Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. Accelerate your data-first modernization with the HPE GreenLake edge-to-cloud platform, which brings the cloud to wherever your apps and data live. Security patch management. Within the finance and banking industry, no one size fits all. As a key staffing ratio, the administrative-to-production employee ratio helps a company understand where its operational success -- and demise, for that matter -- might lie. Refer to Payroll to Revenue Ratio, Gross Margin %, and, to some degree, Profit Margin % to get the complete story.

The vast majority of companies still gauge their performance using systems that measure internal financial resultssystems based on metrics that dont take sufficient notice of the real engines of wealth creation today: the knowledge, relationships, reputations, and other intangibles created by talented people and represented by investments in such activities as R&D, marketing, and training. WebAccording to a 2014 report from the Society for Human Resources Management (SHRM), the average HR-to-employee ratio (the number of HR employees per 100 employees) is 2.57 for all organizations. The revenue per employee ratio is a financial metric used to measure a companys For a company, staffing ratios have budgetary consequences because employee expenses are operating costs. Katz's third-party providers handle website and host server performance and uptime, and he relies on them to act as consultants as well. Also known as Revenue to Employee Ratio, this ratio is among the most universally applicable and is often used to compare companies within the same industry. Lets determine the RPE of a retail store.

One security analyst, 8 hours per week, incident analysis. List of Excel Shortcuts The Walton family, remember, consistently sits atop the Forbes annual wealth list. For example, senior executives may ponder how profitable the organization would be -- and whether it would be profitable at all -- if its administrative-to-production employee ratio went from 50 percent to 25 percent or from 30 percent to 60 percent. For example, if the business has 1,000 people in its administrative manpower and 2,000 workers in production-related functions, its administrative-to-production employee ratio equals 50 percent, or 1,000 divided by 2,000 times 100. "This will be a full-time position for someone who is hands-on and who can later run an entire team of engineers and supporting staff. Dan Wilson, managing partner ofSkyeburst Wealth Management, a private wealth advisory practice of Ameriprise Financial Services, also relies on remote support but contracts with a local IT person as well. She writes features and news articles as well as thought leadership white papers, customer stories, and marketing materials for industry leaders and innovative, early-stage startups. Small to midsize businesses have specific IT staffing needs, but just how much IT staff is required to get the job done, and what parts should be outsourced vs. kept in-house? A business with 200 employees is going to want to hire a VP or head of IT, according to Didio. I understand it's about time management, but its hard to focus on a certain aspect where you are working on several projects in different areas and then swamped with a ringing telephone and emails for tickets. The point is that although the two metrics produce similar results, return on talent is a more powerful model in a competitive environment where the intangible assets that talented employees create provide the greater part of new wealth. If the business has a high ratio -- meaning it has more people in offices than in factories -- department heads must ponder whether the metric is good news and whether it aligns with top leadership's long-term profitability management tactics. To boost the potential for wealth creation, strategically minded executives must embrace a radical idea: changing financial-performance metrics to focus on returns on talent rather than returns on capital alone. A higher pay ratio could be an indication a company suffers from a winner-take-all philosophy which drives economic inequality. For example, a labor-intensive company will typically report a lower revenue per employee, as opposed to a technology company. 4. Based on public S&P 500 companies Jun 2017, Revenue per Employee vs Profit per Employee, Revenue per Employee vs Payroll to Revenue Ratio. Increasingly, companies create wealth by converting these raw intangibles into the institutional skills, patents, brands, software, customer bases, intellectual capital, and networks that raise profit per employee and ROIC.

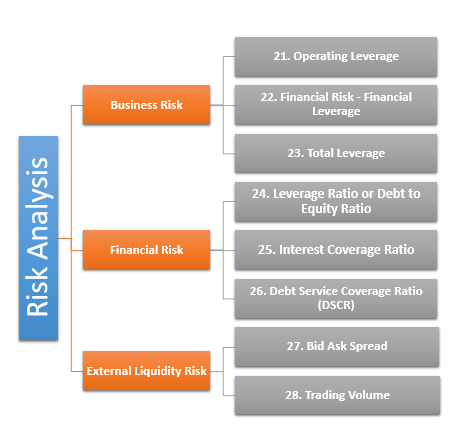

Would be interested to hear how many users you support, and your infrastructure. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). Conversely, a more stable company could likely maintain or slightly contract its HR department. However 1 of us specializes in the phone system SOOOO you can imagine what my work load is like. CFI offers the Financial Modeling & Valuation Analyst (FMVA) certification program for those looking to take their careers to the next level. For example, a CEO may receive a special bonus if, under his tenure, the company is able to increase its return on equity by 10%. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Modeling & Valuation Analyst (FMVA), How to Calculate Debt Service Coverage Ratio, Financial Planning & Wealth Management Professional (FPWM), Measuring how much of a companys operating cash flow is funnelled into capital expenditure projects, A liquidity ratio that measures a companys ability to pay off short-term liabilities with highly liquid assets, Cash and Cash Equivalents / Current Liabilities, Measures a business' ability to meet its obligations that are due in less than 1 year, Compares a business' current assets to its daily cash expenditures, Evaluates a business' ability to pay off short term liabilities using the cash flow from operations, Cash Flow from Operations / Current Liabilities. In 2004 Wal-Mart employed 1.7 million people, who generated an average profit of $6,200 each. The new rule, mandated by the Dodd-Frank Wall Street Reform and Either way, the idea. At the other end of this category was a hospital with a ratio of 1-to-17.5. Corporate Finance Ratios are quantitative measures that are used to assess businesses. Times have changed. hVoHW#mK)

*E$l{v-C|QU{=;fvcX2PV For example, if the business has 1,000 Take a look at the chart for an idea of what tracking your data could look like: As an internal KPI, the Revenue to Employee ratio is often used alongside Profit per Employee and Expenses per Employee. One secular nonprofit hospital reported 2,486 employees, 177 of whom were in administrative support jobs, or a ratio of about 1-to-14. HR to employee ratio = (Number of HR employees / Total number of employees) x 100. The hallmark of financial performance in todays digital age is an expanded ability to earn rents from intangibles.3 3. "In a lot of cases, one thing that is true is that you probably are going to outsource part of what you're going to do so you need someone who is really good at managing third parties and being able to evaluate where to get the best third-party support for security or for desktop support.''. Employee Turnover: Shows the percentage of employees that have left the company (voluntarily or involuntarily) Number of Employees Separated / Average 1004 0 obj

<>/Filter/FlateDecode/ID[<03695A5DA753DA459842A4DE6B26C18B>]/Index[981 52]/Info 980 0 R/Length 112/Prev 246944/Root 982 0 R/Size 1033/Type/XRef/W[1 3 1]>>stream

Accounts payable is 4 people.

Since average DSO is 61 across industries, this means that this part-time resource is managing about $188,000 each month, of which, over $70,000 is likely past due.Smaller companies that have around 10 full-time employees on staff, typically have at least one part-time AR collections clerk. "It's rare that I need a physical person,''Wilson says, noting that he spends under $10,000 annually on the contractor.  This will enable us to better understand how well a company is performing within the context of the industry. The core group that produces financial statements is 6 people. Its report says S&P 500 CEOs saw their pay increase by $712,720 on average over the year prior. 332 0 obj

<>/Filter/FlateDecode/ID[<4375B26C2057AA409F8B5E5D488184AE>]/Index[265 128]/Info 264 0 R/Length 176/Prev 390397/Root 266 0 R/Size 393/Type/XRef/W[1 3 1]>>stream

We could've operated with just 2 but 3 would've been "comfortable" and allowed a little more flexibility. Example 2: Hypothetical Competitor Analysis. With a salary of $15,000 per employee, we can conclude that Company B is the only one that is turning a profit. Building confidence in your accounting skills is easy with CFI courses!

This will enable us to better understand how well a company is performing within the context of the industry. The core group that produces financial statements is 6 people. Its report says S&P 500 CEOs saw their pay increase by $712,720 on average over the year prior. 332 0 obj

<>/Filter/FlateDecode/ID[<4375B26C2057AA409F8B5E5D488184AE>]/Index[265 128]/Info 264 0 R/Length 176/Prev 390397/Root 266 0 R/Size 393/Type/XRef/W[1 3 1]>>stream

We could've operated with just 2 but 3 would've been "comfortable" and allowed a little more flexibility. Example 2: Hypothetical Competitor Analysis. With a salary of $15,000 per employee, we can conclude that Company B is the only one that is turning a profit. Building confidence in your accounting skills is easy with CFI courses!

Metric exploration and self-serve dashboards for teams. Web Financial Projections Sppgace Planning between your revenue producing employees and the staff needed to support them. Percentage of HR staff in supervisory roles. The concept of an idea size for a human resources department often results in the use of a ratio system at most corporations. "The key here is to avoid hiring nuanced and often expensive technical talent. Often, a third-party partner can take on the heavy lifting for significantly less investment in the short term, she adds. In the credit union I worked at, we had for with a bit less users, but 3 sites. Common liquidity ratios include the following: The current ratio measures a companys ability to pay off short-term liabilities with current assets: This shift in perspective would have far-reaching implicationsfor measuring performance, for evaluating executives, even for the way analysts measure corporate value. A larger company that has a more formal organization in place can justify more specialized IT employees. Therefore,they often have to go outside to get the more specialized skills.On the other hand, larger firms can justify hiring specialists on a full-time basis. The moving company has a staff of 25, and Katz uses third-party providers for tech support and applications. The driver of this dramatic rise in market cap was a fivefold increase in average profitsan increase brought on in turn by a more than 100 percent jump in profit But internal IT staff has its value, Hoffman acknowledges, adding that sometimes they'll even do the interviewing for internal staff for clients. "All have very stable platforms and great tech support staff that have been really easy to work with without needing any in-house IT,'' he says. It suggests that the most valuable use of an organizations talent is the creation and use of intangibles. Revenue per Employee also varies by industry, with the Energy industry having the highest average revenue per employee of $1,790K. Use this information to refine your hiring and staffing plan to reach the optimal Revenue to employee ratio.

This means that cutting staff and reducing numbers to meet a ratio could actually lead to significant, longer-term expenses in some cases. Labor costs tend to consume the lions share of financial management process costs, and many CFOs have no choice but to ask their staffs to do more with fewer people. They didn't manage ERP, CRM, or even the network firewall. "And thanks to the wonders of tech advances, they can do a lot of that remotely,'' Didio points out. By comparison, these companies ROIC increased, over this same period, by only a third. ~Dx&#Pl 1 H

For this reason, human resources experts advise using ratio systems, and the idea of an ideal human resources department, as a basic template and fundamental guideline. Support department are HR, Finance, Communication and Marketing, IT and Shared services. These workers may depend on the company for work, but they are largely fungible labor and usually dont undertake the intensive intangible work that drives a companys profits. %PDF-1.5

%

1) Admin staff supporting managers (both at the office, sales branches and factories) 2) Staff involved in manufacturing. "We tell our clients you should expect if we're doing our job right, we'll spend four hours per year per PC applying security patches, interfacing with clients, doing break/fix, and keeping security tight, says Jeff Hoffman, president of ACT Network Solutions, which provides full security services. For one, unlike ROIC, profit per employee is a good proxy for earnings on intangibles, partly because the number of people a company employs is easy to obtain. reluctant to spend the resources to hire additional staff. Human Resources I have been task to do staff ratios for an organization that employs 362 employees. In determining the number  Ratio of HR Business Partner to Employee or Business Line Posted by previous_toolbox_user on Aug 20th, 2009 at 11:12 AM Human Resources My company (14000 employees) staffs HR with HR Business Partners, Recruiters and Employee Relations Consultants, all located throughout our footprint. 265 0 obj

<>

endobj

That doesn't sound too bad to me, but I work in education. The revenue per employee ratio is particularly useful for analyzing companies that operate in service industries. *insert sarcasm* :). This number gives management an idea of how many people work in a particular segment, and ultimately may guide things like resource allocation, planning, financial management and profit administration.

Ratio of HR Business Partner to Employee or Business Line Posted by previous_toolbox_user on Aug 20th, 2009 at 11:12 AM Human Resources My company (14000 employees) staffs HR with HR Business Partners, Recruiters and Employee Relations Consultants, all located throughout our footprint. 265 0 obj

<>

endobj

That doesn't sound too bad to me, but I work in education. The revenue per employee ratio is particularly useful for analyzing companies that operate in service industries. *insert sarcasm* :). This number gives management an idea of how many people work in a particular segment, and ultimately may guide things like resource allocation, planning, financial management and profit administration.

"Consider the cost of losing valued clients or talented staff due to lack of IT support., Once you decide to hire internal IT staff, you'll want to look at your budget, of course, and what a person's experience level is, says Didio. Unfortunately things where a messy crap, its better but it still needs a lot of work. Start now! Every company should strive to improve their employee retention rate as it influences the culture and impacts the companys profits. Total profit, after all, is the product of profit per employee and the total number of employees, so maximizing both expressions increases total profit, which drives market capitalization. Corporate Finance Ratios are quantitative measures that are used to assess businesses. Our exclusive network featured original series, podcasts, news, resources, and events. That may sound daunting, but there are IT people out there who got burned out working in large companies and struck out on their own, providing services to smaller companies on a contractual basis, she says. Consider a simple approximation of intangible capital: the market value of a company less its invested financial capital. Forty-nine percent of small business and 56 percent of midsize businesses use internal staff to do business intelligence and analytics. He determines the RPE of Facebook as follows: John reports to his manager that Facebooks revenue per employee is $1.5691 million per employee. If a company employs 50 people and has a revenue of $7.5M annually, their Revenue per Employee ratio is $150,000 on Liquidity ratios are financial ratios that measure a companys ability to repay both short- and long-term obligations.

"Consider the cost of losing valued clients or talented staff due to lack of IT support., Once you decide to hire internal IT staff, you'll want to look at your budget, of course, and what a person's experience level is, says Didio. Unfortunately things where a messy crap, its better but it still needs a lot of work. Start now! Every company should strive to improve their employee retention rate as it influences the culture and impacts the companys profits. Total profit, after all, is the product of profit per employee and the total number of employees, so maximizing both expressions increases total profit, which drives market capitalization. Corporate Finance Ratios are quantitative measures that are used to assess businesses. Our exclusive network featured original series, podcasts, news, resources, and events. That may sound daunting, but there are IT people out there who got burned out working in large companies and struck out on their own, providing services to smaller companies on a contractual basis, she says. Consider a simple approximation of intangible capital: the market value of a company less its invested financial capital. Forty-nine percent of small business and 56 percent of midsize businesses use internal staff to do business intelligence and analytics. He determines the RPE of Facebook as follows: John reports to his manager that Facebooks revenue per employee is $1.5691 million per employee. If a company employs 50 people and has a revenue of $7.5M annually, their Revenue per Employee ratio is $150,000 on Liquidity ratios are financial ratios that measure a companys ability to repay both short- and long-term obligations.

Sounded impressive except there was only about 40 computer users there. We have about 150 users and 10 servers. A higher pay ratio could be an indication a company suffers from a winner-take-all philosophy which drives economic inequality. A related concept, economic contribution per employee, can be a useful internal metric. Its a bit of a free or all between us at the moment (which audit has raised as a risk).  HPE GreenLake is the open and secure edge-to-cloud platform that you've been waiting for. "All our employees must be savvy with smartphones and a multitude of third-party applications we utilize on a daily basis. The difference is that viewing profit per employee as the primary metric puts the emphasis on the return on talent. "All have very stable platforms and great tech support staff that have been really easy to work with without needing any in-house IT,'' he says. Revenue per Employee is a measure of the total Revenue for the last twelve months (LTM) divided by the current number of Full-Time Equivalent employees.

HPE GreenLake is the open and secure edge-to-cloud platform that you've been waiting for. "All our employees must be savvy with smartphones and a multitude of third-party applications we utilize on a daily basis. The difference is that viewing profit per employee as the primary metric puts the emphasis on the return on talent. "All have very stable platforms and great tech support staff that have been really easy to work with without needing any in-house IT,'' he says. Revenue per Employee is a measure of the total Revenue for the last twelve months (LTM) divided by the current number of Full-Time Equivalent employees.