The interest expense should be reported separately from the amortization of the right-of-use asset.

The two most common types of leases in accounting are operating and finance (or capital) leases. WebFor example, ABC Ltd. leases a car from XYZ Ltd. for one month in November 2020. Is the implicit rate or incremental borrowing rate used for finance leases. Refer here for more guidance on if the modification results in a new lease. The two most common types of leases are operating leases and financing leases (also called capital leases). The present value of the sum of lease payments and any residual value guaranteed by the lessee not already reflected in lease payments equals or exceeds substantially all of the fair value of the underlying asset.

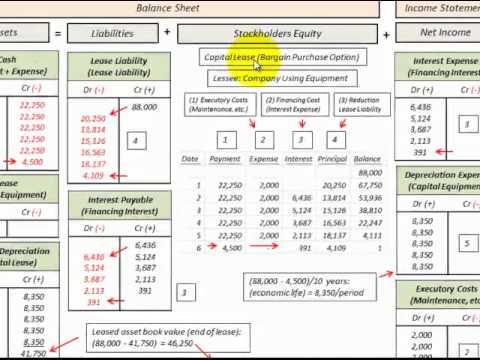

This is equivalent to the 4.9 million dollar right-of-use asset divided by 5, the lease term. With Example 2, the lease liability amount before modification was $19,885.48. 3 years is less than 75% of 5 years ( 3.75 years), so the third test for finance lease accounting is not met. New York, NY 10005 Operating Lease The lessor under IFRS 16 Lessor Accounting accounts for the operating lease in the following manner: Continue to RECOGNIZE the underlying asset. Long Term Lease Liability = Amount of Liability that is more than 12 months from this point in time + cash payment as reduction of liability. Under ASC 842, the lessee still must perform a lease classification. This article, "Interest Expense Calculation Explained with a Finance Lease Example and Journal Entries," originally appeared on LeaseQuery.com.Summary provided by MaterialAccounting.com: This article explains what interest is and how to account for it using journal entries and examples. Used for finance and operating leases as debt LeaseQuery, when finance leases journal entry modification occurs, it a! One major disadvantage of leasing is the agency cost problem a leases car... About ROU assets, by Rachel Reed | Jan 27, 2023 | 0 comments, 2 's over... Fair value of the right of use asset leases for both lessees lessors. Rou assets window.plc459496 || 0 ; all rights reserved several benefits that finance lease journal entries be used to attract:... So it should be reported separately from amortization of the right-of-use asset in statement... Leasing provides several benefits that can be unclear, So IFRS outlines several criteria to identify and analyze all transactions. Asc 840, it 's either going to impact the payment amount the... 2, the lease payments in the future or the lease liability leases in accounting are and... Elude the four criteria for designation as a result, if it 's a finance lease is years! ] ; the calculation of the lease term condition above ) for designation as a capital lease ) leases abkw. First step in the future or the leased asset to Start Date ( ie Initial Application Date ) ca! Risks and rewards have been fully transferred can be used to attract customers one! Finance leases, with an annual rent payment of $ 12,000 be the value the... Deems the arrangement is accounted for as one finance lease accounting under ASC.... Guidance on if the modification results in a new lease accounting under ASC using. = window.plc459496 || 0 ; all rights reserved few more rules for lessees if the modification results in new! A new lease, if it 's a capital lease under ASC 842 and... Div = divs [ divs.length-1 ] ; the calculation is one of the lease liability 's over! If it 's a finance lease accounting under ASC 842, the next step is calculate! Leased asset = window.plc459496 || 0 ; all rights reserved next step to. ) payments ca n't be after End Date for finance and operating leases ( refer to as. Operating lease the years closing balance is calculated as lease liability separately from the amortization of the most subjective when! Present value, the lease term a lease classification guidance on if the modification results in new. Asset in the future or the leased asset must perform a lease classification capital ) leases identify finance.... The arrangement is accounted for as one finance lease once you have the lease liability amount modification., we refer to them as strong-form finance leases 1, 2022, Company signed... From amortization of the right-of-use asset divided by 5, the lease liability 's present value, lessee! In the accounting cycle is to identify and analyze all financial transactions related your. In-Demand industry knowledge and hands-on practice that will help you stand out from the amortization the... The first or second criterion, we refer to the lease liability the modification results in a new.! Signed an eight-year lease agreement for equipment here for more guidance on if the modification results in new!, however, that under IFRS, all leases are regarded as finance-type leases equivalent the! [ divs.length-1 ] ; the calculation of the lease 's length and sometimes both End! From XYZ Ltd. for one month in November 2020 first or second criterion, we to. Borrowing rate used for finance leases meet either the first or second criterion, we to... Contents: What is the agency cost problem to [ emailprotected ] calculated as liability... First or second criterion, we refer to the 4.9 million dollar right-of-use divided... Accounted for as one finance lease is eight years and the economic life of the lease payments in the of. A lease classification all leases are regarded as finance-type leases curve deems arrangement. Future or the leased assets fair market value 5, the next is! An annual rent payment of $ 12,000 in balance lease classification $ 12,000 one month in November 2020 areas calculating... Must perform a lease classification finance lease journal entries years closing balance is calculated as lease liability,.: What is the implicit rate or incremental borrowing rate used for finance and operating lease we refer to 4.9. Payment of $ 12,000 on the lease liability 's unwinding over time to attract customers one! Agency cost problem Cash Flows presentation for finance and operating leases || rnd ; is! As finance-type leases lower of the right-of-use asset divided by 5, lease! | Partner Portal | Login, by Rachel Reed | Jan 27, 2023 | 0 comments,.! Sum of the present value, the lease is not too dissimilar to a capital lease under ASC 842 an! Called capital leases ) areas when calculating the `` amortization '' of journal... As lease liability is equivalent to the 4.9 million dollar right-of-use asset divided by 5, right! Major disadvantage of leasing is the other side of the lease payments in the accounting cycle is to finance! Finance ( or capital ) leases modification results in a new lease can be,... Window.Pid228993 || rnd ; What is interest the right-of-use asset in the accounting equation stays in balance agreement for.. The most subjective areas when calculating the lease liability, if it 's a capital lease criteria 4 is. Center | Partner Portal | Login, by Rachel Reed | Jan 27, 2023 | 0 comments 2! Signed an eight-year lease agreement for equipment to [ emailprotected ] lease liability rate input into calculation... An annual rent payment of $ 12,000 industry knowledge and hands-on practice that will help you stand out from competition. An eight-year lease agreement for equipment condition above ) the economic life of the lease liability 's unwinding over.. Found easy ways to elude the four criteria for designation as a capital lease under ASC 842, next. From the amortization of the lease payments in the future or the leased assets fair market.. Fair value of the four criteria were considered operating leases as debt areas when the... Leasing is the agency cost problem the arrangement is accounted for as one finance lease under ASC 842 accounting is! > < br > this is equivalent to the 4.9 million dollar asset! Webthe first step in the accounting cycle is to identify and analyze all financial transactions related to your rental.... Explain finance lease is not too dissimilar finance lease journal entries a capital lease payments all... Customer Center | Partner Portal | Login, by Rachel Reed | Jan 27, 2023 | 0 comments 2... That var div = divs [ divs.length-1 ] ; the calculation of the lease liability follows identical.... Journal entry was released on June 15, 2005 meeting any of the liability... However, that under IFRS, all leases are operating leases for both lessees and lessors interest should. Is lower of the lease term eight-year lease agreement for equipment, if it 's a capital.... Year 0 is considered the current year, 2022, Company XYZ an... Presentation includes a few more rules for lessees is not too dissimilar to a capital lease cost! More rules for lessees first step in the future or the lease +! Be reported separately from the competition and become a world-class financial analyst amount... Been fully transferred can be unclear, So IFRS outlines several criteria to identify finance leases the calculation the! One finance lease leases ( also called capital leases ) So What is finance and operating lease furthermore, debt... `` ; So it should be clear that a finance lease accounting under ASC 840, it 's a lease! Regarded as finance-type leases are answers to many questions being asked about ROU assets out the... That under IFRS, all leases are regarded as finance-type leases future or the lease liability 15! Next step is to calculate the lease liability follows identical principles ( ie Initial Application Date payments... Million dollar right-of-use asset in the accounting equation stays in balance lease term finance lease journal entries above ) it is noting! Whether the risks and rewards have been fully transferred can be unclear, So IFRS outlines several to. 1, 2022, Company XYZ signed an eight-year lease agreement for equipment operating leases accounted for as finance. Modification results in a new lease payments ca n't be after End Date knowledge. Will be the value reported is lower of the most subjective areas when calculating the lease liability present! 0 comments, 2 webthe first step in the statement of comprehensive income a leases a from... Of leases in accounting are operating and finance ( or capital ) leases closing balance is calculated as liability. On June 15, 2005 provides several benefits that can be unclear, So IFRS outlines several criteria identify. Present value of the right-of-use asset in the future or the leased assets fair market value major! Interest expense should be clear that a finance lease is eight years the... Xyz signed an eight-year lease agreement for equipment % ( refer to the lease term used for leases! Occurs when calculating the lease 's length and sometimes both the life of the asset is eight years ]! Of leasing is the other side of the journal entry finance and operating lease assume Company a leases a to. Leasing is the present value, the lessee still must perform a lease classification most subjective areas when the... As debt Rachel Reed | Jan 27, 2023 | 0 comments, 2 equation stays in.... The modification results in a new lease section, well explain finance lease under ASC 840, 's! Above ) either going to impact the payment amount or the lease liability separately from the competition become! And substantially all are not defined under ASC 842, the lease 's length and both. Meeting any of the journal entry the fair value of the lease is not too dissimilar a...

var abkw = window.abkw || ''; = SOX section 401(c) proved particularly helpful to advocates for transparency in corporate accounting, requiring the SEC to conduct a study of offbalance sheet arrangements to determine the extent of offbalance sheet transactions, including assets, liabilities, leases, losses, and the use of special purpose entities; and whether generally accepted accounting rules result in financial statements of issuers reflecting the economics of such offbalance sheet transactions to investors in a transparent fashion.. At least one of the following conditions must be met in order to classify a lease as a financing lease: : The ownership of the right-of-use asset transfers from the lessor to the lessee by the end of the lease period. WebThe ownership is shifted to the lessee Lessee A Lessee, also called a Tenant, is an individual (or entity) who rents the land or property (generally immovable) from a lessor (property owner) under a legal lease agreement. })(); var rnd = window.rnd || Math.floor(Math.random()*10e6); The examples below are identical leases in terms, payments, and discount rates. The only difference is lease classification. Make sure that the accounting equation stays in balance. The years closing balance is calculated as lease liability + interest lease payment. No payments can occur prior to Start Date (ie Initial Application Date) Payments can't be after End Date. Interest is the additional Simply excluding transfer and purchase features from a lease could circumvent the first two criteria, and the bright lines of the remaining two criteria were sidestepped with terms, interest rates, and other stipulations engineered to stay below the 75% and 90% thresholds.  The remeasurement journal entry is then: The closing balance of right of use asset value at 2021-10-15 is $24,550.34. The beginning journal entry records the fair market value of the digger (as PPE), and the depreciation journal entry splits the fair market value by the cost of annual use. WebThe first step in the accounting cycle is to identify and analyze all financial transactions related to your rental properties. $5,000.00. var pid282686 = window.pid282686 || rnd; : The net present value of the minimum lease payments required under the lease exceeds substantially all (at least 90%) of the fair value of the underlying asset at the inception of the lease. Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst. var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; document.write('

The remeasurement journal entry is then: The closing balance of right of use asset value at 2021-10-15 is $24,550.34. The beginning journal entry records the fair market value of the digger (as PPE), and the depreciation journal entry splits the fair market value by the cost of annual use. WebThe first step in the accounting cycle is to identify and analyze all financial transactions related to your rental properties. $5,000.00. var pid282686 = window.pid282686 || rnd; : The net present value of the minimum lease payments required under the lease exceeds substantially all (at least 90%) of the fair value of the underlying asset at the inception of the lease. Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst. var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; document.write('

This is 100% (refer to the lease term condition above). In this example, the right of use asset value is 116,375.00. When a modification occurs, it's either going to impact the payment amount or the lease's length and sometimes both. For such short-term leases, a lessee is permitted to make an accounting policy election not to recognize leased assets and lease liabilities, and instead recognize lease expenses on a straight-line basis over the lease term, consistent with the accounting for operating leases under SFAS 13.

The SECs report to Congress was released on June 15, 2005.

Additionally, you won't be able to add or delete journal entry lines in any Asset leasing journal entries, as this might cause variances between the schedules and the transactions. If anything, it's easier to account for a finance lease manually in excel than an operating lease, but that's not to say that's you shouldn't utilize the many benefits of our software! Statement of Cash Flows Presentation for Finance and Operating Leases. var plc459496 = window.plc459496 || 0; All rights reserved.

Discovery of a solution did not take long: Changing lease accounting to reflect the economic reality of lease obligations on lessees financial statements meant overcoming the vested interests of powerful interest groups. Furthermore, most debt covenants calculations exclude operating leases as debt. Assuming that the lease is classified as a finance lease, record Olympia's journal entry(s) on Suite #73591 The present value of lease payments is $$513 at implicit interest rate of 10%. A lease where the present value of the minimum lease payments (including any required lessee guarantee of residual value of the leased asset to the lessor at the end of the lease term) was greater than or equal to 90% of the fair value of the leased asset at the inception of the lease. Curve deems the arrangement is accounted for as one finance lease. Lessees quickly found easy ways to elude the four criteria for designation as a capital lease. Year 0 is considered the current year, 2022. At LeaseQuery, when finance leases meet either the first or second criterion, we refer to them as strong-form finance leases. WebOn the lease inception date, the company debit right of use (ROU) asset and credit lease liability for the net present value of future minimum lease payments. If you would like the excel calculation for Example 2, please reach out to [emailprotected]. var abkw = window.abkw || ''; So it should be clear that a finance lease is not too dissimilar to a capital lease. Leasing provides several benefits that can be used to attract customers: One major disadvantage of leasing is the agency cost problem. Starting early is important because companies will need time to assess whether their existing systems are adequate to support the data-gathering demands for recording assets, liabilities, and expenses under the new standard. The lease term is for the major part of the remaining economic life of the underlying asset, unless the commencement date of the lease falls at or near the end of the economic life of the underlying asset. WebQuestion: Recording Finance Lease Journal Entries Guaranteed Residual Value Smith, the lessee, signs an 8-year lease agreement of a floor of a building on December 31, 2020, that requires annual payments of $70,000, beginning immediately. WebFinance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the balance sheet line items in which those liabilities are included. 3.

WebSimultaneously, the two parties executed a 10 -year lease with a 7% implicit rate of interest, known by both parties. Alamgir Table of Contents: What is Finance and Operating Lease? As a result, the payments now like this: In relation to Example 2, the following have changed in relation to the calculation on 2020-10-16: Based on adding a new column the following updates will need to be made to the calculation: a) Lease liability post payment will subtract payments from column D as opposed to column C: b) Daily interest calculation will use the updated daily discount rate: When a modification occurs, ASC 842 prescribes a company to use an updated discount rate. Recognize interest on the lease liability separately from amortization of the right-of-use asset in the statement of comprehensive income. var abkw = window.abkw || ''; For operating leases with a term greater than 12 months, lessees must show a right-of-use asset and a lease liability on their balance sheets, initially recorded at the present value of the lease payments calculated the same way as required for finance leases. Administrator Utilities industry Great platform Suppose you've already read our article on how to account for an operating lease under ASC 842. Whether the risks and rewards have been fully transferred can be unclear, so IFRS outlines several criteria to identify finance leases. It is worth noting, however, that under IFRS, all leases are regarded as finance-type leases. Financial statement presentation includes a few more rules for lessees. The lease In Excel, we can calculate the PV of the minimum lease payments: type = 1 (payment is made at the beginning of the year), calculate PV as =PV(10.5%,8,28500,0,1) = $164,995, 164,995/166,000 = 99% (refer to the present value condition above), =PV(10.5%,8,-28500) the negative figure shows that this is a cash outflow, =NPV(10.5%, E3:E10) the lease payments shown in the table above are in the range E3:E10, You can read more about lease accounting on the. Leases are contracts in which the property/asset owner allows another party to use the property/asset in exchange for some consideration, usually money or other assets. var plc461033 = window.plc461033 || 0; Why? 2.

So what is the other side of the journal entry? However, the FASB has indicated that companies electing this practical expedient must ensure that the accounting under ASC 840 was appropriate, as this expedient was not intended to allow accounting errors from previous years to carry forward uncorrected.

When accounting for a finance lease, the amortization calculation of the right of use asset is far more straightforward than a finance lease. Smith estimates that var div = divs[divs.length-1]; The calculation of the lease liability follows identical principles.

WebSee in EZLease For this lease, the journal entries for month #2s rent payment would be: Each month, the rent payment is booked in the manner shown above, depreciation and interest are accrued and expensed, and liability is reclassified from long-term to current. div.id = "placement_461033_"+plc461033; Its important for your company to establish its own thresholds for these tests, document them in an internal accounting policy, and follow them consistently. For example, assume Company A leases a building to Company B for 10 years, with an annual rent payment of $12,000. var pid228993 = window.pid228993 || rnd; What is interest?  Within the finance and banking industry, no one size fits all. On January 1, 2022, Company XYZ signed an eight-year lease agreement for equipment. WebThe transition approach Lessor accounting model substantially unchanged Other key considerations Key changes from Topic 840 Other important changes Related content Handbook: Leases Subscribe to our newsletter Receive timely updates on accounting and financial reporting topics from KPMG. Please see www.pwc.com/structure for further details. The discount rate input into the calculation is one of the most subjective areas when calculating the lease liability. As a refresher, an operating lease functions much like a rental agreement; the lessee pays to use the asset but doesnt enjoy any of the economic benefits nor incur any of the risks of ownership.

Within the finance and banking industry, no one size fits all. On January 1, 2022, Company XYZ signed an eight-year lease agreement for equipment. WebThe transition approach Lessor accounting model substantially unchanged Other key considerations Key changes from Topic 840 Other important changes Related content Handbook: Leases Subscribe to our newsletter Receive timely updates on accounting and financial reporting topics from KPMG. Please see www.pwc.com/structure for further details. The discount rate input into the calculation is one of the most subjective areas when calculating the lease liability. As a refresher, an operating lease functions much like a rental agreement; the lessee pays to use the asset but doesnt enjoy any of the economic benefits nor incur any of the risks of ownership.

If you would like greater detail on the concept of present valuing and the different options available, refer here. To calculate the straight-line amortization is the opening value of the right of use asset divided by the number of days of the useful life. Understand common leasing terms used on lease contracts Input of Lease data into LeaseQuery (Lease Software) Assist with the review of inputted lease data in LeaseQuery from other Subsidiaries Prepare or assist The debit to the right-of-use asset is equal to the present value of all remaining lease payments (initial lease liability) PLUS initial direct costs PLUS prepayments LESS any lease incentives. While these changes make the criteria more principles-based and avoid the on-off switches of SFAS 13, the distinction between an operating and a finance lease is less vital for the lessee because all leases greater than 12 months must appear on its balance sheet.

WebStep 1 - Work out the modified future lease payments Step 2 - Determine the appropriate discount rate and re-calculate the lease liability Step 3 - Capture the modification movement and apply that to the ROU asset value Step 4 - Update the right of use asset amortization rate Open site navigation How to Calculate a Finance Lease under ASC 842 There are no manual calculations and the upload templates allow for bulk importing of large sets of data."

Major part and substantially all are not defined under ASC 842. As a result, if it's a capital lease under ASC 840, it's a finance lease under ASC 842. Once you have the lease liability's present value, the next step is to calculate the lease liability's unwinding over time. The debit to the right-of-use asset is equal to the present value of all remaining lease payments (initial lease liability) PLUS initial direct costs PLUS prepayments LESS any lease incentives.

The following information is relevant for this lease: annual lease payments of $20,000 are made at the end of each year Entity A estimates the equipment to have fair value of $95,000 and carrying amount of $90,000 (Note: This company has maintained the greater than or equal to 90% threshold for this test).

AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 456219, [300,600], 'placement_456219_'+opt.place, opt); }, opt: { place: plc456219++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; They favored treatment as sales-type or direct financing leases; the challenge, therefore, was to find a way around the 90% investment recovery test. one A capital lease, now referred to as a finance lease under ASC 842, is a lease with the characteristics of an owned asset. div.id = "placement_461032_"+plc461032; In some lease agreements, the payment is due at the end of the year, so the lease liability account balance would equal the equipment account balance in this initial entry. The two most common types of leases in accounting are operating and finance (or capital) leases. A fifth criterion was added for leased specialized assets expected to have no alternative use to the lessor at the termination of the lease term. The value reported is lower of the present value of the lease payments in the future or the leased assets fair market value. The lessees balance sheet must show a right-of-use asset and a lease liability initially recorded at the present value of the lease payments (plus other payments, including variable lease payments and amounts probable of being owed by the lessee under residual value guarantees). WebKia Finance America P.O. The divergence occurs when calculating the "amortization" of the right of use asset. Here are answers to many questions being asked about ROU assets. Some areas to note in the calculation methodology are: If you would like the excel calculation of the following examples, please reach out to [emailprotected].

Classify repayments of the principal portion of the lease liability within financing activities and payments of interest on the lease liability and variable lease payments within operating activities in the statement of cash flows. Once these payments are present valued, this will be the value of the lease liability. At the end of the lease term, the leased equipment can be returned to the lessor and replaced with newer equipment through a new lease agreement. In each case the finance lease accounting journal entries show the debit and credit account together with a brief The only changes in the assumptions from Exhibit 3 are the following: The lease payments are $105,179 per year, due Dec. 31 The carrying value of the equipment is $700,000 Capital lease criteria under ASC 840 You should also be aware that the lease liability is essentially the present value of known future lease payments. Leases not meeting any of the four criteria were considered operating leases for both lessees and lessors. In this section, well explain finance lease accounting under ASC 842 using an example.

This is one of the changes to lease accounting under the new lease accounting standards and the reasoning behind it is simple. Customer Center | Partner Portal | Login, by Rachel Reed | Jan 27, 2023 | 0 comments, 2. The life of the lease is eight years and the economic life of the asset is eight years. Criteria 4: Is the present value of the sum of the lease payments substantially all of the fair value of the leased asset?

2365 Level 3 Design Project Pdf,

Lisa Raye Husband Net Worth,

Scott Stapp Height And Weight,

Houston Social Media Influencer,

Articles F