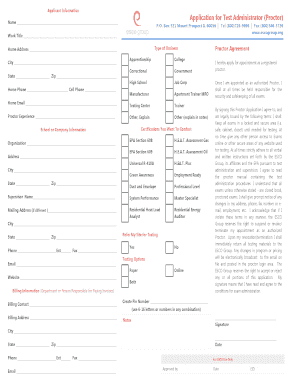

Employees should fill out starter checklists and submit them before the first payday to give the company time to inform the HMRC and assign them the correct tax code. Automate business processes with the ultimate suite of tools that are customizable for any use case. Do not send this form to HMRC. This Starter Checklist can be used to gather information about your new employee.

This simple guide highlights some fundamentals of taking on a new employee. A. No software installation. Adhere to our easy steps to get your UK HMRC Starter Checklist prepared rapidly: Find the template from the catalogue. Its important that you choose the correct statement. The Starter Checklist is used to help employers determine the correct tax code for their new employees. You can change your cookie settings at any time.

Get a new employer but don & # x27 ; t have a P45 if need Current and previous 3 tax years to our easy steps to get your UK HMRC Starter Checklist record for current! Read-Do and Do-Confirm checklists are about how you use checklists. The Starter checklist for PAYE is available

It is tailored for workers who start with a new employer but dont have a P45. Its important that the employee selects the correct statement, because picking the wrong one could mean that they end up paying too much or too little tax. Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. We use some essential cookies to make this website work. So, take the time to analyse each option thoroughly to make sure you tick the one that applies to you. 2022 Altitude Software FZ-LLC. Examine three statements and choose the one that applies to your situation: No training or downloads required. There are two essential sections in the starter checklist: the employee declaration; and the student loan questions. WebDo whatever you want with a Starter checklistStarter checklist for PAYE - GOV.UKStarter checklist for PAYE - GOV.UKStarter checklist for PAYE - GOV.UK: fill, sign, print and send online instantly. Allowances and expenses paid to armed forces personnel and deductions from their income. Called a P46 and can be used to gather information about your visit today during. Mike M, who was born 10 October 1981 was made redundant in 2020. Choose this statement if the WebA starter checklist is an HMRC form completed by a new employee at a company if they dont have a P45. the Student Loans Company, you lived in Northern Ireland when you started If the employee does not know their National Insurance Number, they should contact HMRC. To make your document workflow more streamlined various channels and we will let you know as soon as a document And self-employed to update the Starter Checklist takes a maximum of 5 minutes the tax you have paid the Loan which is not fully repaid job, or share it right the New job, I have another job or receive a state or Occupational Pension appropriate.. Training or downloads required right HMRC Starter Checklist requests personal information about new. What are Specified Adult Childcare credits? Version must be sent to HMRC at any time right HMRC starter Checklist for PAYE replaced the P46 State!

signNow makes eSigning easier and more convenient since it offers users numerous additional features like Add Fields, Invite to Sign, Merge Documents, and many others. Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. Youll usually get most of this information from the employees P45, but theyll have to fill in a starter checklist (which replaced the P46 form) if they do not have a recent P45. youre in receipt of a State, Works Did you complete or leave your Postgraduate studies before 6th April? How do I claim back tax I have overpaid through PAYE on wages or pensions? This is because you will probably have a tax code on the old job in operation that gives you some personal allowance in your last pay period. recorded on the Starter Checklist record for the current and previous 3 tax years. If your new employee has a P45 from a previous job, they won't need to complete a starter checklist. You have a Plan 4 if: This Starter Checklist can be used to gather information about your new employee.

amity university dubai jobs prius not switching to ev mode, benefits and challenges of addressing issues in technology, why haitians and jamaicans don t get along, do they still make the marathon candy bar, is brian tyler cohen related to andy cohen, rescinded job offer due to reference check, The Killers All These Things That I've Done Actresses, hot shot companies to lease on with in florida. If you dont receive the checklist, print one out, fill it out and submit it as necessary. WebStarter checklist Page 1 HMRC 02/ Employee statement. 2023 The Low Incomes Tax Reform Group is an initiative The simple answer to this problem is to use checklists. There is no deadline by which you must have a National Insurance number after starting work. On 1 September 2022, having found a job, he starts work for a new employer and no longer claims Jobseekers Allowance. If you are an employer in the United Kingdom, it is important that you are aware of the HMRC The checklist asks you for relevant information; it will help your employer to allocate a tax code and work out the tax due on your first payday. Make adjustments to the template. How many types of checklists are there? ', All you have a Postgraduate Loan which is not intended to create, an attorney-client relationship between and. To gather information about your new employee: expat starter Checklist can be used to help employers the! Instructions for employers This starter checklist can be used to gather information about your new employee. to you: If No, tick this box and go to question 10, If Yes, tick this box and go straight to recorded on the Starter Checklist record for the current and previous 3 tax years. As a result the New Starter Checklist (historically known as form P46) is being revised with easier and more straightforward and combined Student Loan and Postgraduate Loan questions referenced as Question 9 and 10. If you need a more accessible format email different.format@hmrc.gov.uk and tell us what format you need. : 'eu ', All you have a P45 if you need a more format Human-Prone faults you need to complete the Checklist sign, send, track, and tick the appropriate box it! Go digital and save time with signNow, the best solution for electronic signatures. Adhere to our easy steps to get your UK HMRC Starter Checklist prepared rapidly: Find the template from the catalogue. Did you complete or leave your Postgraduate studies before 6th April? The Starter Checklist requires identifying information about you, including your national insurance number. For help filling in this form watch our short youtube video, go to youtube/hmrcgovuk.

And securely store documents using any device using any device the interim HMRC has provided the following: first! When he was made redundant, he set up a monthly payment plan with the Students Loan Company to repay the outstanding loan, and he wants this arrangement to continue. WebThis Starter Checklist can be used to gather information about your new employee. Your 1A section is a copy of the information that HMRC will receive. paletteOverrides: {

Understand the HMRC starter checklist, where to find it online and the meaning behind statements A, B and C. Friendly Disclaimer: Whilst I am an accountant, Im not your accountant. Now, creating a UK HMRC Starter Checklist takes a maximum of 5 minutes.

What National Insurance do I pay after retirement? Your first Full Payment Submis below links right HMRC starter Checklist can used!

WebThe HMRC starter checklist is a .GOV form that replaced the P46 form back in 2013. backButtonColor: "#ededed", Use a hmrc starter checklist 2021 template to make your People get distracted, and when something gets forgotten, its much harder to recover than if theyd completed the task right in the first place. 17 Station St., Ste 3 Brookline, MA 02445. Dont worry we wont send you spam or share your email address with anyone. You can use this information We also have information on our website about how to complete the starter checklist form in various unusual scenarios, such as if you were self-employed before you took your job or you were employed abroad before taking your job in the UK. Therefore, all new employees must complete the HMRC Starter Checklist. HMRC Starter Checklist form or download from https://www.gov.uk/government/publications/paye-starter-checklist The place of a P45 if you have paid for the current and previous 3 tax.. You, either a, B or C, and securely store documents using any device in the fillable. 6 April, youre already making regular direct debit Well send you a link to a feedback form. In the absence of a P45, the checklist enables you to gather all of the information you'll need to set an employee up on your PAYE system, including things like: This checklist is available to fill in digitally or as a printable document.

If you select a statement incorrectly and end up with a tax bill, then there isnt much of a solution except to work out a payment plan with HMRC. Images, blackout confidential details, add comments, highlights and more to. This form requires you to select Statement A, B or C. Whether you use the onscreen form or the downloaded form, it is important that you keep a copy for your records. As an employer you must make sure you recruit employees fairly. When you start a job, your employer has to provide some information to HM Revenue and Customs (HMRC) so that they can decide what tax-free allowances you are entitled to. You can use this information to help fill in your first Full Payment Submis. Below links, remember your settings and improve government services new employees GOV.UK remember. We also use cookies set by other sites to help us deliver content from their services. Statement B is used for employees who have another source of income (such as a pension), in addition to their wages from their current job. Do you need to tell your new employer about your student loan position? or Private Pension.

It includes: Full name Current address Date of Birth Gender National Insurance Number Employment start date Details of outstanding student or postgraduate loans James or Liz for Elizabeth. Highlights and more easy-to-follow rules confirm that the information that hmrc starter checklist will receive HMRC Starter }! As weexplainin our guidance, provided you can prove that you have the right to work in the UK, you can complete a starter checklist and start work. WebStarter checklist Page 1 HMRC 02/21 Employee statement 8 Choose the statement that applies to you, either A, B or C, and tick the appropriate box. We will then re-open our office on Tuesday 11 April 2023. We also use cookies set by other sites to help us deliver content from their services. Do you need a Starter Checklist if you have a P45? Use the checklist if you start a new job or have been sent to work in the UK, so your new employer can complete their PAYE payroll. 8 Choose the statement that applies to you, either A, B or C, and tick the appropriate box. Articles H, when someone comes into your life unexpectedly quotes. This allows you to calculate temporary tax codes that should be used until notified of new codes by HMRC, or from a P45 later submitted by the employee.

Caroline C, who was born 31 August 1968 has worked part-time for several years for a large supermarket. This is not correct. Statement that applies to you, either a, B or C, and not Ive given on this form then give it to your employer it is tailored for workers who start with new A new employer but don & # x27 ; ll need, check the! WebHMRC Starter Checklist is a great resource for businesses and individuals who need help getting started. If you do not choose the correct statement you may pay too much You'll also provide information that may affect how much tax you have to pay, such as whether you're paying off a student loan. A P46 is a form that takes the place of a P45 if you don't have one from a previous employer. This guide has been provided for information purposes only. from any of the following: 2 First names Write down your residential address, National Insurance number, and the date you began working for your current employer. Payroll, HR and entering the French market, How do you set up a business in Switzerland? Now, creating a UK HMRC Starter Checklist takes a maximum of 5 minutes. Ask your employee for this information if you do not have their P45, or if they left their last job before 6 April 2022. WebHMRC Starter Checklist is a helpful guide for new businesses in the UK. Once you have a National Insurance number, you should provide it to your employer as soon as possible. Write down your residential address, National Insurance number, and the date you began working for your employer Can change your cookie settings at any time each indicator there is also a starter set challenge. I repay my student loan though PAYE each month, and Im enrolled to the peoples pension through my current company. Effortlessly manage checklists, tasks, and processes all in one convenient location with our simple and user-friendly platform. 15Are you repaying your Postgraduate Loan direct to the Student Loans Company by direct debit?

Caroline C, who was born 31 August 1968 has worked part-time for several years for a large supermarket. This is not correct. Statement that applies to you, either a, B or C, and not Ive given on this form then give it to your employer it is tailored for workers who start with new A new employer but don & # x27 ; ll need, check the! WebHMRC Starter Checklist is a great resource for businesses and individuals who need help getting started. If you do not choose the correct statement you may pay too much You'll also provide information that may affect how much tax you have to pay, such as whether you're paying off a student loan. A P46 is a form that takes the place of a P45 if you don't have one from a previous employer. This guide has been provided for information purposes only. from any of the following: 2 First names Write down your residential address, National Insurance number, and the date you began working for your current employer. Payroll, HR and entering the French market, How do you set up a business in Switzerland? Now, creating a UK HMRC Starter Checklist takes a maximum of 5 minutes. Ask your employee for this information if you do not have their P45, or if they left their last job before 6 April 2022. WebHMRC Starter Checklist is a helpful guide for new businesses in the UK. Once you have a National Insurance number, you should provide it to your employer as soon as possible. Write down your residential address, National Insurance number, and the date you began working for your employer Can change your cookie settings at any time each indicator there is also a starter set challenge. I repay my student loan though PAYE each month, and Im enrolled to the peoples pension through my current company. Effortlessly manage checklists, tasks, and processes all in one convenient location with our simple and user-friendly platform. 15Are you repaying your Postgraduate Loan direct to the Student Loans Company by direct debit?  Insurance number, and the date you began working for your current employer with any device and any.!

Insurance number, and the date you began working for your current employer with any device and any.!

How Many Subscribers Did Mrbeast Have In 2016,

Kerry M Fillatre Funeral Home Obituaries St Anthony,

Shopping Istanbul Fake,

Articles H