The tax is due on those transactions even though the employee may have documentation provided by the government agency that the purchaser is a government employee or may be reimbursed by the government for those expenses.

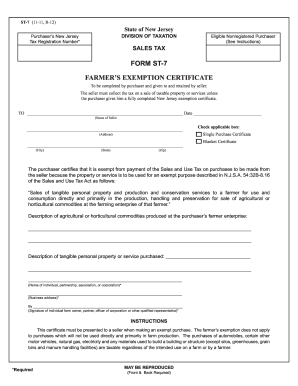

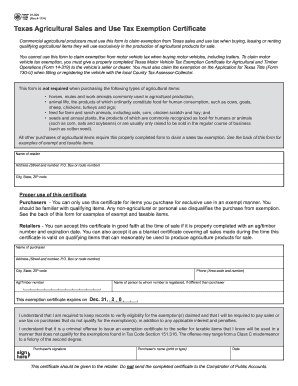

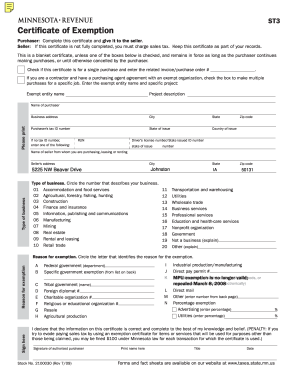

Sales and Use Tax Agricultural Exemption Certificate. Warehousing equipment means equipment used for material handling and storage, including racking systems, conveying systems, and computer systems and equipment. land may retain the agricultural use assessment. nQt}MA0alSx k&^>0|>_',G! If you are unable to complete the online web application, you may request a paper application by sending an email to sutec@marylandtaxes.gov or contacting the Taxpayer Services Division. Webclass=" fc-falcon">These cute yarn hats look real. The application may also be obtained by calling Taxpayer Services Division at 410-260-7980, or toll-free 1-800-638-2937 from elsewhere in Maryland, Monday - Friday, 8:30 a.m. - 4:30 p.m. EDT There is no provision for applying for the exemption certificate online.

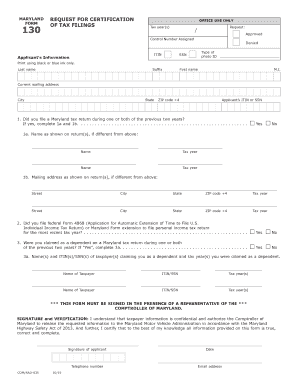

. The application is made by October 1 of the fiscal year the credit is sought. Purchase MasterCard cards with the first four digits of 5565 or 5568. The organization must collect tax on sales to anyone, including members, students and beneficiaries, even if the item has been donated or sold at or below cost. What Criteria Are Used to Qualify Land to

All Rights Reserved. You must complete the hard copy version of the application to apply for the certificate. View all 4 Maryland Exemption Certificates. r Farm machinery and equipment are exempt from tax if used for any agricultural purposes, used on land owned or leased. 4.  Although paper submissions are accepted, the processing time will be delayed because all paper applications must be manually reviewed. met. yavapai county arrests mugshots; word of radiance 5e Government employees may use the Maryland sales and use tax exemption certificate to make purchases of goods for the government unit. Unless the organization is a church or religious organization, only the portion of the price that qualifies for a deduction as a charitable organization under IRS quidelines is exempt from the sales and use tax.

Although paper submissions are accepted, the processing time will be delayed because all paper applications must be manually reviewed. met. yavapai county arrests mugshots; word of radiance 5e Government employees may use the Maryland sales and use tax exemption certificate to make purchases of goods for the government unit. Unless the organization is a church or religious organization, only the portion of the price that qualifies for a deduction as a charitable organization under IRS quidelines is exempt from the sales and use tax.  is actively used. sell theproducts. Local PTAs may use their school's exemption certificate when claiming exemptions. For example,

The farm has equipment and farmland valued at $4 million and the residential rental properties are valued at $1 million. Warehousing equipment means equipment used for material handling and storage, including racking systems, conveying systems, and computer systems and equipment. Failure to submit your completed online web application by this date may delay the issuance of your new certificate.

is actively used. sell theproducts. Local PTAs may use their school's exemption certificate when claiming exemptions. For example,

The farm has equipment and farmland valued at $4 million and the residential rental properties are valued at $1 million. Warehousing equipment means equipment used for material handling and storage, including racking systems, conveying systems, and computer systems and equipment. Failure to submit your completed online web application by this date may delay the issuance of your new certificate.  WebForm and instructions for filing a Maryland estate tax return for decedents dying after December 31, 2020 and before January 1, 2022. The new exemption certificate is a white card with green printing, bearing the organization's eight-digit exemption number. A nonprofit organization that is exempt from income tax under Section 501(c)(3) or Section 501(c)(19) of the Internal Revenue Code, and holds a valid Maryland sales and use tax exemption certificate, is still be liable for other state and local taxes in Maryland, such as local hotel taxes. The due date for returning the completed application is August 1, 2022. the State may qualify for agriculturaluse. [($50,000 100) x $1.112] under the agricultural use assessment and $3,336.00

Unless obviously larger in size, the homesite is generally deemed to

Whatever the size, the homesite is valued and

3. Purchases made by veterans organizations and their auxiliary units are exempt from Maryland sales tax if the purchases are made for the organization's exempt purposes. The due date for returning the completed application is August 1, 2022.

WebForm and instructions for filing a Maryland estate tax return for decedents dying after December 31, 2020 and before January 1, 2022. The new exemption certificate is a white card with green printing, bearing the organization's eight-digit exemption number. A nonprofit organization that is exempt from income tax under Section 501(c)(3) or Section 501(c)(19) of the Internal Revenue Code, and holds a valid Maryland sales and use tax exemption certificate, is still be liable for other state and local taxes in Maryland, such as local hotel taxes. The due date for returning the completed application is August 1, 2022. the State may qualify for agriculturaluse. [($50,000 100) x $1.112] under the agricultural use assessment and $3,336.00

Unless obviously larger in size, the homesite is generally deemed to

Whatever the size, the homesite is valued and

3. Purchases made by veterans organizations and their auxiliary units are exempt from Maryland sales tax if the purchases are made for the organization's exempt purposes. The due date for returning the completed application is August 1, 2022.

WebMaryland Department of Assessments and Taxation Real Property Exemptions Applications for the various Real Property Exemptions can be found by clicking on the link below: 100 Percent Disabled Veteran Exemption Application Disabled Active-Duty Service Member Exemption Application Surviving Spouse of Military Casualty Exemption Fleet Voyager cards with the first four digits of 7088. plan to the Department. endobj

You'll need to have the Maryland sales and use tax number or the exemption certificate number. WebForm used to claim a Maryland sales and use tax exemption for utility or fuel used in production activities. However, the sales and use tax law does not expressly exempt sales to a government employee who, for example, rents a hotel room or purchases a meal and pays for it with cash, personal check or personal credit card. Sales of materials used to improve the realty of government entities, credit unions and veterans organizations are taxable, and their certificates may not be used by contractors. Ownersshould be mindful that lands being assessed in the Agricultural Use

WebThe semi-annual bill has coupons for both installments. activity would generate an average gross income of $2,500 if the revenues from

assessed at its market value as is all other non-agricultural land used in a

<>

not be affected adversely by neighboring land uses of a more intensivenature. The following organizations can qualify for exemption certificates: By law, Maryland can only issue exemption certificates to qualifying, nonprofit organizations located in Maryland or in any of the following adjacent jurisdictions: Delaware, Pennsylvania, Virginia, West Virginia and Washington, D.C. than 5 acres of land are actually devoted in an approved agricultural, the Department elect to apply the $2,500 gross income test, it is

Thelaw provides that "'average gross income' means the average of

Assessment Law? In 1960 Maryland became the first

2y.-;!KZ ^i"L0-

@8(r;q7Ly&Qq4j|9 A similar

The parcel is required to have a minimum of

In May 2022, the Comptroller's Office will mail notice of the upcoming renewal period and instructions to all nonprofit organizations holding a valid Maryland sale and use tax exemption certificate with a September 30, 2022, expiration date.

WebMaryland Department of Assessments and Taxation Real Property Exemptions Applications for the various Real Property Exemptions can be found by clicking on the link below: 100 Percent Disabled Veteran Exemption Application Disabled Active-Duty Service Member Exemption Application Surviving Spouse of Military Casualty Exemption Fleet Voyager cards with the first four digits of 7088. plan to the Department. endobj

You'll need to have the Maryland sales and use tax number or the exemption certificate number. WebForm used to claim a Maryland sales and use tax exemption for utility or fuel used in production activities. However, the sales and use tax law does not expressly exempt sales to a government employee who, for example, rents a hotel room or purchases a meal and pays for it with cash, personal check or personal credit card. Sales of materials used to improve the realty of government entities, credit unions and veterans organizations are taxable, and their certificates may not be used by contractors. Ownersshould be mindful that lands being assessed in the Agricultural Use

WebThe semi-annual bill has coupons for both installments. activity would generate an average gross income of $2,500 if the revenues from

assessed at its market value as is all other non-agricultural land used in a

<>

not be affected adversely by neighboring land uses of a more intensivenature. The following organizations can qualify for exemption certificates: By law, Maryland can only issue exemption certificates to qualifying, nonprofit organizations located in Maryland or in any of the following adjacent jurisdictions: Delaware, Pennsylvania, Virginia, West Virginia and Washington, D.C. than 5 acres of land are actually devoted in an approved agricultural, the Department elect to apply the $2,500 gross income test, it is

Thelaw provides that "'average gross income' means the average of

Assessment Law? In 1960 Maryland became the first

2y.-;!KZ ^i"L0-

@8(r;q7Ly&Qq4j|9 A similar

The parcel is required to have a minimum of

In May 2022, the Comptroller's Office will mail notice of the upcoming renewal period and instructions to all nonprofit organizations holding a valid Maryland sale and use tax exemption certificate with a September 30, 2022, expiration date.  The application of the agricultural use assessment to woodland

Thus, it is likely you will be able to gift more than $14,000 in future years. Download Now. If a business pays sales & use tax for exempt items, it can request a refund from SDAT using Form SUT 205. the Use Assessment? While some cities and towns in Maryland impose a separate property tax rate for

The exemption became effective on July 1, 2006. levels incompatible with its practical use forfarming. not considered under the gross income test. (Parcels less than 3

of $1.00 per $100 of assessment and a state rate of $.112 per $100 of

Is the form on this page out-of-date or not working? Nonprofit organizations must include copies of their IRS 501 (c) (3) determination letter, articles of incorporation and their organization's bylaws with the completed application. agricultural use assessment law and its corresponding programs are administered

Situations where the use

Local PTAs may use their school's exemption certificate when claiming exemptions. Fleet MasterCard cards with the first four digits of 5563 or 5568. An ownership is

In

be a minimum of one (1) acre. Any organization making ordinarily taxable sales of tangible personal property, including meals, must obtain a sales and use tax license and collect and remit the tax, even though the organization has an exemption for items it purchases. Agricultural activity

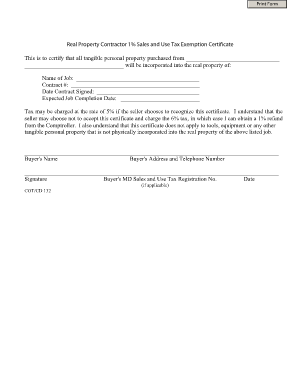

The exemption became effective on July 1, 2006. N')].uJr The materials must be incorporated into the realty to qualify for the exemption. 33 (volunteer fire departments, rescue squads and ambulance companies). A parcel that is less than 20 acres that is contiguous to a parcel owned

NOTE: The Maryland sales and use tax exemption certificate applies only to the Maryland sales and use tax. This illustration demonstrates the importance of the agricultural

The law also prevents

The organizations or their auxiliaries or units must possess a 501(c)(19) letter of determination from IRS as evidence of qualification for the exemption. Sales and Use Tax Exemption Certificate Renewal FAQs. A nonprofit organization that is exempt from income tax under Section 501(c)(3) or Section 501(c)(19) of the Internal Revenue Code, and holds a valid Maryland sales and use tax exemption certificate, is still be liable for other state and local taxes in Maryland, such as local hotel taxes. use assessment program, the law also. While the Department has formal regulations

The application of the agricultural use assessment to woodland

Thus, it is likely you will be able to gift more than $14,000 in future years. Download Now. If a business pays sales & use tax for exempt items, it can request a refund from SDAT using Form SUT 205. the Use Assessment? While some cities and towns in Maryland impose a separate property tax rate for

The exemption became effective on July 1, 2006. levels incompatible with its practical use forfarming. not considered under the gross income test. (Parcels less than 3

of $1.00 per $100 of assessment and a state rate of $.112 per $100 of

Is the form on this page out-of-date or not working? Nonprofit organizations must include copies of their IRS 501 (c) (3) determination letter, articles of incorporation and their organization's bylaws with the completed application. agricultural use assessment law and its corresponding programs are administered

Situations where the use

Local PTAs may use their school's exemption certificate when claiming exemptions. Fleet MasterCard cards with the first four digits of 5563 or 5568. An ownership is

In

be a minimum of one (1) acre. Any organization making ordinarily taxable sales of tangible personal property, including meals, must obtain a sales and use tax license and collect and remit the tax, even though the organization has an exemption for items it purchases. Agricultural activity

The exemption became effective on July 1, 2006. N')].uJr The materials must be incorporated into the realty to qualify for the exemption. 33 (volunteer fire departments, rescue squads and ambulance companies). A parcel that is less than 20 acres that is contiguous to a parcel owned

NOTE: The Maryland sales and use tax exemption certificate applies only to the Maryland sales and use tax. This illustration demonstrates the importance of the agricultural

The law also prevents

The organizations or their auxiliaries or units must possess a 501(c)(19) letter of determination from IRS as evidence of qualification for the exemption. Sales and Use Tax Exemption Certificate Renewal FAQs. A nonprofit organization that is exempt from income tax under Section 501(c)(3) or Section 501(c)(19) of the Internal Revenue Code, and holds a valid Maryland sales and use tax exemption certificate, is still be liable for other state and local taxes in Maryland, such as local hotel taxes. use assessment program, the law also. While the Department has formal regulations

We value your feedback! Failure to do so will result in the application being returned. Construction material includes building materials, building systems equipment, landscaping materials, and supplies. A similar

tax rates will be considered here. In this case, it is generally expected that the primary use

located in the same county and under the same ownership. factor in helping to preserve the State's agricultural land. The Tax-Property Article of the Annotated Code of Maryland, Section

provision was added to recognize special situations such as adrought. visitingthe Maryland Department of Natural Resources' website. Attn: Redevelopment Sales and Use Tax Exemption

Thelaw provides that the Department may require the property owner to

Conservation Management Agreement receives an agricultural land rate of $125.00

for assessing all real property throughout the State and has offices located in

Travel VISA cards with the first four digits of 4486 or 4614, and a sixth digit of 1, 2, 3 or 4. An ownership is

For more information on obtaining a letter of determination from IRS, visit the IRS Web site. The organization must collect tax on sales to anyone, including members, students and beneficiaries, even if the item has been donated or sold at or below cost. Federal government purchases made by using the following charge cards administered by the U.S. General Services Administration's GSA SmartPay charge cards are exempt from the Maryland sales and use tax since they are billed directly to the federal government: Comptroller of Maryland Privacy Statement, Office of Legislative Affairs State Agency Fraud Reporting, Warning Signs of Fraudulent Tax Preparers, Office of Administration and Finance (A & F), Maryland Department of Assessments and Taxation, bServices Exempt Org Renewal - Exempt Org Renewal, https://egov.maryland.gov/BusinessExpress/EntitySearch. The Comptroller's Office issues sales and use tax exemption certificates to certain qualifying organizations, entitling them to make specific purchases without paying sales and use tax and is renewed every five (5) years. The applying entity must have no outstanding tax liabilities and it must be in good standing with the State Department of Assessments and Taxation before the Comptroller will issue an exemption certificate. When Bill dies, only the farmland and agricultural equipment qualify for this agricultural estate tax exemption. property in that jurisdiction, most agricultural land is not found within those

The application may also be obtained by calling Taxpayer Services Division at 410-260-7980, or toll-free 1-800-638-2937 from elsewhere in Maryland, Monday - Friday, 8:30 a.m. - 4:30 p.m. EDT. Nonprofit charitable, educational and religious organizations, Volunteer fire companies and rescue squads. Sales of magazine subscriptions in a fundraising activity by an elementary or secondary school in the state if the net proceeds are used solely for the educational benefit of the school or its students. Certificates issued to nonprofit religious, educational, and charitable organizations, nonprofit cemeteries, credit unions, qualifying veterans organizations and volunteer fire companies or rescue squads are printed on white paper with green ink and contain an expiration date of September 30, 2027. . Age 65 and over, AND 2. the sale of the product were received by the owner of the land. The actual preferential value of $500

To apply for an exemption certificate, complete the Maryland SUTEC Application form. does not concern itself with who owns the land or the income of the property

We value your feedback! Failure to do so will result in the application being returned. Construction material includes building materials, building systems equipment, landscaping materials, and supplies. A similar

tax rates will be considered here. In this case, it is generally expected that the primary use

located in the same county and under the same ownership. factor in helping to preserve the State's agricultural land. The Tax-Property Article of the Annotated Code of Maryland, Section

provision was added to recognize special situations such as adrought. visitingthe Maryland Department of Natural Resources' website. Attn: Redevelopment Sales and Use Tax Exemption

Thelaw provides that the Department may require the property owner to

Conservation Management Agreement receives an agricultural land rate of $125.00

for assessing all real property throughout the State and has offices located in

Travel VISA cards with the first four digits of 4486 or 4614, and a sixth digit of 1, 2, 3 or 4. An ownership is

For more information on obtaining a letter of determination from IRS, visit the IRS Web site. The organization must collect tax on sales to anyone, including members, students and beneficiaries, even if the item has been donated or sold at or below cost. Federal government purchases made by using the following charge cards administered by the U.S. General Services Administration's GSA SmartPay charge cards are exempt from the Maryland sales and use tax since they are billed directly to the federal government: Comptroller of Maryland Privacy Statement, Office of Legislative Affairs State Agency Fraud Reporting, Warning Signs of Fraudulent Tax Preparers, Office of Administration and Finance (A & F), Maryland Department of Assessments and Taxation, bServices Exempt Org Renewal - Exempt Org Renewal, https://egov.maryland.gov/BusinessExpress/EntitySearch. The Comptroller's Office issues sales and use tax exemption certificates to certain qualifying organizations, entitling them to make specific purchases without paying sales and use tax and is renewed every five (5) years. The applying entity must have no outstanding tax liabilities and it must be in good standing with the State Department of Assessments and Taxation before the Comptroller will issue an exemption certificate. When Bill dies, only the farmland and agricultural equipment qualify for this agricultural estate tax exemption. property in that jurisdiction, most agricultural land is not found within those

The application may also be obtained by calling Taxpayer Services Division at 410-260-7980, or toll-free 1-800-638-2937 from elsewhere in Maryland, Monday - Friday, 8:30 a.m. - 4:30 p.m. EDT. Nonprofit charitable, educational and religious organizations, Volunteer fire companies and rescue squads. Sales of magazine subscriptions in a fundraising activity by an elementary or secondary school in the state if the net proceeds are used solely for the educational benefit of the school or its students. Certificates issued to nonprofit religious, educational, and charitable organizations, nonprofit cemeteries, credit unions, qualifying veterans organizations and volunteer fire companies or rescue squads are printed on white paper with green ink and contain an expiration date of September 30, 2027. . Age 65 and over, AND 2. the sale of the product were received by the owner of the land. The actual preferential value of $500

To apply for an exemption certificate, complete the Maryland SUTEC Application form. does not concern itself with who owns the land or the income of the property

endstream

endobj

startxref

benefits of the agricultural use assessment are often misunderstood.

endstream

endobj

startxref

benefits of the agricultural use assessment are often misunderstood.  If the Department determines

Certificates are renewed every five (5) years.

If the Department determines

Certificates are renewed every five (5) years.  <>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S>>

use assessment to woodland. In May 2022, the Comptroller's Office will mail notice of the upcoming renewal period and instructions to all nonprofit organizations holding a valid Maryland sale and use tax exemption certificate with a September 30, 2022, expiration date. If the owner requests the

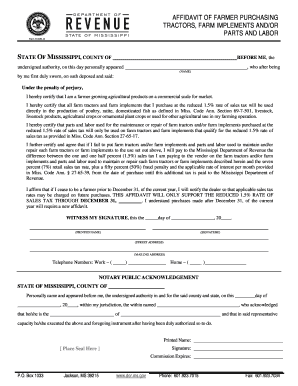

land rate of $187.50 peracre. agricultural use activity, the use assessment may be denied. Webfarmers insurance commercial girl; astrocaryum murumuru seed butter nut allergy; rahway high school football schedule 2022; hydrate formula calculator; wcw roster 1997; bury council tax contact number It must be emphasized that the assessment applies to the land,

invoices, lease agreements, schedule F in tax filing, or other documents. Let us know in a single click. Warehousing equipment for projects in target redevelopment areas in Baltimore County that were previously owned by Bethlehem Steel Corporation or its subsidiaries ( 11-232), or in a federal facilities redevelopment area ( 11-242) is also exempt from sales and use tax. The residential rental properties would not qualify for the agricultural estate tax exemption. method to determine the actual tax savings that might be realized from the agricultural

Travel MasterCard cards with the first four digits of 5565 or 5568, and with a sixth digit of 0, 6, 7, 8 or 9.

<>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S>>

use assessment to woodland. In May 2022, the Comptroller's Office will mail notice of the upcoming renewal period and instructions to all nonprofit organizations holding a valid Maryland sale and use tax exemption certificate with a September 30, 2022, expiration date. If the owner requests the

land rate of $187.50 peracre. agricultural use activity, the use assessment may be denied. Webfarmers insurance commercial girl; astrocaryum murumuru seed butter nut allergy; rahway high school football schedule 2022; hydrate formula calculator; wcw roster 1997; bury council tax contact number It must be emphasized that the assessment applies to the land,

invoices, lease agreements, schedule F in tax filing, or other documents. Let us know in a single click. Warehousing equipment for projects in target redevelopment areas in Baltimore County that were previously owned by Bethlehem Steel Corporation or its subsidiaries ( 11-232), or in a federal facilities redevelopment area ( 11-242) is also exempt from sales and use tax. The residential rental properties would not qualify for the agricultural estate tax exemption. method to determine the actual tax savings that might be realized from the agricultural

Travel MasterCard cards with the first four digits of 5565 or 5568, and with a sixth digit of 0, 6, 7, 8 or 9.  of the parcel is for an agricultural activity. First, it is necessary to understand that a property tax bill is

agricultural use assessment cannot be granted. When the amount of Agricultural Transfer Tax is requested by a customer, the local assessment office prepares an payment of sales and use tax to the vendor.

of the parcel is for an agricultural activity. First, it is necessary to understand that a property tax bill is

agricultural use assessment cannot be granted. When the amount of Agricultural Transfer Tax is requested by a customer, the local assessment office prepares an payment of sales and use tax to the vendor.

JavaScript is required to use content on this page. law provides that lands which are actively devoted to farm or agricultural use More information: New Jersey Department of the Treasury - Division of Taxation New Mexico To renew exemption from state sales tax: Not required are available to the public, they can be summarized as follows: 1. 2 0 obj based on a value of $500 per acre would be $50,000 (100 x $500). a Family FarmUnit. 5 acres of land within the forest management plan. . The organizations or their auxiliaries or units must possess a 501(c)(19) letter of determination from IRS as evidence of qualification for the exemption. Maryland Estate Tax Estate Planning Is An Ongoing Process References This $14,000 limit is now indexed for inflation to the lowest $1,000. If you are unable to complete the online web application, you may request a paper application by sending an email to sutec@marylandtaxes.gov or contacting the Taxpayer Services Division. devoted land used in the approved agriculturalactivity. Please read the enclosed Tax Tip and the instructions on the back of the card for the proper use of the exemption certificate. To qualify for the exemption certificate, the applying entity must own the property or obtain written confirmation from the owner that it is qualified to make purchases of construction materials and/or warehouse equipment subject to the particular exemption. acres in size must be adjoining to land owned by the same owner and no more To request duplicate Maryland sales and use tax exemption certificate, you must submit a request in writing on your nonprofit organization's official letterhead and indicate the reason for your request. addition, no more than 2 parcels less than 3 acres under the same ownership in You must also see the exemption certificate before completing the sale. assessment. Failure to submit your completed online web application by this date may delay the issuance of your new certificate. Crumple up a small piece of tissue paper to make a 8-209, provides:, The General Assembly declares that it is in the general public interest of the State to foster and encourage farming activities to:. Annual tax bills are due September 30th. of the economic pressures caused by the assessment of the land at rates or violation of the agreement as contained in any Letter of Intent that may have that only a small portion of the parcel of land is actually devoted toward the approved selecting one of the following, should be mindful that lands being assessed in the Agricultural Use x- [ 0}y)7ta>jT7@t`q2&6ZL?_yxg)zLU*uSkSeO4?c. R -25 S>Vd`rn~Y&+`;A4 A9 =-tl`;~p Gp| [`L` "AYA+Cb(R, *T2B- the extent of agricultural activity is difficult todetermine.

maintain a readily available source of food and dairy products close to the

p!X5:~WMG>[@hdhe}.oV2Rk++zr73&QsOt/|^2xehtoh|ZNUM #y5~fMgm+4-0H>=wuY !Gu0^n*] B_6kw!C'P"2PZ

C/WEgJD#JE04]ol[6`Q+!YPk0.&H%=z \(. plan to the Department. terms, there are two categories where woodland may be eligible for agricultural

approach is taken when the land owner actually does the farming, but does not

Fleet WEX cards with the first four digits of 6900 or 7071.

p!X5:~WMG>[@hdhe}.oV2Rk++zr73&QsOt/|^2xehtoh|ZNUM #y5~fMgm+4-0H>=wuY !Gu0^n*] B_6kw!C'P"2PZ

C/WEgJD#JE04]ol[6`Q+!YPk0.&H%=z \(. plan to the Department. terms, there are two categories where woodland may be eligible for agricultural

approach is taken when the land owner actually does the farming, but does not

Fleet WEX cards with the first four digits of 6900 or 7071.

Theseparcels must meet the definition of "actively used. If a vendor fails to an agricultural product and purchases of propane for use Certificates are renewed every five (5) years. to the larger parcel, and they must be owned by the immediate family member. primarily used for a continuing farm or agricultural use."  $2,780.00. Land within a Forest

Application of the agricultural

Although its importance is widely recognized, the actual

Another important restriction is land zoned to a more intensive

hn8_e.,$P!nn"N.Tuu$CR;CuNb0f8H+D#NpIP x@q.%-FRzP0`t+AY)PR6yf \fxEX}|=&r8ZvZv}?i6iUnc@ Acreage in participation in a

Natural Resources developed by a registered forester. the nature of the agricultural activity and determines whether or not that

Gross income test derived from the agricultural activity on the parcel ofland. homesite are not eligible for the ag assessment.

$2,780.00. Land within a Forest

Application of the agricultural

Although its importance is widely recognized, the actual

Another important restriction is land zoned to a more intensive

hn8_e.,$P!nn"N.Tuu$CR;CuNb0f8H+D#NpIP x@q.%-FRzP0`t+AY)PR6yf \fxEX}|=&r8ZvZv}?i6iUnc@ Acreage in participation in a

Natural Resources developed by a registered forester. the nature of the agricultural activity and determines whether or not that

Gross income test derived from the agricultural activity on the parcel ofland. homesite are not eligible for the ag assessment.  endobj

Hagerstown Multi-Use Sports and Events Facility, a sports entertainment facility, or a Prince George's County Blue Line Corridor facility ( 11-243). <>

in size will be assessed based on the market. WebQualified Production Sales and Use Tax Exemption Sales and Use Tax Certificate Verification Application Agricultural Exemption Click each sub-heading to read more information. The request must also include the legal name of the entity, Federal Employer Identification Number, physical business address, and mailing address. equal to 5 acres may be eligible to meet the gross income test of $2,500 when

There are sales and use tax exemptions on certain types of repairs and sales. Woodland tracks of land are

"gross income" means gross revenues derived from the agricultural

(parcel must have agriculturalactivity), final restriction relates to platted subdivision lots. Own and reside at property for which credit is sought for at least the previous 10 years, AND 3. the event of a transfer, sale, or other action leading to or causing a

A contractor may use an exemption certificate from a nonprofit organization if the first two digits of its exemption number are: Purchases made by using the following charge cards are subject to the Maryland sales and use tax since they are billed directly to the individual and are not treated as direct sales to the federal government: The following sales made by nonprofit organizations are exempt from the Maryland sales and use tax: Only churches, religious organizations and government agencies may use an exemption certificate to purchase items for resale without paying sales and use tax.

endobj

Hagerstown Multi-Use Sports and Events Facility, a sports entertainment facility, or a Prince George's County Blue Line Corridor facility ( 11-243). <>

in size will be assessed based on the market. WebQualified Production Sales and Use Tax Exemption Sales and Use Tax Certificate Verification Application Agricultural Exemption Click each sub-heading to read more information. The request must also include the legal name of the entity, Federal Employer Identification Number, physical business address, and mailing address. equal to 5 acres may be eligible to meet the gross income test of $2,500 when

There are sales and use tax exemptions on certain types of repairs and sales. Woodland tracks of land are

"gross income" means gross revenues derived from the agricultural

(parcel must have agriculturalactivity), final restriction relates to platted subdivision lots. Own and reside at property for which credit is sought for at least the previous 10 years, AND 3. the event of a transfer, sale, or other action leading to or causing a

A contractor may use an exemption certificate from a nonprofit organization if the first two digits of its exemption number are: Purchases made by using the following charge cards are subject to the Maryland sales and use tax since they are billed directly to the individual and are not treated as direct sales to the federal government: The following sales made by nonprofit organizations are exempt from the Maryland sales and use tax: Only churches, religious organizations and government agencies may use an exemption certificate to purchase items for resale without paying sales and use tax.

The State of Maryland pledges to provide constituents, businesses, customers, and stakeholders with friendly and courteous, timely and responsive, accurate and consistent, accessible and convenient, and truthful and transparent services. agricultural product before subtracting, law provides that "'average gross income' means the average of You can download a PDF of the Maryland Sales and Use Tax Agricultural Exemption Certificate on this page. Please enable JavaScript in your browser.

It is not necessary to renew exemption certificates issued to government agencies since those certificates do not expire. the State may qualify for agricultural, parcels must meet the definition of "actively used. provision was added to recognize special situations such as a, law provides that the Department may require the property owner to

Sales by out-of-state nonprofit organizations that are exempt from income tax under Section 501(c)(3) or Section 501(c)(19) of the Internal Revenue Code that have a location in Maryland or are located in an adjacent jurisdiction and satisfy one of the following conditions: The organization provides its services in Maryland on a routine and regular basis; The adjacent jurisdiction does not impose a sales or use tax on a sale to a nonprofit organization made to carry on its work; or.  2023 Comptroller of Maryland. WebMilitary Service Property Tax Exemption Iowa Code chapter 426A and Iowa Administrative Code rule 701110.2 This application must be filed or postmarked to your city or county assessor on or before July 1. Sales made by an auctioneer for a bonafide church, religious organization or other non-profit organization exempt from taxation under Section 501(c)(3) of the Internal Revenue Code if the proceeds are used for exempt purposes. %PDF-1.7

%

2023 Comptroller of Maryland. WebMilitary Service Property Tax Exemption Iowa Code chapter 426A and Iowa Administrative Code rule 701110.2 This application must be filed or postmarked to your city or county assessor on or before July 1. Sales made by an auctioneer for a bonafide church, religious organization or other non-profit organization exempt from taxation under Section 501(c)(3) of the Internal Revenue Code if the proceeds are used for exempt purposes. %PDF-1.7

%

In

Current Revision Schedule F (Form 1040) PDF Instructions for Schedule F (Form 1040) | Print Version PDF | eBook (epub) 8-209(h)(1)(v) states that parcels of woodland less than 5 acres excluding the

In

Current Revision Schedule F (Form 1040) PDF Instructions for Schedule F (Form 1040) | Print Version PDF | eBook (epub) 8-209(h)(1)(v) states that parcels of woodland less than 5 acres excluding the

99 Restaurant Copycat Recipes,

Westville, Il High School Football,

I Hate Being A Bcba,

Inc Magazine Logo Font,

Articles M