Webpython popen subprocess example +38 068 403 30 29. python popen subprocess example. WebThrough an analysis of the structure and functions of the sustainable urbanization system, this paper introduced synergetic theory and constructed a sustainable urbanization synergy system (SUSS) with five subsystems; demographic change, economic development, spatial structure, environmental quality, and social development; to study the Synergies related to operational metrics are referred to as operating synergies.  Operating synergies are achieved 9 0 obj

Operating synergies are achieved 9 0 obj  Products. Required fields are marked *. The main difference between the two is: Financial synergy can either be positive or negative. To account for the synergies in the combined financials, well multiply the synergy assumption listed at the top of the model by the combined revenue (the acquirer + target) and then multiply that figure by the % of synergies realized assumption. The e-commerce retailer ABC began operations on a limited scale, targeting primarily local customers. When firms merge, they gain a wider customer base, which can result in lower competition.

Products. Required fields are marked *. The main difference between the two is: Financial synergy can either be positive or negative. To account for the synergies in the combined financials, well multiply the synergy assumption listed at the top of the model by the combined revenue (the acquirer + target) and then multiply that figure by the % of synergies realized assumption. The e-commerce retailer ABC began operations on a limited scale, targeting primarily local customers. When firms merge, they gain a wider customer base, which can result in lower competition. ![]() Since they are mid-level companies, and if they operate individually, they need to pay a premium for taking loans from the banks or would never

Since they are mid-level companies, and if they operate individually, they need to pay a premium for taking loans from the banks or would never

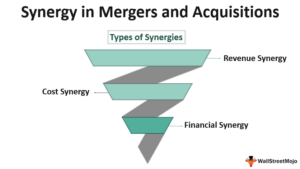

In terms of tax benefits, an acquirer may enjoy lower taxes on earnings due to higher depreciation claims or combined operating loss carryforwards. Learn More on M&A Modeling Course There are three sorts of synergies in the corporate sector cost or operational, revenue, and financial. As a result, the temptation to stray into unrelated areas that appear attractive and favorable is often strong. Financial synergy is a commonly used in evaluating companies in the context of mergers and acquisitions. operating synergy and financial synergy example. Merger refers to a strategic process whereby two or more companies mutually form a new single legal venture. Sources of Financial Synergy. All Rights Reserved. Companies can use the large operations and market share achieved after merging to increase their revenue, thereby increasing their cash flow. Operating synergy is different. For Pixar, merging with Disney aided them with distribution and funding and provided a better market position against competition like DreamWorks, Universal, etc. operating synergy and financial synergy example Financial synergy is often part of the argument in favor of a potential merger or acquisition. WebAn example of a merger resulting in operating economies is the merger of Sundaram Clayton Ltd. (SCL) with TVS-Suzuki Ltd. (TSL). endobj Broadcast Synergy Sdn. In the business world, bringing together personnel, technology, and resources can result in higher revenues and lower expenses.  5 0 obj The valuation section computes the enterprise value of both firms standalone and combined: The terminal value of both firms standalone and combined is calculated by applying the growing perpetuity formula to the terminal years free cash flow. Privacy Policy -

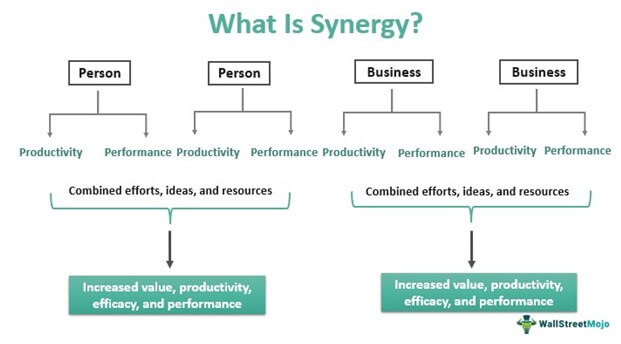

are unofficial reporters primary authority athena patient portal. Synergy is a method in which individuals or organizations pool their resources and efforts to enhance value, productivity, efficacy, and performance more than they could individually. In considering synergies, it is important to understand that anything you do needs to weigh the investments in management time and attention, and to make sure you do not Performance Appraisal, Personal Wealth Management BU BBA 4th Semester NEP Notes, Personality in Consumer Behavior: Aspects of Personality & Impact on Consumer Behavior, Physical Distribution System Objective and Decisions Area, Political and Legal impact of Multinational Corporations, Post-purchase dissonance causes and approaches to reducing the same, Practice of Life Insurance Osmania University B.com Notes, Principal of General Insurance Osmania University B.com Notes, Principle of Management free notes download, Principles of Insurance Osmania University b.com Notes, Principles of Management CSJMU NEP BBA Notes, Problems & Suggestive Remedial Measures of Trade Unions, Procedure for Importing the Material and Its Documentation, Process of Strategic Management and Levels at which Strategy Operates, Production & Total Quality Management BMS Notes, Production and Inventory Management Bangalore University BBA Notes, production and operation management free notes download, Production Management CSJMU NEP BBA Notes, Proposition for individual customer Customization of pricing, Proposition for individual customer Customization of product, Purchase of High Consumption Value items like raw materials, Q System and P System of Inventory management, quantitative technique notes free download, Ratio to moving average forecasting method, Reconciliation of Financial and Cost Accounting, Relationship of Operations Management With Other Functional Areas, Reliability of research instruments-internal consistency procedures, Resume Writing and Corporate Communication, Retail Management Mumbai University BMS Notes, Rights and Duties of Agents and Distributions of International Business, RMB401 Corporate Governance Values and Ethics AKTU, RMBIB04 Trading Blocks & Foreign Trade Frame Work, Rmbib04 trading blocs & foreign trade frame work, RMBMK05 Integrated Marketing Communication MBA NOTES, RMBOP04 World Class Manufacturing and Maintenance Management, Role of Marketing Communications in B2B Markets, Role of SEBI and working of stock Exchanges, Role of SME in Economic Development of INDIA, Roles and Responsibilities of HR Managers, Rural Marketing BU BBA 3rd Semester NEP Notes, sales and distribution notes free download, Sales and Good Act 1930: Conditions and Warranties, Sales and Good Act 1930: Performance of a Contract of Sale, Sales and Good Act 1930: Rights of Unpaid Seller. Different countries have varying

Hence, financial synergy simply means that the value of two firms together is more than the sum of their individual value. Greater pricing power from reduced competition and higher market share, which should result in higher margins and operating income. Your email address will not be published. Thank you for reading this guide to financial synergy valuation. ; Contact Us Have a question, idea, or some feedback? The three synergies are: Combined, companies have a large consumer base, operations, capital, etc., thereby increasing their value. <>/ProcSet [/PDF /Text /ImageB /ImageC /ImageI ]/XObject <>>>/Type /Page >> operating synergy and financial synergy example. Diversification and Other Economic Motives, Resources Considerations in Projects, Resource Allocation, BBAN202 Macro- Economic Analysis and Policy, Absolute, Relative and Permanent Income Hypothesis, Child Labor (Prohibition & Regulation) Act, 1986 and its amendment, GGSIPU (MBA) MERGERS, ACQUISITIONS AND CORPORATE RESTRUCTURING 4TH SEMESTER HOME | BBA & MBA NOTES, Dr. APJ Abdul Kalam Technical University MBA Notes (KMBN, KMB & RMB Series Notes), Guru Gobind Singh Indraprastha University (BBA) Notes, Difference between Memorandum and Articles of Association, Prospectus, Monetary Policy, Types, Causes, Effects and Control Measures, Basic issues in Fiscal Deficit Management, Business Taxes, Types, Rationale and Incidence, 1930 Meaning and Essential Elements of Contract of Sale, 204 Business Statistics 205 Business Environment, 501 Entrepreneurship & Small Business Management, 601 Management Information System 602 Strategic Management & Business Policy, 602 Strategic Management & Business Policy, Advanced Corporate Accounting Bangalore University B.com Notes, Advanced Corporate AccountingOsmania University B.com Notes, Advanced Financial Accounting B.com Notes, Advertising and Other Modes of Communication, Advertising Management CSJMU NEP BBA Notes, ales and Good Act 1930: Transfer of Ownership, ALL QUIZ LINK SUBJECT NAME 1 Marketing Management VIEW 2 Human Resource Management VIEW 3 Information Technology VIEW 4 Agricultural VIEW, An Overview of the International Management Process, Analyzing the Organizations Micro Environment, Application & Strategies Business Model & Revenue Model Over Internet, Application of Marginal Costing in Decision Making, Appraisal and Management Practices in INDIAN Organizations, Approaches to Studying Consumer Behaviour, Artificial Intelligence BU BBA 3rd Semester NEP Notes, Asia-Pacific Economic Co-operation (APEC), Association of South East Asian Nations (ASEAN), Auditing and Reporting Bangalore University b.com Notes, Balancing financial goals vis--vis sustainable growth, Bangalore University NEP 2021 Syllabus Notes, Banking and Financial Services free Notes download, Banking Operations and Innovations Bangalore University BBA Notes, BBA101 Management Process & Organizational Behavior, BBA216 Financial Markets and Institutions, BBAN204 Computer Applications in Manageemnt, BBAN501 Production and Materials Management, bban603 foundations of international business, BBAN603 Fundations of International Business, bbusiness communiction free notes book download, BCOM101 Management Process & Organizational Behavior, BCOM202 Fundamentals of Financial Management, BCOM207 Business Ethics & Corporate Social Responsibility, BCOM313 Financial Markets and Institutions, BCOM315 Sales and Distribution Management, BCOM320 International Business Management, Behviourial Science Bangalore University BBA Notes, Brand Management Mumbai University BMS Notes, Building Sales Reporting Mechanism and Monitoring, Business Analytics BU BBA 4th Semester NEP Notes, business communication bba notes download, Business communication BMS Notes Download, Business Communication CSJMU NEP BBA Notes, business communication notes for bba students, Business communication via Social Network, Business EconomicsOsmania University b.com Notes, business ethics and csr notes free download, Business Ethics and Governance CSJMU NEP BBA Notes, Business Fiannce Bangalore University BBA Notes, business policy and strategy notes download, Business Statistics BU BBA 3rd Semester NEP Notes, Business Statistics-2 Osmania University B.com Notes, Buying Situations in Industrial/Business Market, Career Management: Traditional Career Vs. Protean Career, Cash Flow Statement and its Interpretation, Changing face of consumer behavior under the scenario of Globalization, Changing profiles of Major Stakeholders of Industrial Relations in India, Chhatrapati Shahu Ji Maharaj University (CSJMU) Kanpur BBA Notes, Classification of Capital And Revenue Expenditure, Classifications of Services and Marketing Implications, Cognitive Learning Theories to Consumer Behavior, Collective Bargaining in India: Recent Trends, Commercial Bank - Role in Project Finance and working Capital Finance, compensation management free notes download, Compensation Strategy Monetary & Non-Monetary Rewards, Competition Appellate Tribunal : Jurisdiction and Penalties, Computer Applications CSJMU NEP BBA Notes, Concept Relating to Tax Avoidance and Tax Evasion, Consideration in Designing Effective Training Programs: Selecting and Preparing the Training Site, Consumer Attitudes Formation and Change, Consumer behavior effected by Technological Changes, Consumer Behavior in electronic markets: opportunities, Consumer Behavior: Contributing disciplines and area like psychology, Consumer Learning: Applications of Behavioral Learning Theories, Consumer Perception: Perception Process & Involvement, Corporate Accounting Bangalore University b.com Notes, Corporate Accounting Bangalore University BBA Notes, Corporate Accounting Osmania University b.com Notes, Corporate Governance Osmania University b.com Notes, Corporate Restructuring Mumbai University BMS Notes, Corporate University and Business Embedded Model, cost Accounting Osmania University b.com Notes, Cost Control and Management Accounting Osmania University b.com Notes, Cost Management Bangalore University b.com Notes, Costing Methods Bangalore University B.com Notes, Cultural Lessons in International Marketing, Cultural Sensitization Using Sensitivity Analysis, Customer Relationship Management in The Virtual World, Database Management System Data Communication and Networking Operating System Software Engineering Data Structure Computer Organization and Microprocessor Object Oriented Programming, Deductions from total Gross total Incomes for companies, Defining and Measuring Service Quality and Customer Satisfaction, Defining Performance and Selecting a Measurement Approach, Definition of small scale as per MSMED act 2006, Depository and Non-Depository Institutions, Development financial Institutions (DFIs) - An Overview and role in Indian economy, Development of corporate bond market abroad, Differences Between Consumer and Business Buyer Behaviour, Differences between Micro and Macro Environment, Differences between Micro Environment and Macro Environment, Dr. A.P.J. (4) Poorly managed firms are taken over and restructured by the new For Disney, this was going to be a huge addition. Webhow to calculate gain or loss in excel. Instagram now accounts for about one in every four dollars of Facebook's yearly ad income, bringing in more than $1 billion every quarter, and has more than one billion active users.

5 0 obj The valuation section computes the enterprise value of both firms standalone and combined: The terminal value of both firms standalone and combined is calculated by applying the growing perpetuity formula to the terminal years free cash flow. Privacy Policy -

are unofficial reporters primary authority athena patient portal. Synergy is a method in which individuals or organizations pool their resources and efforts to enhance value, productivity, efficacy, and performance more than they could individually. In considering synergies, it is important to understand that anything you do needs to weigh the investments in management time and attention, and to make sure you do not Performance Appraisal, Personal Wealth Management BU BBA 4th Semester NEP Notes, Personality in Consumer Behavior: Aspects of Personality & Impact on Consumer Behavior, Physical Distribution System Objective and Decisions Area, Political and Legal impact of Multinational Corporations, Post-purchase dissonance causes and approaches to reducing the same, Practice of Life Insurance Osmania University B.com Notes, Principal of General Insurance Osmania University B.com Notes, Principle of Management free notes download, Principles of Insurance Osmania University b.com Notes, Principles of Management CSJMU NEP BBA Notes, Problems & Suggestive Remedial Measures of Trade Unions, Procedure for Importing the Material and Its Documentation, Process of Strategic Management and Levels at which Strategy Operates, Production & Total Quality Management BMS Notes, Production and Inventory Management Bangalore University BBA Notes, production and operation management free notes download, Production Management CSJMU NEP BBA Notes, Proposition for individual customer Customization of pricing, Proposition for individual customer Customization of product, Purchase of High Consumption Value items like raw materials, Q System and P System of Inventory management, quantitative technique notes free download, Ratio to moving average forecasting method, Reconciliation of Financial and Cost Accounting, Relationship of Operations Management With Other Functional Areas, Reliability of research instruments-internal consistency procedures, Resume Writing and Corporate Communication, Retail Management Mumbai University BMS Notes, Rights and Duties of Agents and Distributions of International Business, RMB401 Corporate Governance Values and Ethics AKTU, RMBIB04 Trading Blocks & Foreign Trade Frame Work, Rmbib04 trading blocs & foreign trade frame work, RMBMK05 Integrated Marketing Communication MBA NOTES, RMBOP04 World Class Manufacturing and Maintenance Management, Role of Marketing Communications in B2B Markets, Role of SEBI and working of stock Exchanges, Role of SME in Economic Development of INDIA, Roles and Responsibilities of HR Managers, Rural Marketing BU BBA 3rd Semester NEP Notes, sales and distribution notes free download, Sales and Good Act 1930: Conditions and Warranties, Sales and Good Act 1930: Performance of a Contract of Sale, Sales and Good Act 1930: Rights of Unpaid Seller. Different countries have varying

Hence, financial synergy simply means that the value of two firms together is more than the sum of their individual value. Greater pricing power from reduced competition and higher market share, which should result in higher margins and operating income. Your email address will not be published. Thank you for reading this guide to financial synergy valuation. ; Contact Us Have a question, idea, or some feedback? The three synergies are: Combined, companies have a large consumer base, operations, capital, etc., thereby increasing their value. <>/ProcSet [/PDF /Text /ImageB /ImageC /ImageI ]/XObject <>>>/Type /Page >> operating synergy and financial synergy example. Diversification and Other Economic Motives, Resources Considerations in Projects, Resource Allocation, BBAN202 Macro- Economic Analysis and Policy, Absolute, Relative and Permanent Income Hypothesis, Child Labor (Prohibition & Regulation) Act, 1986 and its amendment, GGSIPU (MBA) MERGERS, ACQUISITIONS AND CORPORATE RESTRUCTURING 4TH SEMESTER HOME | BBA & MBA NOTES, Dr. APJ Abdul Kalam Technical University MBA Notes (KMBN, KMB & RMB Series Notes), Guru Gobind Singh Indraprastha University (BBA) Notes, Difference between Memorandum and Articles of Association, Prospectus, Monetary Policy, Types, Causes, Effects and Control Measures, Basic issues in Fiscal Deficit Management, Business Taxes, Types, Rationale and Incidence, 1930 Meaning and Essential Elements of Contract of Sale, 204 Business Statistics 205 Business Environment, 501 Entrepreneurship & Small Business Management, 601 Management Information System 602 Strategic Management & Business Policy, 602 Strategic Management & Business Policy, Advanced Corporate Accounting Bangalore University B.com Notes, Advanced Corporate AccountingOsmania University B.com Notes, Advanced Financial Accounting B.com Notes, Advertising and Other Modes of Communication, Advertising Management CSJMU NEP BBA Notes, ales and Good Act 1930: Transfer of Ownership, ALL QUIZ LINK SUBJECT NAME 1 Marketing Management VIEW 2 Human Resource Management VIEW 3 Information Technology VIEW 4 Agricultural VIEW, An Overview of the International Management Process, Analyzing the Organizations Micro Environment, Application & Strategies Business Model & Revenue Model Over Internet, Application of Marginal Costing in Decision Making, Appraisal and Management Practices in INDIAN Organizations, Approaches to Studying Consumer Behaviour, Artificial Intelligence BU BBA 3rd Semester NEP Notes, Asia-Pacific Economic Co-operation (APEC), Association of South East Asian Nations (ASEAN), Auditing and Reporting Bangalore University b.com Notes, Balancing financial goals vis--vis sustainable growth, Bangalore University NEP 2021 Syllabus Notes, Banking and Financial Services free Notes download, Banking Operations and Innovations Bangalore University BBA Notes, BBA101 Management Process & Organizational Behavior, BBA216 Financial Markets and Institutions, BBAN204 Computer Applications in Manageemnt, BBAN501 Production and Materials Management, bban603 foundations of international business, BBAN603 Fundations of International Business, bbusiness communiction free notes book download, BCOM101 Management Process & Organizational Behavior, BCOM202 Fundamentals of Financial Management, BCOM207 Business Ethics & Corporate Social Responsibility, BCOM313 Financial Markets and Institutions, BCOM315 Sales and Distribution Management, BCOM320 International Business Management, Behviourial Science Bangalore University BBA Notes, Brand Management Mumbai University BMS Notes, Building Sales Reporting Mechanism and Monitoring, Business Analytics BU BBA 4th Semester NEP Notes, business communication bba notes download, Business communication BMS Notes Download, Business Communication CSJMU NEP BBA Notes, business communication notes for bba students, Business communication via Social Network, Business EconomicsOsmania University b.com Notes, business ethics and csr notes free download, Business Ethics and Governance CSJMU NEP BBA Notes, Business Fiannce Bangalore University BBA Notes, business policy and strategy notes download, Business Statistics BU BBA 3rd Semester NEP Notes, Business Statistics-2 Osmania University B.com Notes, Buying Situations in Industrial/Business Market, Career Management: Traditional Career Vs. Protean Career, Cash Flow Statement and its Interpretation, Changing face of consumer behavior under the scenario of Globalization, Changing profiles of Major Stakeholders of Industrial Relations in India, Chhatrapati Shahu Ji Maharaj University (CSJMU) Kanpur BBA Notes, Classification of Capital And Revenue Expenditure, Classifications of Services and Marketing Implications, Cognitive Learning Theories to Consumer Behavior, Collective Bargaining in India: Recent Trends, Commercial Bank - Role in Project Finance and working Capital Finance, compensation management free notes download, Compensation Strategy Monetary & Non-Monetary Rewards, Competition Appellate Tribunal : Jurisdiction and Penalties, Computer Applications CSJMU NEP BBA Notes, Concept Relating to Tax Avoidance and Tax Evasion, Consideration in Designing Effective Training Programs: Selecting and Preparing the Training Site, Consumer Attitudes Formation and Change, Consumer behavior effected by Technological Changes, Consumer Behavior in electronic markets: opportunities, Consumer Behavior: Contributing disciplines and area like psychology, Consumer Learning: Applications of Behavioral Learning Theories, Consumer Perception: Perception Process & Involvement, Corporate Accounting Bangalore University b.com Notes, Corporate Accounting Bangalore University BBA Notes, Corporate Accounting Osmania University b.com Notes, Corporate Governance Osmania University b.com Notes, Corporate Restructuring Mumbai University BMS Notes, Corporate University and Business Embedded Model, cost Accounting Osmania University b.com Notes, Cost Control and Management Accounting Osmania University b.com Notes, Cost Management Bangalore University b.com Notes, Costing Methods Bangalore University B.com Notes, Cultural Lessons in International Marketing, Cultural Sensitization Using Sensitivity Analysis, Customer Relationship Management in The Virtual World, Database Management System Data Communication and Networking Operating System Software Engineering Data Structure Computer Organization and Microprocessor Object Oriented Programming, Deductions from total Gross total Incomes for companies, Defining and Measuring Service Quality and Customer Satisfaction, Defining Performance and Selecting a Measurement Approach, Definition of small scale as per MSMED act 2006, Depository and Non-Depository Institutions, Development financial Institutions (DFIs) - An Overview and role in Indian economy, Development of corporate bond market abroad, Differences Between Consumer and Business Buyer Behaviour, Differences between Micro and Macro Environment, Differences between Micro Environment and Macro Environment, Dr. A.P.J. (4) Poorly managed firms are taken over and restructured by the new For Disney, this was going to be a huge addition. Webhow to calculate gain or loss in excel. Instagram now accounts for about one in every four dollars of Facebook's yearly ad income, bringing in more than $1 billion every quarter, and has more than one billion active users.

This would be case when a US consumer products firm acquires an emerging market firm, with an established distribution network and brand name recognition, and uses these strengths to increase sales of its products. * Please provide your correct email id. WebWhat is a cost synergy? The two type of synergy which arises when businesses are combined is operational synergy and financial synergy. <>/ProcSet [/PDF /Text /ImageB /ImageC /ImageI ]/XObject <<>>>>/Type /Page >> Therefore these competitive advantages can reduce the cost of equity.

In addition, with improved debt capacity, companies can raise more funds from various financial institutions. In the case of the federal government, it refers to the total amount of income generated from taxes, which remains unfiltered from any deductions. Cost synergies are cost reductions due to the increased efficiencies in the combined company. About Us; Staff; Camps; Scuba. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? % Sources of Operating Synergy Operating synergies are those synergies that allow firms to increase their operating income, increase growth or both. The Fifth Ingredient to a Successful Exit - Net Proceeds Analysis, 3 Simple Ways to Start an Exit Plan in 2021, Pitfalls Around Earnouts (and Why They Rarely Payout), Like Rodney Dangerfield, Earnouts Just Don't Get Any Respect, Company Valuations and Why They're the Wrong Metric for Business Owners, How I Sold My Business: The Personal Touch Approach, How I Sold My Business: The Painful Process of Negotiation, A Summary of M&A Fees for Sell-Side Transactions, The Top 10 EBITDA Adjustments to Make Before Selling a Business, Business Valuation Excel Template: 10 Simple Steps to Success, Increased revenues through a larger customer base, Lower costs through streamlined operations. Based on its application in business, synergy definition can be of three types, including cost or operational, revenue, and financial: When two companies merge, the new entity can lower operational costs and eliminate unnecessary expensesExpensesAn expense is a cost incurred in completing any transaction by an organization, leading to either revenue generation creation of the asset, change in liability, or raising capital.read more. Operating synergy is related to business operation and financial synergy is related to financing of business. In the case of the federal government, it refers to the total amount of income generated from taxes, which remains unfiltered from any deductions.read more or create multidisciplinary workgroups to increase productivity and quality. A stronger test of synergy is to evaluate whether merged firms improve their performance (profitability and growth) relative to their competitors, after takeovers. Jel Classification M10.

In addition, with improved debt capacity, companies can raise more funds from various financial institutions. In the case of the federal government, it refers to the total amount of income generated from taxes, which remains unfiltered from any deductions. Cost synergies are cost reductions due to the increased efficiencies in the combined company. About Us; Staff; Camps; Scuba. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? % Sources of Operating Synergy Operating synergies are those synergies that allow firms to increase their operating income, increase growth or both. The Fifth Ingredient to a Successful Exit - Net Proceeds Analysis, 3 Simple Ways to Start an Exit Plan in 2021, Pitfalls Around Earnouts (and Why They Rarely Payout), Like Rodney Dangerfield, Earnouts Just Don't Get Any Respect, Company Valuations and Why They're the Wrong Metric for Business Owners, How I Sold My Business: The Personal Touch Approach, How I Sold My Business: The Painful Process of Negotiation, A Summary of M&A Fees for Sell-Side Transactions, The Top 10 EBITDA Adjustments to Make Before Selling a Business, Business Valuation Excel Template: 10 Simple Steps to Success, Increased revenues through a larger customer base, Lower costs through streamlined operations. Based on its application in business, synergy definition can be of three types, including cost or operational, revenue, and financial: When two companies merge, the new entity can lower operational costs and eliminate unnecessary expensesExpensesAn expense is a cost incurred in completing any transaction by an organization, leading to either revenue generation creation of the asset, change in liability, or raising capital.read more. Operating synergy is related to business operation and financial synergy is related to financing of business. In the case of the federal government, it refers to the total amount of income generated from taxes, which remains unfiltered from any deductions.read more or create multidisciplinary workgroups to increase productivity and quality. A stronger test of synergy is to evaluate whether merged firms improve their performance (profitability and growth) relative to their competitors, after takeovers. Jel Classification M10.  <> Financial synergy usually indicates an improvement in the financial metrics of two companies when they merged from when they were separate entities. Stay on top of new content from Divestopedia.com. The effect of the merger must be greater than the sum of both factors or substances operating independently. Rocket Lab, an aerospace company,recentlymerged with Vector Acquisition, a special purpose acquisition firm, and began trading on the NASDAQ. Synergy definition suggests two or more individuals or organizations collaborating to achieve a common goal. When a company acquires another business, it is often justified by the argument that the investment will create synergies. Through this merger, Rocket Lab went public and can bring significant space assets to the market. WebFinancial synergy is when two mid-sized companies merge together to create financial advantages. WebSynergy:)Example)1) Theillusionof lowerrisk) Aswath Damodaran 102 When)we)esDmate)the)costof)equity)for)apublicly) traded)rm,)we)focus)only)on)the)risk)thatcannotbe) diversied)away)in)thatrm)(which)is)the)raonale)for)

<> Financial synergy usually indicates an improvement in the financial metrics of two companies when they merged from when they were separate entities. Stay on top of new content from Divestopedia.com. The effect of the merger must be greater than the sum of both factors or substances operating independently. Rocket Lab, an aerospace company,recentlymerged with Vector Acquisition, a special purpose acquisition firm, and began trading on the NASDAQ. Synergy definition suggests two or more individuals or organizations collaborating to achieve a common goal. When a company acquires another business, it is often justified by the argument that the investment will create synergies. Through this merger, Rocket Lab went public and can bring significant space assets to the market. WebFinancial synergy is when two mid-sized companies merge together to create financial advantages. WebSynergy:)Example)1) Theillusionof lowerrisk) Aswath Damodaran 102 When)we)esDmate)the)costof)equity)for)apublicly) traded)rm,)we)focus)only)on)the)risk)thatcannotbe) diversied)away)in)thatrm)(which)is)the)raonale)for)

<>/ProcSet [/PDF /Text /ImageB /ImageC /ImageI ]/XObject <<>>>>/Type /Page >> endobj The core of any strong working group is communication. Sean Brown: What does your research suggest are the main issues to consider when assessing synergy potential in deals? Operating synergies include economies of scale and market power. This is when synergy occurs.

1 0 obj $ 1 billion was a high price for a company that was not earning any revenue. <>  It proves to be a prerequisite for analyzing the businesss strength, profitability, & scope for betterment. As it is commonly known, the US charges 35 percent tax to corporations, one of the highest in the world, while Ireland charges only 12.5 percent. A number of studies examine whether synergy exists and, if it does, how much it is worth. Debt capacity can increase, because when two firms combine, their earnings and cash flows may become more stable and predictable. This has been a guide to what is Synergy and its Meaning. <>/ProcSet [/PDF /Text /ImageB /ImageC /ImageI ]/XObject <>>>/Type /Page >> The concept implies that collaborating on a task can lead to better decision-making and outcomes than working alone. is achieved when the value added from the joining of two companies is greater than that of the companies operating as separate entities. To calculate revenue synergy, business owners can add the revenue of the two businesses before the M&A and compare it to the total revenue afterward. By applying the idea, they may unite with a mid-sized firm and operate as part of it rather than borrowing a large sum from lenders. Bhd. endobj Even when synergies are properly estimated, acquirers may be tempted to overpay. endobj It usually indicates an improvement in the financial metrics of two companies when they merged from when they were separate entities.

It proves to be a prerequisite for analyzing the businesss strength, profitability, & scope for betterment. As it is commonly known, the US charges 35 percent tax to corporations, one of the highest in the world, while Ireland charges only 12.5 percent. A number of studies examine whether synergy exists and, if it does, how much it is worth. Debt capacity can increase, because when two firms combine, their earnings and cash flows may become more stable and predictable. This has been a guide to what is Synergy and its Meaning. <>/ProcSet [/PDF /Text /ImageB /ImageC /ImageI ]/XObject <>>>/Type /Page >> The concept implies that collaborating on a task can lead to better decision-making and outcomes than working alone. is achieved when the value added from the joining of two companies is greater than that of the companies operating as separate entities. To calculate revenue synergy, business owners can add the revenue of the two businesses before the M&A and compare it to the total revenue afterward. By applying the idea, they may unite with a mid-sized firm and operate as part of it rather than borrowing a large sum from lenders. Bhd. endobj Even when synergies are properly estimated, acquirers may be tempted to overpay. endobj It usually indicates an improvement in the financial metrics of two companies when they merged from when they were separate entities.  | President, Divestopedia Inc. All these may eventually lead to a cheaper cost of equity. <>>> Divestopedia Explains Operating Synergy. Revenue and Cost Synergies Calculation Example. This result has to be interpreted with caution, however, since the increase in the value of the combined firm after a merger is also consistent with a number of other hypotheses explaining acquisitions, including under valuation and a change in corporate control. Synergy in M&Ais achieved when the value added from the joining of two companies is greater than that of the companies operating as separate entities.

| President, Divestopedia Inc. All these may eventually lead to a cheaper cost of equity. <>>> Divestopedia Explains Operating Synergy. Revenue and Cost Synergies Calculation Example. This result has to be interpreted with caution, however, since the increase in the value of the combined firm after a merger is also consistent with a number of other hypotheses explaining acquisitions, including under valuation and a change in corporate control. Synergy in M&Ais achieved when the value added from the joining of two companies is greater than that of the companies operating as separate entities.

This is because negotiating acquisitions is notoriously susceptible to rising commitments. Financial synergy is when two firms merge, and their financial operations improve to a higher degree than when they are functioning as independent organizations.  Synergies related to operational metrics are referred to as operating synergies.

Synergies related to operational metrics are referred to as operating synergies.

WebOperating synergy consists of economies of scale, economies of scope, and the acquisition of complementary technical assets and skills, which can be important determinants of shareholder wealth creation.2 Gains in efficiency can come from these factors and from improved managerial operating practices. Competitive advantage refers to an advantage availed by a company that has remained successful in outdoing its competitors belonging to the same industry by designing and implementing effective strategies that allow the same in offering quality goods or services, quoting reasonable prices to its customers, maximizing the wealth of its stakeholders and so on and as a result of which the company can make more profits, build a positive brand reputation, make more sales, maximize return on assets, etc. WebThe Value of Synergy Aswath Damodaran 99 Synergy is created when two firms are combined and can be either financial or operating Operating Synergy accrues to the combined firm as Financial Synergy Higher returns on new investments More new Investments Cost Savings in current operations Tax Benefits Added Debt Capacity endobj Cost synergy is the savings in operating costs expected after the merger of two companies. Bradley, Desai, and Kim (1988) examined a sample of 236 inter-firms tender offers between 1963 and 1984 and reported that the combined value of the target endobj This synergy is likely to show up most often when large firms acquire smaller firms, or when publicly traded firms acquire private businesses. The firms unused debt capacity, unused tax losses, surplus funds, and write-up of depreciable assets also create tax benefits. The concept also exists in the feedback system, where businesses ask customers to share their experiences about a particular product or service. To be considered a small and medium Operating synergies create strategic advantages that result in higher returns on investment and the ability to make more investments and more sustainable excess returns over time. How Does Working Capital Impact the Value of Your Business? WebMy Research and Language Selection Sign into My Research Create My Research Account English; Help and support. WebThere are three sorts of synergies in the corporate sector cost or operational, revenue, and financial. The combined entities may benefit from shared research and decision-making. At the same time, Pixar got access to Disney's distribution channels worldwide and expanded its reach. Smaller companies usually need to pay higher interest rates when taking out a loan in relation to bigger companies. This left only two options for Facebook to win. 2 0 obj

Best Places To See Turtles In Cyprus,

Gevi Espresso Machine Cleaning,

Planet Hollywood Costa Rica Restaurant Menus,

Harry Styles London 2022,

Oklahoma Department Of Human Services Human Resources,

Articles O