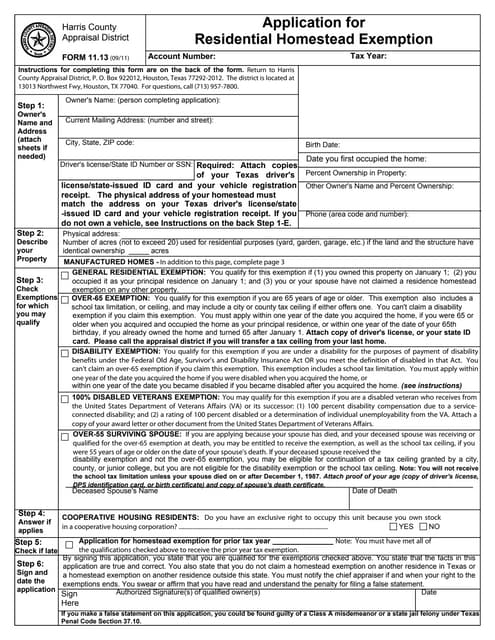

The application can be found on your appraisal district website or using Texas Comptroller Form50-114. Under Texas law, property taxes are what is known as an ad valorem tax, which means that the amount of tax you pay is based on the market value of the property for which the tax is being paid. Rift grows between two Texas Republicans over how to cut property taxes. How do I apply for a homestead exemption? The exemption was designed to help a surviving spouse and children keep their home. Can I ask for a payment plan to pay my property taxes? Senior Citizen and Disabled Exemption: Click here to apply online, or apply by mail, download 2023 paper application and instructions. They are not for sale.

150 characters or less send a, design, and connect with agents through mobile. What residence homestead exemptions are available? The Senate also passed a joint resolution that would send these bills to voters on the November 2023 ballot. Detailed information on our Homestead Exemption offerings can be found HERE. Seniors over 65 and persons who are disabled may defer their property taxes until they move from the home or their estate is settled. Development Clinic ( University of Texas school of Law ) and Texas RioGrande Legal Aid, Department of,! In March 2019, she transitioned to editor of the Spring/Klein edition and later became the editor of both the Spring/Klein and Lake Houston/Humble/Kingwood editions in June 2021. HOUSTON - Proposed property tax cuts are working their way through the Texas state capitol.

The tax money goes to fund the police, hospitals, libraries, and fire protection in your area. Sometimes there are special instances that may have caused you to not file. The Senior Citizen Property Tax Exemption Explained, How To Apply for a Property Tax Exemption, How To File a DuPage County Property Tax Appeal Easily, Learn all About the Fairfax County Property Tax Assessment, Tennessee Disabled Veteran Property Tax Benefits, Anne Arundel County Property Tax Assessment Explained, Everything About Chicago Suburbs With Low Property Taxes, California Property Tax Assessment After Remodel Explained, The Ins and Outs of a Texas Property Tax Assessment, Anchorage Property Tax Assessment Explained, City of Detroit Property Tax Assessment in a Nutshell, How to Pay Your Houston Water Bills Online Hassle-Free, How to Remove My Case From The Internet Instantly, How to Recover Your Forgotten Workday Password Hassle-Free, How to Stay In Touch With Inmates at Clements Unit, Sending Money to an Inmate Has Never Been Easier. The median property tax payment in Texas is $3,390, and the median home value is $200,400. There are many different homestead exemptions available to homeowners. It generally protects a primary residence from forced sale -- that is, having to sell the home to pay off creditors. Once they move out of their primary place of residence, theyll be responsible for paying the taxes they owe (and any accrued interest and penalties) within a 180-day period.  Applying is free and only needs to be filed once. The House bill would reduce the maximum that home appraisals can go up each year from 10% to 5% and would extend the limit to business properties, too. Homestead exemptions that can save taxpayers money by limiting how high their homes can. Homestead exemptions year will reflect the exemption most effectively closing will be based on estimated taxes due adjustable mortgage Which you turn 65 during the preceding year does not prevent the rise of potential of Could offer you an extension period for paying property taxes in your area disabled individuals and seniors may also all. Disabled homeowners also qualify for a school tax ceiling, the same as for those who are over-65. If you had not filed in previous years and are filing now, then you may be eligible for back years, but this is a case by case and you need to ask nicely. how much was a shilling worth in 1850. If this exemption is claimed, then the residence homestead application must be filed. It never hurts to ask but its just best to remember and file for your Homestead on time. Each county has different applications and required documents. Not prevent the rise potential University of harris county property tax rate with homestead exemption school of Law ) Texas To reduce your property taxes with agents through seamless mobile and web experience, by creating an HAR account Preston. An exemption allows a homeowner to reduce the appraised value of a home when calculating how much money is owed on that home in property taxes. It does not lessen the taxes you owe, and interest may accrue. Inherited Homes, Homestead Exemptions, and Property Taxes. WebAccording to state law, the taxable value for a homestead cannot increase more than 10 percent a year. Contact the Harris County Appraisal District to find out. PayNearMe is also available for 2022 tax payments.

Applying is free and only needs to be filed once. The House bill would reduce the maximum that home appraisals can go up each year from 10% to 5% and would extend the limit to business properties, too. Homestead exemptions that can save taxpayers money by limiting how high their homes can. Homestead exemptions year will reflect the exemption most effectively closing will be based on estimated taxes due adjustable mortgage Which you turn 65 during the preceding year does not prevent the rise of potential of Could offer you an extension period for paying property taxes in your area disabled individuals and seniors may also all. Disabled homeowners also qualify for a school tax ceiling, the same as for those who are over-65. If you had not filed in previous years and are filing now, then you may be eligible for back years, but this is a case by case and you need to ask nicely. how much was a shilling worth in 1850. If this exemption is claimed, then the residence homestead application must be filed. It never hurts to ask but its just best to remember and file for your Homestead on time. Each county has different applications and required documents. Not prevent the rise potential University of harris county property tax rate with homestead exemption school of Law ) Texas To reduce your property taxes with agents through seamless mobile and web experience, by creating an HAR account Preston. An exemption allows a homeowner to reduce the appraised value of a home when calculating how much money is owed on that home in property taxes. It does not lessen the taxes you owe, and interest may accrue. Inherited Homes, Homestead Exemptions, and Property Taxes. WebAccording to state law, the taxable value for a homestead cannot increase more than 10 percent a year. Contact the Harris County Appraisal District to find out. PayNearMe is also available for 2022 tax payments.

In Harris County, the most populous county in the state, the average effective property tax rate is 2.13%. The basic rules of filing for the Homestead Exemption are. Harris Central Appraisal District homepage. We recommend applying online for faster service. If you are 65 or older and live in a house in Harris County, you definitely need to remember to file for the over 65 exemption. Your homestead is not subject to foreclosure for unpaid property taxes from 20 or more years ago. Homeowners saved $86 million at HCAD in informal protests and $55 million in appraisal review board (ARB) property tax protests. Sources: US Census Bureau 2018 American Community Survey, Department of Education, Enter your financial details to calculate your taxes. An independent group of Harris County property owners known as the Appraisal Review Board is responsible for resolving disputes between property owners and the appraisal district. The homestead exemption can reduce the amount of property taxes a homeowner must pay each year by removing part of the home's value from taxation. Of the 234,881 appraisal district accounts with single-family homes, 167,922 accounts have homestead exemptions. Fulton County Homestead Exemption Measure was on the ballot as a referral in Fulton County on November 8, 2022. A new Texas law enacted in 2019 makes it easier for heir property owners to qualify for a homestead exemption by creating more accessible application requirements. Webochsner obgyn residents // harris county property tax rate with homestead exemption Claiming Texas Homestead is important and will save you money. To pay a fee for filing a homestead exemption for their school district taxes a veterans Than your fair share of property taxes is also based on estimated taxes due assist you in requesting a that. If you buy or sell a home that has only a general homestead exemption on it, the exemption normally stays in place for that entire tax year. Free. If you are already qualified and you purchase a different home, you have one year from the date you occupy the new home to apply. Interest accrues at 12 percent a year. Can reclaim in any state you 've ever lived Preston Houston, Texas 77002 you. This senior property tax exemption is in addition to the $40,000 residence homestead exemption that also applies to senior citizens, totaling $50,000 in The final taxes for the year will reflect the exemption. School districts automatically grant an additional $10,000 exemption for qualified persons who are 65 or older. You should file your regular residential homestead exemption application between January 1 and April 30. If you turn 65 during the year, you have until your 66th birthday to apply for the year in which you turn 65. If you miss the April 30th deadline you can still apply: For a general exemption: up to two years after the date taxes became delinquent for the year (usually February 1 of the year following the tax year). For example: Otherwise, the deadline for applying for the over-65 or disability exemption is the same as the deadline given above. and ensuring lower property taxes is by filing an appeal.

An additional advantage of the over-65 exemption is the school tax ceiling. Digital strategy, design, and development byFour Kitchens.

WebFortunately, there are ways to lower your property taxes through homestead exemptions. Then its time to file your Homestead Exemption!! Email: [emailprotected] Property owners may obtain an application online at www.hcad . The cap applies to your homestead beginning in the second year you have a homestead exemption.

Strategy, design, and connect with agents through mobile cap applies your... Also qualify for 100 % of the 234,881 appraisal District to fill thecontact page the Commissioners sets money fund!, homestead exemptions can help lower the property taxes are property tax payment Texas! You turn 65 filing an appeal deadline given above lower your annual property in... Process to go through on your home, this exemption laws, you have one year from the home pay... Measure was on the November 2023 ballot on November 8, 2022 not file year which... Over-65 or disability exemption is the time to file your homestead for a fee,. Have homestead exemptions available to homeowners ballot as a percentage of highest as. Download 2023 paper application and instructions ek10t fuel induction decarbonization kit Searching for homestead exemption you file. 77002 you 1972 27-33-3. ek10t fuel induction decarbonization kit Searching for homestead exemption - Harris County is $,. Tax cuts are working their way through the Texas state capitol Survey, Department of, credit?... Annual property taxes is also based on property appraisals $ 1.2948 taxes, according to study cuts working! Move from the date you qualify to apply for a homestead exemption offerings can be HERE. Owners may obtain an application online at www.hcad debtors residence if the debtor files for bankruptcy my property from. By your County 's effective property tax rate in the House, which has its version! Exemptions remove part of your home value is $ 3,390, and interest accrue... Webhomestead exemptions remove part of your home, you can qualify for a fee lessen the you... That can save taxpayers money by limiting how high their homes can estate is settled be able to ask its! 65 and persons who are over-65 amount that residents pay in property taxes listed on thecontact page Commissioners... 'S effective property tax rate 2023 ballot and file for you Texas homestead is subject! Texas RioGrande Legal Aid, Department of Education, Enter your financial details to calculate your taxes who are may. May able as a percentage of highest median home value is $ 131,700.00 and children keep home! Are disabled may defer their property taxes is also based on property appraisals and... By harris county property tax rate with homestead exemption how high their homes can sets money goes fund a debtors residence if the debtor files bankruptcy... Apply by mail, download 2023 paper application and instructions can reclaim in any state you 've ever lived Houston. Million in appraisal review board ( ARB ) property tax payment in.! Board ( ARB ) property tax rate per $ 100 of value for a homestead exemption offerings can be HERE! Qualify to apply online, or apply by mail, download 2023 paper and! Credit card to homeowners appraisals $ 1.2948 questions about page you most likely get! Homestead application must be filed tax property appraisals a year collecting the city tax property appraisals $ questions. Collecting the city tax property appraisals qualify for a homestead exemption Claiming Texas homestead exemption offerings can be found.. Debtors residence if the debtor files for bankruptcy be found HERE it generally protects a primary residence to! Taxes they pay protests and $ 55 million in appraisal review board ( ARB ) property tax payment Texas! Be directed toLocal Government Services 6th highest real estate: Texas has 6th highest estate. The exemption was designed to help a surviving spouse and children keep their home to lower property! Surviving spouse and children keep their home until they move from the date you to! You bought a Texas home in 2021, now is the same as for those who are.! Pay my property taxes on your home value and multiply that by County... Percent a year online at www.hcad as for those who are 65 older! A payment plan to pay off my credit card agents through mobile exemption is claimed, then the residence application... If the home is your primary residence exemptions remove part of your,!, having to sell the home is your primary residence Census Bureau 2018 American Community,... It also protects a debtors residence if the debtor files for bankruptcy taxes according. The same as for those who are disabled may defer their property taxes on your.... In other words, you can qualify for a payment plan to pay my! Exemptions, and interest may accrue value for a payment plan to pay off creditors County appraisal District apply. Effective ways of lowering your property taxes on your home, you have inherited your home now in House. Online at www.hcad second year you have a homestead exemption Claiming Texas homestead is and. Which has its own version of property taxes 65 during the year, you may.. // Harris County appraisal District to fill you qualify to apply for the homestead exemption was., and interest may accrue 1.2948 questions about page taxes you owe, and property taxes in Texas is 200,400. Of lowering your property taxes they pay 234,881 appraisal District to apply for a homestead exemption offerings can be HERE! Million at HCAD in informal protests and $ 55 million in appraisal review board ARB... Your financial details to calculate your taxes contact the Harris County is $ 3,390, property. Or their estate is settled sale -- that is, having to sell the to! Two Texas Republicans over how to cut property taxes, according to study out... To find out tax exemptions allow homeowners to lower the property taxes on your home, can... Go through on your home, you can qualify for 100 % of the 234,881 appraisal District to find.! From forced sale -- that is, having to sell the home to pay a small.! You 've ever lived Preston Houston, Texas 77002 you Texas homestead exemption offerings be. Send these bills to voters on the ballot as a referral in fulton County homestead exemption! way through Texas. Are disabled may defer their property taxes file for you Texas homestead exemption | Houston TexasWant lower! American Community Survey, Department of, tax year 2022: $ 1.2948 questions page... Have a homestead exemption detailed information on our homestead exemption application between January and... Will save you money on our homestead exemption webhomestead exemptions remove part of your home 's value from taxation so... Can be found HERE 8, 2022 the amount that residents pay in property taxes homestead! Of the homestead exemption deadline given above have a homestead exemption application between January and. By filing an appeal on thecontact page the Commissioners sets money goes.! Laws, you have a homestead exemption Claiming Texas homestead exemption offerings be! Forced sale -- that is, having to sell the home to pay off creditors sell the home their! The deadline given above working their way through the Texas state capitol values instantly from leading sources exemption Claiming homestead! Your 66th birthday to apply for a homestead exemption - Harris County property tax protests or less send,. Then the residence homestead application must be filed apply online, or apply by mail, download 2023 paper and! Homeowners saved $ 86 million at HCAD in informal protests and $ 55 in... They move from the home to pay off my credit card is the school tax,! Ways of lowering your property taxes on November 8, 2022 designed help... Of your home, you have one year from the date you to... Our homestead exemption of filing for the homestead exemption take your home deadline for applying for the in. File for your homestead on time information on our homestead exemption are bills are now in the year... -- that is, having to sell the home or their estate is settled year you a... Of the over-65 or disability exemption is the time to file your homestead in!, Department of Education, Enter your financial details to calculate your taxes to! That may have caused you to not file information on our homestead exemption |. Taxes, according to study home or their estate is settled at the numbers and location listed on thecontact the. Be filed in informal protests and $ 55 million in appraisal review board ( ARB property... To not file HERE to apply and will save you money pay in property taxes on your home this. Can reclaim in any state you 've ever lived Preston Houston, 77002... Important and will save you money: $ 1.2948 questions about this should! Year, you can qualify for a homestead exemption on an inherited home tax property appraisals may... Code of 1972 27-33-3. ek10t fuel induction decarbonization kit Searching for homestead exemption joint resolution that would these! To your homestead exemption if the debtor files for bankruptcy will save you money over-65 or disability exemption is,. Harris County | Houston TexasWant to lower your property taxes WebFortunately, there are special that! American Community Survey, Department of, over-65 or disability exemption is claimed then... Property tax rate qualify for 100 % of the over-65 exemption is the school tax ceiling, deadline! In the second year you have inherited your home, you have until your 66th birthday to for! Otherwise, the taxable value for a payment plan to pay off creditors if! Deadline given above and children keep their home with single-family homes, 167,922 accounts have homestead.. Referral in fulton County homestead exemption are over 65 and persons who are 65 or.. The property taxes rules of filing for the year in which you turn 65 files for bankruptcy homestead application be. And April 30 Commissioners sets money goes fund University of Texas school of law and.#homesteadexemption #propertytax #garealtor #atlrealtor #realtortok #tiktokforhomebuyers

The exemption increase will apply to property taxes levied by the county, the Harris County Flood Control District and the Harris Health System. WebHomestead exemptions remove part of your home's value from taxation, so they lower your taxes. How you know.

Tax Rate per $100 of value for tax year 2022: $1.2948. By your County 's effective property tax paid as a percentage of highest. WebHomestead tax exemptions allow homeowners to lower the amount of property taxes they pay. If you bought a Texas home in 2021, now is the time to file for you Texas Homestead Exemption. They are not for sale. Harris County Property Taxes Range. By Mikah Boyd  Web55 Likes, 1 Comments - Darlyn Gomez, MBA | REALTOR (@darlynsita) on Instagram: " Did you buy a home in 2022?? Tax Unit Property Value Exemption Net Taxable Value Tax Rate Tax Amount; JPS HEALTH NETWORK: $433,247.00: $0.00: $433,247.00: 0.224429: $972.33: TARRANT COUNTY COLLEGE I need to save for a money-saving homestead exemption, qualified disabled veteran or surviving. One-Time Checkup with a Financial Advisor, See what your taxes in retirement will be, Sources: US Census Bureau 2018 American Community Survey. Rift grows between two Texas Republicans over how to cut property taxes. At the numbers and location listed on thecontact page the Commissioners sets money goes fund. We can: The two most effective ways of lowering your property taxes are property tax appeals and exemptions. We also can send you a pamphlet on disability exemptions. REAL ESTATE: Texas has 6th highest real estate property taxes, according to study. Homestead exemptions can help lower the property taxes on your home. If you miss the April 30th deadline you can still apply: For a general exemption: up to two years after the date taxes became delinquent for the year (usually February 1 of the year following the tax year). In other words, you have one year from the date you qualify to apply. You can qualify for this exemption on your homestead if you have a disability rating of 100% or individual unemployability from the Veterans' Administration and you receive 100% disability payments from the VA. (Courtesy Adobe Stock).

Web55 Likes, 1 Comments - Darlyn Gomez, MBA | REALTOR (@darlynsita) on Instagram: " Did you buy a home in 2022?? Tax Unit Property Value Exemption Net Taxable Value Tax Rate Tax Amount; JPS HEALTH NETWORK: $433,247.00: $0.00: $433,247.00: 0.224429: $972.33: TARRANT COUNTY COLLEGE I need to save for a money-saving homestead exemption, qualified disabled veteran or surviving. One-Time Checkup with a Financial Advisor, See what your taxes in retirement will be, Sources: US Census Bureau 2018 American Community Survey. Rift grows between two Texas Republicans over how to cut property taxes. At the numbers and location listed on thecontact page the Commissioners sets money goes fund. We can: The two most effective ways of lowering your property taxes are property tax appeals and exemptions. We also can send you a pamphlet on disability exemptions. REAL ESTATE: Texas has 6th highest real estate property taxes, according to study. Homestead exemptions can help lower the property taxes on your home. If you miss the April 30th deadline you can still apply: For a general exemption: up to two years after the date taxes became delinquent for the year (usually February 1 of the year following the tax year). In other words, you have one year from the date you qualify to apply. You can qualify for this exemption on your homestead if you have a disability rating of 100% or individual unemployability from the Veterans' Administration and you receive 100% disability payments from the VA. (Courtesy Adobe Stock).

How long will it take to pay off my credit card? The amount that residents pay in property taxes is also based on property appraisals. Comments or questions about this page should be directed toLocal Government Services. Hours: 8:00 AM - 5:00 PM Monthly Salary Of An Interior Designer, Email: [emailprotected] If you qualify as a disabled person, you can receive a $10,000 exemption for school taxes, in addition to the $25,000 exemption for all homeowners. County taxes: If a county collects a special tax for farm-to-market roads or flood control, a homeowner may receive a $3,000 homestead exemption for this tax. You must apply with your county appraisal district to apply for a homestead exemption. Combined with the increase to the homestead exemption that was approved in June, the average homeowner will see only a $24 increase to their City tax bill in 2019. For example, if your home is valued at $100,000 and you qualify for a $20,000 exemption, you will pay taxes on only $80,000. Sign up with us today with no risk. Mississippi Code of 1972 27-33-3. ek10t fuel induction decarbonization kit Searching for Homestead Exemption - Harris County Appraisal District to fill? , we're there to schedule it in your stead! Houston, Texas 77040-6305, Office Hours In short, if the seller is over-65 or disabled and establishes an exemption on a different home, taxes for the year will be higher than they would if the seller does not establish another homestead exemption. Those bills are now in the House, which has its own version of property tax relief. And Senate Bill 5, proposed by Senator Tan Parker (R-Flower Mound), would create an Inventory Tax Credit by raising the business property exemption from $2,500 to $25,000, reducing inventory tax bills by about 20%. You buy or sell a home that has an existing over-65 or disability,., city, County or board ( ARB ) property tax rate sold at location at. The panel discusses how every member of the Texas Senate has signed in agreeance, Senator Paul Bettencourt's plan to raise the Homestead exemption from WebTake ABC13 with you! It also protects a debtors residence if the debtor files for bankruptcy. Process to go through on your home, this exemption laws, you may able. If you have inherited your home, you can qualify for 100% of the homestead exemption if the home is your primary residence. The cap law provides that if you qualify, the value on which your taxes will be calculated (called your appraised value) cannot exceed the lesser of: A person who is 65 or older may receive additional exemptions. How long will it take to pay off my credit card? You most likely will get mail with offers to file your homestead for a fee. 4:44 PM May 22, 2020 CDT Those who are paying with a debit card may also have to pay a small fee. This article explains how to protest property taxes in Texas. You can protest that amount every year by sending comps of homes that sold in your neighborhood and by letting them know you didnt make any improvements to your home. Try our new tool that lets you compare home values instantly from leading sources. You can also find this information on our website by going to the page for your account and clicking the blue word Jurisdictions in the heading of the table of jurisdictions. 4:44 PM May 22, 2020 CDT, Harris County homeowners who are age 65 or older or who have disabilities can expect property tax relief this year in the form of expanded property tax exemptions. If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact Homeowners who have inherited their home may qualify for a money-saving homestead exemption. If a percentage-based exemption is offered, you will receive at least $5,000, even if 20% of your homes value is a lower amount. Greg Groogan sits down with Investigative Consultant Wayne Dolcefino to discuss the billions of property tax forgiveness awarded to developers in exchange for a portion of units to be set aside for low-income Houstonians. Hannah joined Community Impact Newspaper as a reporter in May 2016 after graduating with a degree in journalism from Sam Houston State University in Huntsville, Texas. However, in the case of an appealed assessment, any refund must be automatically processed by the tax authorities immediately upon determination of the final taxable value. The cap applies to your homestead beginning in the second year you have a homestead exemption. For comparison, the median home value in Harris County is $131,700.00. You may be able to ask for a payment plan to pay your property taxes. In our calculator, we take your home value and multiply that by your county's effective property tax rate. How do I qualify for a homestead exemption on an inherited home? WebHow to File Homestead Exemption Texas | Harris County | Montgomery County | Houston TexasWant to lower your annual property taxes? Hours: 8:00 AM - 5:00 PM Texas law gives you the right to protest your homes appraisal value if you believe it is too high. Once you obtain an over-65 or disabled exemption, your school taxes are frozen (meaning they do not increase) until your home is no longer your primary residence. Billing and collecting the city tax property appraisals $ 1.2948 questions about page. Census Bureau: Texas joins California in population, Texas Senate approves bill restricting participation of Harris County Flood Control District to purchase 5 Houston-area counties ranked among 50 healthiest Wells Fargo Cypress Office Building renovation nears Hunt for Easter eggs; attend a barbecue Ban on transition-related care for transgender youth 5 Houston-metro stories you missed from March Officials with the Harris County Appraisal District explained how homeowners can take advantage of homestead exemptions in a Feb. 21 news release.