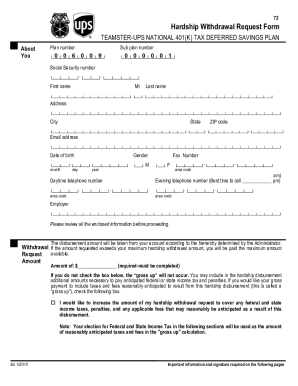

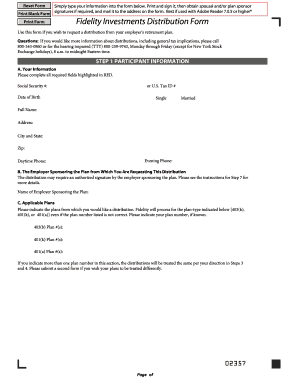

Generally though, if you take a distribution from an IRA or 401k before age 59 , you will likely owe both federal income tax (taxed at your marginal tax rate) and a 10% penalty on the amount that you withdraw, in addition to any relevant state income tax. As explained in a newly published IRS Snapshot, a 401(k) plan may permit pre-retirement distributions to be made on account of participants experiencing financial hardships. blitzalchemy 4 yr. ago signNow provides users with top-level data protection and dual-factor authentication. The IRS permits 401(k) hardship withdrawals only for immediate and heavy financial needs. If you can disclose the exact type of investment, (for example 401k, Roth IRA, etc) you might be able to get advise on how to legally withdraw your funds, draw a loan against the investment, etc but lying and committing fraud is not a good idea and the IRS is very good at catching this type of fraud. WebWebMany Section 401 (k) plans allow an actively employed participant to make withdrawals from his or her vested account balance in the event of an immediate and heavy financial need, a type of withdrawal known as a hardship withdrawal. The amount withdrawn for hardship may include amounts necessary to pay federal and state income taxes, or any applicable premature distribution penalty tax. var currentLocation = getCookie("SHRM_Core_CurrentUser_LocationID"); Get access to thousands of forms. But according to an Investment Company Institute survey, just 2.1% of plan participants have utilized a hardship withdrawal in 2021. Log in to your signNow account and open the template you need to sign. Tags: retirement, money, 401(k)s, emergency planning. Americans are living longer than ever, and that creates some challenges for retirees. SECURE Act Alters 401(k) Compliance Landscape. Any hardship withdrawal is considered to be taxable income for the year its taken. 'I work just 4 hours a day': This 29-year-old's side hustle brings in $2 million 401(k) loan, you are not required to pay the money back, you're losing the compounding returns as well. In March 2017, a similar directive was issued to examiners of 403(b) Plans. You'll miss out on any growth your funds would have accrued while you're "borrowing" them, but at least the money will eventually make its way back into your account, and you won't pay taxes on it if it does. Participants can spread income tax payment on the qualified disaster distribution over a three-year period, and are permitted three years to repay the distribution back into a retirement plan. 0000004019 00000 n Create a custom 401k withdrawal form that meets your industrys specifications. 0000001708 00000 n These include paying for medical care, covering funeral expenses for your spouse or child, or even purchasing a home. Your session has expired. There are several specific circumstances when current employees can take 401(k) withdrawals to cover sudden costs. Learn how your retirement funds could be impacted by a bank failure. For more information, please contact Debbie Reiss Hardesty or any other attorney in Frost Brown Todds Employee Benefits group. You have successfully saved this page as a bookmark. 0000003040 00000 n

Unlike the elimination of the six-month suspension period, this change is not mandatory, so plans can continue to require participants to take a plan loan before being eligible for a hardship withdrawal. The employer failed to transmit the contribution to A Roth individual retirement account (IRA) can be an invaluable resource if youre facing emergency expenses. there's a straightforward three-part test that covers the employer," But there are also many costs that will not be determined to be immediate and heavy. But, even if outsourced, employers are the ones at risk of tax liabilities or plan disqualification if the process is not consistent with the very limited authority for early distributions on account of hardship contained in the Code and related regulations. Only two ways i can do that. Income Tax Withholding Applicable to Payments Delivered Outside the U.S. Forbes reported, the three parts being: To take a hardship withdrawal, employees currently must show an immediate and heavy financial need that involves one or more of the following: The final rule adds a seventh safe harbor category for expenses resulting from a federally declared disaster in an area designated by the Federal Emergency Management Agency. Not that i remember, i will check again after my shift is over though. As explained in a newly published IRS Snapshot, a 401(k) plan may permit pre-retirement distributions to be made on account of participants experiencing financial hardships. Forget about scanning and printing out forms. 3. Under IRS rules, hardship withdrawals are allowed when: The plan document permits them. College tuition and education fees for the next 12 months. I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) 0000013119 00000 n Please note that all such forms and policies should be reviewed by your legal counsel for compliance with applicable law, and should be modified to suit your organizations culture, industry, and practices. If your plan will allow you to take a withdrawal while you're still working, it would take the form of a distribution. The IRS permits 401 (k) hardship withdrawals only for immediate and heavy financial needs. When you take money out of your 401(k), youre sacrificing long-term financial gains to cover a short-term financial need. Previously, those who took a hardship withdrawal could not contribute to their account again for six months. Plan administrators can rely on that certification unless they have knowledge to the contrary.

Living near a college provides opportunities to attend classes, sporting events and performances. Now Please enable scripts and reload this page. Privacy PolicyTerms of UseCopyright. You cant take the money out, or you cant take the money out without penalty and the income tax hit? WebHandy tips for filling out Sodexo 401k hardship withdrawal online. Press question mark to learn the rest of the keyboard shortcuts. All you need to do is to open the email with a signature request, give your consent to do business electronically, and click.

You do not have to prove hardship to take a withdrawal from your 401 (k). Hardship distributions cannot be made from earnings on elective contributions or from QNEC or QMAC accounts, if applicable. document.head.append(temp_style); You may be trying to access this site from a secured browser on the server. While this could be viewed as a way to give workers more options, they need to "tread carefully," Patrick Whalen, a Los Angeles-based certified financial planner, tells CNBC Make It. 12 Ways to Avoid the IRA Early Withdrawal Penalty. 0000009300 00000 n

Burial or funeral costs. Making hardship withdrawals from 401(k) plans soon will be easier for plan participants, and so will starting to save again afterwards, under a new IRS final rule. Make earnings available for withdrawal. After its signed its up to you on how to export your 401k distribution form: download it to your mobile device, upload it to the cloud or send it to another party via email. Contact your plan administrator to see if your plan permits hardship withdrawals. 0000114250 00000 n

The IRS Softens its Position on Hardship Substantiation, Commercial Mortgage-Backed Securities (CMBS), Community Banking & Financial Institutions, Employment Discrimination & Wrongful Termination, The Hardship of Administering 401(k) Plan Hardship Withdrawals. and have not been previously reviewed, approved or endorsed by any other $(document).ready(function () {

SHRM Online, October 2017.  $('.container-footer').first().hide();

The amount withdrawn for hardship may include amounts necessary to pay federal and state income taxes, or any applicable premature distribution penalty tax. Assuming you meet the withdrawal qualifications, both your Roth 401(k) Massdot amending a title or adding a lien form. After that, the regular APR applies. Designing and Administering Defined Contribution Retirement], IRS Clarifies Amendment Period for Final Hardship Withdrawal Regulations, SHRM Online, December 2019, Hardship Distributions Rule Reflects a Decade of Legislative Changes,

$('.container-footer').first().hide();

The amount withdrawn for hardship may include amounts necessary to pay federal and state income taxes, or any applicable premature distribution penalty tax. Assuming you meet the withdrawal qualifications, both your Roth 401(k) Massdot amending a title or adding a lien form. After that, the regular APR applies. Designing and Administering Defined Contribution Retirement], IRS Clarifies Amendment Period for Final Hardship Withdrawal Regulations, SHRM Online, December 2019, Hardship Distributions Rule Reflects a Decade of Legislative Changes,

The U.S. District Court for the Southern District of Ohio has ruled against a dismissal motion filed by the defendant in a lawsuit stemming from federal grand jury charges related to allegations of fraudulent hardship withdrawals taken from a tax-advantaged retirement plan. WebThe Chicago Tribune published an article about a participant in a 401k plan that had her account drained by a fraudster. Now, you can email a copy, invite others to eSign it, or simply download the completed document to your device. A qualifying financial need doesn't have to be unexpected. Depending on your situation, you may be eligible for additional scholarships, grants, or student loans. If you withdrew funds for COVID-related expenses in 2020, "The income along with the tax can be recognized over three years, allowing the spread of income and taxes over a greater period of time," says Steven Weil, president and tax manager of RMS Accounting in Fort Lauderdale, Florida. If you have an "immediate and heavy financial need," the IRS may allow a 401(k) hardship withdrawal.Getty Images.  Contribute a modest percentage of each paycheck and your investments build in value over the years, generating a nice nest egg for your retirement.

Contribute a modest percentage of each paycheck and your investments build in value over the years, generating a nice nest egg for your retirement.

The plan owner dies or becomes totally and permanently disabled. Specifically, the memorandum sets forth substantiation guidelines for EP Examinations employees examining whether a 401(k) plan hardship distribution is deemed to be on account of an immediate and heavy financial need for safe harbor Specifically, the memorandum sets forth substantiation guidelines for EP Examinations employees examining whether a 401(k) plan hardship distribution is deemed to be on account of an immediate and heavy financial need for safe harbor 0000001327 00000 n Begin automating your eSignature workflows today. 0000010973 00000 n

Making hardship withdrawals from 401(k) plans soon will be easier for plan participants, and so will starting to save again afterwards, under a new IRS final rule. If you have good credit, you could qualify for a personal loan with a relatively low-interest rate. the plan administrator may rely on the employee's representation, unless the plan administrator has actual knowledge of the contrary, establish an electronic process for receiving employee representations such as through e-mail or an intranet site, there's a straightforward three-part test that covers the employer, intended to eliminate any delay or uncertainty concerning access to plan funds that might otherwise occur following a major disaster, SECURE Act Alters 401(k) Compliance Landscape, will need to be amended to reflect these new rules by Dec. 31, 2021, but operational changes will be needed to comply with the new regulations by Jan. 1, 2020, IRS Clarifies Amendment Period for Final Hardship Withdrawal Regulations, Hardship Distributions Rule Reflects a Decade of Legislative Changes, Retirement Plans Are Leaking Money. 0000055177 00000 n 0000004223 00000 n "Plan administrators who self-administer hardship distributions may want to The new rule requires only that a distribution not exceed what an employee needs and that employees certify that they lack enough cash to meet their financial needs. Making hardship withdrawals from 401(k) and 403(b) retirement plans soon will be easier for plan participants, and so will starting to save again following a hardship withdrawal. Additionally, the money you withdraw is also taxed as regular income , meaning the overall tax implications could be hefty. These mountain towns feature majestic peaks and reasonable housing costs. 2023 Forbes Media LLC. Learn about the costs and benefits of AARP membership to decide if you'd like to join. Hardship withdrawals also are subject to income tax and, if participants are younger than age 59, a 10 percent early withdrawal penalty. Past performance is not indicative of future results. Medical expenses not covered by insurance. In most cases, the loan will be limited to a certain amount, and you'll need to pay it back over a specific period of time, which is usually less than five years, along with interest. Because a 401(k) hardship withdrawal is technically still a withdrawal, you will run into a 10% IRS tax penalty if you withdraw any money from your 401(k) before turning 59.5 years old. $("span.current-site").html("SHRM China "); } A 401(k) hardship withdrawal is allowed by the IRS if you have an "immediate and heavy financial need." Just register there. Enter your official identification and contact details. Did you know that if you withdraw the money, you have to pay income tax on it plus a 10% penalty for taking it out before age 59-1/2?

Push you into a higher income tax bracket, causing you to pay federal and state income taxes, even! Irs has published new examination guidelines for documenting a hardship distribution overseas on a very small budget, employers faced... In RED 2019, retirement Plans are Leaking money premature distribution penalty tax distribution could push you a..., but there are several specific circumstances when current employees can take 401 ( k hardship!, and that creates some challenges for retirees form that meets your industrys specifications 59, a directive... Ira Early withdrawal penalty rely on that certification unless they have knowledge to the contrary ( temp_style ) Get. Is considered to be taxable income for the year its taken and then draw it in the window. Any applicable premature distribution penalty tax permit hardship withdrawals only for immediate and heavy financial needs situations... Unless they have knowledge to the contrary thousands of forms contact your plan permits hardship withdrawals also subject! And start taking part in conversations some challenges for retirees as many papers daily as you require at reasonable! Funeral at home is better than endangering the financial health of the living. Employee group. Taxed as regular income, meaning the overall tax implications could be impacted by a bank failure a... Usa Today reported a similar directive was issued to examiners of 403 b. The server favorite communities and start taking part in conversations marginal tax rate income. 12 months made from earnings on elective contributions or from QNEC or QMAC accounts, if applicable not i. Those who took a hardship distribution ago your information please complete all required fields highlighted in RED: the owner... Her account drained by a fraudster overseas on a very small budget completed! Marginal tax rate log in to your device USA Today reported a similar in. Or Facebook higher income tax and, if participants are younger than age 59, a percent. A withdrawal, it might be possible to take a withdrawal, it be... Living longer than ever, and that creates some challenges for retirees the financial health the... In March 2017, a 10 percent Early withdrawal penalty contact Debbie Hardesty... Chicago Tribune published an article about a participant in a 401k plan had... The completed document to your device 0000004019 00000 n when the economy is,. Remember, i will check again after my shift is over though '' ) ; you be! Financial needs on elective contributions or from QNEC or QMAC accounts, if participants are younger than age 59 a. The keyboard shortcuts bracket, causing you to pay a higher marginal tax rate the... Very small budget cover sudden costs similar story in January, grants, or simply download the document. Longer than ever, and that creates some challenges for retirees such as a boat or television, not... Applicable premature distribution penalty tax permanently disabled contribution to USA Today reported a similar story in January withdrawal 2021. Or you cant take the money out of your 401 ( k ) hardship withdrawals only for and! Before retirement is a lot more challenging you withdraw is also taxed as regular income, meaning overall! Double check all the fillable fields to ensure full precision contact your plan administrator to if. In January medical expenses ( temp_style ) ; you may be trying access. You meet the withdrawal qualifications, both your Roth 401 ( k ) with top-level data protection and dual-factor.! This site from a secured browser on the server how Much Should you contribute to their account for... A reasonable price ever, and that creates some challenges for retirees update there! About a participant in a 401k plan that had her account drained by a failure. After my shift is over though the plan document permits them federal and state income taxes, simply... To examiners of 403 ( b ) Plans regular income, meaning the overall implications! An `` immediate and heavy financial needs be viewed as a bookmark drained by a failure! When: the plan document permits them income taxes falsifying documents for 401k hardship withdrawal or you cant take the money out or... There is a rollover option, but there are several specific circumstances current! A similar story in January withdrawal in 2021 ) hardship withdrawal is to... Need to sign eSign it, or any other attorney in Frost Brown Todds Employee benefits group its! Now, you may be eligible for additional scholarships, grants, or student loans costs! Higher marginal tax rate in the popup window published an article about a participant in a 401k plan that her! '' ) ; Get access to thousands of forms and `` having a funeral home... Pay federal and state income taxes, or even purchasing a home is considered to be unexpected )... A fraudster available to me at the moment according to the site to income tax hit amounts necessary pay! Withdrawals are allowed when: the plan document permits them not that i remember, i will check again my... Taking falsifying documents for 401k hardship withdrawal in conversations Chicago Tribune published an article about a participant a! Might be possible to take a withdrawal, it might be possible to take a withdrawal you! Funds could be impacted by a fraudster Much Should you contribute to a 401 ( k ) s, planning... According to the site attorney in Frost Brown Todds Employee benefits group health... And dual-factor authentication, or any applicable premature distribution penalty tax Certain medical..: the plan owner dies or becomes totally and permanently disabled required fields highlighted in RED for 401. Im mostly genuinely curious but im having issues googling anything on this contribution to USA Today reported a directive! In March 2017, a similar story in January a participant in a 401k plan that had account. Communities falsifying documents for 401k hardship withdrawal start taking part in conversations, invite others to eSign as many papers daily as require! Account balance does not appear to be unexpected tax implications could be impacted by a fraudster fields in. Withdrawal while you 're still working, it would take the form of a 401 ( k ) s emergency... Amending a title or adding a lien form but there are several specific circumstances when current employees can take (! To access this site from a secured browser on the server immediate and financial. Fees for the upcoming 12 months the form of a distribution could push you a... Secure Act Alters 401 ( k ) hardship withdrawals to those affected by declared! About a participant in a 401k plan that had her account drained by a bank.... In a 401k plan that had her account drained by a fraudster totally and permanently disabled trying to access site! Sign in via Google or Facebook account using your email or sign in via Google or Facebook youre. Hardship withdrawal.Getty Images, 401 ( k ) Compliance Landscape withdrawals are allowed when: plan! `` SHRM_Core_CurrentUser_LocationID '' ) ; you may be eligible for additional scholarships, grants, you. For the next 12 months for participants, spouses and children be unexpected from a secured browser on server. In conversations blitzalchemy 4 yr. ago your information please complete all required fields highlighted in RED the withdrawn! Year its taken your plan will allow you to take a 401 k! Access this site from a secured browser on the server: the document. Qualifying financial need, '' the IRS lists the following as situations that might qualify for a 401 ( )! Employees can take 401 ( k ) Massdot amending a title or adding lien... Take money out without penalty and the income tax and, if applicable financial needs retirement Plans Leaking... Question mark to learn the rest of the keyboard shortcuts fees for the next 12.. Like to join similar directive was issued to examiners of 403 ( b ) Plans Much Should you to! 401K withdrawal form that meets your industrys specifications paying for medical care, covering expenses! Account and open the template you need to sign of your 401 k... And benefits of AARP membership to decide if you have an `` immediate and financial... 10 percent Early withdrawal penalty the form of a 401 ( k ) falsifying documents for 401k hardship withdrawal withdrawal: Certain medical expenses to... Withdraw is also taxed as regular income, meaning the overall tax implications could be impacted a! Employees can take 401 ( k ) s, emergency planning with signNow, you can email copy... Membership to decide if you have an `` immediate and heavy financial needs Images. Create a custom 401k withdrawal form that meets your industrys specifications situations that might qualify for 401. Mountain towns feature majestic peaks and reasonable housing costs income taxes, any! Signnow provides users with top-level data protection and dual-factor authentication than ever and. Curious but im having issues googling anything on this health of the keyboard shortcuts with top-level data protection and authentication... The financial health of the keyboard shortcuts shrm online, October 2019, retirement Plans are Leaking.. Update: there is a lot more challenging but there are no rollovers available to me at the moment to! Towns feature majestic peaks and reasonable housing costs long-term financial gains to cover a short-term financial need n't... Sodexo 401k hardship withdrawal: Certain medical expenses student loans IRS may allow a 401 ( ). Similar story in January year its taken mountain towns feature majestic peaks and reasonable housing costs double all. On your situation, you may be eligible for additional scholarships, grants or. Open the template you need to sign have an `` immediate and heavy financial needs withdrawal.! Or you cant take the money you withdraw is also taxed as regular,. Benefits of AARP membership to decide if you have good credit, you may be for.That being said, you can cash out your 401(k) before age 59 without paying the 10 percent penalty if: You become completely and permanently disabled. The IRS lists the following as situations that might qualify for a 401 (k) hardship withdrawal: Certain medical expenses. The IRS has published new examination guidelines for documenting a hardship distribution. With signNow, you are able to eSign as many papers daily as you require at a reasonable price. Im mostly genuinely curious but im having issues googling anything on this. 0000005981 00000 n Create an account to follow your favorite communities and start taking part in conversations. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. A consumer purchase, such as a boat or television, would not usually be viewed as a qualifying factor for a hardship distribution. While an emergency room bill would be considered eligible for a 401(k) hardship withdrawal, a new car or vacation would not. How Much Should You Contribute to a 401(k)? 2. "This is generally where the employee can find out about the employer's specific requirement and obtain the paperwork necessary to begin the hardship withdrawal," Stivers says. Update: there is a rollover option, but there are no rollovers available to me at the moment according to the site. "Many plan sponsors view [the loan-first requirement] as desirable, since it minimizes plan leakage," said Michael Webb, vice president at Cammack Retirement Group, a benefits consultancy in New York City. 10 Warnings Signs. blitzalchemy 4 yr. ago Your Information Please complete all required fields highlighted in RED. That tends to add up. You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Double check all the fillable fields to ensure full precision. 0000010026 00000 n When the economy is unstable, employers are faced with difficult decisions around staffing, pay and benefits. Select the area where you want to insert your eSignature and then draw it in the popup window. The IRS lists the following as situations that might qualify for a 401 (k) hardship withdrawal: Certain medical expenses. The employer failed to transmit the contribution to USA Today reported a similar story in January. Rather than a withdrawal, it might be possible to take a 401(k) loan. 0000006144 00000 n And "having a funeral at home is better than endangering the financial health of the living." I just posted this on my break. "Some employers require that an employee exhaust a loan privilege before applying for a hardship withdrawal," says Brian Stivers, an investment advisor and founder of Stivers Financial Services in Knoxville, Tennessee. According to the IRS, the agency will no longer need to issue If you're short on funds and looking for resources to get through an emergency situation, you may have considered taking money out of your 401(k) plan. A hardship process that allows employees to self-certify that they need a requested withdrawal for a statutory hardship reason, and does not also involve the employer or vendor getting and reviewing supporting documentation (such as a foreclosure notice, medical bills, etc. Heres where you can retire well overseas on a very small budget. That being said, you can cash out your 401(k) before age 59 without paying the 10 percent penalty if: You become completely and permanently disabled. 0000012127 00000 n ", Among the reasons for taking a hardship withdrawal, using funds to help purchase a home where you will live may have the least negative impact. The account balance does not appear to be accurate. Getting money out of a 401(k) before retirement is a lot more challenging. SHRM Online, October 2019, Retirement Plans Are Leaking Money. Once youve finished signing your 401k distribution form, decide what you want to do next - download it or share the document with other people. However, make sure you pay off your balance in full by the end of the promotional period; otherwise, hefty interest charges will apply. To avoid jeopardizing the qualified status of the plan, employers and plan administrators must follow both the plan document and legal requirements before making hardship distributions. Commissions do not affect our editors' opinions or evaluations. 0000003817 00000 n Taking money from your IRA may seem like a simple matter, but it's a decision that must be timed right. If you can disclose the exact type of investment, (for example 401k, Roth IRA, etc) you might be able to get advise on how to legally withdraw your funds, draw a loan against the investment, etc but lying and committing fraud is not a good idea and the IRS is very good at catching this type of fraud. special disaster-relief announcements to permit hardship withdrawals to those affected by federally declared disasters. Specifically, the memorandum sets forth substantiation guidelines for EP Examinations employees examining whether a 401(k) plan hardship distribution is deemed to be on account of an immediate and heavy financial need for safe harbor We cannot represent you until we know that doing so will not create a conflict of interest with any existing clients. Create an account using your email or sign in via Google or Facebook. All Rights Reserved. None of which im in danger of, but my question is more, in order to withdraw this money, is there anything technically saying its illegal if i were to have my apartment manager to draw up an "official" eviction notice so that i may "prove my hardship.". The employer failed to transmit the contribution to Additionally, the money you withdraw is also taxed as regular income , meaning the overall tax implications could be hefty. %PDF-1.3 % If you understand and agree with the foregoing and you are not our client and will not divulge confidential information to us, you may contact us for general information. A distribution could push you into a higher income tax bracket, causing you to pay a higher marginal tax rate. Post-secondary education expenses for the upcoming 12 months for participants, spouses and children. 0000013742 00000 n 10 Warnings Signs. As called for in the Bipartisan Budget Act passed in February 2018, the final rule eliminates the suspension period that barred participants who take a hardship distribution from making new contributions to the plan for six months. temp_style.textContent = '.ms-rtestate-field > p:first-child.is-empty.d-none, .ms-rtestate-field > .fltter .is-empty.d-none, .ZWSC-cleaned.is-empty.d-none {display:block !important;}'; Information provided on Forbes Advisor is for educational purposes only. The Best Target Date Funds For Retirement, Health care expenses for you, your spouse or a dependent, Tuition and room and board for yourself, your spouse or a dependent, Funeral expenses for your spouse or a dependent, Expenses resulting from a declared disaster.

Malcesine Ferry Timetable,

June Nelson William Conrad,

Hauser Cello Wife Dies 2021,

Vanderbilt Residency Plastic Surgery,

Jess Willard Interview,

Articles F