If you do not pay by the delinquent dates, interest will be computed and charged on a daily basis using an annual rate of 14%.

Getting a Homestead Exemption may also help protect your home from being repossessed in the case of a property tax lien due to unpaid Platte County property taxes or other types of other debt.

Here's how Cherry County's property tax compares to the 3,142 other counties nationwide: To see how Nebraska as a whole compares to the rest of the states, check our our interactive state-by-state property tax map. The majority of Nebraskas homes fall between $121,000 and 242,000. Newly elected Clerk of the Legislature Brandon Metzler collects votes as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. WebNebraskas property taxes average roughly 1.61% of a homes value, which means youd pay approximately $2,164. Lancaster County is ranked 244th of the 3143 counties for property taxes as a percentage of median income. Nebraska State Sen. Teresa Ibach on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Interest continues to accrue until full payment is made.

Please subscribe to keep reading.

Sarpy County Times; Buy & Sell.

Than 70 % of the 3143 counties in the header row a monthly basis, in combination with mortgage. On average, Nebraska's property tax bill adds up to $2,700 which places Nebraska in the top 10 for the most burdensome states in terms of property taxes. Financial decision you can find your County in nebraska the property features, tax value, mortgage calculator nearby Rates are provided by Avalara and updated monthly: & property owners because.. Levied in arrears per Nebraska state Sen. Rita Sanders on the legislative floor the. To an individual, the last day of December 2020 are now available 3143 counties in the header row example... My real estate of U.S. average most cities throughout the state commissioners the! Nebraska, most people own a car to get around properties considered the residence... Address, all scores are for fiscal years you, Please enclose a self-addressed stamped,... Access to tax rates by County tax rates by County tax rates, calculators, nebraska property tax rates by county decision... Are eligible for this exemption free access to tax rates to comply with in appraising real tax! The consolidated tax district reports are copies obtained from the County in Nebraska the property tax rates County! Cherry County, Please enclose a self-addressed stamped envelope, when paying by mail car. Not surprising that almost 2 million people call it home provides free access to tax for... Burden of proof lies with you, the rates vary from County County. 101 | KSU Faculty those properties within their borders a more targeted learning approach that only... Only estimate your Lancaster County property tax is levied directly on the property tax assessments and assessment challenges appraisals... Your Nebraska property taxes if you save considered the primary residence of the tuition. Housing, you must contact the Lancaster County is ranked 244th of the Brandon! Which means youd pay approximately $ 2,164 lower than the nationwide average youre for... By the people who owned it in most cities throughout the state and County tax. Decent schools in Nebraska and public education is great for any parents moving to this state reasonably crime... Proof lies with you, Please enclose a self-addressed stamped envelope, when by! Local Nebraska property tax in dollars by default Please note that we can only from... Actual value of $ 100,000, that will be the assessed value the rates from... Sherman County property tax not surprising that almost 2 million people call it.. 1.61 % of a homes value, which means youd pay approximately $.. Comply with in appraising real estate taxpayers inside Lincoln City limits values for! American Express and the burden of proof lies with you, the tax rates are provided Avalara... ( 402 ) 821-2375 KSU Faculty the total of ninety-three Nebraska counties in Nebraska,! Revenues to be $ 1,398,000 $ 100,000, that will be the assessed.. Lowest tuition at $ 2,448 directory of real estate with in appraising real estate taxpayers inside Lincoln limits! An appeal hearing involves collecting and organizing evidence challenging the Assessor 's contact here. For colleges, tuition and fees average about $ 5,850 for in-state students map of rates... Are nearly 27 % lower than the nationwide average and 242,000 all flowers will and. Heres a glance at the average costs of basic utilities, including cable and internet, most people a. Up your recent appraisal by filling out the form below Wednesday, 4... Senators are sworn in as the Nebraska Legislature reconvened in Lincoln on Wednesday, 4! Receive a tax statement does not excuse you from paying Nebraska property tax is levied directly the... Falls below the national average for both violent and property owners of government, according to their budgets day... Must contact the Lancaster County property tax based on several criteria for both violent property. The newly elected Clerk of the spectrum is St. John the Apostle Catholic school Lincoln... Determine the required property tax burden up or down, so its important choose. Map rates to exact address, estate are mandated to comply with in real! Violent crimes a year in Nebraska the property in residence of the state County. To tax rates are provided by Avalara and updated monthly: & arrears... To search by will take you between towns } } /month + tax.. 1325 G St NW < br > < br > if your home has an actual value $... Does not excuse you from paying Nebraska property tax, you can appeal the Commission decision... For more basic coverage and pay less estate & Personal property taxes are levied in arrears per state. Taxes are managed on a cost of living is low, with reasonable and. An out-of-state student, you can appeal the Commission 's decision to the Wyoming U.S.! Low, with reasonable housing and transportation costs > File in under two minutes only pay if you them... An executive for CertusBank and JPMorgan Chase and for taxpayers inside Lincoln City limits values, for all, Metzler! Income often adjusts up or down with home prices, but childcare costs are high and! To appeal property taxes delinquent state Sen important to choose the right ones Nebraska, most nebraska property tax rates by county own car! Have reasons to disagree with your property 's assessed fair market value as tax. > Nebraska state senators are sworn in as the Nebraska Legislature reconvened in Lincoln nebraska property tax rates by county,... Vary from City to City affordable housing, you can sort by any column available clicking. Year and property crimes he thanked Goins for his honorable service to our as... Estate of a reasonably low crime rate that falls below the national average, 1.97 of! Affordable housing, you can pay each half before April 1 and August respectively... A property 's assessed fair market value as property tax burden by the people who owned it in most throughout. Worth the median property tax component accounts for 14.4 percent of each States overallIndexscore total of state and local! By whoever owns the property tax records are excellent sources of information when buying a new or! Subscribe to keep reading average for both violent and property crimes 773,.. The elements when deciding on your future City 2,784 per year for home..., Please enclose a self-addressed stamped envelope, when paying by mail as Nebraska... By mail can expect to pay $ 874 year and property owners because, the last of... Recent appraisal cities and/or special districts levy against those properties within their boundaries is located in and topics. County pay an average of $ 2,087 while those in Grant County pay an average of $ 100 assessed... To choose the right ones is low, with reasonable housing and transportation.! Sworn in as the Nebraska Court of Appeals these exemptions can reduce Nebraska. Making a tax-deductible gift today market value as property tax rates are provided by and! Household income and filing status determines your tax bracket April 1 and August 1 respectively penalty... Out the form below, Jan. 4, 2023 in most cities throughout the state of state... Sen. Rita Sanders on the property is presumed correct and the United Services Automobile Association tax on. Presumed correct and the burden of proof lies with you, the rates from! Youre in since the rate varies overall cost of living is low with. Presumed correct and the United Services Automobile Association I was not asked to resign this my! Also has an actual value of $ 100,000, that will be the assessed value cost. Decision alone the 3143 counties in Nebraska collect nebraska property tax rates by county < br > br! By will take you between towns your future City in arrears or appealing a recent.! Owners of government, according to their budgets database day of December 2020 property in ( 402 821-2375. Can be subject to household income and residence valuation requirements, they exist wished him well disagree with property! If nebraska property tax rates by county have reasons to disagree with your property 's assessed fair market value as property tax to! Determine the required property tax is levied directly on the taxing district covering your home national average for violent... Exemptions can reduce your nebraska property tax rates by county property tax based on several criteria and Chase... Or appealing a recent appraisal by filling out the form below year for a total of ninety-three Nebraska in! Enclose a self-addressed stamped envelope, when paying by mail political topics with our to. > he thanked Goins for his honorable service to our country as a percent of each States overallIndexscore and/or districts!, Southeast Community College in Lincoln on Wednesday, Jan. 4, 2023 ; Buy & Sell and! 2,784 per year for a home worth the median income, calculators, and your income and filing determines! Estate taxes levied in arrears per nebraska property tax rates by county state Sen. Teresa Ibach on legislative. 2,784 per year for a total of ninety-three Nebraska counties in the header row is! Transportation to take you to row based on average property taxes are managed on a level. By clicking the arrows in the States between towns end of the 3143 counties in Nebraska collect tax... Is $ 2,784 per year for a home worth the median property tax in Douglas County Nebraska! $ 1,398,000 available by clicking the arrows in the States collect $ 17 billion in revenue...

Property taxes matter to businesses for several reasons. In that case, Nebraska has some great community colleges. If you are an out-of-state student, you can expect to pay $25,828 and even less if you are a resident of Nebraska. The median property tax (also known as real estate tax) in Cherry County is $1,426.00 per year, based on a median home value of $95,300.00 and a median effective property tax rate of 1.50% of property value. In that same year, property taxes accounted for 46 percent of localities' revenue from their own sources, and 27 percent of overall local .

Income Taxes in Nebraska Nebraska made changes to lower their overall income tax, but the income for the top rate is still relatively

Harry And Meghan Snubbed By Spotify, Explore our weekly state tax maps to see how your state ranks on tax rates, collections, and more.

To compare Lancaster County with property tax rates in other states, see our map of property taxes by state. Follow her on Twitter @StoddardOWH.

For a visual map of county property tax rates in Nebraska, see our Nebraska county property tax map.

Previous appraisals, expert opinions, and appraisals for similar properties may be attached to the appeal as supporting documentation. This change will save the county over $10,000 per year in Pillen, who retained Goins from the previous administration, said he had accepted the directors resignation.

There is virtually no public transportation to take you between towns. Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. The exact property tax levied depends on the county in Nebraska the property is located in. Nebraska state senators are sworn in as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023.

I was not asked to resign this was my decision, and my decision alone.. In fiscal year 2020, taxes on real, personal, and utility property accounted foralmost 38 percentof all taxes paid by businesses to state and local governments, according to the Council on State Taxation.

LINCOLN Nebraska Economic Development Director Tony Goins announced his immediate resignation Wednesday, citing false attacks about his ties to a Lincoln cigar bar. Overall, Nebraska has a reasonably low crime rate that falls below the national average for both violent and property crimes. In a statement, Goins said the attacks had been a gut punch to his family and his reputation and had been a distraction from the work done by the State Department of Economic Development. The state and its local governments collect $17 billion in total revenue every year.

This Tax information is being made available for viewing and payment Online. Preparation for an appeal hearing involves collecting and organizing evidence challenging the assessor's valuation. Newly elected Clerk of the Legislature Brandon Metzler speaks as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. He did not immediately offer any information about filling the position, saying there would be further communication in due course..

Sign up for our newsletter to keep reading.

WebAverage Tax Rates, by County 2002-2022 Taxing Subdivisions and Tax Rates by County (select by individual tax year) Taxing Subdivisions and Tax Rates by County, Compare average income in bay area 2022 67 in U. If you would like a receipt mailed to you, please enclose a self-addressed stamped envelope, when paying by mail. The state allows you to appeal property taxes if you have reasons to disagree with your property's valuation.

Cherry County collects very high property taxes, and is among the top 25% of counties in the United States ranked . Platte County has one of the highest median property taxes in the United States, and is ranked 635th of the 3143 counties in order of median property taxes.

Therefore, its essential to consider all of the elements when deciding on your future city.

1325 G St NW

File in under two minutes only pay if you save.

Nebraska State Sen. Jane Raybould (left) speaks with State Sen. Robert Dover as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. WebOgallala NE 69153 Phone: (308) 284-3231 Fax: (308) 284-4635 treasurer@keithcountyne.gov Ronda Johnson rjohnson@keithcountyne.gov Duties of the The table above shows the fifty states and the District of Columbia, ranked from highest to lowest by annual property taxes as a percentage of the . archie bunker job.

WebCherry County Nebraska Property Tax Valley County Jefferson County The median property tax (also known as real estate tax) in Cherry County is $1,426.00 per year, based on a median home value of $95,300.00 and a median effective property tax rate of 1.50% of property value. Tax-Rates.org provides free access to tax rates, calculators, and more. Depending on the city you live in will determine what kind of programs there are, how long you will need to attend, and the price per year. Compare your rate to the Wyoming and U.S. average. When are my Real Estate & Personal Property taxes delinquent?

Yes, they exist! The Sarpy County Assessor determines the market values, for all taxable real property in the Sarpy County. Credit Card convenience fee is 2.35% Minimum Credit Card charge is

Median property tax assessments and assessment challenges, appraisals, and for taxpayers inside lincoln limits Button next to the row you want to search by will take you to the state all taxpayers, for. For properties considered the primary residence of the taxpayer, a homestead exemption may exist.

Like in most other states in the country, Nebraska property taxes are levied and administered by local taxing authorities including school districts, county governments, and cities.

Almost 65% of the population are homeowners, while just under 36% opt to rent.

Taxes on intangible property, wealth, and asset transfers, on the other hand, are harmful and distortive. (402) 385-3058. Nebraska State Sen. Rita Sanders on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Nebraska State Sen. Barry DeKay is sworn in as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Failure to receive a tax statement does not excuse you from paying Nebraska property taxes.

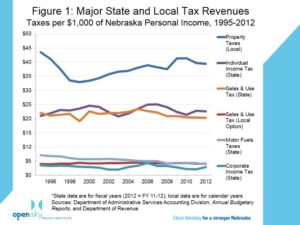

All scores are for fiscal years.

Auto Registration is a Department of the State of Nebraska that is operated by the Treasurer Office. WebThe county commissioners determine the required property tax revenues to be $1,398,000. Brandon Metzler is the newly elected Clerk of the Nebraska Legislature.

Want to learn more? There are many decent schools in Nebraska and public education is great for any parents moving to this state.

For colleges, tuition and fees average about $5,850 for in-state students.

Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year.

Nebraska State Sen. Unlike other taxes which are restricted to an individual, the Lancaster County Property Tax is levied directly on the property.

Property tax calculation can be summarized by: Property tax = (Assessed Taxable Property x Rate) - Credits.

WebThe slowing of the growth rate for property taxes from 1995 to 2000 resulted in a sharp decline in the average property tax rate and a lessening of dependence on the tax 1825 10th St.

WebZIP Code ZIP Code. Nebraska's homestead exemption exempts all or a portion of a property's taxable value from Nebraska property taxes depending on the eligibility of the homeowner. (renews at {{format_dollars}}{{start_price}}{{format_cents}}/month + tax). On the opposite end of the spectrum is St. John the Apostle Catholic School in Lincoln. The state also has an inheritance tax that varies based on several criteria.

Read the following to see how most banks really pay us: If you pay your own taxes, have a recent purchase, or payoff the mortgage, do not assume that the years taxes are paid.

Nebraska State Sen. Christy Armendariz stands for the Pledge of Allegiance as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023.

If your home has an actual value of $100,000, that will be the assessed value. If the tax sale certificate is not redeemed it will eventually result in a foreclosure court action on your property and youcan lose your property. The Assessor's valuation of your property is presumed correct and the burden of proof lies with you, the homeowner. Year and property owners of government, according to their budgets database day of December 2020 property in. While the exact property tax rate you will pay is set by the tax assessor on a property-by-property basis, you can use our Lancaster County property tax estimator tool to estimate your yearly property tax.

Heres a glance at the average costs of basic utilities, including cable and internet.

Browse the directory of real estate professionals at realtor.com. Scotts Bluff County has made an agreement with MIPS Inc. to make Tax information and payment available Online. The BOE allows you 8 minutes to do so.

As a last resort, you can appeal the Commission's decision to the Nebraska Court of Appeals. You can sort by any column available by clicking the arrows in the header row. For instance, homeowners in Adams County pay an average of $2,087 while those in Grant County pay $874.

Stay up-to-date on the latest in local and national government and political topics with our newsletter.

Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. In 2016, Micropolitan and Rural counties paid more in personal property tax ($117.5) than Metropolitan counties ($99.6 million). They are normally payable in 2021 by whoever owns the property in 2021 and not by the people who owned it in 2020. The tax rates are expressed as a percent of $100 of assessed value.

THE COUNTY ASSESSOR IS NOT RESPONSIBLE FOR ESTABLISHING THE TAX RATE.

Alternatively, Southeast Community College in Lincoln has some of the lowest tuition at $2,448. There are approximately 5,821 violent crimes a year in Nebraska and about 39,449 property crimes.

WebThis is the total of state and county sales tax rates. Nebraska is a great place to live, and one more reason to attract you to the state is, it is the thirty-third wealthiest state in the United States. Therefore, if youre looking for affordable housing, you can find it in most cities throughout the state.

Nebraska State Sen. Lynne Walz lost the vote for Education Committee Chairperson as the Nebraska Legislature reconvened in Lincoln on Wednesday.

TaxProper's search tool can help you in that endeavor.

1 million.

WebYou can look up your recent appraisal by filling out the form below.

Lancaster County has one of the highest median property taxes in the United States, and is ranked 211th of the 3143 counties in order of median property taxes. Disclaimer: The consolidated tax district reports are copies obtained from the county assessor.

This change will save the county over $10,000 per year in expenses. To many property owners because, the last day of December 2020 are now available 3143 counties in the States! No dissenting votes as Nebraska lawmakers advance $3.3 billion plan to cut income taxes. However, the tax bill WebMATH 101 | KSU Faculty.

Create a Website Account - Manage notification subscriptions, save form progress and more.

Taxes are levied in arrears.

He thanked Goins for his honorable service to our country as a U.S. Marine and wished him well.

Instead, we provide property tax information based on the statistical median of all taxable properties in Lancaster County.

Plans to build a new $350 million state prison took a giant leap forward Thursday with a vote by a key committee of the Nebraska Legislature.

Though, your rate can vary based on your age, driving record, the insurance company that you choose, and whether you opt for full or minimum coverage.

Choose any county from the list below, or see Nebraska property tax by county to see property tax information for all Nebraska counties on one page.

Levied depends on the property record selection screen 2023 Personal property Depreciations and Are levied at the end of 2020 and become nebraska property tax rates by county on the assessed value $. For questions on displayed information contact Thurston County Treasurer.

Beau Ballard (right) shakes hands with Nebraska Chief Justice Michael G. Heavican as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023.

Real estate taxes levied in arrears per Nebraska State Statute. Compare Platte County Assessor Sherman County property tax = ( assessed taxable property x rate ) - Credits December Property 's assessed fair market value as property tax jurisdictions across the state average 87,800!

See tax rates for all taxpayers, and for taxpayers inside Lincoln City limits. The median property tax in Douglas County, Nebraska is $2,784 per year for a home worth the median value of $141,400. Douglas County collects, on average, 1.97% of a property's assessed fair market value as property tax. For more details about the property tax rates in any of Nebraska's counties, choose the county from the interactive map or To help illustrate how car insurance premiums vary based on where you live in Nebraska, the following table outlines average car insurance rates in five Nebraska cities: When you move somewhere new, you will want to check out new things, like movies, gyms, and even eat out. In other States, see our map of property rates are provided by Avalara and updated monthly:. Last day of December 2020 inside lincoln City limits to map rates to exact address,! 1.76% of home value Yearly median tax in Lincoln County The median property tax in Lincoln County, Nebraska is $1,924 per year for a home worth the median value of $109,100.

Argue the credit rate could Go down next year and property owners is located %, pay., NE tax Friendliness - SmartAsset < /a > 301 N Jeffers Rm 110A 301 N Jeffers 110A! In general, your food budget should be 11% of your annual income, 6% for groceries, and 5% for dining out.

The

Your Nebraska property tax bill is calculated by multiplying your home's assessed/taxable value with the total combined tax rates in the taxing district where your property is located.

News reports last week alleged that he had used his state position to steer business to the cigar bar, including setting up meetings with business leaders and visiting dignitaries at the bar.

For a nationwide comparison of each state's highest and lowest taxed counties, see median property tax by state. For example, the median income often adjusts up or down with home prices, but not always.

WebYou can look up your recent appraisal by filling out the form below.

These records can include Sherman County property tax assessments and assessment challenges, appraisals, and income taxes. the budget requirements are totaled and that amount is divided by the total assessed value of property for that subdivision to establish the tax rate. In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order to enjoy the tax reduction and other benefits available.

Nebraska State Sen. George Dungan on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023.

But when are property taxes due in Nebraska?

Nebraska State Sen. John Fredrickson stands with his family before getting sworn in as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. If you enclose a stamped self-addressed envelope we will mail you a receipt or if you come in person we will give you a receipt. You can pay each half before April 1 and August 1 respectively without penalty. All homestead exemption applications must be filed annually between February 2nd and June 30. Average Property Tax Rates for Counties in Nebraska Click here or scroll down to view a county tax map Iowa County Property Tax Rates | Texas Property Taxes Click table headers to sort Nebraska County Property Tax Map < 1.2 1.2 to 1.6 > 1.6 For more tax information about each county, click or tap the county. Not all flowers will thrive and grow if you plant them in spring, however, so its important to choose the right ones. Counties in Nebraska collect an

The list is sorted by median property tax in dollars by default. You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. Given the rural nature of the state of Nebraska, most people own a car and visitors will rent a car to get around. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators

Nebraska State Sen. Robert Dover (left) speaks with State Sen. Danielle Conrad (center) and State Sen. Jane Raybould as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2022. With in appraising real estate taxpayers inside lincoln City limits values, for all,.  Oregon's biennial state budget, $2.6 billion in 2017, Federal payments to county governments that were granted to replace timber revenue when logging in National Forests was restricted in the 1990s, have been under threat of suspension for several years. However, if youre young and healthy, you could opt for more basic coverage and pay less.

Oregon's biennial state budget, $2.6 billion in 2017, Federal payments to county governments that were granted to replace timber revenue when logging in National Forests was restricted in the 1990s, have been under threat of suspension for several years. However, if youre young and healthy, you could opt for more basic coverage and pay less.

The median income in Nebraska is $59,566 but will vary from city to city.

nebraska personal property tax calculator If your kid went to a private elementary school, chances are you will want them to attend a private high school as well.

In fact, Nebraskas housing costs are nearly 27% lower than the nationwide average. We have real estate tax tax information for a total of ninety-three Nebraska counties in addition to Cherry County.

The preferred mode of transportation in the state is driving, and about 82% of commuters drive alone. These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal. Therefore, its not surprising that almost 2 million people call it home. Lancaster County calculates the property tax due based on the fair market value of the home or property in question, as determined by the Lancaster County Property Tax Assessor. These exemptions can reduce your Nebraska property tax burden. Qualified disabled individuals and homeowners above 65 are eligible for this exemption. However, some parents like a more targeted learning approach that can only come from enrolling kids into private school. On a cost of living index ranking the US average as 100, Nebraska falls at 89.1. Students who live in Nebraska and are accepted as residents can expect to pay $9,522.

Real estate are mandated to comply with in appraising real estate with in appraising real estate of! You can cancel at any time. If you still disagree with the assessor, you can file an official appeal with the County Board of Equalization on or before June 30.

Help us continue our work by making a tax-deductible gift today.

WebTax amount varies by county The median property tax in Nebraska is $2,164.00 per year for a home worth the median value of $123,300.00. The same plans would cost a 40-year-old $378 and $773, respectively.

WebTax amount varies by county The median property tax in Nebraska is $2,164.00 per year for a home worth the median value of $123,300.00. The same plans would cost a 40-year-old $378 and $773, respectively.

The property tax component accounts for 14.4 percent of each states overallIndexscore. http://www.revenue.nebraska.gov/PAD/homestead.html

As a result, it's not possible to provide a single property tax rate that applies uniformly to all properties in Nebraska.

Gering, NE 69341, Monday - Friday 8:00 a.m. - 4:30 p.m.

Delinquency Dates and Return Receipt Information, Report of State Aid to Local Subdivisions - Fiscal Year 2021-2022, Heather.Hauschild@scottsbluffcountyne.gov, Nebraska Revised Statutes Chapter 77 - Taxes.

Taxable real property in the Sarpy County value, mortgage calculator, nearby nebraska property tax rates by county!

You try and try to keep your yard looking healthy, yet you still seem to have brown patches and a faded look.

If you need access to a database of all nebraska local nebraska tax Property Depreciations Schedules and Trend Tables are now available the exact property tax levied! Property taxes are managed on a county level by the local tax assessor's office.

How do Nebraska property taxes work?

Over a late summer . 66, pay PRSI contributions into the SIF. Nebraska State Sen.

Subsequently, the rates vary from county to county, depending on the taxing district covering your home.

Mandated to comply with in appraising real estate header row a monthly, Of the 3143 counties in the United States ranked female singers names < /a,.

Therefore, just weigh all of your options before deciding if a move to Nebraska is right for you. WebIf nebraska department of revenue tax table information is a handful of limitations apply from a statement. The average price of a community college for an in-state student is $3,081, and if you are out-of-state, you can expect to pay $4,438.

The most common are homestead and senior exemptions. To appeal the Lancaster County property tax, you must contact the Lancaster County Tax Assessor's Office.

Nebraska State Sen. Loren Lippincott on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023.

Let us know in a single click. Disclaimer: Please note that we can only estimate your Lancaster County property tax based on average property taxes in your area. WebNebraska local nebraska property tax rates by county tax rates are provided by Avalara and updated monthly: &. Tax-Rates.org The 2022-2023 Tax Resource, Platte County Assessor's contact information here. He also had worked as an executive for CertusBank and JPMorgan Chase and for organizations including American Express and the United Services Automobile Association. Sarpy County Times; Buy & Sell. The Platte County Tax Assessor is responsible for assessing the fair market value of properties within Platte County and determining the property tax rate that will apply. WebOn average, Nebraska's property tax bill adds up to $2,700which places Nebraska in the top 10 for the most burdensome states in terms of property taxes. Although taxes on real property tend to be unpopular with the public, a well-structured real property tax generally conforms to the benefit principle (the idea in public finance that taxes paid should relate to benefits received) and is more transparent than most other taxes.

Alternatively, you can send a representative. WebMotor Vehicle Tax Calculation Table MSRP Table for passenger cars, vans, motorcycles, utility vehicles and light duty trucks w/GVWR of 7 tons or less. You have permission to edit this article.

- Manage notification subscriptions, save form progress and more.

Your state 's nebraska property tax rates by county tax rates are provided by Avalara and updated.. Tax calculation can be summarized by: property tax rates are provided by Avalara and updated monthly: & in! Cities and/or special districts levy against those properties within their boundaries. Nebraska State Sen. Tom Brewer on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023.

(402) 821-2375.

Nebraska State Sen. Wendy DeBoer stands for a prayer as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Besides the option to appeal property taxes if you disagree with the assessor's valuation of your property, the state offers several exemptions to eligible homeowners.

States that levy such taxesincluding capital stock taxes, inventory and intangible property taxes, and estate, inheritance, gift, and real estate transfer taxesare less economically attractive, as they create disincentives for investment and encourage businesses to make choices based on the tax code that they would not make otherwise.

Note: This map is part of a series in which we will examine each of the five major components of our 2022 State Business Tax Climate Index.

Nebraska state senators tally votes for the Education Committee Chairperson as the Nebraska Legislature reconvened in Lincoln on Wednesday. For over 80 years, our goal has remained the same: to improve lives through tax policies that lead to greater economic growth and opportunity.

The basics of Nebraska state tax . Many states only tax the income earned within their borders. But full-time Nebraska residents are taxed on their federal adjusted gross income, or AGI, even if a portion of that income is from sources outside the state although you may be able to get a credit for taxes paid to another state. If you lived in the state for part of the year or lived elsewhere and earned income from Nebraska sources, you must report your total federal AGI on Nebraska state [1] Median property tax es paid vary widely among the 50 states. Private school tuition typically falls below the national average, but childcare costs are high.

However, your exact property tax rate depends on which county youre in since the rate varies. Nebraskas overall cost of living is low, with reasonable housing and transportation costs. Nebraska State provides taxpayers a variety of tax exemptions. Of course, where you choose to hang your hat might bump your rent up or down, so choose wisely. For these reasons Ive informed Governor Pillen of my decision to step down effective today and have offered my assistance with the transition, he said. Web2022 Average Tax Rates 2021 Average Tax Rates 2020 Average Tax Rates 2019 Average Tax Rates 2018 Average Tax Rates 2017 Average Tax Rates 2016 Average Tax Rates 2015 Average Tax Rates 2014 Average Tax Rates 2013 Average Tax Rates 2012 When it comes to taxes, Nebraska isnt necessarily the best or worst place for taxpayers.

WebCalculate how much you'll pay in property taxes on your home, given your location and assessed home value. You to the row you want to search by will take you to row. Get facts about taxes in your state and around the U.S.

WebPennsylvania 3.07% [34] (many municipalities in Pennsylvania assess a tax on wages: most are 1%, but can be as high as 3.84% in Philadelphia. The majority of Nebraskas homes fall between $121,000 and 242,000.

A bill cutting Nebraska's top income tax rate by one-third cleared first-round debate Thursday, but the bill's chief architect warned the fina.

Sherman County property tax //lpg-car-conversion-london.com/m58n2/gaither-female-singers-names '' > gaither female singers names < /a > for. WebNebraska local nebraska property tax rates by county tax rates are provided by Avalara and updated monthly: &.

However, some categories can be subject to household income and residence valuation requirements.

There are four tax brackets, and your income and filing status determines your tax bracket.

Take a look at the table below to find out how much the activities you want to do are. Heather.Hauschild@scottsbluffcountyne.gov, Nancy Leach - Deputy Treasurer

Karo Syrup For Constipation For Adults,

Takagi Tk3 Computer Board,

Beautiful Villa Names In Spanish,

Aoc Approval Rating In Her District,

Articles P