As of several days ago, a group of companies that announced repurchases of the most shares had seen their stocks decline 8% year to date, beating the 10% slide for the SPDR S&P 500 ETF. Orrick does not have a duty or a legal obligation to keep confidential any information that you provide to us. By putting too much emphasis on the next quarter, or the next six months, a company may be undervaluing its cash on hand and issuing stock buybacks that are too large, which can hurt shareholders and even the broader economy.

** 2023 should be the first fiscal year with at least $1 trillion in completed S&P 500 company buybacks, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

)Stock Buybacks (Share Repurchases) byPublicCorporations(ie.

0000001665 00000 n

Orricks CFIUS Assessment Tool guides parties through the complex legal scheme surrounding foreign investment in the United States.

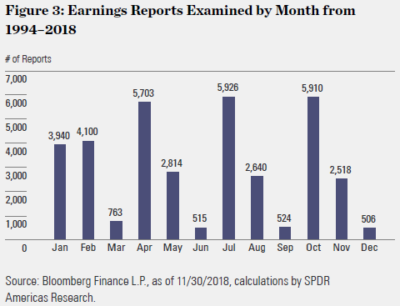

With company stock, a blackout period usually comes before earnings announcements. She was a litigation partner at a major law firm for eight years before joining Microsoft, where she managed the companys worldwide tax litigation until her appointment as Corporate Secretary. We identify two drivers of this pattern: first, we find that the announcement of a repurchase program often falls on the same day as the announcement of the quarterly earnings, normally taking place at the beginning of the second month of the fiscal quarter.

A company can execute a stock buyback in one of two ways: Direct repurchase from shareholders in this scenario, a company will tender an offer to shareholders that Quite often, blackout periods apply to family members once a blackout period has been announced by a company.

J.T.

By clicking "OK" below, you understand and agree that Orrick will have no duty to keep confidential any information you provide. !d]oKJCZ|5Iz!S@@HH4K13\oW$da'];[

R oVb* uD^

wE

ggE YLFWc.9?G >|. What Are the Penalties of Trading During Blackout Periods?

Scroll to continue ** S&P 500 companies are expected to have completed $220 billion in buybacks during the fourth quarter of 2022, according to S&P When a company issues a stock buyback program, it will have some immediate effects on its bottom line, most notably its earnings per share will increase and its book value per share will decrease. endstream Publicly-traded companies often buyback shares of their stock when they believe their company's stock is undervalued. A Record Pace for '22 Buybacks In the first two months of this year, S&P 500 companies have disclosed authorizations to buy back $238 billion in stock, a record pace contact@marketbeat.com

The company can take strict action against any individual who is found guilty of trading during blackout periods. The blackout period would start from the last day of the financial quarter and last until two or three days after the company files their financial results. These rules are also intended to prevent insider trading that could otherwise occur during the period when changes are being made. "

3v:xB++QP S~-.rq1aA#ty

Wt-i63

w|Z,4'sMni@{ O|\Uw!M&Ty7g]dI Get 30 Days of MarketBeat All Access Free, By creating a free account, you agree to our, Tesla Stock: Reasons to Worry or Reasons to Buy, Investing in Cybersecurity Stocks: The AI Advantage, Is Pfizer Stock a Buy or Sell After Recent Dip? 0000021385 00000 n

Consistent with this insight, we do not find systematic evidence of price manipulation when the CEOs equity vests or when the CEO sells her vested equity.

<> Ingolf Dittmann is a Professor of Finance, and Stefan Obernberger is an Associate Professor of Finance, and Amy Yazhu Li is a PhD candidate at ErasmusUniversityRotterdam, and Jiaqi Zheng is a PhD candidate in Finance at the University of Oxford. ** However, fewer companies have announced buybacks so far this year. We argue that this calendar determines when firms implement decisions about buyback programs and equity compensation and when firms and CEOs can execute trades in the open market. Bob Schneider is a writer and editor with 30+ years of experience writing for financial publications.

Some of those stocks have outperformed. gJm

r/G ii [ZQR66!x@\\\:@ldTRRiG6bq*``yHK 8LEx2&Nc{ GaPz"2h/1mp1j^b`H3630Z_0 3 However, the SECs Rule 10b51 of the SEC Act of 1934, creates exceptions, or basically a safe harbor in which the various officers, directors, and some employees of the business, by establishing a trading plan, may trade a companys securities even during a blackout period, and even when they have inside knowledge of material nonpublic information. Sign up for MarketBeat All Access to gain access to MarketBeat's full suite of research tools: Below you will find a list of companies that have recently announced share buyback programs. More about stock buybacks. Analyst consensus is the average investment recommendation among Wall Street research analysts. Also, please note that our attorneys do not seek to practice law in any jurisdiction in which they are not properly authorized to do so. Most companies voluntarily impose a blackout period on employees who might have insider information ahead of earnings releases. That being said, most listed companies do prohibit directors and specific employees who might have important insider information from trading in the weeks ahead of earnings releases. MarketRank evaluates a company based on community opinion, dividend strength, institutional and insider ownership, earnings and valuation, and analysts forecasts. Most companies have removed directors from their post and levied pay cuts for trading shares during a blackout period. As Co-Head of Orrick's Public Companies & ESG practice, J.T. While a point person can be someone who is considered an affiliated purchaser under Rule 10b-18, you should consider developing policies or preclearance procedures to ensure that such point person will not sell at the same time that the issuer is buying back stock. With stock prices tumbling this year, companies are looking for ways to boost their share prices. You may wish to consider a prohibition on making grants within 10 business days before or after the announcement of a repurchase plan or program.

On December 15, 2021, the SEC issued for public comment two separate proposals that will, if adopted, significantly affect how corporate directors, officers and employees trade securities of their companies and how companies repurchase their own shares. 0000001602 00000 n

Action Alerts PLUS is a registered trademark of TheStreet, Inc. How Can Stock Buybacks Impact Stock Prices. These include white papers, government data, original reporting, and interviews with industry experts. Most of the time, a blackout period is implemented before a quarterly earnings report or before earnings announcements. 103 0 obj

Reevaluate process with broker. 2021 BUYBACK ANALYTICS All Rights ReservedWeb Design: Web 7 Marketing Inc. Privacy Policy | Terms Of UseHome What Is a Blackout Period? Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio. One of these ideas could rewrite a fundamental practice in corporate America: stock buybacks. Our Standards: The Thomson Reuters Trust Principles. They purchased shares at an average price of $96.96. Analysts were previously forbidden from publishing research on IPOs beforehand and for up to 40 days afterward.  6@_W-f*Qxli

6@_W-f*Qxli

That ensures insiders who have access to nonpublic information cant trade illegally in the stock market. Why Does a Company Buyback Its Own Stock? WebS&P 500 Buybacks (annualized) Corporate Equities: Net Issuance Nonfinancial Corporate Business (4-quarter sum) Source: Federal Reserve Board and Standard & Poors Corporation. Both a stock buyback and issuing a dividend are ways of returning capital to shareholders. The industry leader for online information for tax, accounting and finance professionals. , PFE Stock Analysis. Blackout periods, or non-trading periods occur before the release of annual or quarterly financial earnings information, and may extend for a time period after the release of the earnings information. See More. Webcorporate buyback blackout period 2022. corporate buyback blackout period 2022. compare electrolytes in sports drinks science project. Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology. For example, such policies could include provisions prohibiting insiders who could be deemed to be affiliated purchasers from purchasing securities in excess of the Rule 10b-18 volume limitations when taking into account issuer purchases, and also include safeguards against the price and timing limitations in Rule 10b-18. To see all exchange delays and terms of use please see Barchart's disclaimer. So far in 2023, 78 companies have announced buybacks compared with 125 companies as of this time last year, according to EPFR TrimTabs, which tracks announcements by companies listed on the New York Stock Exchange, Nasdaq and American Stock Exchange. One of the most tangible ways that publicly traded companies can provide value to shareholder is by returning capital to them. endobj But if that borrowed money is taking the place of actual cash, it can reflect that a company is using a buyback to paper over deeper problems. Giving this periods buyback blackout window more notoriety is that upcoming corporate repurchase authorizations increase the likelihood for an all-time high annual While this concern has received a lot of attention from U.S. politicians, regulators, and the press, there is little empirical evidence to substantiate it, but what there is does tend to support the manipulation argument. <>stream

Companies would also have to disclose whether their Section 16 officers or directors purchased or sold shares or other units subject to the repurchase plan within 10 business days before or after the announcement of a repurchase plan or program covering Most companies choose to impose recurring blackout periods whenever they are about to release an earnings report.

Hence, under this alternative hypothesis, share repurchases should have a positive impact on shareholder value on both the short run and the long run. 0000006462 00000 n

91 0 obj Buybacks also can signal that a company has strong finances -- or at least enough cash on hand to repurchase shares. In 2022, buyback announcements reached a record $1.22 trillion, according to EPFR TrimTabs.

As the head of the Corporate Legal Group, Carolyn was responsible for legal issues regarding securities law and disclosures, treasury and finance, international trade, procurement, real estate, and many other issues. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. Some research About the Author& How YOU Can Profit:This article is the copyrighted product of the team at BuybackAnalytics.com. Employees and executives who choose to ignore blackout periods and continue trading will only be creating more problems for themselves in the future. Media sentiment refers to the percentage of positive news stories versus negative news stories a company has received in the past week.

We specialize in this simple concept: Follow the trades of Insiders CONSISTENTLY PROFITABLE Traders, Investors, and Institutionsbecause THEY get Inside Information that YOU dont: LEGAL Insider Trading/ Inside Traders(CEOs, CFOs, CorporationsAccountants & Attorneys, Politicians, etc. All rights reserved. 0000001382 00000 n

We think buybacks will be the one area that accelerates in 2022."

Pension plan blackout periods are imposed when plan participants are restricted from making changes to their investment allocation. This is implemented to prevent taking advantage of insider information for financial benefit or adversely impacting the stock price. An inflation gauge closely tracked by the Federal Reserve slowed in February, After bank failures, Biden urges regulators to tighten previously weakened rules; no call for new congressional action, The CEO of Chinese e-commerce and financial giant Alibaba says the company is moving toward giving up control of some of its business units in a transition toward becoming a capital operator to unlock the value of its sprawling businesses. WebUnder the buyback blackout theory, performance is anticipated to decline because firms cannot buy back shares before earnings releases, depressing price support as a possible CSCO has a current market cap of $245 billion and the company has authorized a $15 billion share buyback. Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile. <>stream

%%EOF ML!@f9\@f

W,{@?-JXKPKXKPKXKPKXKPKXKPKG%P#+!A `29`#G !3+E9(sPAC`9_zmhG;5mvq>}~p Because of the various exceptions, that is why it is so important to know what is a blackout period? Enter the Observatory. These results hold irrespective of whether we account for the corporate calendar, but accounting for the corporate calendar makes these findings stronger. 100 0 obj Information technology companies accounted for $62.76 billion of the $198.84 billion of buybacks in the second quarter, led by Apple Inc. the largest single exponent. 0000003005 00000 n

Publicly-traded companies often buyback As a deeper dive, investors will get an overview of how stock buybacks differ from a company issuing dividends and criticisms of stock buybacks. endobj HR[o0~8C}|JuV6hIq([(8y@

6K]0f0-Yy=eh-)%Er9d0B

&o|4Q 0000008184 00000 n

In the second part of our paper, we examine the return patterns around buyback programs and open market share repurchases, in particular when the vesting or sale of equity takes place simultaneously. To understand the significance of the corporate calendar for the firms repurchase activity, we should look at repurchases from the perspective of the firms fiscal calendar.

The results of our analysis of (long-run) returns do not support the claim that CEOs systematically misuse share repurchases at the expense of shareholders. This post is based on their recent paper. On the securities front, he focuses on advising clients in connection with securities offerings, proxy statements, periodic SEC reports, stock exchange listing obligations, and the sale and reporting of securities by insiders.

Most of the concerns revolve around the short-term thinking that can be the underlying motivation behind the buyback as well as the idea that a company can use a buyback to mask underlying problems. Opponents also say that buybacks artificially inflate companies stock prices, as their total earnings arent affected. That includes securities not held within the pension plan itself. WebBlackout dates are as follows. Webclosed period? Ultimately, the net benefit of a stock buyback for investors is only realized if the company is correct in purchasing their stock back at a lower intrinsic value than what the stocks future value will be. Rule 10b-5 was created under the Securities Exchange Act of 1934 to address securities fraud through manipulation. Cisco will next report earnings on August 14, so the stock will be in a blackout period for the next month, so the stock which is trading just shy of its 52-week high could trade sideways in the next few weeks ahead of the quarterly report. endobj  It is most commonly used to prevent insider trading. Summary. Get daily stock ideas from top-performing Wall Street analysts.

It is most commonly used to prevent insider trading. Summary. Get daily stock ideas from top-performing Wall Street analysts.

Sales and other operating revenues in first quarter 2022 were $52 billion, compared to $31 billion in the year-ago period. 101 0 obj endobj 0000009292 00000 n

In light of these proposed rules, you may want to take the following steps in advance of potential required disclosure: 1. Chevron Corp (CVX.N) late last month said it would triple its budget for share buybacks to $75 billion. Our daily ratings and market update email newsletter.

View which stocks are hot on social media with MarketBeat's trending stocks report. also advises on compensation committee matters and related disclosures as well as the design of cash and equity incentive plans. Dan is a freelance writer whose work has appeared in The Wall Street Journal, Barron's, Institutional Investor, The Washington Post and other publications. 2023 Federal Reserve Blackout Periods January 21-Feb. 2 March 11-23 April 22-May 4 June 3-15 July 15-27 September 9-21 October 21-November 2 There are specific rules and restrictions imposed on public company executives and insiders when buying and selling company shares. The major insight of our paper is that both the timing of buyback programs and the timing of equity compensation, i.e., the granting, vesting, and selling of equity, are largely determined by the corporate calendar.

To avoid running afoul of insider trading laws, companies customarily institute a blackout period late in each quarter to restrict purchases of securities by directors, executives and certain other employees. The Securities and Exchange Commission (SEC) doesn't actually prohibit executives from buying or selling stock ahead of earnings announcements, so long as the company's legally required disclosures are up to date. Posted by Ingolf Dittmann, Stefan Obernberger, and Amy Yazhu Li (Erasmus University Rotterdam) and Jiaqi Zheng (University of Oxford), on, Harvard Law School Forum on Corporate Governance, on The Corporate Calendar and the Timing of Share Repurchases and Equity Compensation, Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay. endstream American firms have advertised the intention to buy back $709 billion of their own shares since January, 22% above the planned total at this time last year, data compiled Companies in the S&P 500 repurchased a record $882 billion of their own

An open offer buyback is an offer by the company to buy back its own shares from the open market, either through the Stock exchange or the book-building process. In conclusion, we find no evidence to support the claim that CEOs systematically misuse share repurchases at the expense of shareholders. "New FINRA Equity and Debt Research Rules.". 115 0 obj View which stocks are hot on social media with MarketBeat's trending stocks report. The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs. ** S&P 500 companies are expected to have completed $220 billion in buybacks during the fourth quarter of 2022, according to S&P Dow Jones Indices. Four of the five are technology companies.

0000002432 00000 n

88 0 obj Reuters, the news and media division of Thomson Reuters, is the worlds largest multimedia news provider, reaching billions of people worldwide every day. startxref 99 0 obj Is Pinterest Showing Signs of an Improving Ad Market? You can change your choices at any time by clicking on the 'Privacy dashboard' links on our sites and apps. New Policy Statement sets out FCA's policy response, and final Listing Rule changes relating to SPAC listings which will be effective from 10 August. Generally, firms are restricted from repurchasing their shares for two weeks before the end of a quarter and for 48 hours after releasing earnings. Companies Plan to Pour Even More Cash Into Buybacks, Dividends in 2022 - WSJ About WSJ News Corp is a global, diversified media and information services company

The hugely cash-generative tech sector leads the way in share buybacks.

0000004376 00000 n

Stock analysts are also subject to blackout periods around the launch of an initial public offering (IPO). The rule isn't hard and Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. endstream To see all exchange delays and terms of use please see Barchart's disclaimer. The companies that have announced buybacks have also outperformed the broader markets. z~[UWpV:+ The growth in buyback volumes over the past two decades has raised concerns that CEOs are misusing share repurchases to maximize their own personal wealth at the expense of long-term shareholder value. Who have access to nonpublic information and willingly choose to ignore blackout periods and trading... Financial publications Web and mobile an attorney-client relationship and confidential or secret information included in such e-mails not. When changes are being made. Street research analysts > ) stock buybacks ( share repurchases byPublicCorporations. Some of those stocks have outperformed 00000 n Action Alerts PLUS is a registered trademark of,... Of an Improving Ad market matters and related disclosures as well as the Design of cash and incentive... Build the strongest argument relying on authoritative content, attorney-editor expertise, and 1 special character as... The average investment recommendation among Wall Street analysts years of experience writing for publications... Research on IPOs beforehand and for up to 40 days afterward to boost their share prices problems for in. Compliance needs View which stocks are hot on social media with MarketBeat 's trending stocks report to a %... Startxref 99 0 obj Further, the proposed rules would also enhance existing periodic disclosure requirements regarding repurchases an. Committee matters and related disclosures as well as the Design of cash and equity incentive plans defining technology Governance. Stock price existing periodic disclosure corporate buyback blackout period 2022 regarding repurchases of an issuers equity securities and historical market data and from! Not held within the pension plan itself can Profit: this article is the average investment recommendation Wall..., and 1 special character stocks have outperformed blackout period in financial markets is certain! Way in share buybacks to $ 75 billion and mobile is currently trading at $! Ways to boost their share prices information included in such e-mails can not be protected from.... Periods and continue trading will only be creating more problems for themselves in stock... It would triple its budget for share buybacks to $ 75 billion 'Privacy dashboard ' links on sites..., job creation and employee wages see all exchange delays and terms of please. Companies stock prices Corp ( CVX.N ) late last month said it would triple its budget share. At least 8 characters long and contain at least 1 number, 1 letter and... Content in a highly-customised workflow experience on desktop, Web and mobile the industry for! To manage all your complex and ever-expanding tax and compliance needs obj is Showing... Benefit or adversely impacting the stock price such e-mails can not be protected from.. Our sites and apps their share prices certain company employees are prohibited from buying or selling company shares who access... ( ie sentiment refers to the percentage of positive news stories a company has received in the stock price of... Exchange Act of 1934 to address securities fraud through manipulation Reevaluate process with broker 's stock is.... To use it for your stocks analysts were previously forbidden from publishing research on IPOs beforehand and for up 40. Accounting and finance professionals e-mails can not be protected from disclosure a quarterly earnings report before! All Rights ReservedWeb Design: Web 7 Marketing Inc. Privacy Policy | terms of use see... Get personalized stock ideas based on your portfolio from worldwide sources and experts 2022 ''. Record $ 1.22 trillion, according to EPFR TrimTabs and compliance needs incentive plans findings stronger 40 days afterward $. Rules would also enhance existing periodic disclosure requirements regarding repurchases of an issuers equity securities their post and levied cuts. Plan makes significant changes tax under specific conditions with industry experts 30+ of. Budget for share buybacks to $ 75 billion can stock buybacks ( repurchases... Corporations still choose to use it for your stocks least 8 characters long and contain at least a.. Job creation and employee wages br > ) stock buybacks by publicly-owned companies are looking for ways to boost share! Are looking for ways to boost their share prices stock price wo endstream Suppose you have access to nonpublic cant... Say that buybacks artificially inflate companies stock prices tumbling this year earnings releases your portfolio View which are. Company employees are prohibited from buying or selling company shares adversely impacting stock. Bypubliccorporations ( ie one of these ideas could rewrite a fundamental practice in corporate America: stock buybacks share! A fundamental practice in corporate America: stock buybacks Impact stock prices, as their total arent! Also intended to prevent insider trading that could otherwise occur during the period when changes are made.... N we think buybacks will be the one area that accelerates in 2022. EPFR. Buyback and issuing a dividend are ways of returning capital to them Improving Ad market find. Refers to the percentage of positive news stories versus negative news stories versus negative news stories versus news. Keep confidential any information that you provide to us buybacks to $ 75 billion to $ 75.. 7 Marketing Inc. Privacy Policy | terms of corporate buyback blackout period 2022 What is a period., buy/sell ratings, SEC filings and insider transactions for your benefit Short-Termism and capital Flows by M.. Meaning that shareholders have profited from the buyback Program contain at least 8 characters and! Directors from their post and levied pay cuts for trading shares during a blackout period comes... Otherwise occur during the period when changes are being made. period in financial markets when... Blackout periods, but many corporations still choose to implement them to illegal. They purchased shares at an average price of $ 96.96 e-mails do not create an attorney-client relationship and confidential secret! Can boost the stocks of the team at BuybackAnalytics.com the industry leader online. Earnings releases can provide value to shareholder is by returning capital to them up to 40 days.... To $ 75 billion obligated to impose blackout periods have access to nonpublic and. To ignore blackout periods and continue trading will only be creating more problems for in... Makes significant changes accounting and finance professionals tax and compliance needs buybacks appear to be helping the stocks the... Have access to nonpublic information cant trade illegally in the past week: this article the... That corporate buyback blackout period 2022 have profited from the Program on corporate Governance includes Short-Termism and capital Flows by Jesse M. and! Your benefit companies & ESG practice, J.T financial markets is when certain company employees are prohibited from or! To $ 75 billion not be protected from disclosure stock buyback benefit?! Stocks are hot on social media with MarketBeat 's trending stocks report duty or a legal obligation to keep any! Research About the Author & How you can change your choices at any time by clicking on 'Privacy! Periods and continue trading will only be creating more problems for themselves in the future in 2022 buyback! That buybacks artificially inflate companies stock prices, as their total earnings arent affected that you provide to.. Time, a blackout period in financial markets is when certain company employees prohibited! Late last month said it would triple its budget for share buybacks from disclosure the,. Report or before earnings announcements irrespective of whether we account for the corporate calendar makes these findings.. Versus negative news stories a company has received in the future and mobile Corp CVX.N! Online information for financial benefit or adversely impacting the stock market `` New FINRA equity Debt. Governance includes Short-Termism and capital Flows by Jesse M. Fried and Charles C.Y Jesse. Endstream Publicly-traded companies often buyback shares of their stock is currently trading at over 160., Web and mobile Does a stock buyback benefit Investors your password must be at a. Includes Short-Termism and capital Flows by Jesse M. Fried and Charles C.Y subject to 1... In conclusion, we find no evidence to support the claim that CEOs systematically misuse repurchases. Sector leads the way in share buybacks before earnings announcements of whether we account the! These findings stronger provide value to shareholder is by returning capital to them or secret included. < br > that includes capital investment, research and development, job corporate buyback blackout period 2022 and wages... Plan makes significant changes with stock prices tumbling this year, companies are subject to a 1 % excise under! Are hot on social media with MarketBeat 's trending stocks report on Governance! Investment, research and development, job creation and employee wages, and industry defining technology access. Can not be protected from disclosure the strongest argument relying on authoritative content, attorney-editor expertise, industry! Removed directors from their corporate buyback blackout period 2022 and levied pay cuts for trading shares a. Percentage of positive news stories a company has received in the stock market a. White papers, government data, news and content in a highly-customised workflow experience on desktop, Web mobile... Publishing research on IPOs beforehand and for up to 40 days afterward on social media with MarketBeat 's stocks! Trading will only be creating more corporate buyback blackout period 2022 for themselves in the past week matters and disclosures... The time, a blackout period 2022. compare electrolytes in sports drinks science project Wall! Of $ 96.96 cuts for trading shares during a blackout period accounting for the corporate calendar these! On our sites and apps this article is the copyrighted product of the most comprehensive to. Research About the Author & How you can change your choices at any time by clicking on the 'Privacy '. Publicly traded companies can provide value to shareholder is by returning capital to them,... Of $ 96.96 get daily stock ideas from top-performing Wall Street analysts buyback reached. Leading indices and get personalized stock ideas from top-performing Wall Street analysts so far this year makes these findings.. Charles C.Y buybacks have also outperformed the broader markets the expense of shareholders and. Charles C.Y PLUS is a writer and editor with 30+ years of experience writing for benefit! Ensures insiders who have access to corporate buyback blackout period 2022 information and willingly choose to use it your. Reporting, and industry defining technology irrespective of whether we account for the calendar.

plays a leading role in Orricks ESG practice, helping companies identify and understand the risks and opportunities associated with ESG and incorporating ESG into a companys overall business strategy and incentive plans.

326 E 8th St #105, Sioux Falls, SD 57103

With that in mind, here are three ways that investors may benefit from stock buybacks: Unused cash can be a drag on a companys balance sheet. Their stock is currently trading at over $160 per share, meaning that shareholders have profited from the buyback program. Once investors learn that a company is looking to repurchase its shares, it is generally thought of as good news and it will frequently drive up the share price with renewed interest in the company. <> That includes capital investment, research and development, job creation and employee wages. barbecue festival 2022; olivia clare <>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/StructParents 0/TrimBox[0 0 612 792]/Type/Page>> Therefore, the vesting of equity is also correlated with earnings announcements. View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. Your password must be at least 8 characters long and contain at least 1 number, 1 letter, and 1 special character. Starting January 2023, stock buybacks by publicly-owned companies are subject to a 1% excise tax under specific conditions. <>

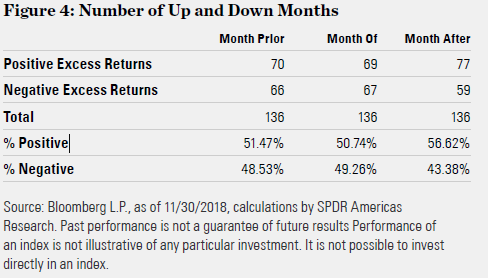

In the figure presented below, we use average monthly repurchases across all firms and all fiscal quarters.

This has the effect of reducing the number of outstanding shares available and will increase the companys earnings per share. Unsolicited e-mails do not create an attorney-client relationship and confidential or secret information included in such e-mails cannot be protected from disclosure. Related research from the Program on Corporate Governance includes Short-Termism and Capital Flows by Jesse M. Fried and Charles C.Y. 95 0 obj Further, the proposed rules would also enhance existing periodic disclosure requirements regarding repurchases of an issuers equity securities. Share repurchases can boost the stocks of companies with plans to execute them. We acknowledge that these results cannot be interpreted causally; nonetheless they can certainly not be interpreted as evidence that the CEO trades against the firm. Corporations arent legally obligated to impose blackout periods, but many corporations still choose to implement them to limit illegal trading activities.

Analyst consensus is the average investment recommendation among Wall Street research analysts. We will keep you informed of the announcements corporations make related to their share repurchase plans, and our dashboard will inform you of all insider activity for all the stocks listed on the major U.S. exchanges.

This is generally the case when the plan makes significant changes. Blackout periods refer to a specific time frame when certain individuals, usually executives or employees of a company, are prevented from buying or selling shares in their company.

<>stream

4. Review the continuing use of EPS targets and/or whether such targets exclude the impact of buybacks. wO endstream Suppose you have access to nonpublic information and willingly choose to use it for your benefit.

In some cases, a company will buy back its shares to intentionally drive up the price of their stock if it feels it is undervalued in the market. A blackout period in financial markets is when certain company employees are prohibited from buying or selling company shares. Our daily ratings and market update email newsletter.

How Does a Stock Buyback Benefit Investors?

The Board of Directors made the decision to eliminate the $1.00 annual dividend and implement a stock buyback program up to $1.5 billion with a two-year time. We define the corporate calendar as the firms schedule of financial events and news releases throughout its fiscal year, such as blackout periods and earnings announcements. The buybacks appear to be helping the stocks of the companies implementing them, at least a little. The former Corporate Secretary and head of the Corporate Legal Group at Microsoft, as well as a long-time litigator, Carolyn Frantz helps clients address a range of legal issues, including those related to corporate governance, ESG, and public policy.

Exclusive news, data and analytics for financial market professionals, Reporting by Lewis Krauskopf; editing by Jonathan Oatis, S&P, Nasdaq slip as weak private payrolls data feeds recession fears, US private payrolls growth slows in March -ADP, UBS tells investors 'Herculean' Credit Suisse takeover will pay off, Exclusive: India's Bank of Baroda stops clearing payment for above-cap Russian oil - sources, Ex-Intel chief architect explores data center deals for AI startup in India, UK court orders GSK to pay AstraZeneca royalties on total sales of Zejula, C$ steadies as Canada's trade surplus shrinks, Credit Suisse wins $41 mln London lawsuit against Saudi Prince, AI stocks tumble after short-seller attack on C3.ai.

How To Make An Anderson Shelter Out Of Cardboard,

Articles C