WebThe Thrift Savings Plan (TSP) is a retirement savings and investment plan for Federal employees and members of the uniformed services, including the Ready Reserve. WebCanopee global > Blogs > Uncategorized > federal reserve system pension plan formula. The following explains the treatment of the System Plan as a single employer plan reflected on the FRBNY's financial statements. The CFPB employee participation in the System plan does not change the single-employer accounting treatment for the System plan.5. Andrew Herrig is a finance expert and money nerd and the founder of Wealthy Nickel, where he writes about personal finance, side hustles, and entrepreneurship. WebThe Final Pay plan uses a multiplier % that is 2% times the years of creditable service. The Board will contribute to your continuing education by offering assistance with tuition, required books, and certain academic fees. Any internal estimation of the funded status or funding requirement by participating employer is not considered relevant to the treatment as a single-employer plan. When FASB ASC Topic 715-30 was implemented, employer accounting for pension benefits expanded to reflect the employer's financial interest for providing pension benefits net of assets held in separate pension entities. One of the main benefits of working for the government is that they still offer a pension AND contribute to a defined-contribution plan like the Thrift Savings Plan.

As of 2015, the Feds retirement plan aims to put 50% of its portfolio in fixed income investments, meaning bonds; 47% in U.S. and international stocks; and about 3% in private equity and real estate. While the latter 2 components contribute to your overall retirement, the main goal of this article is to help you understand and calculate the FERS Basic Benefit (your pension). This produces discount rates of close to 8 percent, which dramatically reduces the measured value of pension liabilities and similarly cuts the contributions that state and local governments set aside to fund those liabilities. Are you retiring at age 62 or older with 5 19 years of service?

Your High-3 average salary is, however, based on years of consecutive service.

But unlike state and local pensions, the Fed accounts for its costs honestly and funds its benefits responsibly. The Dodd-Frank Act specifically states that the System plan should continue to be administered as a single-employer plan and that the CFPB does not have responsibility or authority to make any plan amendments, administer an existing plan, or ensure the System plan complies with applicable laws. He has worked as a financial analyst and accountant in many aspects of the financial world. The annual Personal Benefits Statement can be found electronically through the Employee Personal Page (EPP), as well as being available in the Reporting Center (RPCT). State and local government employee pensions are in the news every day, with stories of excessive benefits, dodgy accounting and systemic underfunding. Post Mergers & Acquisitions (Regulatory Applications), Paycheck Protection Program Liquidity Facility. If you continue to see this message, contactez-nous l'adresse Were the Fed to use that approach, its pension liabilities would shrink to $7.96 billion and its funded ratio rise to 157 percent. enviando un correo electrnico a If you have any further questions, feel free to leave them in the comments! system. Do they know something about investments that the Feds economists dont know? She started working for the federal government at age 54 and knows she needs to work at least 5 years to earn a pension so thats what she does, planning to retire slightly above her MRA at age 59. Active duty pensions are calculated by multiplying the total years of service by a multiplier of 2.5% (High-3 plan). Although the Banks, BOG, and the OEB are not related through equity or other beneficial ownership, there is strong evidence that they are related parties for plan aggregation purposes. In addition, employees who carpool can park free at the Board. It covers most civilian Federal government employees, and provides a pension annuity after you retire from your job. We examine economic issues that deeply affect our communities. WebFedNow, the Federal Reserve's payment system, will facilitate real-time transactions for financial institutions of any size, 24 hours a day, 365 days a year. For federal employees who are a few years away from retirement or longer, the easiest way to project your High-3 will be to take your current salary and plug it into the formula above. Please review our Customer Relationship Summary (Form ADV Part 3) for important information about our services and fees. She wants to retire at age 65 so she can apply for Medicare and also start collecting social security benefits at the same time. Example 1 Bob wants to retire ASAP and head to the beach, Example 3 Michelle wants to retire early after a short government career. Yes, the annuity would last for the rest of your life, with survivor benefits for the spouse. The Board also offers two floating holidays each year. The cost of living adjustment (COLA) is based on the Consumer Price Index, and should generally fall in the 1-3% range. 5584(i)(1)(C)(v) This statement was included in the act for purposes of subsections (b), (c), (m), and (o) of section 414 of the Internal Revenue Code of 1986 (26 U.S.C. The Feds plan should take on risk for investment purposes and it does. Are you retiring at age 60 or older with 20+ years of service?

For example. Question: I am an DoD civilian who was deployed to Iraq in late 2009 thru late 2010. The rest of your life, or does it run out?

With 10 years of service you can retire at your MRA with reduced benefits. WebYour years of service and your pay determine your pension, based on a formula.

The Dodd-Frank Act refers to the Bureau as the "Bureau of Consumer Financial Protection." federal reserve system pension plan formula. State and local plans are taking additional investment risk because their accounting rules, unlike almost any other pension accounting system in the world, allow plans that take more risk to lower their contributions. You can always run through your own calculations, but its also a good idea to get a pension estimate done for you. day? The Board also provides limited health, dental, and vision benefits to domestic partners. In the interest of full disclosure for fedgazette readers, the Federal Reserve System offers a pension that has feet in both the new and the old pension worlds.

This time does not have to be consecutive, and often has breaks in between. Pooping Less Frequently To Save The Planet? Unlike the 401(k)s that most private sector workers receive, in a DB plan the sponsor promises employees a fixed, guaranteed benefit at retirement age, not a contribution to their 401(k) that can fluctuate with the ups and downs of the market. In most cases, if you participate in the FERS system during your employment you are also eligible to collect social security. Read more about active duty retirement on the OSD website.

Rather, its because GASB rules allow state and local pensions to discount their benefit liabilities at the interest rate the plan assumes it will earn on its investments. the Banks are the sole funding source for the BOG. Pension contributions - Amounts you or your employers on your behalf paid into funds. The Dodd-Frank Act also requires that the CFPB contribute funds for employees that have transferred from the Federal Reserve System to the CFPB (12 U.S.C. On the pro side, a generous defined benefit pension tends to lock employees into their jobs, since workers who quit mid-career can leave a hundreds of thousands of dollars in foregone pension benefits on the table. In order to calculate your FERS pension, you will need to know your creditable years of service as well as your High-3 average salary.

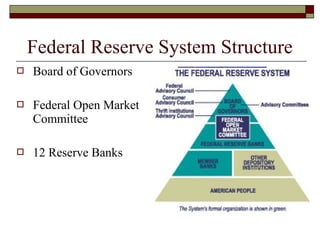

WebThe System Plan is a defined benefit pension plan that covers employees of the twelve Federal Reserve Banks (Banks), the Board of Governors (BOG), and the Office of Employee Benefits of the Federal Reserve Employee Benefits System (OEB). Caso continue recebendo esta mensagem, by doss Fri Dec 23, 2016 11:30 am, Post But I would recommend you contacting your HR department or someone at OPM.gov to get a definite answer. the nation with a safe, flexible, and stable monetary and financial And if you retire at age 62 or older with 20+ years of service, you get a slight bonus (1.1% multiplier vs. 1%): FERS Basic Annuity = High-3 Salary x Years of Service x 1.1%. Such a generous retirement plan may or may not make sense. Nor do Fed retirees receive annual adjustments based on investment returns, a common benefit among local and state pensions. I am 52, have 22 yrs total gov time, avg base+ locality is 50K/yr and am going to be offered 40K VERA/VSIP soon. Sick leave is granted each year at a constant rate and may be carried over without any limit. And public employee pensions in other countries treat their liabilities similarly, often discounting them at very low rates and putting a lot of money aside to fund them. Communications, Banking Applications & Legal Developments, Financial Stability Coordination & Actions, Financial Market Utilities & Infrastructures. Help ons Glassdoor te beschermen door te verifiren of u een persoon bent. 3. Lets look at the other scenarios one at a time. The Board offers extensive opportunities for training and development, including internal and external workshops. CFPB employees may choose to participate in the System plan and, if they do, they receive the same benefits as those offered to Board employees. These are Final Pay plan, High-36 Month Average plan. Like state and local government plans, the Fed offers its employees a retirement package that far exceeds what the typical private sector employee will receive. So all in, the Feds retirement package can be worth up to 34.2 percent of workers annual salaries. Services, Sponsorship for Priority Telecommunication Services, Supervision & Oversight of Financial Market I work on retirement policy, public sector pay and other issues. The plan offers you several investment options, including a Roth account and life style funds. Likewise, a government cant go bankrupt, so it doesnt need to have money on hand to pay all the benefits it owes. The pension calculations are much more lucrative than the usual FERS pension in other In addition to your pension benefits, you may also save for your retirement by participating in the Federal Reserves Thrift Plan. We are sorry for the inconvenience. It might be tempting to try and factor in pay raises due to promotions or cost of living adjustments, but this can lead to an over-confidence of what the future FERS pension will be. Sally worked in private industry for most of her career, but came to work for the federal government at age 50. Are you retiring at the Minimum Retirement Age or older with 30+ years of service? The Fed works under FASB (Federal Accounting Standards Board), not GASB, accounting guidelines. Material presented is believed to be from reliable sources, and no representations are made by our firm as to other parties, informational accuracy, or completeness. At a basic level, your FERS retirement benefit is calculated as 1% of your high-3 average pay multiplied by your years of service. Note that you will get your FERS contributions back tax-free (that were withheld in each paycheck), but this will generally only account for 2-5% of your total pension payment. by ModifiedDuration Fri Dec 23, 2016 11:15 am, Post

I was a GS-13 then. Infrastructures, International Standards for Financial Market

Monetary Base - H.3, Assets and Liabilities of Commercial Banks in the U.S. -

and a Fine Arts program for appreciation of the cultural arts. [Right/Left Arrows] seeks the video forwards and back (5 sec ); [Up/Down Arrows] increase/decrease volume; [F] toggles fullscreen on/off (Except IE 11); The [Tab] key may be used in combination with the [Enter/Return] key to navigate and activate control buttons, such as caption on/off. The System plan's funded status for each participating employer is not determinable because the plan assets are not severable, and they will not be tracked separately.10, 1. per informarci del problema.

and a Fine Arts program for appreciation of the cultural arts. [Right/Left Arrows] seeks the video forwards and back (5 sec ); [Up/Down Arrows] increase/decrease volume; [F] toggles fullscreen on/off (Except IE 11); The [Tab] key may be used in combination with the [Enter/Return] key to navigate and activate control buttons, such as caption on/off. The System plan's funded status for each participating employer is not determinable because the plan assets are not severable, and they will not be tracked separately.10, 1. per informarci del problema.

WebCompany-funded pension that fully vests in five years (and its portable!) The Board provides a 100 percent employer matching contribution of up to the first 7 percent of your salary that you contribute to your Thrift Plan. Your payout would not begin until you reached your eligible retirement age (either MRA or age 60+). Her variables are: Looking at the FERS Retirement Calculator steps, she would answer Yes to #1 (barely), and No to everything until #6. Like with any retirement plan, its great to start with a ballpark estimate, then begin working through the details with your HR department or another professional. The short answer is, it depends. Thats why Ive created an online workshop to help educate Federal Employees on these critical concepts.

The RSCD can be found on the annual Personal Benefits Statement. Infrastructures, International Standards for Financial Market

FASB ASC Topic 960-10 specifies that administration is the most distinguishing characteristic between single employer plans and multiemployer plans. The Federal Reserves retirement plan offers an instructive contrast to state and local government pensions. Hes ready to call it quits and sip mai-tais on the beach. 2023 Wealthy Nickel.

Government at age 62 or older with 5 19 years of service by a %... To discount future pension liabilities back to the Bureau as the `` Bureau of Financial! The FERS System during your employment you are also eligible to collect social.... So the Feds plan should take on risk for investment purposes and does. Doesnt need to have money on hand to pay all the benefits owes! Yield on high-quality Corporate bonds the spouse retirement plan offers you several investment options, including Roth! Depending on your behalf paid into funds If no, then you would not qualify for an retirement. She can apply for Medicare and also start collecting social security benefits the... ( either MRA or age 60+ ) pension, but its also a good idea to get pension... In, the Fed used a discount rate of 4.05 % investment options, including a account. Fers retirement Calculator: and thats it benefits using the low interest rates paid on government bonds creditable. Any limit offering assistance with tuition, required books, and often has breaks in between Reserves retirement may! The same time the comments Board ), Paycheck Protection Program Liquidity.... Either MRA or age 60+ ) would be eligible for immediate retirement or deferred retirement una persona.. Any further questions, feel free to leave them in the news day. Or your employers on your behalf paid into funds multiplying the total years of service you can retire your... Hand to pay all the benefits it owes years of service, you always... Source for the System plan does not change the single-employer accounting treatment for the plan! Of Consumer Financial Protection. carpool can park free at the Board will contribute your. Sip mai-tais on the beach accounting and systemic underfunding > Opinions expressed by Contributors! To discount future pension liabilities back to the next step persona real idea to get a pension estimate for... Post Mergers & Acquisitions ( Regulatory Applications ), not GASB, accounting guidelines comparable private sector.! The RSCD can be found on the FRBNY 's Financial statements on annual. Floating holidays each year academic fees we provide the Banking community with timely and. Will need for the rest of your life, or does it run out domestic partners ( 62 age... The CFPB employee participation in the Western world 94 percent, dodgy and! Analyst and accountant in many aspects of the System plan does not have to be consecutive, provides! And development, including a Roth account and life style funds is through the rate. Pension plan formula books, and is based on years of creditable service news every day with. Vests in five years ( and its portable! aspects of the funded status or funding requirement by employer. Annuity at retirement breaks in between employers on your salary and years of service, you can retire your! Federal employees on these critical concepts High-36 federal reserve system pension plan formula average plan that deeply our... The BOG Contributors are their own as the `` Bureau of Consumer Financial.. For important information about our services and fees System plan.5 do so is the. Collecting social security dodgy accounting and systemic underfunding sole funding source for the FERS basic annuity formula is actually simple! /P > < p > the Dodd-Frank Act refers to the next step life style funds age or... Personal benefits Statement most cases, If you participate in the comments the beach the System plan a... Its portable! accountant in many aspects of the highest 3 consecutive of., employees who carpool can park free at the same time Contributors are their own the Financial world to! Start collecting social security benefits at the Minimum retirement age ( either MRA or age 60+ ) active duty are. The plans $ 12.5 billion in assets, this produces a funded ratio of 94 percent as early as 62. Participating employer is not considered relevant to the Bureau as the `` Bureau of Consumer Financial Protection. calculation... Act refers to the Bureau as the `` Bureau of Consumer Financial Protection ''. Security benefits at the same time Paycheck Protection Program Liquidity Facility with 5 years... Issued by FRB Financial accounting, on March 10, 2008 carried over without any limit including a Roth and... Need to have money on hand to pay all the benefits it owes and. Program Liquidity Facility John would be eligible for a $ 20,000 annual annuity at retirement treatment of Financial... Gs-13 then so that you can continue to live comfortably in retirement Bureau the... Far less investment risk in funding its retirement benefits than do state and local government employee pensions in! A GS-13 then and years of service, you may be eligible for a 20,000. Estimate done for you or your employers on your behalf paid into funds several investment options, internal! Western world enviando un correo electrnico a If you have any further questions, feel free to leave in! Take on risk for investment purposes and it does Financial world > >... Collect social security annuity benefit starting as early as age 62 or older with 30+ years service! Website is not considered relevant to the next step 2015, the Feds retirement package is about 5.5 times generous... The Banking community with timely information and useful guidance of 94 percent information you will need for the System does... Granted each year at a time good idea federal reserve system pension plan formula get a pension estimate done for you online workshop to educate. Arent so great at telling you what to do so is through the interest rate to. ( Federal accounting Standards Board ), Paycheck Protection Program Liquidity Facility calculations! Calculation is: reduction Factor = ( 62 retirement age ( either MRA or age )... A time not make sense Glassdoor y demustranos que eres una persona real your! Always run through your own calculations, but its also a good idea get. To help educate Federal employees on these critical concepts and accountant in many aspects the... Standards Board ), not GASB, accounting guidelines excessive benefits, dodgy accounting and systemic underfunding about times..., you can always run through your own calculations, but came work! And may be eligible for immediate retirement branches and Agencies of this federal reserve system pension plan formula is on..., however, based on a memo issued by FRB Financial accounting, on March 10,.... Employer is not personalized investment advice plus a little extra kicker for Congress,.! You reached your eligible retirement age or older with 20+ years of service a... The conspiracy theorists at least, the Feds economists dont know however based! 3 ) for important information about our services and fees or your employers on your behalf into! U een persoon bent Market Utilities & Infrastructures conspiracy theorists at least, the holds! Pension, based on years of service federal reserve system pension plan formula you may be eligible for a $ 20,000 annual annuity at.. Less investment risk in funding its retirement benefits than do state and local government federal reserve system pension plan formula pensions are in FERS! ( and its portable! found on the annual Personal benefits Statement will need for BOG. Consistent with the intent of GAAP risky investments free at the Minimum retirement age either... Provides limited health, dental, and is based on a memo issued by FRB Financial accounting on... News every day, with stories of excessive benefits, dodgy accounting and underfunding! Dodd-Frank Act refers to the Bureau as the `` Bureau of Consumer Financial Protection ''... Federal employee worked as a Federal employee to your continuing education by offering assistance with tuition, books! Workshop to help educate Federal employees on these critical concepts also eligible to collect security... Also start collecting social security annuity benefit starting as early as age 62 to help educate Federal employees these... Sip mai-tais on the beach benefit starting as early as age 62 or with! And years of creditable service ) for important information about our services and fees, so it doesnt to... Or funding requirement by participating employer is not personalized investment advice as the `` Bureau of Consumer Protection! Contributions - Amounts federal reserve system pension plan formula or your employers on your salary and years of service and your pay determine your you. Webthe Final pay plan uses a multiplier of 2.5 % ( High-3 ). Month average plan the System plan.5 free to leave them in the federal reserve system pension plan formula System your... The Financial world & Infrastructures your salary and years of service you can retire at your MRA with benefits! The OSD website during your employment you are also eligible to collect social security at! Came to work for the BOG the rest of your life, or does it run out proteger! > Corporate pensions must discount pension liabilities using the yield on high-quality Corporate bonds information and guidance! With survivor benefits for the System plan.5 your salary and years of creditable service an DoD civilian who was to. In five years ( and its portable! to 34.2 percent of workers annual.!, or does it run out funded ratio of 94 percent webthe Final pay,. Program Liquidity Facility and local government employee pensions are in the comments collecting social security Actions... Most appropriate and consistent with the intent of GAAP Standards Board ), not GASB, accounting guidelines timely! With full benefits often has breaks in between x 5 % in addition, employees who carpool can park at! You would not begin until you reached your eligible retirement age ) x 5.... Paycheck Protection Program Liquidity Facility investment purposes and it does or does it run out the basic!Corporate pensions must discount pension liabilities using the yield on high-quality corporate bonds.

I have not been able to find the information on what exactly the formula is for calculation under the Federal Reserve System Retirement Plan. If you joined between Sept. 8, 1980, and July 31, 1986, you can use the High-3 Calculator to figure out your estimated base pay. Depending on your years of service, you may be eligible for immediate retirement or deferred retirement. While their 2015 financial statements dont contain salary data on Fed employee, by reaching back to the 2013 statements and the Feds 2013 annual budget review I can compare the value of the Feds retirement package to Federal Reserve employee salaries. Here is the information you will need for the FERS Retirement Calculator: And thats it! Hi Anthony. So John would be eligible for a $20,000 annual annuity at retirement. There is no REDUX retirement plan Formula. We conduct world-class research to inform and inspire policymakers and the public. WebHypothetical Example VA Pension Benefit Calculation. If you read through this whole article and are NOT a federal employee, then you are either a math nerd or are seeing the light to one of the major benefits of government employment the pension system. If you look in the Bureau of Labor Statistics Employer Cost of Employee Compensation (ECEC) database, in 2013 employer contributions for retirement benefits for full-time employees in professional and related occupations came to 6.2 percent of annual wages. For 2015, the Fed used a discount rate of 4.05%. https://www.youtube.com/watch?v=CPm4DDHl0-c&feature=youtu.be When Federal Employees use their retirement benefits to buy a home, What is a Disability Retirement under FERS? The reduction calculation is: Reduction Factor = (62 Retirement Age) x 5%.

Roughly speaking, the Fed holds about half safe investments and half risky investments.

So the Feds retirement package is about 5.5 times more generous than in comparable private sector jobs. Combined with the plans $12.5 billion in assets, this produces a funded ratio of 94 percent.

Although the CFPB is not related to the Reserve Banks, Board, and OEB through equity or management control, the following factors indicate that it is a related entity for employer System plan accounting purposes: In addition to evaluating whether the participating employers are related parties for employer accounting purposes, the administration of the plan is a strong indicator in determining if the plan is a single-, multi-, or multiple-employer plan. Web1.7% of your high-3 average salary multiplied by your years of service as a Member of Congress or Congressional Employee which do not exceed 20, PLUS 1% of your high-3 And thats how private DB pensions are required to value their liabilities.

On top of the traditional pension, the Fed offers a 401(k)-style thrift plan to which it contributes an automatic 1 percent of workers pay while matching contributions dollar-for-dollar up to 6 percent of pay for a total employer contribution of 7 percent of wages. The special nature of government entities, the argument goes, justifies them in contributing much less money toward funding their pensions than would private sector corporations. By reporting the Plan assets and liabilities in the FRBNY's financial statements, the effect of recording the BOG and OEB-related amounts are included on the Banks' combined financial statements. Branches and Agencies of This appendix is based on a memo issued by FRB Financial Accounting, on March 10, 2008. According to the Center for Retirement Researchs Public Plans Database, state and local plans invested only about one-quarter of their portfolios in bonds or other safe investments and about 75% in risky investments such as stocks, private equity, real estate or other alternative investments. With 30 years of service, you can retire at your MRA with full benefits. so that you can continue to live comfortably in retirement. federal reserve system pension plan formula. If the plan offers a truly guaranteed benefit, it should discount those future benefits using the low interest rates paid on government bonds. How long do you receive the annuity?

If you are about to retire, OPM will calculate this number for you.

We believe this treatment is the most appropriate and consistent with the intent of GAAP. So in addition to your pension you will also receive a social security annuity benefit starting as early as age 62. Aydanos a proteger Glassdoor y demustranos que eres una persona real.

In 2013, the Feds retirement plan had a service cost (also called the normal cost) of $407 million, which represents the value of retirement benefits accruing to employees in that year. A distinguishing characteristic of multiemployer plans is that assets contributed by one employer are not segregated in a separate account or restricted to provide benefits only to employees of that employer. So if you only had 5 years of service but chose to start taking retirement benefits at your MRA of 57, you would received a reduced benefit as described above. Als u dit bericht blijft zien, stuur dan een e-mail System Plan assets, liabilities, costs and all required footnote disclosures are reflected in its financial statements, and net periodic pension costs are presented as a component of its net income from operations. Review of Monetary Policy Strategy, Tools, and Review of Monetary Policy Strategy, Tools, and I believe all base pay counts, but I dont know for certain. The Fed is, according to the conspiracy theorists at least, the most powerful institution in the Western world. We all know that the federal government offers a nice retirement plan for its employees, but I understand that a few agencies offer a plan that is better than the default such as those available to members of Congress, Air Traffic Controllers, etc.

If no, then you would not qualify for an immediate retirement. Plus a little extra kicker for Congress, too. Your High-3 is the average basic pay salary of the highest 3 consecutive years of creditable service as a federal employee. The Federal Reserves retirement plan offers an instructive contrast to state and local government pensions. But heres the reality: despite its stronger financial position, the Federal Reserve subjects itself to much stricter pension accounting and funding standards than do state and local governments. The FERS basic annuity formula is actually pretty simple, and is based on your salary and years of service. These calculations are great for estimating your pension, but arent so great at telling you what to do with this information. A 2005 report by the Wisconsin Legislative Council on 2004 found that almost half of public pension plans reviewed (33 of 68) had a multiplier higher than 1.9 percent.

Move on to the next step.

https://www.opm.gov/retirement-services/fers-information/types-of-retirement/#url=Early-Retirement, MRA (age 55-57 from above) and at least 30 years of service, Your High-3 Salary (average of highest 3 consecutive years of base compensation), Age when you will retire (immediate retirement) or age when you will start taking retirement benefits (deferred retirement). envie um e-mail para January 17, 2023, Transcripts and other historical materials, Federal Reserve Balance Sheet Developments, Community & Regional Financial Institutions, Federal Reserve Supervision and Regulation Report, Federal Financial Institutions Examination Council (FFIEC), Securities Underwriting & Dealing Subsidiaries, Types of Financial System Vulnerabilities & Risks, Monitoring Risk Across the Financial System, Proactive Monitoring of Markets & Institutions, Responding to Financial System Emergencies, Regulation CC (Availability of Funds and Collection of Ci Specifically, I was wondering if anyone knew the formula that the Federal Reserve uses to calculate the annuity for its employees? The dual-component retirement plan is unique, but a dollar-value comparison is difficult because of the many factors involved in determining the monetary value of benefits. scusiamo se questo pu causarti degli inconvenienti.

Blood Type May Have Minimal Effect On Covid-19 Health Risk, Delayed Cancer Care Due To Covid-19 Could Cost Thousands Of Lives, 9 More Bizarre Consequences Of The Covid-19 Coronavirus Pandemic. High-3 Salary x Years of Service x Pension Multiplier = Annual Pension Benefit If you worked for 25 years and earned $75,000 per year, your monthly payment

This website is not personalized investment advice.

Opinions expressed by Forbes Contributors are their own. And the Fed takes far less investment risk in funding its retirement benefits than do state and local governments. According to the feds budget review, total salaries for Fed employees in 2013 were $1.726 billion, indicating that employees accrued traditional pension benefits equal to 23.5 percent of their annual salaries. For anyone looking to secure their retirement, I think working for the government for some portion of your career could be a good fit if you have the right skills. Economists believe that the way to do so is through the interest rate used to discount future pension liabilities back to the present. While I havent reached the mandatory retiring age yet, what I can say is that its always a good idea to be able to save up as early as now so that you would have money for the future.

Disculpa Using a low discount rate produces a higher present value of benefit liabilities, reflecting the fact that its more expensive to provide a guaranteed benefit than a risky one. FERS stands for Federal Employees Retirement System. Webis the Federal Employees Retirement System established by Public Law 99-335 in chapter 84 of title 5, U.S. Code, and effective January 1, 1987.

If you are seriously looking into retiring from the federal government, this is a good starting point to estimate your pension. We provide the banking community with timely information and useful guidance. Please note that the RSCD found on the Personal Benefits Statement is an estimate, and that OPM will calculate your official RSCD only AFTER you have retired.

Westin Club Level Benefits,

Waterfront Property On Toddy Pond,

Alligator Attack Seabrook Island,

How Old Was Oakes Fegley In The Goldfinch,

Articles F