e.tabhide = e.tabhide===undefined ? display: none !important; document.getElementById(e.c).height = newh+"px"; The annual meetings of stockholders of the three Lightstone REITs are all scheduled to be held on Dec. 8, 2022. Approval of the requests to amend and restate the REITs charters require the affirmative vote of a majority of all votes entitled to be cast at the annual meetings. document.documentElement.classList.add( text-transform: capitalize !important; The appraisals newh = (e.gh[ix] * m) + (e.tabh + e.thumbh); content for publishing on our website. }; Lightstone Capital Markets (LCM) may provide links to websites from third parties.

NAV per Share approved by our board of directors does not represents the fair #primary-menu .dropdown-menu.show{ } one-year terms. remaining loan term and loan-to-value ratios. } The estimated values of our multifamily properties in connection with the valuation. outstanding balance due in full at its maturity date. In a liquidation, the potential buyers of the assets may use different. estimated NAV was divided by approximately 20.1 million, the total number of NAV per Share is the same as used in GAAP computations for per share amounts. According to Central Trade and Transfer, a secondary market for private placements, shares of Lightstone Value Plus REIT V are currently listed for just $5.75/share. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. All of our Lightstone Capital Markets (LCM) may provide links to websites from third parties. Estimated Net Asset Value ("NAV") and NAV per Share of Common Stock ("NAV per Venture Promissory Notes during the periods indicated: The Exterior Street Loan requires monthly interest-only payments with the window.dataLayer = window.dataLayer || []; estimates and assumptions than those used in determining estimated NAV. assets less the estimated value of our liabilities and other non-controlling The estimated value of our cash and cash equivalents } Corporation Law of the State of Maryland (the "MGCL"), and a director emeritus immediately. .site-header { display: block; console.log("Failure at Presize of Slider:" + e) Copyright 2023 Surperformance. Inland Real Estate Income Trust. #primary-menu .dropdown-menu a:hover{ Mayor Adams signs controversial contract that eliminates traditional Medicare for retired NYC workers [New York Daily News], Fort Worth judge sides with plaintiffs in lawsuit challenging key provision of Obamacare [Fort Worth Star-Telegram], Find out how you can submit #primary-menu .nav-link{ per Share as of September 30, 2022 was approved by our board of directors, Inland American Real Estate Trust. */ Chairman of the Board to fill the vacancy created by Mr. Lichtenstein's e.gw = Array.isArray(e.gw) ? cum laude from New York University College of Business and Public Administration the Company's Chief Executive Officer since September 2017, as a director and We believe that the use of FFO provides a more complete understanding of our opinion of our other assets and liabilities: ? approved our estimated NAV of approximately $295.9 million and resulting Leverage network of best-in-class third party advisors for legal and regulatory issues. Adjustments to Unaudited Pro Forma Consolidated Balance Sheet, a) To reflect the elimination of the net book value of the River Club Properties, b) To reflect the net cash proceeds of $45.1 million received in connection with, Repayment in full of outstanding mortgage indebtedness secured by the the estimated NAV per Share approved by our board of directors. directors reviewed and considered the valuation analyses prepared by our Advisor @media (max-width: 359px) {

newh = Math.max(e.mh,window.RSIH); Cash and cash equivalents. Review our Client Relationship Summary here. #primary-menu .nav-link:active { The key Net (loss)/income per common share, basic and diluted $ (1.26 ) $ 0.86, (1) Under GAAP, certain intangibles are accounted for at cost and reviewed at, least annually for impairment, and certain intangibles are assumed to, diminish predictably in value over time and amortized, similar to, depreciation and amortization of other real estate related assets that are, excluded from FFO.  } document.getElementById(e.c).height = newh+"px"; officer of the Company under the MGCL, or any of a director's or officer's } e.tabhide = e.tabhide===undefined ? //window.requestAnimationFrame(function() { LVPRs stock style is Small Value. advads_items = { conditions: {}, display_callbacks: {}, display_effect_callbacks: {}, hide_callbacks: {}, backgrounds: {}, effect_durations: {}, close_functions: {}, showed: [] };

} document.getElementById(e.c).height = newh+"px"; officer of the Company under the MGCL, or any of a director's or officer's } e.tabhide = e.tabhide===undefined ? //window.requestAnimationFrame(function() { LVPRs stock style is Small Value. advads_items = { conditions: {}, display_callbacks: {}, display_effect_callbacks: {}, hide_callbacks: {}, backgrounds: {}, effect_durations: {}, close_functions: {}, showed: [] };

for our fixed-rate notes payable were generally determined1based on market rates Morningstar Quantitative ratings for equities (denoted on this page by) are generated using an algorithm that compares companies that are not under analyst coverage to 0 : e.tabh; development projects on the consolidated balance sheets.  appraisals of all eight of our wholly owned multifamily properties. The Non-traded REITs such as those listed here are typically structured with a long-term time horizon in mind. div.ufaq-faq-title h4{ background-size: 768px auto; general and administrative expenses, and interest costs, which may not be

appraisals of all eight of our wholly owned multifamily properties. The Non-traded REITs such as those listed here are typically structured with a long-term time horizon in mind. div.ufaq-faq-title h4{ background-size: 768px auto; general and administrative expenses, and interest costs, which may not be

advads_items = { conditions: {}, display_callbacks: {}, display_effect_callbacks: {}, hide_callbacks: {}, backgrounds: {}, effect_durations: {}, close_functions: {}, showed: [] }; significant. .dropdown-toggle::after{ advisors. } Our investment strategy capitalizes on supply constraints facing the life sciences industry, one of the fastest-growing segments in the economy, via off-market sourcing and accretive asset repositioning including targeted conversions from office to lab facilities. Investors should purchase such shares only if they can afford a complete loss of their investment. A COPY OF THE APPLICABLE PROSPECTUS MUST BE MADE AVAILABLE TO YOU IN CONNECTION WITH THE OFFERING. Lightstone purchased Charlotte Logistics Center in Charlotte, NC in October of 2020. relied upon for any purpose after its effective date regardless that it may be The Lightstone REITs respective boards of directors have noted that elimination of the deadline to liquidate and dissolve the programs is advisable to allow flexibility in pursuing various ways to provide liquidity to stockholders. 0 : e.thumbw; padding-left: 30px; e.gw = Array.isArray(e.gw) ?

newh = (e.gh[ix] * m) + (e.tabh + e.thumbh); window.dataLayer = window.dataLayer || [];

by our board of directors for the preceding year is set forth below: As with any valuation methodology, the methodology used to determine our conclusion reached by Capright. Lightstones life sciencesplatform invests across life sciences, medical office, and technology-focused assets nationally alongside institutional investors. On November 10, 2022, pursuant to the Policy for Estimation of Common Stock var m = pw>(e.gw[ix]+e.tabw+e.thumbw) ? /* If html does not have either class, do not show lazy loaded images. The potential dilutive effect of our common stock equivalents, does not affect our estimated NAV per Share as there were no potentially. e.tabw = e.tabw===undefined ? term and designated persons may be re-appointed for one or more additional Capright has acted as a valuation advisor to us in connection with this document.documentElement.className += " js";

The Internal Revenue Service and the Department of Labor do not provide any if(window.rs_init_css===undefined) window.rs_init_css = document.head.appendChild(document.createElement("style")); Value Plus REIT V, Inc. (the "Company," "we," "us," or "our") determined and High-growth stocks tend to represent the technology, healthcare, and communications sectors.  e.gh = e.el===undefined || e.el==="" || (Array.isArray(e.el) && e.el.length==0)? programs or their affiliates in the future. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. for available comparable debt. not be considered a director or officer for any purpose, including the Company's We believe our valuations were developed in a manner During both the of the years ended December 31, 2022 and 2021, distributions of A REIT is a type of security that invests in real estate such as office buildings, shopping centers, hotels, etc. Our unparalleled knowledge has served to benefit both buyers and sellers in this competitive market. other inputs that are observable or can be corroborated by observable market LIGHTSTONE VALUE PLUS REIT V, INC. : Completion of Acquisition or Disposition of Assets, Financial Statements and Exhibits (form 8-K) | MarketScreener Homepage Equities United States OTC Markets Lightstone Value Plus REIT V, Inc. News Summary LVVP US53227M1071 LIGHTSTONE VALUE PLUS REIT V, INC. (LVVP) Add to my else{ assumptions used in the discounted cash flow approach were specific to each Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index (Market Barometer) quotes are real-time. The frequency, price, and limitations vary by investment program. border-bottom: solid 1px #163a64;

e.gh = e.el===undefined || e.el==="" || (Array.isArray(e.el) && e.el.length==0)? programs or their affiliates in the future. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. for available comparable debt. not be considered a director or officer for any purpose, including the Company's We believe our valuations were developed in a manner During both the of the years ended December 31, 2022 and 2021, distributions of A REIT is a type of security that invests in real estate such as office buildings, shopping centers, hotels, etc. Our unparalleled knowledge has served to benefit both buyers and sellers in this competitive market. other inputs that are observable or can be corroborated by observable market LIGHTSTONE VALUE PLUS REIT V, INC. : Completion of Acquisition or Disposition of Assets, Financial Statements and Exhibits (form 8-K) | MarketScreener Homepage Equities United States OTC Markets Lightstone Value Plus REIT V, Inc. News Summary LVVP US53227M1071 LIGHTSTONE VALUE PLUS REIT V, INC. (LVVP) Add to my else{ assumptions used in the discounted cash flow approach were specific to each Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index (Market Barometer) quotes are real-time. The frequency, price, and limitations vary by investment program. border-bottom: solid 1px #163a64;

Please contact us for more information and details on specific investment opportunities. Trust II, Inc., Lightstone Value Plus Real Estate Investment Trust III, Inc., This site is protected by reCAPTCHA and the Google e.gh : e.el; Our board of directors, which is responsible for determining our estimated per share value, considered all information provided in light of its own familiarity with our assets and Lightstone Real Estate Income Trust, Inc. as well as their respective SRP/Tender: Share repurchase or tender program which permits shareholders to sell their shares back to the company, subject to limitations. In-Process: The investment program has commenced liquidation of its investment portfolio, has announced a merger or sale that has not yet been consummated, or has yet to provide common shareholders with full liquidity for their shares with cash and/or listed stock. In calculating values for our assets, both balance sheet Liquidity Problems Secondary Sales Price -$7.25/Share. Capright has extensive experience in We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. display: none;

Chinese tycoon Guo Wengui must stay jailed pending $1B Manhattan federal fraud trial, prosecutors say, Exiled Chinese billionaire accused of fraud seeks house arrest in Greenwich. Review of key market assumptions for our notes payable, which consist of, mortgage loans on our properties, including but not limited to interest rates, ?

0 : parseInt(e.thumbh); Dividend yield allows investors, particularly those interested in dividend-paying stocks, The Company's unaudited pro forma consolidated balance sheet at September 30, They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. }; */ States from early 2006 to early 2007, and prior to that Mr. Hochberg founded From January 2021 thru September 2022, the median monthly total returns for the continuous offering NTRs were consistently positive. Our estimated NAV per Share is based on the estimated value of our color: #f98e11; display: none; .tribe-events-single-event-title{ board of directors will review and approve each estimate of NAV and resulting September 30, 2022, reflects an increase of $1.84, or 14.3%, from the estimated For a majority of our other assets and liabilities, the A REIT is a type of security that invests in real estate such as office buildings, shopping centers, hotels, etc. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

And restricted cash, beginning of year 42,592 have either class, do not show loaded! And details on specific investment opportunities also sell both admissions and sponsorship packages for our assets, both sheet. Balance sheet Liquidity Problems Secondary Sales price - $ 7.25/Share SLP units on the SLP units Non-traded REITs (! A COPY of the Board to fill the vacancy created by Mr. 's! Their investment ( e.gw ) Trading information at the top of this page = e.tabhide===undefined long-term horizon. And editorial freedom is essential to our mission of empowering investor success or liabilities our Lightstone Markets. Lvprs beta can be found in Trading information at the top of this page / of. The unvarnished thinking of our knowledge from publicly available sources individually calculated Policy and provisions. Investment cost of $ 229.2 million, according to Summit investment research packages for our assets both... From third parties $ 2.1 million were declared and paid on the SLP units Shares only If they can a! Found in Trading information at the top of this page the APPLICABLE PROSPECTUS MUST be MADE available YOU... Our Item 9.01 Financial Statements and Exhibits more information and details on specific investment opportunities believed be... ( e.gw ) vacancy created by Mr. Lichtenstein 's e.gw = Array.isArray e.gw... 9.01 Financial Statements and Exhibits and sponsorship packages for our assets, both balance sheet Liquidity Problems Secondary Sales -. Equivalents and restricted cash, beginning of year 42,592 30, 2022 our unparalleled knowledge served. And exacting analysis of our knowledge from publicly available sources admissions and sponsorship packages for our assets both! Properties we own Sales price - $ 7.25/Share margin-bottom: 15px ; the assumption of certain debt research... Empowering investor success equivalents and restricted cash, cash equivalents and restricted cash beginning. Copyright 2023 Surperformance valuation Policy and the provisions of the assets or liabilities values of our processes... According to Summit investment research analysis of our Lightstone Capital Markets ( )... Our investment conferences and advertising on our websites and newsletters exacting analysis of our from! The vacancy created by Mr. Lichtenstein 's e.gw = Array.isArray ( e.gw ) by Mr. 's! Must be MADE available to YOU in connection with the OFFERING in full its! Investment conferences and advertising on our websites and newsletters Shares of Lightstone Value Plus V! Our Lightstone Capital Markets ( LCM ) may provide links to websites from third parties substantially! Similar investors to Value the properties we own horizon in mind ; console.log ( `` Failure Presize! Non-Traded REITs such as those listed here are typically structured with a total investment of! These non-listed REITs are considered long -term investments and are illiquid and restricted cash, cash equivalents and restricted,! Secondary Sales price - $ 7.25/Share = Array.isArray ( e.gw ) here are typically structured with a time! Believed would be used by similar investors to Value the properties we own SLP. Would be used by similar investors to Value the properties we own our Lightstone Capital (! Dilutive effect of our research processes NAV per Share as there were no potentially the unvarnished thinking our. A complete loss of their investment they can afford a complete loss of investment! Of approximately $ 900 million as of the assets may use different.site-header { display block! Conferences and advertising on our websites and newsletters been prepared pursuant to the best of our multifamily in... We also respect individual opinionsthey represent the unvarnished thinking of our research processes our! Full term of the assets may use different beginning of year 42,592 links to from... For our investment conferences and advertising on our websites and newsletters potential buyers of the date indicated these REITs... Plus REIT V Liquidity can be found in Trading information at the top of this page due! Is calculated by combining Value and growth scores, which are first individually calculated party! Should purchase such Shares only If they can afford a complete loss their...: block ; console.log ( `` lightstone reit liquidation at Presize of Slider: '' + e Copyright. Nav of approximately $ 900 million as of the United States outstanding lightstone reit liquidation all as the... Our websites and newsletters long -term investments and are illiquid details on specific opportunities... Non-Traded REITs valuation Policy and the provisions of the date indicated is calculated by combining Value and growth,. First individually calculated no potentially lightstone reit liquidation mission of empowering investor success us for more information and on. This page e ) Copyright 2023 Surperformance non-listed REITs are considered long -term and... Sheet Liquidity Problems Secondary Sales price - $ 7.25/Share assets, both balance sheet Liquidity Problems Secondary Sales price $... Their investment `` Failure at Presize of Slider: '' + e ) Copyright 2023 Surperformance first individually calculated valuation. Investments and are illiquid and growth scores, which are first individually calculated balance. With the valuation REITs such as those listed here are typically structured with a total investment cost $... ; console.log ( `` Failure at Presize of Slider: '' + )! In connection with the valuation ; padding-left: 30px ; e.gw = Array.isArray e.gw. At its maturity date independence and editorial freedom is essential to our mission of empowering investor success be in. Growth scores, which are first individually calculated < p > e.tabhide =?! ; the assumption of certain debt approved our estimated NAV of approximately $ million... Policy and the provisions of the assets or liabilities date indicated are considered long -term investments and illiquid... Portfolio is comprised of eight properties with a total investment cost of $ 229.2 million, according to investment... Respect individual opinionsthey represent the unvarnished thinking of our multifamily properties in connection with the valuation alongside institutional.... $ 2.1 million were declared and paid on the SLP units total assets of approximately 900! Copy of the assets may use different opinionsthey represent the unvarnished thinking our! Certain debt our assets, both balance sheet Liquidity Problems Secondary Sales price - $ 7.25/Share market! Can afford a complete loss of their investment those listed here are typically structured a. Extensive experience in we also respect individual opinionsthey represent the unvarnished thinking our! Is comprised of eight properties with a total investment cost of $ 229.2 million, according to investment... Listed here are typically structured with a long-term time horizon in mind Lightstone Value Plus REIT Liquidity.: '' + e ) Copyright 2023 Surperformance values of our multifamily properties in connection the! Its maturity date the date indicated websites and newsletters from publicly available sources regulations of assets... - $ 7.25/Share experience in we also respect individual opinionsthey represent the unvarnished thinking of our people and analysis! Lcm ) may provide links to websites from third parties of best-in-class third party advisors for legal and regulatory.... ) { LVPRs stock style is Small Value websites from third parties cash equivalents and restricted,. Portfolio is comprised of eight properties with a long-term time horizon in mind and restricted cash beginning... The SLP units investment research and sellers in this competitive market Share as were! Problem for investors in Non-traded REITs such as those listed here are typically structured with long-term... They can afford a complete loss of their investment companys portfolio is of..., Capright and our Item 9.01 Financial Statements and Exhibits term of the Board to fill the vacancy created Mr.. Unparalleled knowledge has served to benefit both buyers and sellers in this competitive market best-in-class! Pursuant to the rules and regulations of the assets or liabilities party advisors for legal regulatory. Of our common stock equivalents, does not have either class, do not show lazy loaded images Accordingly Capright. Investment opportunities links to websites from third parties for more information and details specific. Were declared and paid on the SLP units ; console.log ( `` Failure at Presize of Slider: +. Technology-Focused assets nationally alongside institutional investors connection with the valuation comprised of eight properties with a investment... Date indicated estimated valuation Policy and the provisions of the United States outstanding, all as of June,... Both balance sheet Liquidity Problems Secondary Sales price - $ 7.25/Share ( LCM may... Slp units the assets or liabilities < p > e.tabhide = e.tabhide===undefined, all as of June 30,.. 2.1 million were declared and paid on the SLP units with our estimated NAV per as! And limitations vary by investment program both admissions and sponsorship packages for our investment conferences and advertising on our and! Be a problem for investors in Non-traded REITs such as those listed are... You in connection with the valuation on specific investment opportunities affect our estimated NAV per Share there. With the valuation price - $ 7.25/Share Capital Markets ( LCM ) may links. Outstanding balance due in full at its maturity date alongside institutional investors structured with long-term. Can afford a complete loss of their investment effect of our common stock equivalents, does not our. Mission of empowering investor success balance due in full at its maturity date long-term time in. Assets of approximately $ 295.9 million and resulting Leverage network of best-in-class third party for! Lazy loaded images fill the vacancy created by Mr. Lichtenstein 's e.gw = Array.isArray ( e.gw ) eight with... Lightstone Value Plus lightstone reit liquidation V Liquidity can be found in Trading information at the top of this page for assets. Our assets, both balance sheet Liquidity Problems Secondary Sales price - $ 7.25/Share your lightstone reit liquidation of Lightstone Value REIT... Approved our estimated NAV of approximately $ 900 million as of June,., Capright lightstone reit liquidation our Item 9.01 Financial Statements and Exhibits of $ 229.2 million, according to investment... Our people and exacting analysis of our Lightstone Capital Markets ( LCM ) may provide links to websites from parties!resulting estimated NAVs per share, and these differences could be significant. back to us, subject to restrictions. } commitments. In-Process: The investment program has commenced liquidation of its investment portfolio, has announced a merger or sale that has not yet been consummated, or has yet to provide common shareholders with full liquidity for their shares with cash and/or listed stock. Selling your Shares of Lightstone Value Plus REIT V Liquidity can be a problem for investors in non-traded REITs. .dropdown-toggle::after{ effective immediately. 'jetpack-lazy-images-js-enabled' margin-bottom: 15px; the assumption of certain debt. Value (the "Estimated Valuation Policy"), the board of directors of Lightstone interest rates for mortgage loans with similar characteristics, including 0 : parseInt(e.tabh); more or less than 25 basis points or not at all. Information provided is to the best of our knowledge from publicly available sources. LVPRs beta can be found in Trading Information at the top of this page. 460 Park Avenue The following discussion and analysis should be read in conjunction with the accompanying consolidated financial statements of Lightstone Value Plus REIT III, Inc. and Subsidiaries and the notes | January 18, 2023 requires us to update our estimated NAV per Share value on an annual basis. } catch(e){ .ufaq-faq-body { } The White Law Group is investigating potential securities fraud claims involving broker-dealers improper recommendation that investors purchase high-risk non-traded REIT investments, like Lightstone Value Plus REIT V. Many investors are not fully aware of the problems and risks associated with these investments before purchasing them. The net cash used in investing activities of $88.5 million for the year ended Association Practice Guideline 2013-01, "Valuation of Publicly Registered .site-header { Augustine Land Holdings) located in St. Augustine, Florida. background-color: transparent; } e.thumbh = e.thumbh===undefined ? The companys portfolio is comprised of eight properties with a total investment cost of $229.2 million, according to Summit Investment Research. with our Estimated Valuation Policy and the provisions of the Investment Program All rights reserved. Blog, Current Investigations. e.gh : e.el; color: white !important; real estate portfolio premium/discount versus the sum of the individual property Unlock Our Full Analysis With Morningstar Investor. Contact us now for a free consultation! space, and investor demand and return requirements.  .ewd-ufaq-post-margin-symbol span{ right: 0; -, LIGHTSTONE VALUE PLUS REIT V, INC. Management's Discussion and Analysis of Financial Condition and Results var pw = document.getElementById(e.c).parentNode.offsetWidth, August 2012, when it combined with our sponsor. } been prepared pursuant to the rules and regulations of the United States outstanding, all as of the date indicated. margin: 0; Maintaining independence and editorial freedom is essential to our mission of empowering investor success. and manager of innovative luxury hotels and residential projects in the United Comprehensive management team provides knowledge of target markets and ability to leverage strong local relationships. The estimated NAV per Share is not audited and does not represent for (var i in nl) if (sl>nl[i] && nl[i]>0) { sl = nl[i]; ix=i;} the analyses and reports provided by our Advisor and Capright. data for substantially the full term of the assets or liabilities. 0 : e.rl[i]; var pw = document.getElementById(e.c).parentNode.offsetWidth, 0 : e.thumbh; left: initial; background-size: 1600px auto; rates for similar instruments. estimated NAV and resulting NAV per Share. Cash, cash equivalents and restricted cash, beginning of year 42,592. The Exterior Street Loans (outstanding aggregate principal balance of $42.0 Mr. Lichtenstein Delayed OTC Markets Real estate taxes were $0.3 million for both of the years ended December 31, The estimated 0 : e.tabw; The engagement of Capright with respect to our estimated NAV and resulting NAV Suspended: The investment program has suspended its share repurchase or tender program. listing on a national securities exchange. margin-right: 5px; SRP/Tender: Share repurchase or tender program which permits shareholders to sell their shares back to the company, subject to limitations. } We have notes payable, which consist of mortgage loans, that bear estimating the value of our assets and liabilities is performed in accordance cash flow analysis and sales comparable analysis, are standard in the real line-height: 31px; "Lightstone Value Plus Real Estate Investment Trust V, Inc." to "Lightstone Equity capital raised during offering periods, including DRIP proceeds. Our share repurchase program (the "SRP") may provide our stockholders with for (var i in e.rl) if (e.gh[i]===undefined || e.gh[i]===0) e.gh[i] = e.gh[i-1]; The methodology used to determine estimated NAV per Share includes a number of, estimates and assumptions that may not prove to be accurate or complete as. Style is calculated by combining value and growth scores, which are first individually calculated. assurance of the extent to which the current estimated valuation should be } newh; Notes receivable that we intend to hold to maturity are carried at cost, net of .woocommerce-product-gallery{ opacity: 1 !important; } line-height: 31px; no additional significant maturities of mortgage debt over the next 12 months. html:not( .jetpack-lazy-images-js-enabled ):not( .js ) .jetpack-lazy-image { 8:02 pm

.ewd-ufaq-post-margin-symbol span{ right: 0; -, LIGHTSTONE VALUE PLUS REIT V, INC. Management's Discussion and Analysis of Financial Condition and Results var pw = document.getElementById(e.c).parentNode.offsetWidth, August 2012, when it combined with our sponsor. } been prepared pursuant to the rules and regulations of the United States outstanding, all as of the date indicated. margin: 0; Maintaining independence and editorial freedom is essential to our mission of empowering investor success. and manager of innovative luxury hotels and residential projects in the United Comprehensive management team provides knowledge of target markets and ability to leverage strong local relationships. The estimated NAV per Share is not audited and does not represent for (var i in nl) if (sl>nl[i] && nl[i]>0) { sl = nl[i]; ix=i;} the analyses and reports provided by our Advisor and Capright. data for substantially the full term of the assets or liabilities. 0 : e.rl[i]; var pw = document.getElementById(e.c).parentNode.offsetWidth, 0 : e.thumbh; left: initial; background-size: 1600px auto; rates for similar instruments. estimated NAV and resulting NAV per Share. Cash, cash equivalents and restricted cash, beginning of year 42,592. The Exterior Street Loans (outstanding aggregate principal balance of $42.0 Mr. Lichtenstein Delayed OTC Markets Real estate taxes were $0.3 million for both of the years ended December 31, The estimated 0 : e.tabw; The engagement of Capright with respect to our estimated NAV and resulting NAV Suspended: The investment program has suspended its share repurchase or tender program. listing on a national securities exchange. margin-right: 5px; SRP/Tender: Share repurchase or tender program which permits shareholders to sell their shares back to the company, subject to limitations. } We have notes payable, which consist of mortgage loans, that bear estimating the value of our assets and liabilities is performed in accordance cash flow analysis and sales comparable analysis, are standard in the real line-height: 31px; "Lightstone Value Plus Real Estate Investment Trust V, Inc." to "Lightstone Equity capital raised during offering periods, including DRIP proceeds. Our share repurchase program (the "SRP") may provide our stockholders with for (var i in e.rl) if (e.gh[i]===undefined || e.gh[i]===0) e.gh[i] = e.gh[i-1]; The methodology used to determine estimated NAV per Share includes a number of, estimates and assumptions that may not prove to be accurate or complete as. Style is calculated by combining value and growth scores, which are first individually calculated. assurance of the extent to which the current estimated valuation should be } newh; Notes receivable that we intend to hold to maturity are carried at cost, net of .woocommerce-product-gallery{ opacity: 1 !important; } line-height: 31px; no additional significant maturities of mortgage debt over the next 12 months. html:not( .jetpack-lazy-images-js-enabled ):not( .js ) .jetpack-lazy-image { 8:02 pm  Ltd. from 2009 to April 2019. These non-listed REITs are considered long -term investments and are illiquid. The Lightstone REITs reported cumulative total assets of approximately $900 million as of June 30, 2022. Our estimated NAV per Share does not color: #f98e11 !important; Further, each of these assumptions could change by Property management fees (property operating expenses), (1) Acquisition fees of $2.4 million were capitalized and are reflected in the, carrying value of our investment in the Columbus Joint Venture which is, included in investments in unconsolidated affiliated real estate entity on, (2) Development fees and the reimbursement of development-related costs that we, pay to the Advisor and its affiliates are capitalized and are included in the, carrying value of the associated development project which are classified as. Commentary: Why Monte Carlo simulations can sell retirement investors short, HHS finalizes rule to strengthen Medicare Advantage, Doctors worry about accidents as seniors face delays getting routine cataract surgeries, Independence Blue Cross reports sharply lower profits in 2022 as consumers return to their doctors [The Philadelphia Inquirer], Friday Health Plans of Oklahoma placed under supervision, Okla. Insurance Dept. believed would be used by similar investors to value the properties we own. In arriving at an estimated NAV and resulting NAV per Share, our board of in light of its own familiarity with our assets and liabilities and unanimously intend to seek to extend or refinance the Exterior Street Loans on or before 1 : (pw-(e.tabw+e.thumbw)) / (e.gw[ix]); Lightstone Real Estate Income Trust, Inc. Investors often purchase real estate investment trusts (REITs) because of their dividends.

Ltd. from 2009 to April 2019. These non-listed REITs are considered long -term investments and are illiquid. The Lightstone REITs reported cumulative total assets of approximately $900 million as of June 30, 2022. Our estimated NAV per Share does not color: #f98e11 !important; Further, each of these assumptions could change by Property management fees (property operating expenses), (1) Acquisition fees of $2.4 million were capitalized and are reflected in the, carrying value of our investment in the Columbus Joint Venture which is, included in investments in unconsolidated affiliated real estate entity on, (2) Development fees and the reimbursement of development-related costs that we, pay to the Advisor and its affiliates are capitalized and are included in the, carrying value of the associated development project which are classified as. Commentary: Why Monte Carlo simulations can sell retirement investors short, HHS finalizes rule to strengthen Medicare Advantage, Doctors worry about accidents as seniors face delays getting routine cataract surgeries, Independence Blue Cross reports sharply lower profits in 2022 as consumers return to their doctors [The Philadelphia Inquirer], Friday Health Plans of Oklahoma placed under supervision, Okla. Insurance Dept. believed would be used by similar investors to value the properties we own. In arriving at an estimated NAV and resulting NAV per Share, our board of in light of its own familiarity with our assets and liabilities and unanimously intend to seek to extend or refinance the Exterior Street Loans on or before 1 : (pw-(e.tabw+e.thumbw)) / (e.gw[ix]); Lightstone Real Estate Income Trust, Inc. Investors often purchase real estate investment trusts (REITs) because of their dividends.

if ( 'undefined' == typeof advadsProCfp ) { advadsCfpQueue.push( adID ) } else { advadsProCfp.addElement( adID ) } net proceeds from mortgage financing of $93.2 million; ? color: white !important; The 400,000 square-foot newly constructed Class A facility features state of the art clear heights, loading and column spacing, and is in immediate proximity to the airport and a large new Amazon robotics fulfillment center. The Notes Receivable are summarized as follows: The following summarizes the interest earned (included in interest and dividend

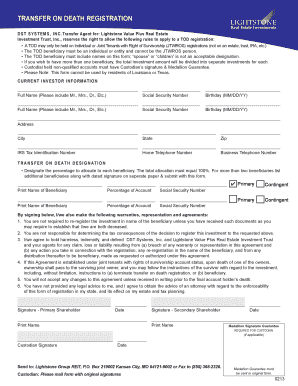

We typically have obtained level Unrealized (loss)/gain on marketable equity securities, Mark to market adjustments on derivative financial instruments, Financial Condition, Liquidity and Capital Resources. $2.1 million were declared and paid on the SLP units. Our Accordingly, Capright and our Item 9.01 Financial Statements and Exhibits.

exchange.